4.8out of 3,000+ reviews

Updated February 9, 2023

Auto insurance quotes comparison: Everything you need to know

Car insurance rates differ widely, which is why it’s important to compare quotes before buying a policy. Several factors determine your rate, including your age, location, driving record, level of education, and the kind of car you drive. Each insurance company has its own unique way of weighing these factors, which is why the same policy may be priced differently based on where you’re getting a quote from.

To help you better understand how car insurance quotes work and how to compare them to find a better policy, we’ve developed a comprehensive guide with the average rates from every major auto insurance company for every state and different driver groups.

Quick Facts

Car insurance rates for the same driver may vary significantly between different companies.

Differences in companies and quotes make it important to compare car insurance if you want to save money.

The average American driver pays $148 a month for car insurance.

Comparing quotes with Insurify can save you up to $996 a year.

Compare car insurance quotes by age

Insurance rates vary dramatically with age. Generally, younger drivers pay more than older drivers who have more experience on the road. Teen drivers have the most expensive car insurance premiums of any age group in every state. And insurers generally categorize drivers younger than 25 as high-risk drivers. Luckily, some insurance companies are cheaper for younger drivers than others.[1] and gain more experience on the road. Using an online comparison tool could help young drivers find options that are more affordable than their current insurance.

| Insurance Company | Average Monthly Quote |

|---|---|

| State Farm | $280 |

| GEICO | $220 |

| Progressive | $485 |

| Allstate | $307 |

| USAA | $188 |

| Liberty Mutual | $492 |

| Farmers | $392 |

| Nationwide | $471 |

| American Family | $355 |

| Travelers | $450 |

| Amica | $673 |

| Bristol West | $556 |

| AAA | $573 |

| Dairyland | $521 |

| Erie | $173 |

| The Hartford | $399 |

| National General | $373 |

| State Auto | $608 |

Insurify’s car insurance experts have shared a wealth of knowledge for drivers of all ages. Check out our guides to car insurance tips, quotes, and discounts:

