4.8out of 3,000+ reviews

Updated February 14, 2023

You may have encountered Esurance during your online hunt for auto insurance and wondered if it's the best car insurance company for you. If you're a tech-savvy driver looking for an efficient way to manage your car insurance, Esurance offers its customers a quality, digital experience.

Quick Facts

Esurance is a subsidiary of Allstate, one of the country’s largest auto insurers.

Esurance's well-rated mobile app allows for a smooth claims process without a claims representative.

Esurance's telematic program, DriveSense, has unique tracking functionalities and comes with a discount.

What is Esurance?

Allstate, a popular insurance provider, founded Esurance in 1999. While relatively new, Esurance prides itself on its digital accessibility and comprehensive telematics program.

What is Esurance’s DriveSense app?

Esurance's DriveSense app does more than track your driving habits. It has unique capabilities such as mapping your driving route, delivering weekly recaps of your driving performance, and offering tips to improve your safety as a driver.

Upon enrolling in the program, you can get a discount on your policy. On top of that, your discount changes periodically based on your driving history. So, if the app tracks that you're driving safely, you could get an increased discount. DriveSense is currently available in 35 states.

How does Esurance auto insurance work?

Esurance is a tech-based car insurance company. The insurer claims its digital-oriented business model allows the company to reduce costs and pass savings to policyholders.

Esurance may also attract its customers with its easy-to-use website and mobile app. You can get a quote in under six minutes and file a claim with an approval turnaround of as little as one day.

Esurance car insurance coverage

Esurance offers various coverage options to protect you and your vehicle:

Collision coverage: If you run your car into another object or someone damages your car with theirs this coverage helps pay for repairs.

Comprehensive coverage: If your car is in a non-collision-related incident, like theft or a hit-and-run, this coverage will pay for repairs or replacement.

Emergency roadside assistance coverage: If you’re on the side of the road and need a tow or jump start, Esurance will cover up to $75 per incident to get you up and running again.

Loan or lease gap coverage: If you total your car in an accident, this coverage reimburses you up to 25% more than your car's actual cash value to pay the remainder of your car lease or loan, minus a deductible.

Medical payment (MedPay) or personal injury protection coverage: If you or your passengers sustain injuries in an accident, medical payments coverage helps with medical expenses, regardless of whether you were the at-fault driver. Some states require PIP coverage.

Property damage liability coverage: If you damage someone else's property or vehicle, this coverage will pay for those repairs. It's illegal to drive without this insurance in almost every state.

SmartShare rideshare insurance: If you work for a rideshare company, like UBER or Lyft, this insurance can cover the gaps that your rideshare company's insurance may not. This coverage is currently only available in California, Illinois, and New Jersey.

Uninsured or underinsured bodily injury liability coverage: If someone without insurance or enough insurance injures you in a car accident, this insurance will cover your medical expenses.

Uninsured or underinsured property liability coverage: If your car has damages from an accident where someone without insurance or enough insurance runs into you, this insurance will cover the repair costs.

How to get an Esurance car insurance quote

You can get an Esurance policy estimate in minutes by using its online quoting tool or calling 1-800-378-7262 to speak to a live representative.

Esurance car insurance cost by state

It's crucial to look into your state's vehicle insurance requirements to determine what coverages you need. Most states require liability insurance, and some states require personal injury protection insurance.

Where you live will influence how much your policy will cost. For instance, with Esurance, you'll see significantly costlier premiums in New York than in Ohio.

| State | Average Monthly Quote (Full Coverage) | Liability Only |

|---|---|---|

| Arizona | $166 | $125 |

| California | $287 | $145 |

| Colorado | $202 | $137 |

| Georgia | $329 | $271 |

| Maryland | $316 | $281 |

| Missouri | $137 | $94 |

| New Jersey | $287 | $272 |

| New York | $693 | $827 |

| Ohio | $131 | $98 |

| Pennsylvania | $200 | $154 |

| Texas | $250 | $193 |

Esurance auto insurance rates by driving history

Insurance companies look at your driving history to estimate your likelihood of filing a claim.

Drivers with a clean record will likely pay cheaper premiums than people with driving infractions.[1] For instance, with Esurance, drivers with a DUI may have two times more expensive premiums for full-coverage insurance than drivers with a clean driving history.

| Driving History | Average Monthly Quote | Liability-only rate |

|---|---|---|

| Clean record | $267 | $192 |

| With speeding ticket | $358 | $258 |

| With at-fault accident | $382 | $275 |

| With DUI | $531 | $383 |

Esurance car insurance cost by age

Your age will influence the cost of your policy. Insurers see teenagers as a liability since they have less experience on the road than older drivers.[1] Therefore, they usually have the costliest policies.

