The 10 Best Car Insurance Companies (2023)

Insurify weighed coverage, pricing, and reviews to rank the best national and regional car insurance companies.

Updated January 20, 2023

Updated January 20, 2023

By Insurify’s analysis, Clearcover, Nationwide, and American Family are the top three best car insurance providers in the United States.

Traveler’s is one of the best companies for young drivers under the age of 25, with average premiums of $163 per month.

The best-rated car insurance company might not be the best for every driver profile, so it’s important to compare quotes from multiple insurers before committing to a policy.

Finding a car insurance company that both fits your budget and provides you and your car with solid coverage can be time-consuming, which is why so many people end up sticking with the same car insurance company for years. But just because you scored a good deal with a company a year or two ago doesn’t mean it’s still the best choice for you today.

Check out Insurify’s ranking of America’s ten best car insurance companies to get a better idea of which companies are providing quality coverage at the best rates. Once you’ve browsed our list, compare policies and prices for your unique driver profile with Insurify’s car insurance comparison tool to secure the right coverage for your needs.

Here are the best car insurance companies on the market, according to the Insurify Composite Score—an aggregate of customer satisfaction, user reviews, and external ratings from experts such as J.D. Power and A.M. Best:

| Rank | Company Name | Average Cost Per Month | Insurify Composite Score |

|---|---|---|---|

| 1 | Clearcover Best Overall | $135 | 97 |

| 2 | Nationwide Best for Safe Drivers | $199 | 89 |

| 3 | American Family Best for Families with Teen Drivers | $234 | 89 |

| 4 | Safeco Best for Drivers with Poor Credit | $186 | 86 |

| 5 | Farmers Best for Rideshare Coverage | $239 | 85 |

| 6 | Foremost Signature Best for Hassle-Free Claims | $159 | 82 |

| 7 | Liberty Mutual Best for Accident Forgiveness | $241 | 82 |

| 8 | Mercury Best for Face-to-Face Service | $232 | 81 |

| 9 | Progressive Best for Senior Drivers | $147 | 80 |

| 10 | Travelers Best for Young Drivers | $163 | 80 |

If you’re looking for a cutting-edge insurer utilizing 21st century technology to provide drivers with unparalleled savings, Clearcover may be the company for you. Founded in 2016 and based out of Chicago, Clearcover has a stellar ICS score of 97––the best rating on this list––and a strong reputation for helping drivers save money.

Clearcover customers rave about the company’s easy-to-use mobile app, and this new kid on the block offers roadside assistance and rideshare coverage, too. Unlike most other insurance companies, you don’t need to apply for discounts from Clearcover. Instead, discounts you qualify for are automatically applied to your policy.

Top discounts that the company offers include:

Safe Driving Discount

Vehicle Safety Features Discount

Electronic Billing Discount

Upfront Payment Discount

Military Member Discount (15% off in all states except Louisiana; 25% off in Louisiana)

Learn more about the average monthly cost of Clearcover’s car insurance for drivers in the different categories below, with data drawn from Insurify’s proprietary database of millions of unique driver quotes.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $196 |

| Drivers Over 60 | $111 |

| Safe Driver (No Prior Violations) | $127 |

| Driver With Prior Accident | $168 |

| With Prior Speeding Ticket | $155 |

| Driver With Average Credit | $140 |

One thing to note: Clearcover is currently only available in Arizona, California, Illinois, Ohio, Louisiana, Texas, Utah, and Wisconsin. If you live elsewhere, read on to learn more about other companies in our top 10 to find the best rates.

Like USAA and Allstate, Nationwide is one of the best-known and best-loved car insurance companies around. That reputation is well earned: Nationwide scores highly with an ICS score of 89, and its extensive accident forgiveness program and ability to bundle almost any different insurance type appeals to customers in all 50 states.

Nationwide rewards safe drivers with lower premiums, too, with average monthly rates for safe drivers coming in at $170, $31 less than the average for insurers across this list. If you’re looking for a solid, reputable insurance company with a stellar track record, Nationwide makes an excellent choice. Top discounts from Nationwide include:

Top discounts from Nationwide include:

Multi-Policy Bundling Discount

Defensive Driving Course Discount

Safe Driving (5 Years Accident-Free) Discount

Good Student Discount

Easy Pay Discount

Learn more about the average monthly cost of Nationwide’s car insurance for drivers in the different categories below.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $321 |

| Drivers Over 60 | $160 |

| Safe Driver (No Prior Violations) | $170 |

| Driver With Prior Accident | $235 |

| With Prior Speeding Ticket | $220 |

| Driver With Average Credit | $210 |

Ranking #1 for Overall Customer Satisfaction in the Midsize Insurers Category in J.D. Power’s 2022 U.S. Insurance Shopping Study, American Family is an ideal choice for those seeking sterling customer service and a wide range of deals and discounts.