Car Insurance Quotes for Teenagers

Car Insurance Quotes for College Students

Car Insurance Quotes for Seniors

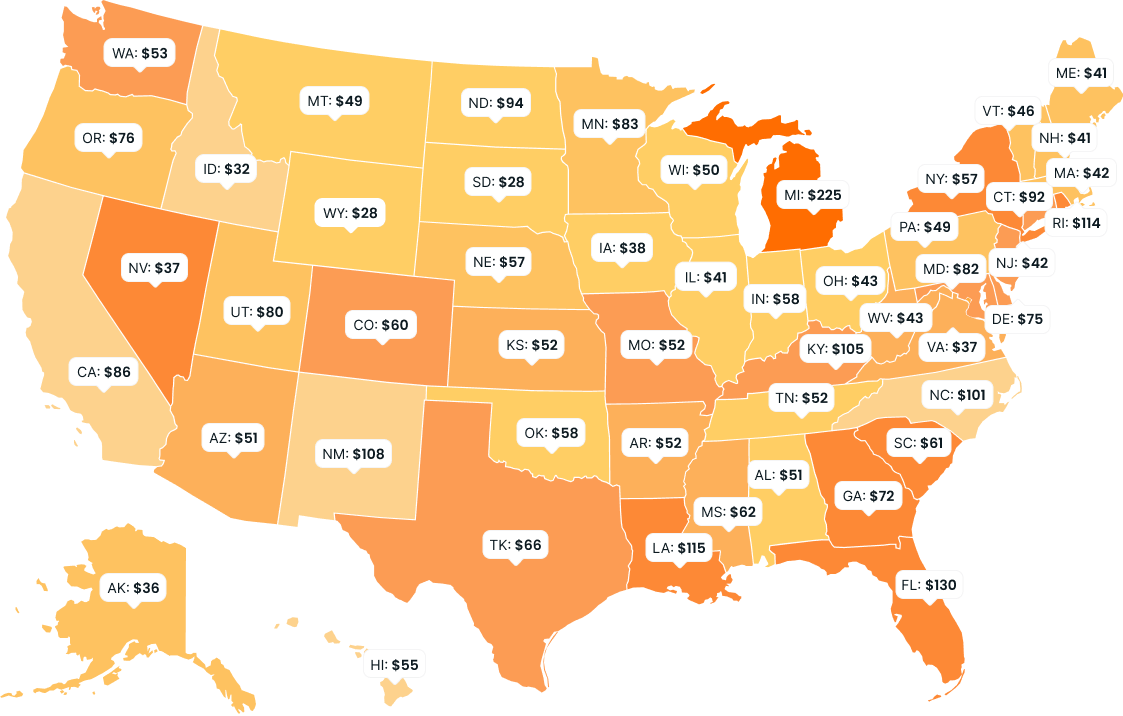

Compare car insurance quotes by state

The state where you live and drive heavily affects your car insurance rate. Variables like legislation, population density, crime rates, and weather patterns affect your likelihood of filing a claim.

Nearly every state requires drivers to have bodily injury liability and property damage liability insurance. You'll need to buy at least your state's minimum coverage requirements, and may choose higher coverage limits if you want more protection.

In summary:

New Jersey has some of the most expensive car insurance premiums in the country, with the cheapest quote being $191.

Iowa has some of the cheapest premiums, with the cheapest quote at just $34.

Compare Car Insurance Quotes Instantly

Compare car insurance quotes by driving history

Your driving history, which includes any previous accidents, speeding tickets, and DUIs, gives insurers an indication of your risk and how likely you are to file a claim.

Typically, those with imperfect driving records are considered risky and are charged high car insurance rates. However, some companies specialize in insuring high-risk drivers and are more likely to provide them with affordable rates.

Regardless of your driving history, Insurify has resources for drivers with all kinds of driving records. Check these out:

Cheap Insurance for Drivers with a Bad Driving Record

Cheap Insurance for High-Risk Drivers

Cheap Insurance for Drivers with a Clean Record

Quote Price by Driving Violation

Compare car insurance quotes for drivers with a DUI

Potentially losing your driver's license is far from the only consequence of driving under the influence of drugs or alcohol. Drivers who've been caught driving under the influence typically have to pay 30% more for their car insurance policy compared to drivers with a clean driving record.

Those with a DUI may also find it difficult to find an insurance company willing to file an SR-22 form on their behalf. Check out some of the cheapest SR-22 insurance quotes below:

| Insurance Company | Average Quote for Driver with a Clean Record | Average Quote for Driver with DUI |

|---|---|---|

| State Farm | $133 | $148 |

| GEICO | $117 | $182 |

| Progressive | $198 | $211 |

| Allstate | $148 | $216 |

| USAA | $101 | $153 |

| Liberty Mutual | $234 | $467 |

| Farmers | $162 | $184 |

| Nationwide | $213 | $287 |

| American Family | $164 | $200 |

| Travelers | $188 | $251 |

| National General | $176 | $178 |

| Erie | $96 | $135 |

| The Hartford | $193 | $245 |

| Bristol West | $282 | $290 |

| Dairyland | $247 | $291 |

| State Auto | $233 | $362 |

| AAA | $298 | $394 |

| Amica | $334 | $631 |

Also check out: Cheap Car Insurance for Drivers with a DUI

Compare auto insurance quotes for drivers with an accident on record

An at-fault accident on your record can lead to a 20% increase in your car insurance rates. However, some companies offer accident forgiveness programs to drivers with a clean record, which guarantees your rates will remain the same even after an accident.

Compare car insurance quotes by driver’s credit score

Historically, drivers with a lower credit score are more likely to file insurance claims, presenting a higher risk to insurance companies.[2]

As a result, insurers take your credit history into account in most states. Five states—California, Hawaii, Massachusetts, Michigan, and Washington—have banned insurers from using your credit to set rates.

