4.8out of 3,000+ reviews

Updated February 14, 2023

The best way to get a great deal on car insurance coverage is to compare quotes from multiple insurance companies before you buy a policy. That’s where insurance comparison sites come in—they deliver quotes from different companies to help you compare auto insurance rates and get the coverage you need.

Many comparison sites claim to return legitimate quotes, like Nerdwallet, The Zebra, Compare.com, and Gabi. However, not all comparison sites are trustworthy — some collect your information to sell to agencies and insurance companies, rather than returning quotes and providing good deals on coverage.

Here's a look at the 10 best and worst car insurance comparison sites and some tips to make sure the process of comparing goes smoothly.

Quick Facts

Drivers who compare quotes before buying a policy can save up to $996 annually.

Quote-comparison sites allow users to compare quotes from multiple insurance providers, whereas lead-generation sites sell users’ information to advertising partners.

Trustworthy quote-comparison sites will not sell your data or information for profit.

How auto insurance quote comparison sites work

What are insurance comparison sites?

Insurance comparison sites are platforms that allow users to compare insurance quotes online. These sites streamline the process of finding insurance and allow users to find the best and cheapest policy easily and in a short amount of time.

Comparison sites allow users to compare real, accurate, and personalized car insurance quotes online. These sites streamline the insurance-buying process by making it easier for customers to enter their information just once to view quotes from multiple providers on a single page. This way, drivers can find the best and cheapest policy in the shortest amount of time.

Comparison-shopping just once a year can shave hundreds of dollars off your insurance premium. However, according to Statista[1], only about 27% of American drivers buy insurance online, let alone compare quotes online before buying a policy. If you fall into that category, no worries — here’s how it works.

First, there are two types of auto insurance comparison websites:

Quote-comparison sites

Lead-generation sites

You submit basic information about yourself, your car, and your coverage needs with both options. But that’s where the similarities end.