American Family is especially well known for its cheap car insurance rates for families with teen drivers; teens who participate in the insurer’s Teen Safe Driving program can have 10% knocked off their policy price. American Family also has a lofty ICS score of 89.

Other top discounts from American Family include:

Away at School Discount

KnowYourDrive Telematics Discount

Young Volunteer Discount

Steer Into Savings Discount (drivers who switch to American Family from a competing insurer are eligible)

Early Bird Discount

Learn more about the average monthly cost of American Family car insurance for drivers in the different categories below.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $346 |

| Drivers Over 60 | $190 |

| Safe Driver (No Prior Violations) | $203 |

| Driver With Prior Accident | $296 |

| With Prior Speeding Ticket | $287 |

| Driver With Average Credit | $249 |

While less well-known than other insurers on this list, Safeco, which was founded in Seattle in 1923 as the General Insurance Company of America, is a natural fit for drivers considered to be “high risk”––those with accidents, speeding tickets, or other traffic accidents on their driving records. Safeco drivers with a prior accident pay just $225 on average per month.

Safeco also charges less on average for drivers with poor credit than many larger insurance providers, and also offers SR-22 and FR-44 forms to those who need them. If you have a spottier history behind the wheel and are seeking to cut your insurance costs, Safeco is a promising option to consider.

Top discounts from Safeco include:

RightTrack Telematics Discount

Claims-Free Cash Back Discount

Further Education Discount

Occupational Discount (Firefighters, Teachers, Business Owners, Police Officers)

Driver’s Education Discount

Learn more about the average monthly cost of Safeco’s car insurance for drivers in the different categories below.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $304 |

| Drivers Over 60 | $149 |

| Safe Driver (No Prior Violations) | $164 |

| Driver With Prior Accident | $225 |

| With Prior Speeding Ticket | $223 |

| Driver With Average Credit | $189 |

Farmers combines the reliability and tradition of a big-name insurer with a reassuringly thorough claims process and a host of perks, including deals catered to families and budget-seekers and rideshare coverage a cut above the industry standard. Farmers was one of the first major insurers to offer rideshare coverage to Uber and Lyft drivers.

Farmers––founded in 1928 as Farmers Insurance Group––is well-known for its reputation for handling even the most bewildering and complex car insurance claims, so the insurer is a safe bet whether you’re seeking excellent customer service or deals for growing households like Farmer’s shared family car policy. You can bundle with your other Farmers policies to save.

Top insurance discounts from Farmers include:

Good Driver / Safe Driver Discount

Youthful Driver Discount

Mature Driver / Senior Driver Discount

Good Payer Discount (Customer has no late billing fees in past year)

Alternative Fuel / Hybrid Discount (California only)

Learn more about the average monthly cost of Farmer’s car insurance for drivers in the different categories below.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $355 |

| Drivers Over 60 | $182 |

| Safe Driver (No Prior Violations) | $217 |

| Driver With Prior Accident | $294 |

| With Prior Speeding Ticket | $287 |

| Driver With Average Credit | $246 |

Foremost may not be one of the better-known car insurance providers, but flying under the radar isn’t necessarily a bad thing. The company, founded way back in 1868 at “MetLife”, offers a wide range of insurance types and apps for mobile claims filing and telematics-style driver tracking. With stellar industry rankings, you know claims processes with Foremost are a breeze.

With an above-average Insurify ICS score of 82, one of the more unique perks Foremost offers is the identity theft protection included in all home, auto, and renters policies. Foremost’s homeowners insurance product is also very highly-regarded, making the insurer a potential match for drivers seeking to bundle their auto and home insurance policies.

Top discounts from Foremost Signature include:

Good Driving Discount

Automated Payment Discount

Multi-Product Discount

Household Superior Driver Discount (eligible if all members in a household have clean driving records)

Anti-Theft Device Discount

Learn more about the average monthly cost of Foremost Signature’s car insurance for drivers in the different categories below.