| Insurance Company | Avg. Monthly Quote |

|---|---|

| State Farm | $210 |

| GEICO | $115 |

| Progressive | $204 |

| Allstate | $119 |

| USAA | $117 |

| Liberty Mutual | $308 |

| Farmers | $244 |

| Nationwide | $225 |

| American Family | $154 |

| Travelers | $206 |

| Amica | $317 |

| Bristol West | $469 |

| AAA | $480 |

| Dairyland | $158 |

| Erie | $172 |

| Esurance | $270 |

| The Hartford | $256 |

| National General | $179 |

| State Auto | $250 |

Regardless of your credit tier, you can always take steps to find cheaper car insurance. Find more resources for finding cheap car insurance here:

Compare car insurance rates by make and model

Your vehicle’s make and model influence your car insurance rate depending on how easy it is to replace the vehicle’s parts and how much it typically costs to make repairs. For this reason, luxury cars are more expensive to insure than standard models. Overall, sedans are the most expensive car type to insure, while minivans are the cheapest.

Cheapest

Known for their accessible pricing and dependability, insurance for Fiat, Buick, and Subaru vehicles costs the least.

Most Expensive

Not only do these car brands make cars that have high starting prices, but they're also the most expensive to insure.

Other factors that affect car insurance prices

Your car insurance quote takes numerous factors into account. Some seem obvious, like your driving record and the value of your vehicle, but others are less so. Check out some of the lesser-known factors that affect your car insurance rates:

Your vehicle’s accident rates

Driving a vehicle with a history of higher accident rates will increase your auto insurance premium rates[3].

Cost of repairs on your vehicle

Some vehicles’ parts are expensive to replace and will most likely make your auto insurance premiums higher. Typically, foreign cars are more expensive to insure than domestic cars for this reason.

Theft rates in your location

Living in a ZIP code with frequent vehicle theft and vandalism will cause your auto insurance rates to increase.

Your annual mileage

Your estimated annual mileage shows how much you’re on the road and, therefore, how much you are at risk for an accident. Drivers with low mileage typically pay less for car insurance than drivers in higher-mileage categories.

Safety features on your vehicle

Auto insurance companies offer safety discounts for certain features, but these features don’t always make your auto insurance cheaper. Extra safety features can be expensive to repair or replace.

Primary use of car

Auto insurers also take into account how you use your vehicle. A car used to commute to work or school will be more expensive to insure because you most likely drive during peak traffic hours.

Claims you’ve filed in the past

Filing claims, whether it’s for an accident you weren’t at fault for or a fender bender that you were at fault for, will drive up your insurance premium. The more claims you file, the bigger a risk you are to insure.

How to compare auto insurance rates: Find the right policy

Drivers looking to make smarter decisions on their car insurance can compare quotes by taking these easy steps:

Gather information needed to receive an accurate quote.

Use an insurance comparison platform like Insurify to view a list of personalized insurance quotes.

Compare policies and pick the one that gives you the best deal for your coverage.

Alternatively, you can speak to one of Insurify’s independent agents if you’d like to talk to a licensed professional.

How much does car insurance cost?

The national average cost of car insurance is $148 a month, according to Insurify data. But how much you pay for car insurance depends heavily on factors like your location, coverage, and driving history.

Car insurance is a fixed monthly expense that you have to pay for as long as you plan on driving a car. There’s no reason to be paying more than you need to. The best way to find the cheapest car insurance policy available to you is by getting quotes from multiple insurance providers and identifying the one that gives you the best deal.