At Esurance, drivers younger than 25 will pay more than $400 per month for a policy. Drivers older than 25 will pay slightly more than half of that.

| Driver Age | Average Monthly Quote |

|---|---|

| 18 | $410 |

| 25 | $223 |

| 30 | $211 |

| 40 | $194 |

| 50 | $189 |

| 60 | $168 |

| 70 | $172 |

Read More: Compare Car Insurance by Age and Gender

Esurance car insurance discounts

Companies offer discounts for various reasons, like owning an electric vehicle, being a member of an affiliated group, or automating your payments. Generally, to obtain information on discounts you might be eligible for from Esurance, you’ll have to go through the company’s quoting process. However, Esurance does promote its telematic program for drivers that can potentially lower their rates.

The DriveSense mobile app logs your miles and gives feedback on your driving performance. You get a rate reduction upon enrolling for the program, and your discount increases or decreases based on how safely it determines you drive.

Esurance bundling options

You can bundle two or more policies from the same insurance company to get a lower rate than you would with separate companies. Again, Esurance only advertises one bundling opportunity on its website. You can add renters insurance to your car insurance policy for additional savings.

See Also: Bundle Home and Auto Insurance: Save With Discounts

Compare Car Insurance Quotes Instantly

Esurance reviews and ratings

Esurance is a relatively new insurance company compared to big players that have been around for nearly a century. With nearly 15,000 reviews on Google Play, Esurance's mobile app earned 4.4 stars out of 5. Esurance has more than 210,000 reviews on the Apple Store and received an average of 4.8 stars out of 5. However, Esurance has its fair share of negative and positive reviews.

