4.8out of 3,000+ reviews

Updated August 4, 2022

If you have an Allstate car insurance policy, know that you have the right to cancel it and switch car insurance companies. You may do so because your circumstances have changed and you find that a plan from a different provider like GEICO, Liberty Mutual, or Progressive is a better fit. This may be because you lock in a lower premium or are simply unhappy with Allstate’s service.

Before you do cancel your Allstate insurance, however, don’t forget to enroll in a new policy. This car insurance quote comparison makes the process a breeze. Simply fill out a short form and receive auto insurance quotes from the leading providers. There are no fees or sign-ups involved, so you truly have nothing to lose.

Quick Facts

You can cancel your Allstate insurance policy via phone, by mail, or in person.

Allstate does not charge cancellation fees.

Before you terminate your Allstate plan, be sure to enroll in new insurance coverage.

Table of contents

- Allstate Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- Allstate Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving Allstate

- Step 4: Secure a New Policy

- Step 5: Cancel Your Allstate Policy

- Step 6: Follow Up on Your Refund

- Canceling Your Allstate Policy

- Frequently Asked Questions

Allstate Cancellation Policy

How do I cancel my Allstate policy?

To cancel a policy with Allstate, you should start by checking your renewal date. You can then cancel over the phone, as Allstate doesn’t allow you to cancel online. You should make sure you have a new policy lined up before canceling with Allstate so you don’t go uninsured.

Allstate strives to satisfy its customers but understands that at some point in time, customers might want to make changes to their current policy or cancel it altogether. Fortunately, the car insurance company doesn’t charge any cancellation fees, so you can cancel without worrying about a hefty penalty. You might even receive a refund for the unused portion of your premium.

If you do decide to cancel your Allstate policy, you’ll need to speak to your Allstate insurance agent directly. Depending on your situation, you might also be required to submit your cancellation request in writing. Allstate recommends that before you cancel, you ask your agent about the policies and discounts available to you. At this time, you can’t cancel online.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

Timing is everything, especially when it comes to canceling your car insurance policy. When you decide to leave your Allstate insurance plan, make sure you know your renewal date. To find it, you can log into your account online or via the mobile app or ask your agent.

Once you know your renewal date, you’ll be able to avoid a lapse in coverage, which can be problematic if a police officer pulls you over or you get into an accident. Ideally, you’d cancel your Allstate policy toward the end of your policy term, right before it renews. Don’t worry if this isn’t possible, as early cancellation is an option.

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

If you have plans to cancel your Allstate insurance, you’ll need to shop around and look for a new plan first. When you search the internet for “car insurance,” you might be a bit overwhelmed. After all, there is no shortage of auto insurance companies with countless coverage options.