Also Check Out: Very Cheap Car Insurance with No Deposit

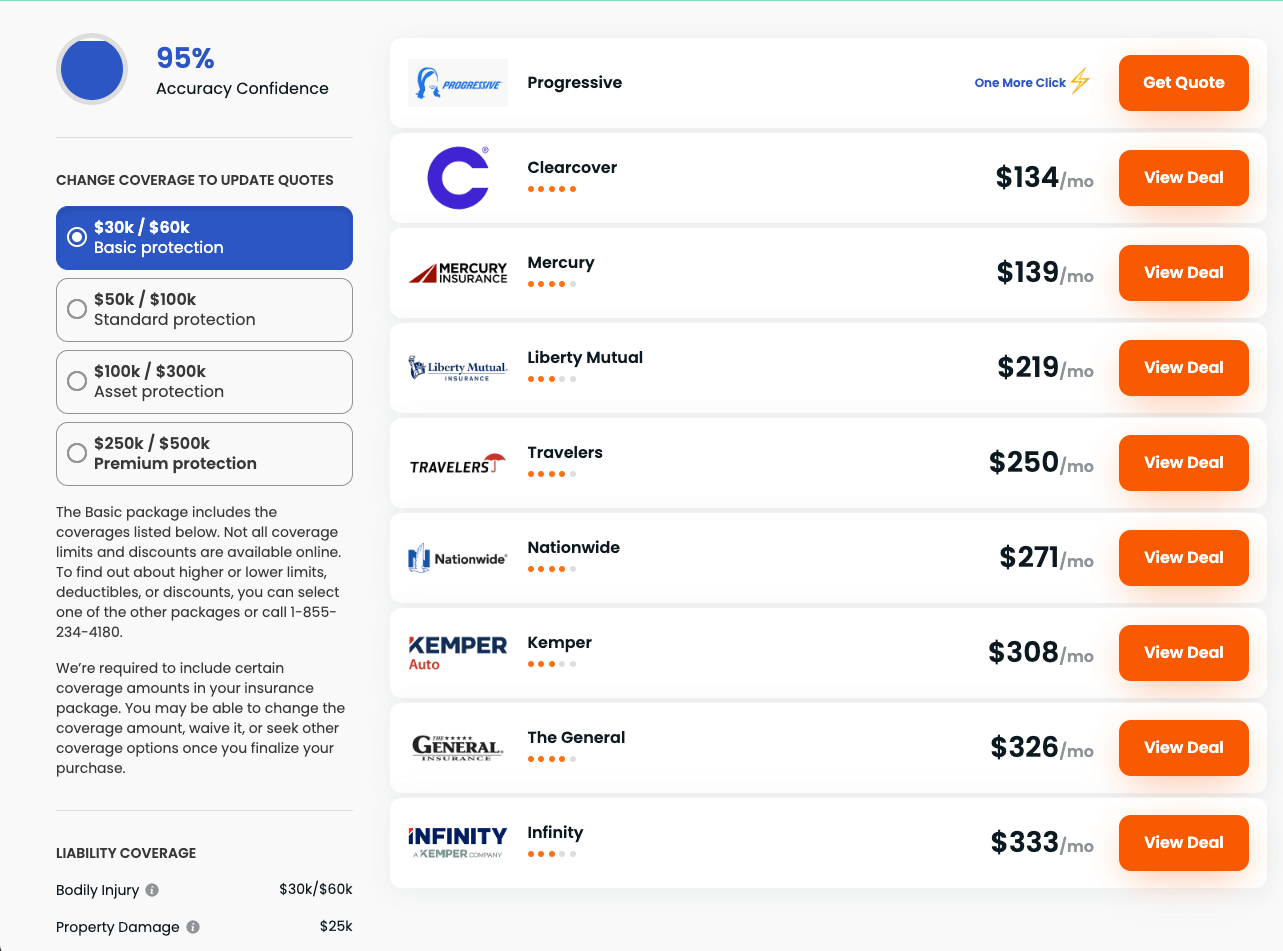

The best car insurance companies

A reputable car insurance company that fits your budget and provides robust coverage, quality customer service, and timely claims management is a tall order. Here are some factors to keep in mind while comparing car insurance companies:

Car insurance quote price

Customer service record

Claims service process

Financial strength

After crunching the numbers, here are the best car insurance companies according to Insurify:

| Rank | Company Name | Average Cost Per Month | ICSThe Insurify Composite Score is a proprietary rating calculated by a team of data scientists at Insurify, weighing multiple factors that reflect the quality, reliability, and health of an insurance company. Inputs to the score include financial strength ratings from A.M. Best, Standard & Poor’s, Moody’s, and Fitch; J.D. Power ratings; Consumer Reports customer satisfaction surveys and customer complaints; mobile app reviews; and user-generated company reviews. |