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $238 |

| Drivers Over 60 | $118 |

| Safe Driver (No Prior Violations) | $138 |

| Driver With Prior Accident | $185 |

| With Prior Speeding Ticket | $189 |

| Driver With Average Credit | $181 |

Liberty Mutual and its famous LiMu Emu are well-known pillars of the insurance industry. But drivers may not know that the century-old insurer takes a surprisingly new-school approach to customer service and claims handling, with a high-tech mobile app that customers love and a sophisticated telematics program, RightTrack, that tracks your driving to score savings.

If you’re just interested in rock-bottom rates, you may find yourself paying slightly more than anticipated for Liberty Mutual car insurance. But the company more than makes up for it with the above perks, as well as an extensive suite of discounts and a robust accident forgiveness policy.

Top discounts on car insurance policies from Liberty Mutual include:

Military Discount (active, retired, or reserve)

Homeowner Discount

Alternative Energy / Hybrid Discount

Accident Free Discount

Violation Free Discount

Learn more about the average monthly cost of Liberty Mutual’s car insurance for drivers in the different categories below:

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $379 |

| Drivers Over 60 | $169 |

| Safe Driver (No Prior Violations) | $233 |

| Driver With Prior Accident | $277 |

| With Prior Speeding Ticket | $268 |

| Driver With Average Credit | $252 |

While many insurers have turned to a fully digital customer experience, Mercury continues to see the value in in-person customer service, assigning a dedicated insurance agent to each individual driver. Founded in 1963 as the Mercury Insurance Group and named one of “America’s 50 Most Trustworthy Companies” by Forbes Magazine in 2015.

Mercury is only available in 11 states, however: Arizona, California, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia. If you live elsewhere, take a look at some of the other companies on this list.

Top car insurance discounts from Mercury include:

Anti-Theft Feature Discount

Auto Pay Discount

E-Signature Discount

Multi-Car Discount

Good Student Discount

Learn more about the average monthly cost of Mercury’s car insurance for drivers in the different categories below:

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $345 |

| Drivers Over 60 | $175 |

| Safe Driver (No Prior Violations) | $204 |

| Driver With Prior Accident | $309 |

| With Prior Speeding Ticket | $300 |

| Driver With Average Credit | $248 |

Everyone’s heard of Progressive. The insurer, known for its iconic spokeswoman, Flo, is the third-largest in the United States, trailing only State Farm and GEICO. Progressive offers a big-tent approach to car insurance, with a wide variety of types of coverage and a reputation for speedy claims-handling and bargain rates for seniors.

As one of the nation’s best-known insurers, Progressive offers customers an amazing range of policy options, spanning from state minimum coverage plans to premium comprehensive coverage with full reimbursement for personal property and medical expenses. The company boasts a respectable ICS score of 80 and a long list of discounts for every kind of driver.

Top discounts from Progressive include:

Snapshots Telematics Device Discount

Teen Driver Discount

Sign Online Discount

Multi-Car Discount

Distant Student Discount

Learn more about the average monthly cost of Progressive’s car insurance for drivers in the different categories below:

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $214 |

| Drivers Over 60 | $111 |

| Safe Driver (No Prior Violations) | $144 |

| Driver With Prior Accident | $160 |

| With Prior Speeding Ticket | $170 |

| Driver With Average Credit | $149 |

Many American drivers are familiar with Travelers insurance and the company’s iconic red umbrella. But they may not know that the insurer offers sweeter-than-average deals for young drivers and for those seeking to add a spouse or child to their car insurance plan. One of the oldest insurance companies in the business, Travelers has unmatched financial stability.

Traveler’s online insurance reviews highlight the company’s no-fuss auto claims handling, bundling of different insurance products, and strong customer service. Young drivers will benefit from a policy with Travelers: drivers under 25 pay just $234 on average per month, $95 less than the average for the other companies on this list.

Top discounts from Travelers include:

Continuous Insurance Discount

Early Quote Discount

Driver Training Discount

IntelliDrive Telematics Device Discount

New Car Discount

Learn more about the average monthly cost of Traveler’s car insurance for drivers in the different categories below:

| Driver Category | Average Monthly Cost |

|---|---|

| Driver Under 25 | $234 |

| Drivers Over 60 | $137 |

| Safe Driver (No Prior Violations) | $146 |

| Driver With Prior Accident | $180 |

| With Prior Speeding Ticket | $194 |

| Driver With Average Credit | $179 |

Kemper is one of the nation’s most well-known and trusted auto insurers. The company provides SR-22 forms for drivers who require them, and positive customer reviews usually highlight the insurance provider’s substantial discounts for families with teenage drivers. If you’re a parent of one or more teen drivers, Kemper may be an option worth exploring.