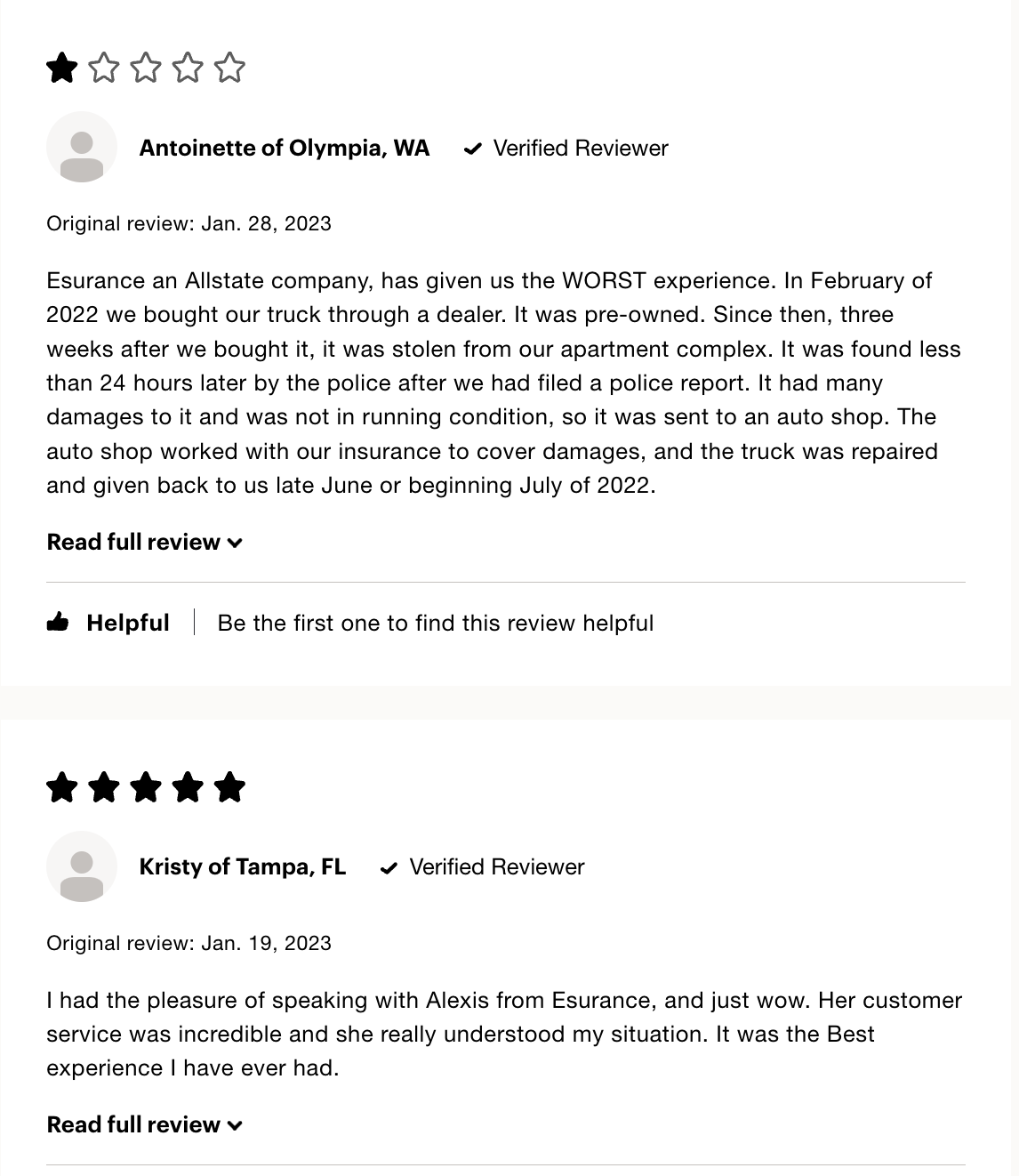

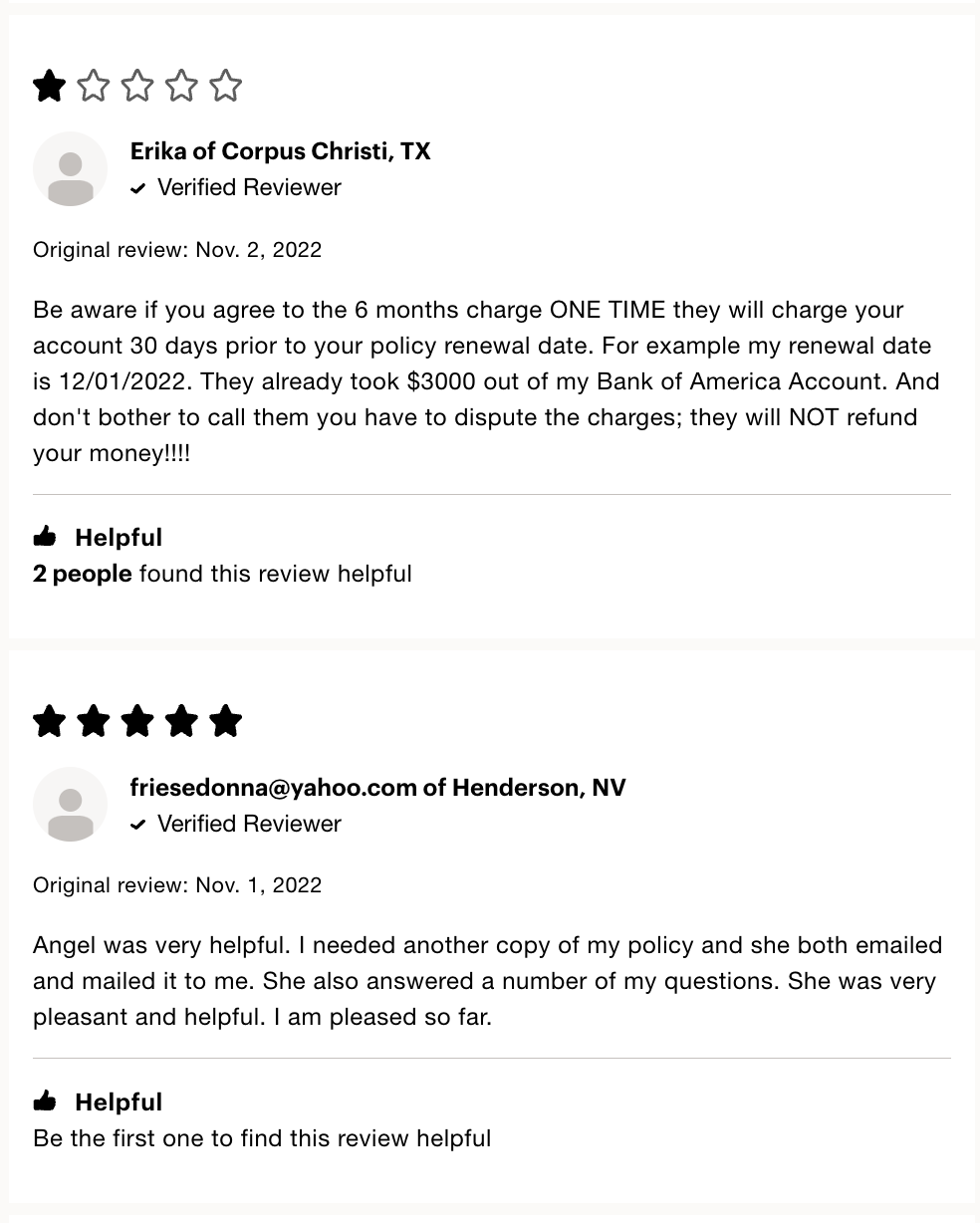

Esurance customer reviews

Esurance received mixed reviews from ConsumerAffairs, earning 3.2 stars out of 5 from 3,065 ratings.