|---|---|---|---|

| 1 | Clearcover Best Overall | $135 | 97 |

| 2 | Nationwide Best for Safe Drivers | $199 | 89 |

| 3 | American Family Best for Families with Teen Drivers | $234 | 89 |

| 4 | Safeco Best for Drivers with Poor Credit | $186 | 86 |

| 5 | Farmers Best for Rideshare Coverage | $239 | 85 |

| 6 | Metlife Best for Hassle-Free Claims | $159 | 82 |

| 7 | Liberty Mutual Best for Accident Forgiveness | $241 | 82 |

| 8 | Mercury Best for Face-to-Face Service | $232 | 81 |

| 9 | Progressive Best for Senior Drivers | $147 | 80 |

| 10 | Travelers Best for Young Drivers | $163 | 80 |

The Insurify Composite Score (ICS) is a proprietary rating calculated by a team of data scientists at Insurify, weighing multiple factors that reflect the quality, reliability, and health of an insurance company.

Inputs to the score include financial strength ratings from A.M. Best, Standard & Poor’s, Moody’s, and Fitch; J.D. Power ratings; Consumer Reports customer satisfaction surveys and customer complaints; mobile app reviews; and user-generated company reviews.

Also check out: Best Insurance Companies

What is the best car insurance comparison site?

The best car insurance comparison sites tend to be sites that provide users with accurate quotes, such as:

In order to get the information you’re looking for, these sites may ask you for a range of information to get you an accurate quote. This includes:

Your car’s make, model, and year

Your age, gender, marital, and employment status

Your address and whether you’re a homeowner

Your credit score, education level, and driving record

In your search for the perfect policy, be careful which sites you give your personal information to. A lot of these are lead-generation websites that exist to sell your data, leaving you with an inbox full of spam.

To make sure you’re not wasting your time and giving away your data, check out our list of the best insurance comparison sites to find sites that will help you save time and money while keeping your data secure.

Cheap car insurance quotes comparison

To keep your quotes low, you should be mindful of the following:

Your level of coverage: Fewer coverage add-ons and lower limits will keep your car insurance costs low, but they also might leave you vulnerable to out-of-pocket costs in the event of an accident.

Your selected deductible: The higher your deductible, the lower your car insurance costs. However, you should make sure you can afford to pay your deductible in the event of an accident.

Discounts: Insurance companies have discounts for everything — from owning a home to earning a 3.5 GPA at school. Most insurance-comparison sites will ask you questions to ascertain which discounts you’re eligible for. Make sure to answer those correctly to keep your quotes low.

Car insurance discounts

Most companies offer policyholders the chance to save with discounts. From good driver to mature driver discounts, you’ll most likely qualify for at least one or two if you know what to look for. Car insurance comparison sites typically include these discounts when displaying rates.

| Discount Type | Average Car Insurance per Month |

|---|---|

| No discount | $134 |

| Senior training | $119 |

| Student training | $240 |

| Military | $128 |

| Married | $109 |

| Home insurance bundle | $106 |

| AAA membership | $125 |

Types of car insurance coverage

Car insurance policies aren’t one-size-fits-all. Most auto insurance policies encompass a mix of six main types of car insurance coverage, plus a few optional additions.

Liability coverage

Nearly every state requires vehicle liability coverage . If you’re found at fault in a car accident, this type of coverage will help pay for damage to the other driver’s vehicle and any resulting medical bills for the other parties involved.

Personal injury protection

Personal injury protection, sometimes abbreviated PIP, covers you and your passengers’ medical bills and lost wages in the case of an accident. Also known as no-fault insurance, PIP will help cover these bills regardless of who's at fault in an accident.

Medical payments

Medical payments coverage, also known as MedPay, is usually offered in non-PIP states. MedPay is a stripped-down version of PIP that will help cover hospital bills for you and your passengers after an accident, even if you’re not in a vehicle.

Uninsured or underinsured motorist coverage

Uninsured or underinsured motorist coverage kicks in when you’re the victim of a hit-and-run or when you’re involved in an accident where the at-fault driver doesn’t have enough coverage to cover your damages. This coverage is currently required in 22 states[5].

Collision Coverage

Collision insurance covers damages if your vehicle collides with another car or object. If you’re driving a car you purchased with a car loan or other financing plan, you’ll probably be required to buy collision coverage.