Highlights of Kemper include:

Insurance for salvaged vehicles:

If your car has a “salvage title”––that is, it was salvaged and rebuilt after an accident––Kemper will likely insure your vehicle.

Gap insurance:

Gap, or “guaranteed asset protection”, is a type of insurance add-on for newer or leased cars that covers the difference between the amount a car is currently worth and the amount the driver owes on a lease or loan in the event of an accident or other damage. Kemper offers gap insurance coverage under their “Auto Loan/Lease” program.

Accident forgiveness:

Under their Kemper Prime Auto Enhanced package, Kemper will waive a first accident or minor driving violation, as well as providing savings for safe driving and waiving deductibles when an insured car is damaged while parked.

While Bristol West may not be as well known as big-name insurers like GEICO or State Farm, the insurer, a member of the Farmers Insurance Group of Companies, does offer affordable policies to drivers with more checkered driving histories.

Bristol West offers coverage options for drivers who may have no prior insurance history, a low credit score, or a history of offenses behind the wheel like speeding tickets or DUIs.

Highlights of Bristol West include:

Rideshare coverage:

If you work for a company like Uber, Lyft, or Postmates, you may be required to obtain rideshare coverage. Bristol West offers an optional rideshare coverage plan tailor-made for drivers frequently behind the wheel.

Diverse payment options:

No matter where you are, Bristol West has made it easy for drivers to file claims and pay car insurance premiums, with flexible billing options like paperless billing, text alerts, and eSignature documents that can be signed on a computer or phone.

SR-22 and FR-44 coverage:

Depending on your state, you may be required to file an SR-22 or FR-44 form if you’ve committed a traffic offense. Unlike many larger insurers, Bristol West offers coverage to drivers needing SR-22s and FR-44s.

Headquartered in Wisconsin and founded in 1953, Dairyland provides affordable auto and motorcycle insurance to millions of American drivers across 37 states. Like Kemper and Bristol West, Dairyland does provide SR-22 or FR-44 forms for drivers, has a wide range of available driver and vehicle discounts, and offers affordable prices if your driving record looks a little spotty.

Dairyland doesn’t provide homeowners coverage, however, so if you’re looking to bundle auto and home policies it may not be the best insurer for you.

Highlights of Dairyland include:

Few repair shop restrictions:

Many larger insurance companies require that drivers use an in-house network of partnered repair shops if their car suffers a dent or a scrape. Dairyland is an exception, allowing drivers to fix their vehicle at most independent garages.

Flexible payment terms:

Dairyland offers a wide range of payment terms spanning from quarterly, bi-annually, yearly, offering cash-strapped drivers more options.

Anti-theft discount:

Like some other insurers, Dairyland offers drivers a substantial discount for equipping their car with an anti-theft device.

Drivers familiar with larger insurance carriers like Esurance or Progressive may be surprised to learn that the lesser-known Metromile could offer them some serious savings on their car insurance rates.

Unlike more traditional insurance companies, Metromile, founded in 2011 in Redwood City, California, focuses on car insurance for low-mileage drivers, charging drivers for each mile driven. If you don’t spend much time behind the wheel and are seeking jaw-droppingly low average monthly quotes, Metromile may be the insurer for you.

Highlights of Metromile include:

Telematic Pulse Device:

Metromile’s Pulse device plugs into cars and measures how many miles are driven each day. Drivers only need to pay a flat rate for those miles, which Metromile estimates saves drivers an average of $741 yearly.

Pet injury protection:

One somewhat unique quirk of Metromile is that any injuries to pets are fully covered in all states the insurer services except Illinois and Virginia. If you like to bring Fido on road trips and errands behind the wheel, it’s a great perk.

Partnership with Turo:

Turo is a startup seeking to be the Airbnb of cars, allowing car owners to rent out their cars to private individuals for short lengths of time. Metromile’s partnership with Turo means that Metromile drivers in California and Illinois who use Turo aren’t charged for miles driven by those renting their vehicle.

You probably know The General from their prolific series of humorous commercials starring NBA star Shaquille O’Neal. However, Nashville-based The General, founded in 1963 and acquired by American Family Insurance in 2012, also offers relatively affordable rates for drivers with less-than-ideal driving records and a wide range of discounts for veterans, good students, safe drivers, homeowners, and more.