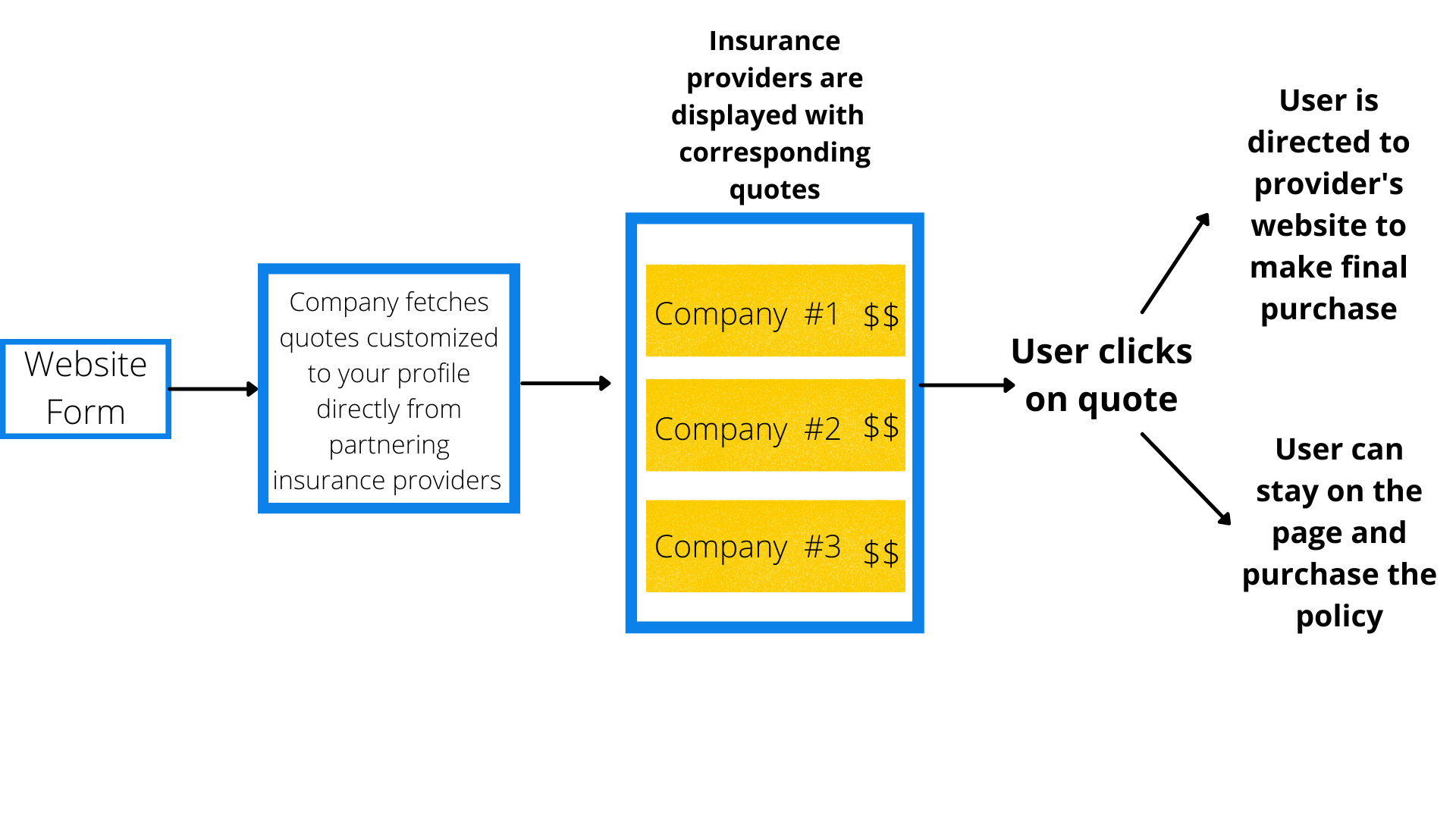

Quote-comparison sites

Quote-comparison sites give you rates from multiple car insurance providers so you can review the options and decide which quotes to pursue.

When comparison-shopping, you’ll come across some sites that provide real-time insurance quotes and others that give an estimate. Estimated quotes use historical data that may not have the most up-to-date information. Real-time quotes are much more accurate, as they’re sourced from insurance companies directly.

Once you’ve made your choice, the car insurance comparison website transfers your data to the agent or company. The site helps the purchasing process go more quickly and smoothly by sharing your information. An important thing to note is that reputable insurance quote comparison services won’t sell your information to auto insurance companies or agencies.