Comprehensive coverage

Comprehensive coverage kicks in when your car is damaged in a non-collision incident. This includes incidents of vandalism, theft, weather-related damage, and other acts of God. This is typically optional but usually required by your lender if you don’t own your car outright.

Full-Coverage Car Insurance

A car insurance policy with both comprehensive and collision coverage in addition to liability coverage is considered a “full-coverage” insurance policy. Take a look below to see how much a full-coverage policy costs compared to a liability-only policy, based on your insurance company:

| State | State Minimum Coverage | Full Coverage |

|---|---|---|

| Alaska | $67 | $108 |

| Alabama | $69 | $128 |

| Arkansas | $78 | $148 |

| Arizona | $85 | $138 |

| California | $72 | $152 |

| Colorado | $87 | $162 |

| Connecticut | $134 | $172 |

| Washington DC | $114 | $148 |

| Delaware | $138 | $192 |

| Florida | $138 | $185 |

| Georgia | $129 | $213 |

| Hawaii | $40 | $75 |

| Iowa | $57 | $108 |

| Idaho | $56 | $92 |

| Illinois | $65 | $104 |

| Indiana | $57 | $98 |

| Kansas | $73 | $130 |

| Kentucky | $123 | $178 |

| Louisiana | $149 | $226 |

| Massachusetts | $80 | $98 |

| Maryland | $128 | $181 |

| Maine | $58 | $89 |

| Michigan | $167 | $291 |

| Minnesota | $76 | $109 |

| Missouri | $94 | $168 |

| Mississippi | $79 | $138 |

| Montana | $61 | $106 |

| North Carolina | $47 | $87 |

| North Dakota | $63 | $97 |

| Nebraska | $73 | $121 |

| New Hampshire | $61 | $81 |

| New Jersey | $135 | $174 |

| New Mexico | $58 | $118 |

| Nevada | $143 | $199 |

| New York | $190 | $215 |

| Ohio | $64 | $97 |

| Oklahoma | $70 | $137 |

| Oregon | $80 | $120 |

| Pennsylvania | $72 | $121 |

| Rhode Island | $150 | $207 |

| South Carolina | $126 | $184 |

| South Dakota | $51 | $103 |

| Tennessee | $64 | $112 |

| Texas | $95 | $172 |

| Utah | $72 | $115 |

| Virginia | $77 | $125 |

| Vermont | $51 | $92 |

| Washington | $96 | $141 |

| Wisconsin | $63 | $101 |

| West Virginia | $79 | $143 |

| Wyoming | $49 | $109 |

Insurify’s Insuring the American Driver report is a comprehensive analysis of the 2021 car insurance quoting landscape, analyzing over 40 million auto insurance premiums. It takes a closer look at the unique factors driving individual insurance costs, covers major events in the industry from this year, and offers projections for car insurance quotes looking ahead into 2022.

The average annual cost of car insurance

Car insurance rates rose 12% in 2021 and are projected to rise another 5%* in 2022, likely influenced by rising inflation rates over the past year.

Driving & fatality trends

In the spring of 2021, Americans drove 32% more miles than during the same period in the previous year. While the fatality rate decreased by 3% from 2020 levels, it remained 26% higher than it was during the same period in 2019, suggesting that reckless driving habits adopted during initial pandemic shelter-in-place orders have endured well beyond those policies’ end.

Insuring the nation’s top 3 most popular vehicles

Ford F-Series Pickup

$1,619

Honda Civic

$1,962

Honda Accord

$1,855

INSURIFY INSIGHT

Coverage & Discounts

Insurer discounts can lower premiums by up to 16%, which can get drivers cheap car insurance to save money significantly over time.These discounts are granted by insurers to low-risk drivers for a variety of qualifications, such as having a clean record, low mileage, or participating in safety training programs.

Bundling with homeowners insurance

Average yearly savings

8.6%Senior driver safety training

Average yearly savings

15.2%Military service

Average yearly savings

2.2%The car insurance quotes displayed on this page were sourced from Insurify’s analysis of public filings in zip codes across all 50 states and Washington D.C.. Data was provided by Quadrant Information Services for drivers with liability coverage for $50,000 bodily injury coverage per person, $100,000 bodily injury coverage per accident, and $50,000 property damage per accident.