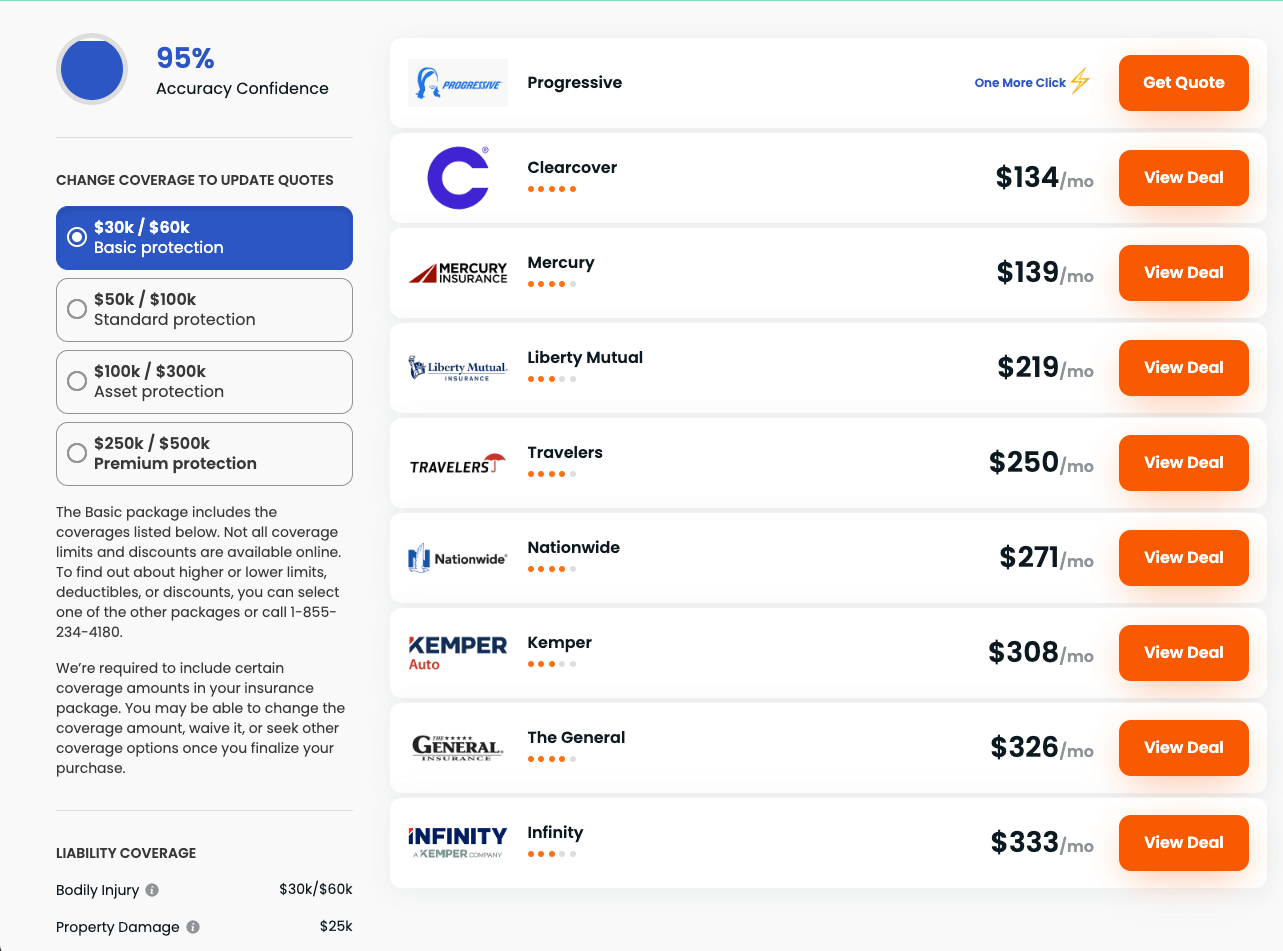

That’s where Insurify comes in. This handy tool takes the guesswork out of finding a new car insurance plan. You can compare auto insurance quotes in minutes from the leading providers. Insurify gives you all the information you need to make an informed decision all in one place.

Allstate Quotes vs. Competitors

| Insurance Company | Average Monthly Quote |

|---|---|

| Allstate | $62 |

| GEICO | $52 |

| State Farm | $50 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Amica | $105 |

| Esurance | $114 |

| National General | $139 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Erie | $52 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| Travelers | $81 |

| NJM | $64 |

| American Family | $84 |

| Mercury | $114 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving Allstate

While it may be tempting to reach out to your Allstate agent to terminate your insurance policy as soon as the idea crosses your mind, it’s a good idea to hone in on your reasoning first. There are a number of scenarios that may warrant a cancellation. The most common one is to save money with lower auto insurance premiums.

You might also want to cancel Allstate because you’ve moved and wish to work with an agent from a different company in your local area. Perhaps your driving habits have changed, and you decide a pay-per-mile plan makes more sense. Although you don’t have to explain to Allstate why you’d like to leave, it’s important to know your own motivation for doing so.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

Once you’ve found a new policy, be sure to enroll in it before your Allstate renewal date. Make sure you understand your new coverage and ask for clarity if something in your plan is unclear. Once you finalize your new car insurance, jot down your effective date, as Allstate might ask for this information.

No matter what your situation is, it’s essential that you have a car insurance policy before you cancel. Even though state laws vary, most states require you to drive with a valid auto insurance plan. If you get caught driving uninsured, you may be on the hook for steep fines and other penalties.

Step 5: Cancel Your Allstate Policy

Fortunately, Allstate makes the cancellation process simple. While you can make a phone call to 1 (800) 255-7828, it’s best to reach out to your local agent directly. You can also visit an agent at a nearby branch or send a letter to Allstate Insurance Company, PO Box 660598, Dallas, TX, 75266-0598. When you do so, expect your agent to attempt to keep your business.

Remember that you have no obligation to stay with Allstate and can use Insurify to explore other options. In some cases, your Allstate agent may ask you to send in a written request to cancel your policy. It will likely take a few days for the termination to be posted to your account, so keep your eyes out for it, but don’t expect anything immediately.

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

Above, we mentioned that it’s in your best interest to cancel your Allstate auto insurance policy as close to your renewal date as possible. One of the perks of doing so is the possibility of receiving a refund. Depending on how you paid for your premium and when you terminate your plan, Allstate might owe you a refund for your unused premium.

If you paid for your Allstate car insurance upfront, you may receive hundreds of dollars back. Even if you went the month-to-month route, you may still be eligible for a refund; consult your Allstate agent for more information. If you find out you’re owed a refund, be sure to follow up in a few weeks if you haven’t received it.

Canceling Your Allstate Policy

It’s your right to cancel your Allstate policy at any time. Whether you’ve been with Allstate for years or just a short time, you don’t have to stay with them if you’re dissatisfied or find an alternative option. With Insurify’s car insurance comparison tool, you’ll be able to explore auto insurance rates from highly rated providers so you can find the right plan for your unique needs.

Frequently Asked Questions

In general, Allstate doesn’t charge cancellation fees. But whether you have to pay one will depend on where you live. Some states do require a cancellation fee, which may be deducted from your refund. Your Allstate agent should inform you of this information in advance so you don’t have to worry about any hidden charges or penalties.

The quickest way to terminate your Allstate policy is to call your agent directly. While you may receive a short sales pitch to stay with them, the agent should honor your request and guide you through the process. If you don’t want to cancel via phone, you can do so through the mail or in person at a local branch.

Before you go ahead and cancel your Allstate insurance, consider why you want to. Then, think about the best time to pull the plug. Ask yourself if you can wait until the end of your policy, just weeks before your renewal date. Also, make sure you have another car insurance plan in place so that you don’t face a gap in coverage.

If you’ve had a bad experience with Allstate or found a better plan elsewhere, canceling is likely your best bet. But if your Allstate agent offers you a discount you can’t pass up or apologizes for a minor mishap, you might be better off keeping your plan. You can always cancel Allstate insurance at a later time.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.