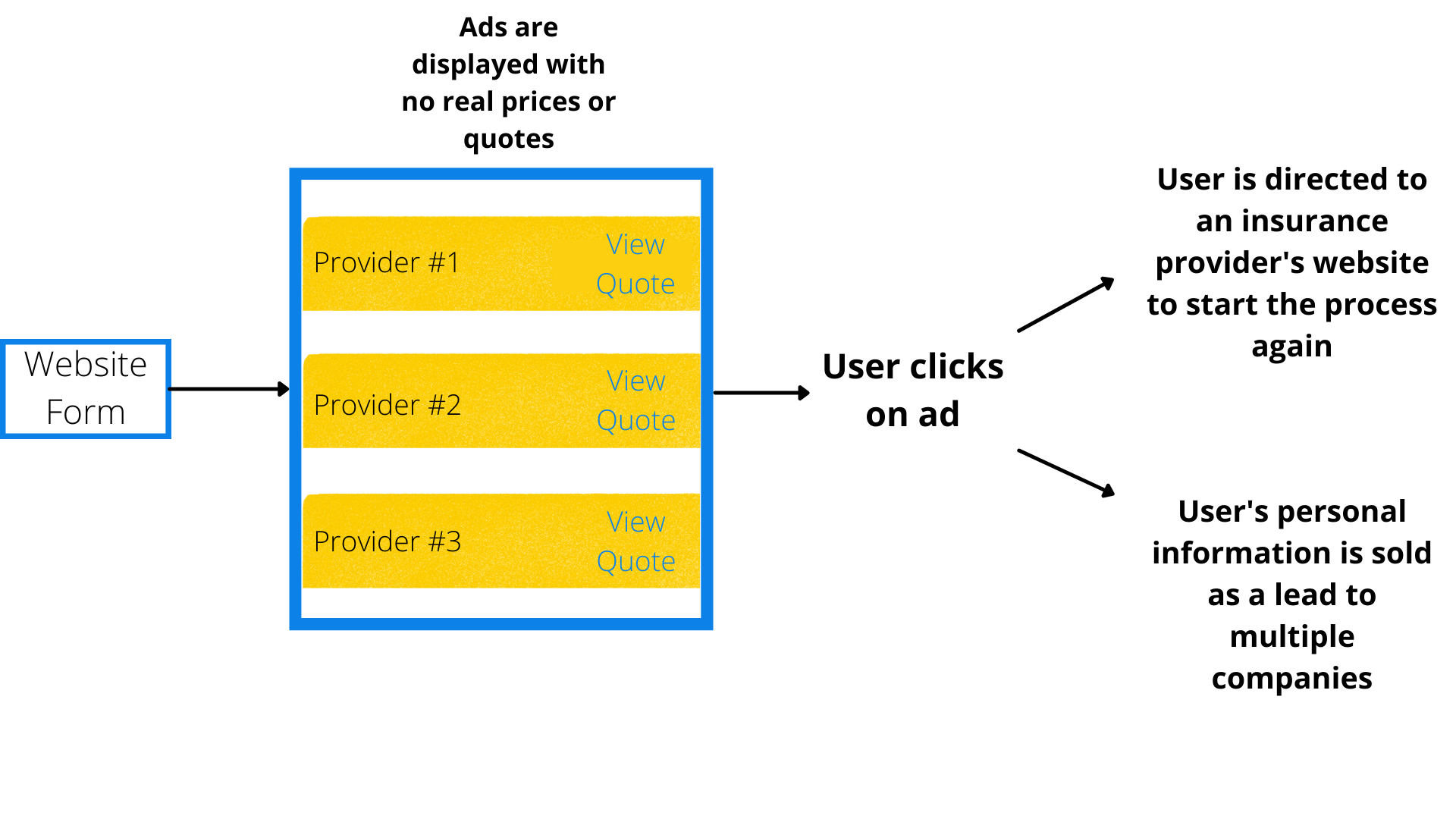

Lead-generation sites

Lead-generation sites collect your information with the promise of giving you multiple quotes to compare. However, these sites often sell your information to advertising partners like insurance companies and agencies.

You generally want to avoid lead-generation sites. They’re not built to provide personalized quotes, and they’re not much help when you’re trying to get accurate pricing information. Plus, you could end up getting tons of cold calls or emails from insurance phone banks and desperate agents.

Read More

The best and worst car insurance quote-comparison sites

With dozens of insurance websites at your fingertips, it can be overwhelming to pick the best insurance shopping experience. To help you choose, here’s a comprehensive list of the best and worst sites to compare car insurance quotes on.

Insurify

The Zebra

Gabi

Policygenius

Compare.com

SmartFinancial

Bankrate

QuoteWizard

ValuePenguin

Otto

| Comparison Site | Shopper Approved Reviews | Trustpilot Reviews | Real-Time Quotes |