Some of the quotes on this page, including those featured in sections pertaining to quotes based on a vehicle’s make and model, quotes for full coverage and state minimum car insurance, as well as quotes for Liberty Mutual were sourced from Insurify’s internal database of over 40 million auto insurance applications across diverse coverage levels. To obtain representative rates, Insurify’s data analysis team performs frequent comprehensive analyses of the factors car insurance providers weigh to calculate rates including driver demographics, driving record, credit score, desired coverage level, and more.

Insurify’s analysis also includes a proprietary rating called the Insurify Composite Score (ICS) assigned to each insurance provider. The ICS weighs multiple factors reflecting the quality, reliability, and health of an insurance company. Ratings used to calculate the ICS include Financial Strength Ratings from A.M. Best, Standard & Poor’s, Moody’s, and Fitch; J.D. Power ratings; Consumer Reports customer satisfaction surveys and customer complaints; mobile app reviews; and user-generated company reviews.

Note, actual quotes will vary based on unique attributes including your driver history and garaging address.

Frequently Asked Questions: comparing auto insurance quotes

To compare car insurance quotes and policies, you can use a comparison platform like Insurify, which offers drivers up to eight personalized quotes from top local and national providers. All you have to do is answer a few questions about you and your car, compare quotes, and buy your policy—all in one place.

The simplest way to find the cheapest car insurance is to compare quotes online. All you have to do is answer a brief questionnaire about your car, driving habits, and a few personal details.

The average annual cost of an auto insurance policy in the United States is $48 a month; however, rates vary greatly depending on your driving history, desired coverage levels, and personal details.

Yes, it’s possible to get multiple car insurance quotes at once on the same page. The best way to do this is by using an insurance comparison website. Typically, you should compare quotes from at least five different insurance companies before buying a policy.

To make sure you’re getting the best deal, Insurify recommends that you compare quotes from at least five different insurance providers.

Insurify works with over 200 of the nation’s top national and regional insurance companies, including Progressive, Liberty Mutual, Nationwide, and Allstate.

Comparing car insurance has no effect on your credit score. Insurance companies use a “soft pull” to check your credit based on information in your credit report. These pulls aren’t visible to lenders, and won’t affect your credit score.

Insurify’s insurance comparison app is your best bet for finding the cheapest insurance policy. Users can easily compare quotes from multiple providers all in one place, adjust their coverage requirements, and buy a policy within minutes.

Rideshare insurance costs an average of $212 a month, but this rate varies significantly based on your location and the laws in your state. On average, rideshare drivers pay an extra $76 a month compared to other drivers.

How to compare auto insurance — Advice from the experts

What kind of car insurance policy provides the most protection?

Jennie L. Phipps

Specialist in Insurance and Personal Finance Writing

If your car loan isn’t paid off, you’ll want “full coverage” car insurance. That’s a policy that includes liability coverage, plus coverage that will pay for repairs to your car and/or a car you damaged. For people with assets, including savings, a large amount of liability coverage is also important. Liability coverage will pay for lawsuits filed against you after an accident. Liability insurance is sold in threes: individual injuries/total injuries/property damage. Policies with 100/300/100 liability limits offer the most protection.

Michael Omansky

Associate Professor in the School of Business and Information Sciences, Felician University

For more protection, you want to include a number of key items: liability, collision, personal injury protection, and underinsured/uninsured motorists.

If you have a leased or financed car – which is the case for most people – you would add in comprehensive to this.

However, you need to be prepared to pay for each of these components. Hopefully, your insurance company can give you a package deal.

Michael Mccloskey

Associate Professor in the School of Business, Temple University

There are four parts to a policy — the main parts are: Section A, Liability, which is what you do to other people; and Section D, Collision and Comprehensive, which covers damage to your own car. What will protect you most is to buy Collision and Comprehensive, which is the most expensive. Part C is Uninsured and Underinsured, which becomes less necessary if you go with Part D.

