4.8out of 3,000+ reviews

Updated August 4, 2022

Ready to cancel your USAA auto insurance policy? The company makes it incredibly easy. Here’s everything you need to know.

While you’re canceling your USAA insurance policy, do you have your next insurance provider picked out? Switching car insurance companies can be disorienting. While you’re decommissioning your USAA policy, enlist Insurify for help. It’s the best car insurance quote comparison tool on the internet, providing you with a quick list of real quotes for free.

Quick Facts

Cancel USAA auto insurance online, in the app, over the phone, or by mail.

There’s no cancellation fee.

Find a new insurance policy *before* you cancel USAA auto insurance.

Table of contents

- USAA Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- USAA Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving USAA

- Step 4: Secure a New Policy

- Step 5: Cancel Your USAA Policy

- Step 6: Follow Up on Your Refund

- Canceling Your USAA Policy

- Frequently Asked Questions

USAA Cancellation Policy

How do I cancel USAA auto insurance?

Canceling USAA car insurance is easy, as the company offers many ways for you to cancel your coverage. Make sure you have a new policy lined up before canceling with USAA to avoid a gap in your coverage.

There’s no cancellation fee, and policyholders can cancel wherever they manage their insurance policy: on the web, over the phone, by mail, and even in the USAA mobile app.

In exchange for this convenience, USAA asks its customers to fill out a survey if they cancel online. That sure beats the hassle of mailing a letter, which some insurance companies actually make you do!

Customers will be reimbursed for their prepaid insurance premiums on a prorated basis. If you’re canceling other insurance products, like renters insurance, life insurance, or home insurance, make sure you know which insurance coverage you want to drop and which you want to keep, and have all your replacement policies squared away.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

Before you cancel, the first question you have to answer is: When? On your USAA auto insurance card, in your USAA account on the company website, or in your mobile app, there will be a renewal date, which you should note. Non-renewal can be more convenient than canceling your policy before the end of the policy term. But you’ll still want to let USAA know.

If you need to cancel ASAP, you can do so. Only make sure you avoid a gap in your insurance coverage. That would spike your auto insurance premiums. Take careful note of your last day of coverage so that your next policy begins the next day at the latest. A little overlap, just for peace of mind, never hurts!

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

So you’ve decided you no longer want to be a USAA customer. Who will get your business next? You’ll want coverage that matches the quality of your current policy with amazing car insurance rates. How to find that? Maybe you’ve tried getting quotes from Allstate, State Farm, GEICO, and other insurance companies that you know.