|---|---|---|---|

| Insurify | 4.8 stars | 3.4 stars | 8 |

| The Zebra | 4.8 stars | 4.1 stars | 2 |

| Gabi | N/A | N/A | 1 |

| Policygenius | N/A | 4.8 stars | 0 |

| Compare.com | 4.8 stars | 3.2 stars | 0 |

| SmartFinancial | N/A | N/A | 0 |

| Bankrate | N/A | 3.3 stars | 0 |

| QuoteWizard | N/A | 3.0 stars | 0 |

| ValuePenguin | N/A | 2.9 stars | 0 |

| Otto | N/A | 4.5 stars | 0 |

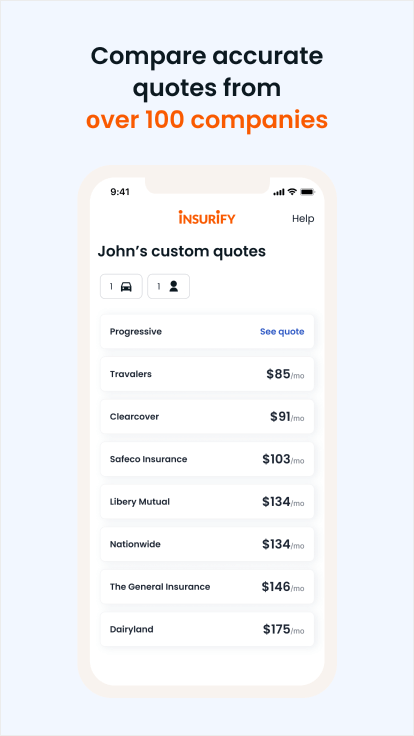

Insurify

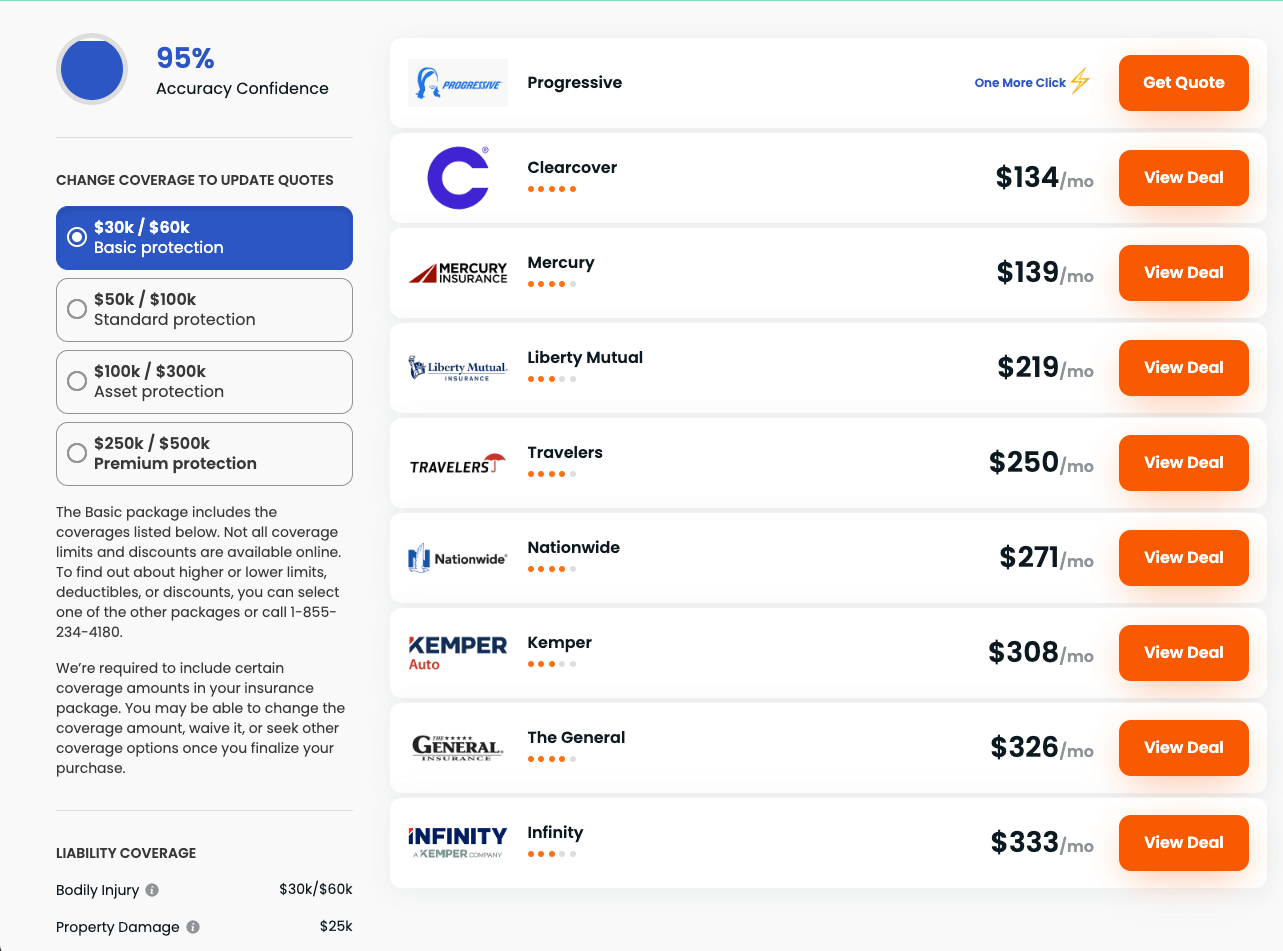

Insurify tops the list ranking as the No. 1 insurance comparison platform in the U.S., according to Shopper Approved[2]. It’s quick, easy to use, and free.

Drivers love Insurify because it provides real-time quotes from top auto insurance companies. That way, you get legitimate rates from some of the most reputable insurers. Insurify is a virtual agent that's licensed in all 50 states.

How Insurify works

You start by entering your ZIP code, car information, and driver details. You’ll then have to choose whether to add comprehensive and collision coverage. Next, Insurify asks for your name, birth date, and other information to match you with available discounts.

The form asks if you’re currently insured and a few questions about your driving history. Then, you’ll enter your email, phone number, and address to streamline the process and get accurate quotes from top insurance companies like Liberty Mutual and Nationwide.

Insurify partners with over 200 insurance companies throughout the U.S., including both regional and big-name national providers. It can match you with personalized discounts and coverage options all in a matter of minutes. The site works well on mobile and desktop browsers, and also offers a user-friendly app.

In addition to using Insurify to compare quotes for car insurance, users can also compare quotes for home and renters insurance, all on the same comparison platform. Insurify has paired millions of drivers and homeowners with their insurance policies.