Highlights of The General include:

Monthly payment plans:

The General offers monthly payment plans in most states in which it operates, making it a sound choice for policyholders who have less liquid cash handy and would prefer to avoid an annual premium payment.

Strong customer satisfaction rating:

The General is wholly owned by American Family insurance, which ranked #1 in midsize insurer’s in J.D. Power’s 2022 U.S. Insurance Shopping Customer Satisfaction Study.

Easy-to-use mobile app:

The General supports online claims filing and boasts a well-regarded mobile app, which has a 4.8 rating on Google Play and is lauded by users for its ease of use and simple design.

You might wonder why some companies on the list have much higher monthly average premiums than others. The disparity in premium pricing is due to the fact that different insurers have different customer bases.

While some insurers specialize in low-risk drivers that are inexpensive to insure, other companies serve higher-risk customers and charge higher premiums as a result. A few more car insurance standouts that didn’t make the list and that serve higher-risk drivers include Amica, Erie Insurance, and The Hartford.

Remember, just because a company is considered “best” overall in your state, doesn’t mean it’s the best for you and your car. To find out which car insurance company is the best fit for you, check out Insurify’s tailored car insurance comparison tool today.

Now that you’ve checked out Insurify’s list of America’s top insurance companies, you’ve got to figure out which company is the best for you and your car. The process is actually quite simple, and once you’re through with it, you’ll find you’ve saved a lot of time and money and gained some peace of mind.

How much money are you willing to spend on car insurance a month? It seems like a simple enough question, but you have to take into account your car and the amount of coverage you want.

Setting Coverage Limits

Most states require you to at least have liability coverage, which covers the damages and medical expenses of the other party in the event of an accident. But a liability-only policy doesn’t cover damages to your own car—that’s what collision and comprehensive coverage are for. A policy that includes liability, comprehensive, and collision coverage is considered full coverage.

More expensive cars are generally more expensive to insure. If you have a valuable car, you should consider securing a full coverage policy with high enough limits so you don’t end up paying too much in out-of-pocket expenses in the aftermath of an accident.

Some drivers might also consider buying underinsured/uninsured motorist coverage, which protects you if you get into an accident where the at-fault party doesn’t carry enough liability coverage to cover your bills. This coverage also kicks in if you’re ever in a hit-and-run accident.

If you don’t own your car outright, you should consider buying a gap coverage, which covers the gap between the actual cash value (ACV) of your car and what’s left on your car loan from your lender, in the event of your car getting totaled.

On the other hand, if you’re driving an old car that doesn’t have much value, you might decide to just buy the minimum car insurance required by your state. This typically entails some combination of property damage and bodily injury liability coverage, but can also include personal injury protection (PIP), underinsured/uninsured motorist coverage.

Insurance Premiums and Deductibles

Your insurance premium is the amount of money you pay to your insurance provider every month, while your deductible is the amount of money you must spend on a claim before your insurance kicks in to take care of the rest.

Insurance premiums and deductibles have an inverse relationship, so the higher your deductible, the lower your premium and vice versa. If your car insurance quote looks a little too expensive, you might consider increasing your deductible to lower the monthly premium.

However, if you set your deductible too high in an attempt to have lower car insurance premiums, you might end up paying thousands in out-of-pocket costs in the event of an actual accident. Ensure you can actually afford to pay your deductible when deciding on your insurance premium.