Esurance ratings

Take a look at several of the scores Esurance received from other rating sites:

A.M. Best: A+

Consumer Affairs: 3.2 out of 5 stars with 3,065 votes

J.D. Power: 836 out of 1,000 (2019 regional average)

Trustpilot: 1.6 out of 5 stars with 31 reviews

Esurance vs. other insurance providers

With plenty of providers to choose from, looking for car insurance can be overwhelming. We've compared Esurance's policies, discounts, and features against competitors to see how it stacks up.

Esurance vs. Allstate

While Esurance is a subsidiary of Allstate, the companies have different perks. At Allstate, you have your pick of discounts, coverages, and bundling opportunities you may not get with Esurance. Additionally, while Esurance offers a digital-first user experience, you may not receive the same quality of service you can get from a live agent.

Esurance's policies are slightly more expensive, at $267 per month for full coverage and $192 per month for liability-only coverage. At Allstate, a full-coverage policy costs $212 per month and a liability-only policy costs $146 per month.

Esurance vs. Liberty Mutual

Liberty Mutual has a long list of discounts that outshines Esurance’s and includes savings for violation-free drivers, bundling homeowners insurance, getting good grades, and more. While Liberty Mutual doesn’t have a telematics-based app savings program, it does offer coverage options similar to Esurances.

The two insurers’ average monthly quotes are also similar. Liberty Mutual’s average monthly quote for full-coverage insurance is $284, and liability-only coverage is $198. Esurance offers average monthly quotes of $267 for full-coverage insurance and $192 for liability only.

Esurance vs. Progressive

Progressive is the third-largest provider in the nation by market share.[2]

Aside from the basic coverages, Progressive offers custom parts replacement and a disappearing deductible, which Esurance doesn't. Like Esurance, Progressive also has a telematics program that the company claims saves drivers an average of $156 on six months' worth of premiums when they renew their policy.

You may pay cheaper premiums with Progressive than at Esurance. Esurance's full-coverage policy costs an average of $267 per month, and its liability-only coverage costs an average of $192. Progressive’s average full-coverage policy costs $238 and its liability-only coverage costs $161.

Esurance pros and cons

Esurance has several attractive features, but weighing the pros against the cons is important to determine if this provider is right for you.

Pros

Highly rated mobile app: Esurance earned more than four stars on the Apple Store and Google Play for its user-friendly functionalities.

Cost-saving telematic program: DriveSense saves money for enrolling in the program and offers additional savings after that for good driving.

Good selection of coverage options: Esurance offers basic coverages, like collision and comprehensive coverage. It also sells supplemental insurance, like emergency roadside assistance and loan/lease gap coverage.

Cons

Not available nationwide: You can only purchase an Esurance policy if you live in one of 43 states.

Discounts not advertised on website: Esurance only lists one of its available discounts on its website. You must obtain a quote to see the company's other cost-saving features.

Relatively expensive: At Esurance, your premiums may be costly compared to other auto insurance companies.

Filing an auto insurance claim with Esurance

After an accident, you must send your insurance company a request for reimbursement of damages and injuries. This formal request is called a claim.

You need several items and pieces of information to file a claim. This will include pictures of the scene, IDs of all drivers in the accident, license plates, insurance cards, and the police report number, if you have one. Your insurer will also ask you to provide a detailed description of the accident.

Start your claim with Esurance by using its mobile app or talking to a representative at 1-800-378-7262. You can even request roadside assistance on the app if you need a tow.

Check Out: Why Do Car Insurance Companies Deny Claims?

Esurance FAQs

Finding the right auto insurance can get complicated. So, here are answers to your most pressing questions about Esurance car insurance.

Yes, Esurance is a legitimate company. It’s been around since 1999 and is backed by Allstate, a major insurance provider.

Esurance is excellent for tech-savvy drivers who value a quick and efficient digital insurance experience. However, you may find better rates elsewhere at a better value.

Esurance costs $267 for a full-coverage policy and $192 for a liability-only policy.

Esurance received an A+ (Superior) rating from A.M. Best. So it has a good track record of meeting its financial obligation to its customers, including paying out claims.

Esurance will track your driving if you enroll in the DriveSense app. You can opt out anytime, but you’ll lose your DriveSense discount.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Sources

- III. "What determines the price of an auto insurance policy?." Accessed February 9, 2023

- III. "Facts + Statistics: Insurance company rankings." Accessed February 9, 2023