Results

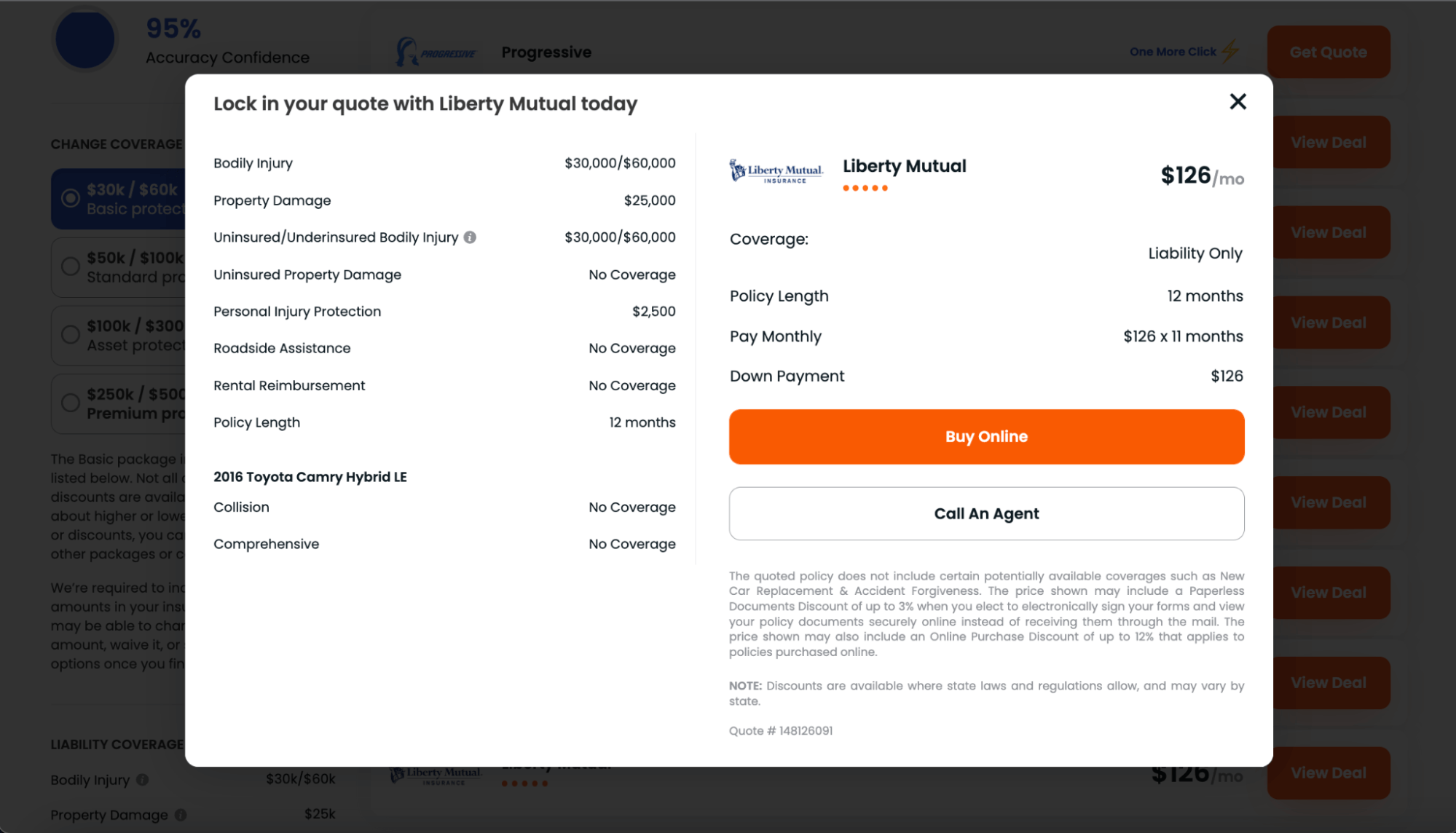

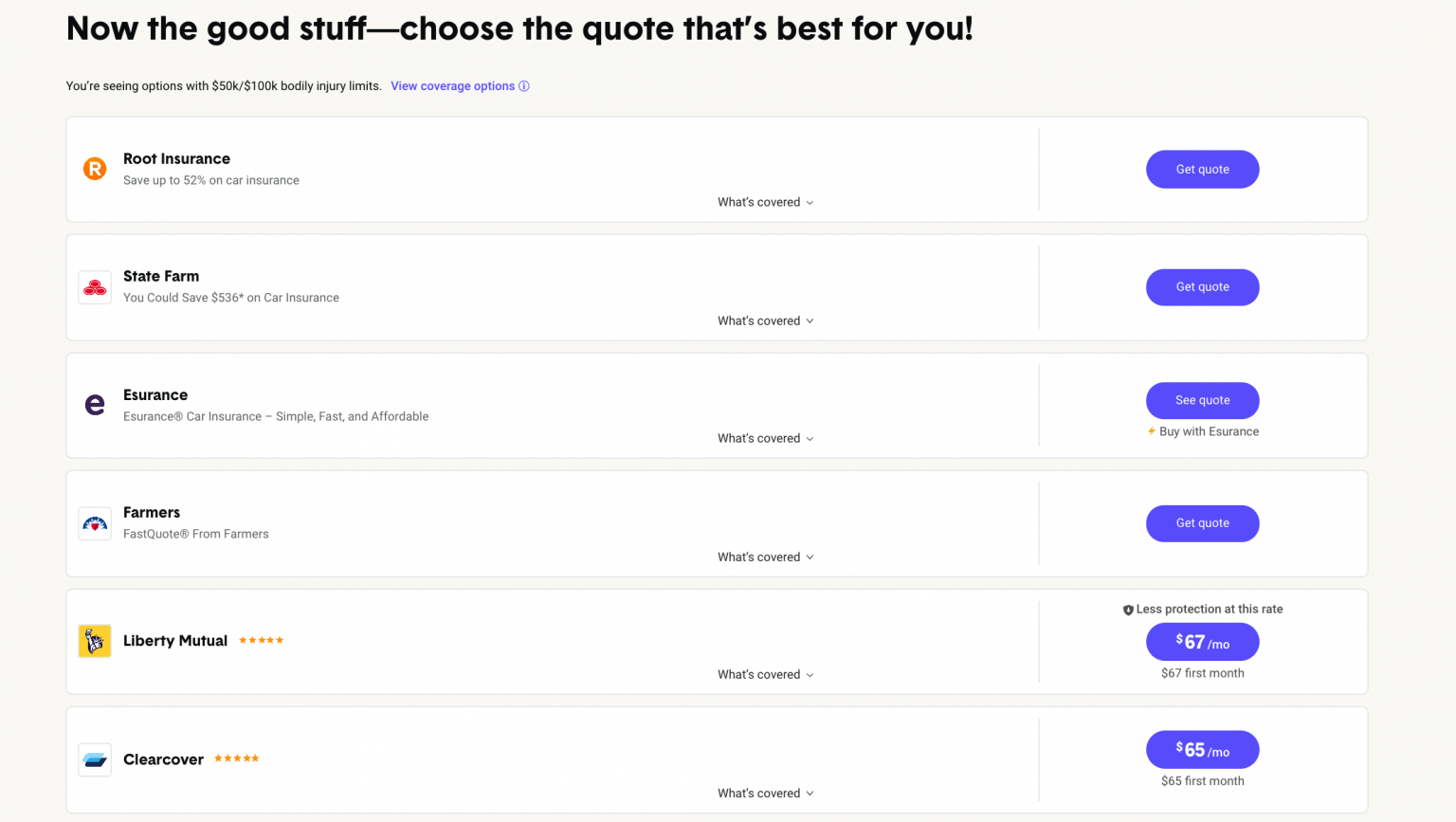

Insurify provided quotes from eight different companies. The site listed the name of the insurer and the quoted price, along with any reduced prices and available deals.

After comparing rates, you have the option to view more details about the offer and to continue the quote process with the company of your choice. Alternatively, you can purchase a policy on Insurify itself. The questionnaire is fast and simple, and Insurify users can secure coverage in two minutes.

Why you should trust Insurify

Founded in 2013, Insurify has built a reputation for pairing users with personalized and accurate real-time quotes sourced directly through its partnerships with America’s leading insurance providers, including Liberty Mutual, Travelers, Allstate, and Progressive.

In addition to its partnerships with top national and regional providers, Insurify also powers insurance comparison platforms for Toyota Insurance Management Solutions and Nationwide. Insurify provides a legitimate, comprehensive insurance comparison platform recognized and trusted across America.

Top 5 advantages of Insurify

Partners with most of America’s top national and regional companies

Displays legitimate quotes in real-time

Offers a quick sign-up process

Protects your data so you’re not bothered by unsolicited phone calls

Excellent mobile app experience

See More: Compare Car Insurance Quotes

The Zebra

The Zebra is another auto insurance comparison site. It aims to simplify insurance by giving you real-time quotes. And, like Insurify, The Zebra is free to use.

You can get coverage no matter where you live—the site partners with more than 30 top providers and offers quotes in all 50 states. The company got its start in auto insurance. However, you can also use it to compare home, renters, and condo insurance policies.

How The Zebra works

To get quotes from The Zebra, you have to first enter your ZIP code. You’ll then be directed to enter additional information, like whether you currently have car insurance and whether you own or rent your home.

After that, the site asks for information about your vehicle and insurance history before moving into questions about you and other drivers who may be on the policy. You also have the option to create an account and save your information for easier access next time.

Results

The Zebra delivered fewer results compared to the options offered by Insurify. Still, the auto insurance companies were reputable and included well-known names, like Liberty Mutual.

After comparing options and choosing an insurer, you click through to complete your quote with your preferred company. The Zebra transfers your data to the provider to streamline the process.