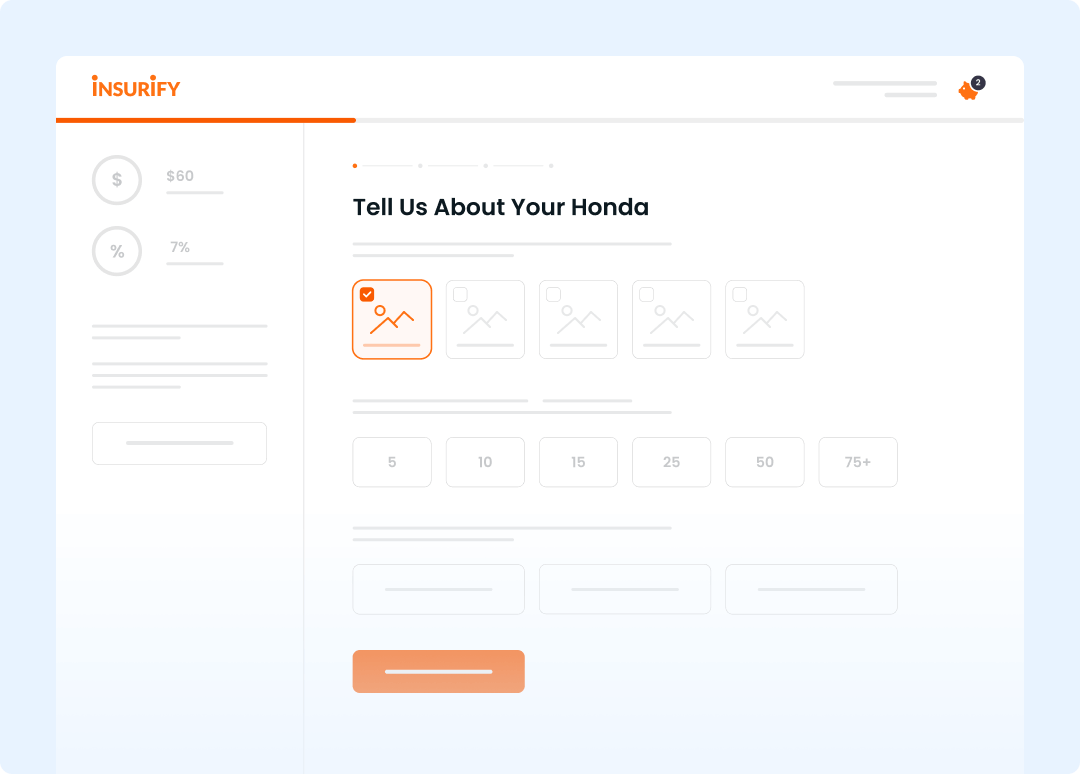

Now that you’ve set your budget, you should go out and collect some car insurance quotes. There are two ways to do this. You can either go to each insurer’s website and fill out a long form for each in order to compare quotes. Or, you can go to a quote comparison website like Insurify, fill out one form, and compare quotes from top companies.

If you want to compare car insurance quotes, using a site like Insurify is easy. All you’ve got to do is visit Insurify and answer some questions about yourself, your driving habits, and your car. This type of information helps Insurify factor in driver discounts you may be eligible for, like having good credit, a clean driving record, or being a homeowner.

The whole process only takes about five minutes in total, at the end of which you can view about 10-20 auto insurance rates from America’s top car insurance companies.