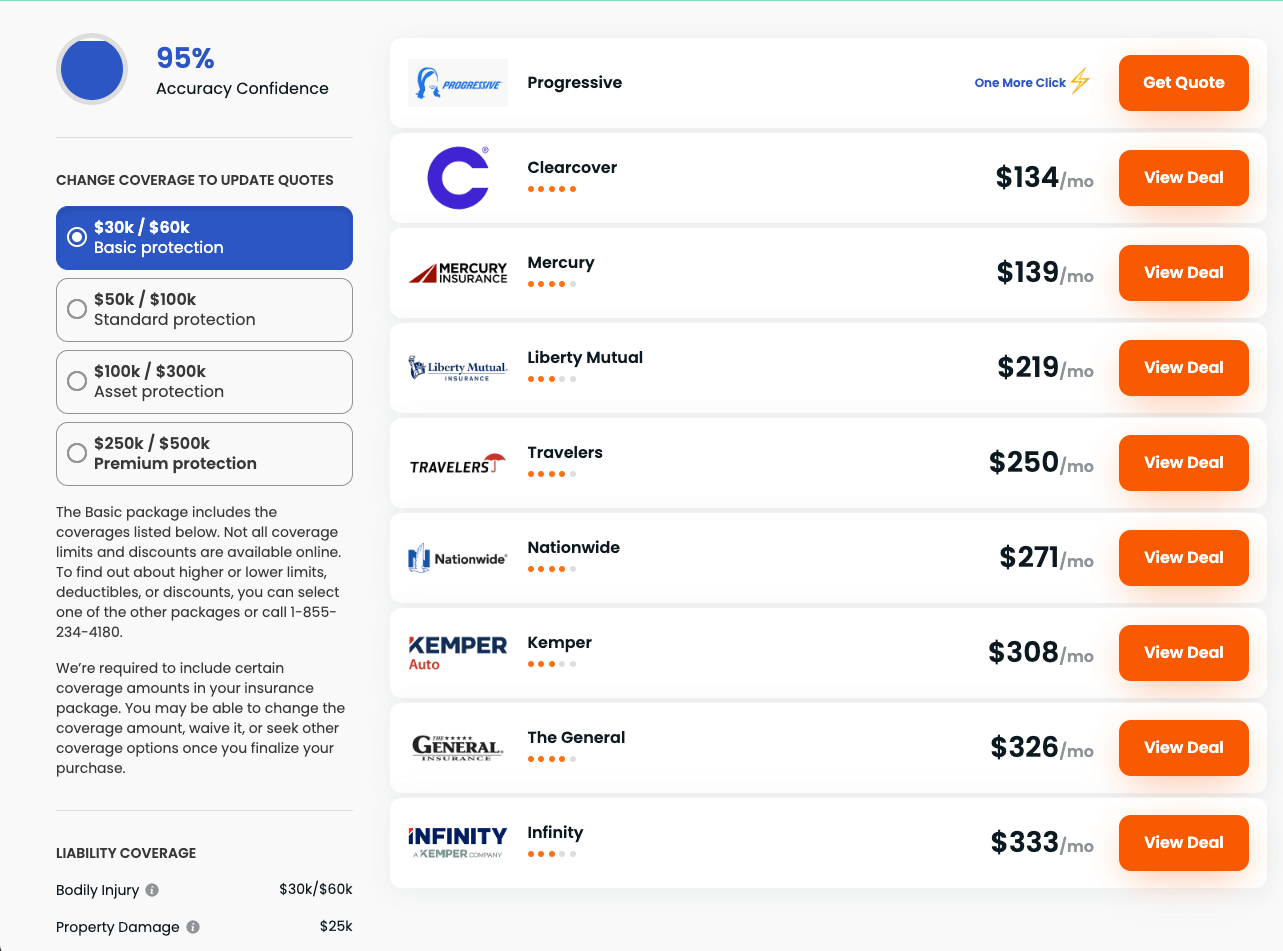

You shouldn’t have to look for car insurance by yourself. Harness the power of the internet and artificial intelligence to do some legwork for you! Insurify is a car insurance comparison service that caters to policyholders just like you. It saves drivers money by getting quotes from up to 20 insurance companies at once, letting you see all your choices in one place. And it’s free!

USAA Quotes vs. Competitors

| Insurance Company | Average Monthly Quote |

|---|---|

| USAA | $149 |

| National General | $139 |

| GEICO | $52 |

| State Farm | $50 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Amica | $105 |

| Esurance | $114 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Erie | $52 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| Travelers | $81 |

| NJM | $64 |

| Mercury | $114 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving USAA

Maybe you were in an at-fault accident or took some other hit to your driving record that skyrocketed your rates. Or your annual mileage is really low, and you want low-use car insurance coverage. Perhaps you took on credit card debt and need a more forgiving car insurance company. These are all plausible reasons to cancel USAA auto insurance.

According to our auto insurance review of USAA, it’s a pretty outstanding company. But if one experience has put you off, like its roadside assistance or the company’s telematics program, SafePilot, keep it in mind as you look for your next insurance company. Auto insurance companies have their own specialties, whether it’s accident forgiveness or insurance for new cars.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

With your dream insurance policy in your imagination, you’re ready to start shopping for car insurance. If you’re a safe driver, you’ll be in the best bargaining position. But anyone can get great car insurance rates if they know where to look.

Or even better—if you know who can do the looking for you. That’s Insurify. It provides bespoke car insurance quote comparison, totally free, secure, and fast. You can also bundle your home insurance or renters insurance with your auto policy. Give it a try!

Step 5: Cancel Your USAA Policy

This is the easy part. Choose any method from the table to cancel your USAA auto insurance.

To cancel by phone, you can call 1 (800) 531-8722, and you should make sure to have your policy number on hand. Alternatively, you can cancel online or on the USAA mobile app. Lastly, you can mail your cancellation to 9800 Fredricksburg Rd, San Antonio, TX 78288; be sure to include your policy number, phone number, and your requested cancellation date.

If you still haven’t found your next insurance policy, you can count on Insurify to find you the best auto insurance rates for your driving record, location, and credit score. To get the liability coverage you need at rates you can afford, you need the best AI-powered car insurance comparison on the web. And that’s Insurify.

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

At the time of cancellation, you should get clear information about whether you’re due for a refund, how much, and when you should expect to receive it.

Take careful note of these details, and maybe even set a reminder or calendar notification so you can check in after the fact. It would be a shame for that money to be lost somehow. Usually, refunds come via the same payment method you used to pay your insurance premiums.

Canceling Your USAA Policy

Luckily, USAA makes it simple to cancel auto insurance. But navigating the vast world of insurance coverage trying to find your next policy? That’s when you need Insurify to search far and wide with its highly rated car insurance quote comparison service. You’ll have a starting point for the best insurance companies for you, and you can even click and buy right away.

Frequently Asked Questions

There is no cancellation fee when you cancel USAA car insurance. Phew! When you cancel, have your policy number ready. If you cancel online, you may be asked to complete a short survey before the process completes.

Yes. USAA customers can cancel their policies online on their USAA account, over the phone with an insurance agent, via mail, and even on their mobile app. It’s rare that a company makes the cancellation process this easy.

Yes. If you cancel your policy before your renewal date, you will be reimbursed at a prorated rate for the insurance premium you’ve already paid. Follow up with an insurance agent if you don’t receive a refund in due time.

The United Services Automobile Association (USAA) is an insurance agency for military members and their families. If you’re not a military member or related to one, you don’t have eligibility to be a USAA customer. The company provides auto insurance, homeowners insurance, renters insurance, life insurance, and other policies at low rates with great service.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.