Pros

Shows quotes in real time

Partners with reputable, well-known insurers

Cons

Users can’t complete their purchase on the site itself

You'll have to re-apply for a policy on the website of the insurance provider you choose

Gabi

Gabi is an online insurance broker. The site lets you compare multiple quotes and offers policies in all 50 states. However, Gabi doesn’t offer a real-time experience. That is, someone from the Gabi team will send you a follow-up email with personalized rates within 48 hours.

The company works with over 40 insurers to help you find affordable car insurance. With Gabi, you’ll see policies from Travelers, Safeco, Clearcover, and Nationwide to name a few.

You can get quotes for landlord, renters, home, and umbrella insurance if you’re looking for additional coverage.

How Gabi works

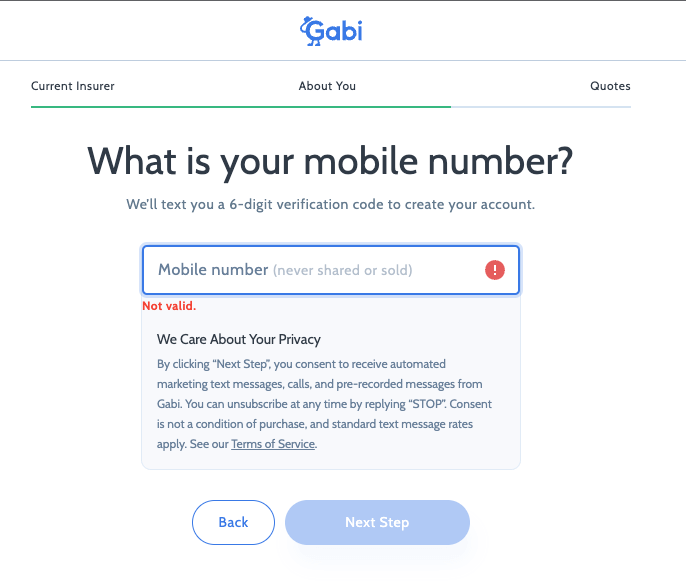

The first question Gabi asks when you request a quote is the name of your current insurer. Gabi then requires you to key in your phone number, and it sends you a six-digit verification code. Gabi also requires you to consent to marketing text messages, calls, and pre-recorded messages before continuing.

After you verify your phone number, you’ll enter basic information about your address, vehicle, and driving history.

Alternatively, you can upload your current policy to the Gabi website, from which a Gabi team member will glean your information. They will then send you insurance quotes via email within 48 hours.

Results

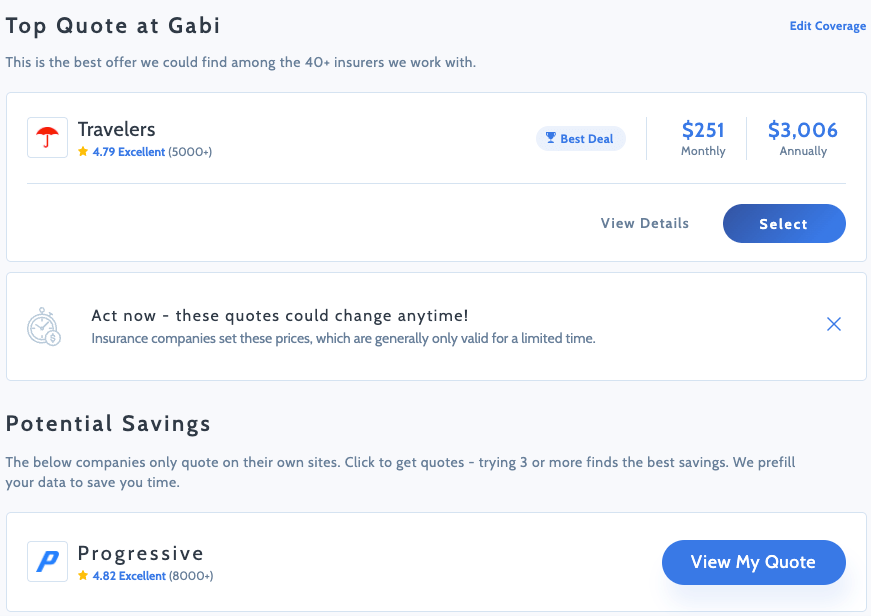

Gabi only listed one car insurance quote, for Travelers, along with an ad for Progressive that displayed no price, despite advertising that it works with 40+ insurers.

Overall, Gabi doesn’t seem to provide much value or save you much time when shopping for auto insurance.