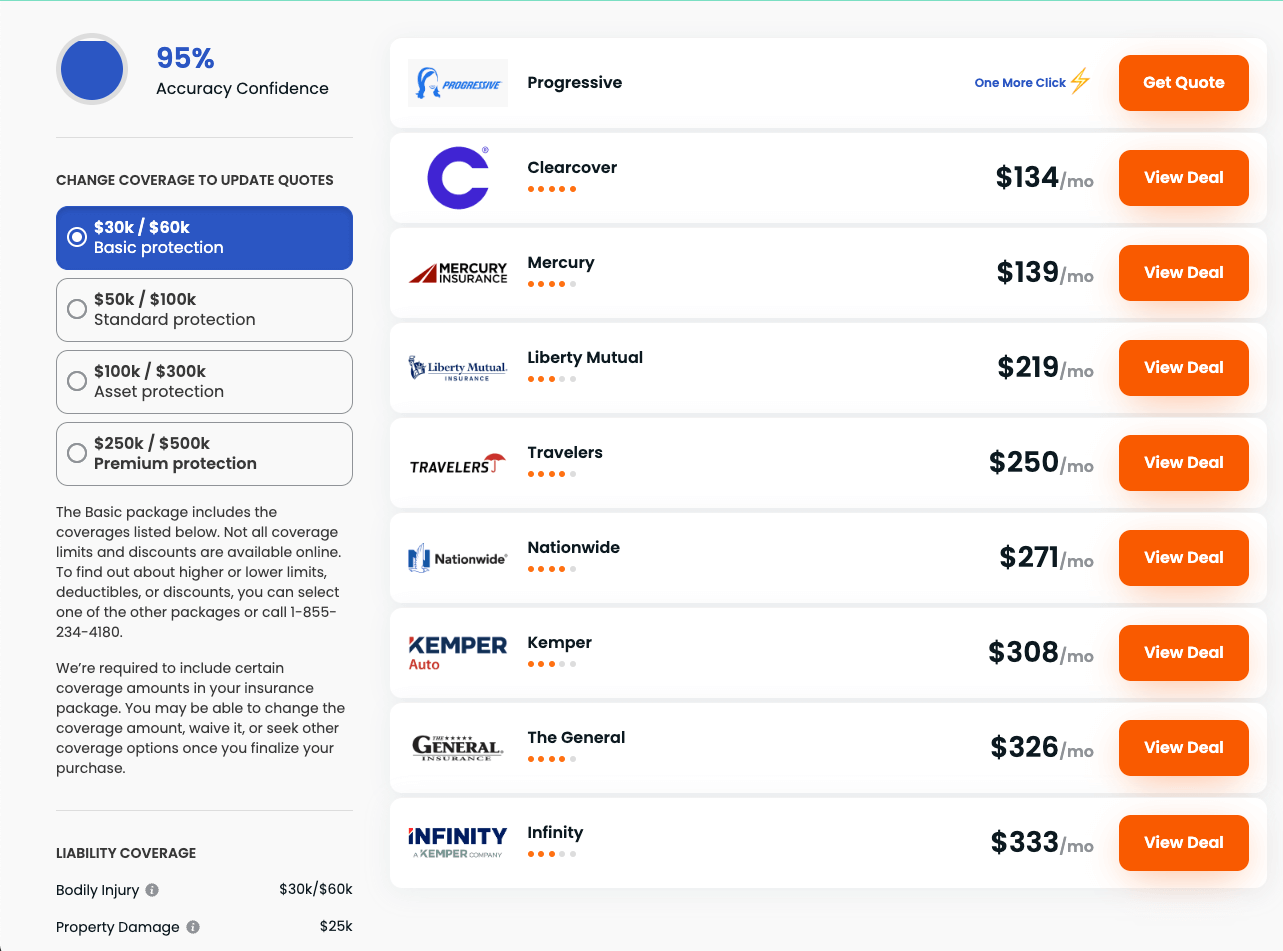

Once you get to Insurify’s final quote list, you’ll be able to view a list of car insurance quotes from various companies. You can then compare these prices and policies with what you currently have and evaluate which company you should switch over to, or if you should switch over at all.

Insurify also offers you the option to toggle between various insurance coverages and levels: state minimum liability insurance, comprehensive coverage, collision coverage, and full coverage, so you can see how much your policy would cost based on your coverage level. You might even find a good deal on extra coverage for an affordable price this way.

Once you’ve narrowed down 2-3 companies that you’re considering, you should check out the Insurify Composite Score for those companies and check out some customer reviews on claims satisfaction before finally settling down on one company and purchasing your policy.

The best car insurance company for you depends on which company can provide you with the best coverage and customer service for an affordable price. To figure out which is the best car insurance company for you, compare car insurance quotes on a site like Insurify, which provides tailored car insurance quotes, complete with options from America’s top insurance companies.

The best type of car insurance policy is a full coverage insurance policy which includes basic liability coverage along with collision and comprehensive coverage. Drivers in certain locations might consider adding on uninsured motorist coverage for additional protection against a hit and run.

Each insurance company assesses risk differently, so there’s no guarantee that a single company will always return the cheapest quotes. To find the cheapest car insurance company for you, compare car insurance quotes from up to 20 different companies on Insurify and pick the one that offers the lowest price.

Contrary to popular belief, finding a good car insurance policy at an affordable rate is not that difficult. Through Insurify, you can tailor your car insurance policy limits to what best suits you, and then view a list of car insurance quotes from America’s top companies. That way you can pick the company that offers you the policy you want at a price you can afford.

Every driver should consider buying a full coverage policy complete with comprehensive and collision coverage along with liability. Additionally, drivers who don’t own their car should consider gap coverage to cover their remaining payments in the event of their car getting totaled. You might also consider buying underinsured/uninsured motorist coverage.

According to Insurify, Foremost insurance had the highest customer claims satisfaction. Other companies, such as GEICO and State Farm, consistently rank well for overall customer satisfaction by J.D. Power expert ratings.

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Jackie Cohen is an editorial manager at Insurify specializing in property & casualty insurance educational content. She has years of experience analyzing insurance trends and helping consumers better understand their insurance coverage to make informed decisions about their finances.

Jackie's work has been cited in USA Today, The Balance, and The Washington Times.

Learn More