Comprehensive is basically all things that happen to your car that you don’t have to do with moving, such as vandalism; and collision is everything to do with moving, like hitting a tree, hitting another car, or another car hitting you.

On the liability side, you really need, or should have, enough coverage to be equal to what your home is worth. Most auto policies cap our around three- or five-hundred. But if you want maximum coverage, you should buy both Collision and Comprehensive.

How are car insurance prices structured, and what can drivers do to keep their premiums low?

Paul Reynolds

Insurance Editor, Money.com

What you pay for car insurance is determined by some factors you can’t control. Those include your age, gender, and (in many states) your credit score (worse scores align with a greater likelihood of filing claims, say insurers).

The good news is many other decisions you make also affect what you pay for insurance – and your choices can potentially reduce premiums. Those include the vehicle you drive, of course, and where you live; some cars and neighborhoods are more claims-prone than others, and insurers will price your premium accordingly. Avoiding tickets and driving in a way that minimizes the likelihood of accidents also helps tamp down what you pay – as can taking a defensive driving course.

Then come the policy options you choose. It can be wise to pick the highest deductible you can afford, to push down your premium (you may not want to pay smaller claims, anyway, since every claim you make can hurt your record and potentially raise your rate). You can also reduce coverage, but be careful. For instance, if you have substantial assets, like a home with equity, choosing liability coverage that isn’t well in excess of skimpy state minimums can leave you vulnerable to losing those possessions because of a costly claim.

Dr. Christopher Newman

Associate Professor of Marketing, University of Mississippi

There are many factors that affect car insurance prices. Some of the most common factors include the drivers’ age, gender, location, model and make of car, usage frequency, credit, and of course, his/her driving record. While some of these factors are uncontrollable, the best thing that drivers can do to keep their premiums low is to keep their driving record clean. For example, try to avoid speeding tickets and other driving citations all together, and make sure to take every action possible to remove them from your record if/when you do receive them (e.g., attend driving school if possible). Drivers can also opt for higher deductibles and/or avoid optional add-on coverages (e.g., optional vandalism coverage) in order to lower their premiums.

Marc Kalan

Assistant Professor of Professional Practice, Rutgers Business School

Experience and age, geography (where you live), gender, cost of your vehicle and potential repair costs in the event of an incident, and of course levels of coverage desired are all contributing factors. But perhaps the single thing one can do most easily and effectively is to raise your deductible from a low level (say $500) to a much higher level (say $1500) and "self-insure" for that difference (in this case $1,000). I have been doing this for over 40 years and with minimal claims (not zero but minimal) my long-term savings have been in the many thousands of dollars.

Why do some states have more expensive car insurance premiums than others?

Dr. Christopher Newman

Associate Professor of Marketing, University of Mississippi

Car insurance premiums often vary from state to state due to inherent differences in location-based risk. For example, some states have higher accident, theft, and vandalism rates than others, leading to more risk for the insurance companies, and thus, higher premiums for the drivers in those particular states. Other factors might include how urban or rural states generally are, typical road conditions in a state, and the number of weather-related incidents in the state. Of course, states also set their own minimum liability coverage requirements, further creating differences in premiums across state lines.

Marc Kalan

Assistant Professor of Professional Practice, Rutgers Business School

Car insurance companies look at their costs of doing business on a market-to-market basis with some areas of the country, such as the crowded Northeast where I live, experiencing a higher cost experience (more accidents, higher costs of labor and repairs, etc.) for that company to bear. In addition, different states mandate different levels of coverage for their citizens, which combined with factors already mentioned help them to calculate insurance premiums.

Dr. Yongqing Wang

Professor of General Studies, University of Wisconsin-Milwaukee

Different states have different laws and requirements for car insurance. For example, almost all states require liability car insurance, while only some states require Personal Injury Protection (PIP) and uninsured/underinsured motorist insurance. The premium would be higher if a state requires more car insurance policies.

In some states, the medical costs and car repair costs are higher. In some states, a car is more likely to be damaged by weather or be stolen. As a result, the premium would be higher.