Pros

Partners with well-known insurance providers

Captures your information from your current insurance policy

Cons

Doesn’t show that many quotes in real time

Takes up to 48 hours to email your quotes

See More: The Best Car Insurance Companies

Policygenius

Like Insurify and The Zebra, Policygenius is an online insurance marketplace. It helps you compare car insurance policies from multiple companies. In addition to auto insurance, the comparison site can help you get a great deal on home, disability, and renters insurance.

Policygenius claims to save drivers an average of $435 per year on auto insurance. The site also claims to save shoppers an average of 35% when bundling home and auto insurance through their platform.

How Policygenius works

When you shop with the Policygenius marketplace, you start by entering your ZIP code. You’ll also choose whether you want to bundle your auto insurance coverage with homeowners insurance to qualify for additional savings.

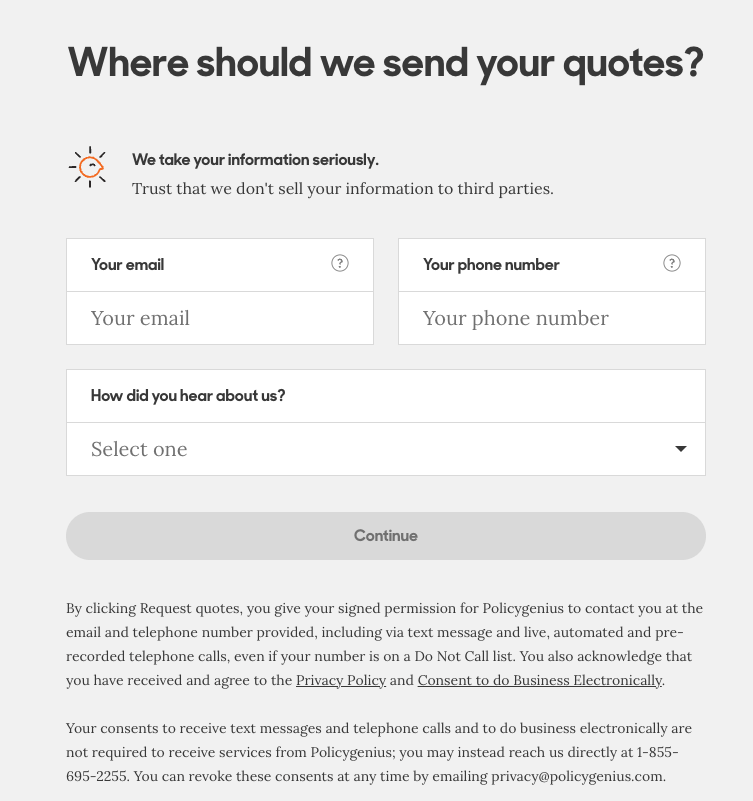

The site asks about your current auto insurance company, policy length, and cost. It then asks you to list out every address you’ve lived at for three years before it moves onto details like claims history, driving record, name, and address.

You’re also required to put in your occupation, personal annual income, credit score, and vehicle make and model.

Results

Policygenius doesn’t display real-time prices when getting an auto insurance quote. Similar to Gabi, Policygenius offers to send you personalized quotes by email or phone.

One perk of Policygenius is that it specializes in comparing bundled home and auto insurance quotes. This focus can save homeowners time when shopping for coverage. It’s also a good bet if you’re looking to bundle policies, but it may not be the best choice when comparing auto insurance quotes.

Pros

Offers quotes for bundling your car and home insurance

Has largely positive customer reviews

Cons

Doesn’t display quotes in real time

Long sign-up process

See More: Cheap Car Insurance

Compare.com

While Compare.com isn’t an insurance broker, it is an option for comparison-shopping online. The site says it works with more than 50 auto insurance companies to help you find the best price. Partners include Travelers, Nationwide, USAA, and Elephant.

Compare.com generally has positive reviews from drivers who use the site to get quotes. However, there’s a key difference between this comparison tool and others — how it uses your data.

The company’s terms and conditions say that when you provide your phone number and click “continue,” you’re giving “consent to receive marketing calls and/or SMS text messages, including the use of pre-recorded messages.”

Put simply, Compare.com shares your phone number with its representatives, providers, and partners. The company’s list of partners includes All Web Leads, QuoteWizard, MediaAlpha, Hometown Quotes, and Avenge Digital.

And here’s the kicker: using this site means you give consent for calls and text messages even if you’re on a “do not call” list.

How Compare.com works

To get a quote on Compare.com, you’ll enter your ZIP code and other identifying details, vehicle information, and driving history.

You must enter your email address to see your rates, but your phone number isn’t required. Remember that Compare.com will share your phone number if you provide it, which could result in numerous unwanted telephone calls and text messages.

Results

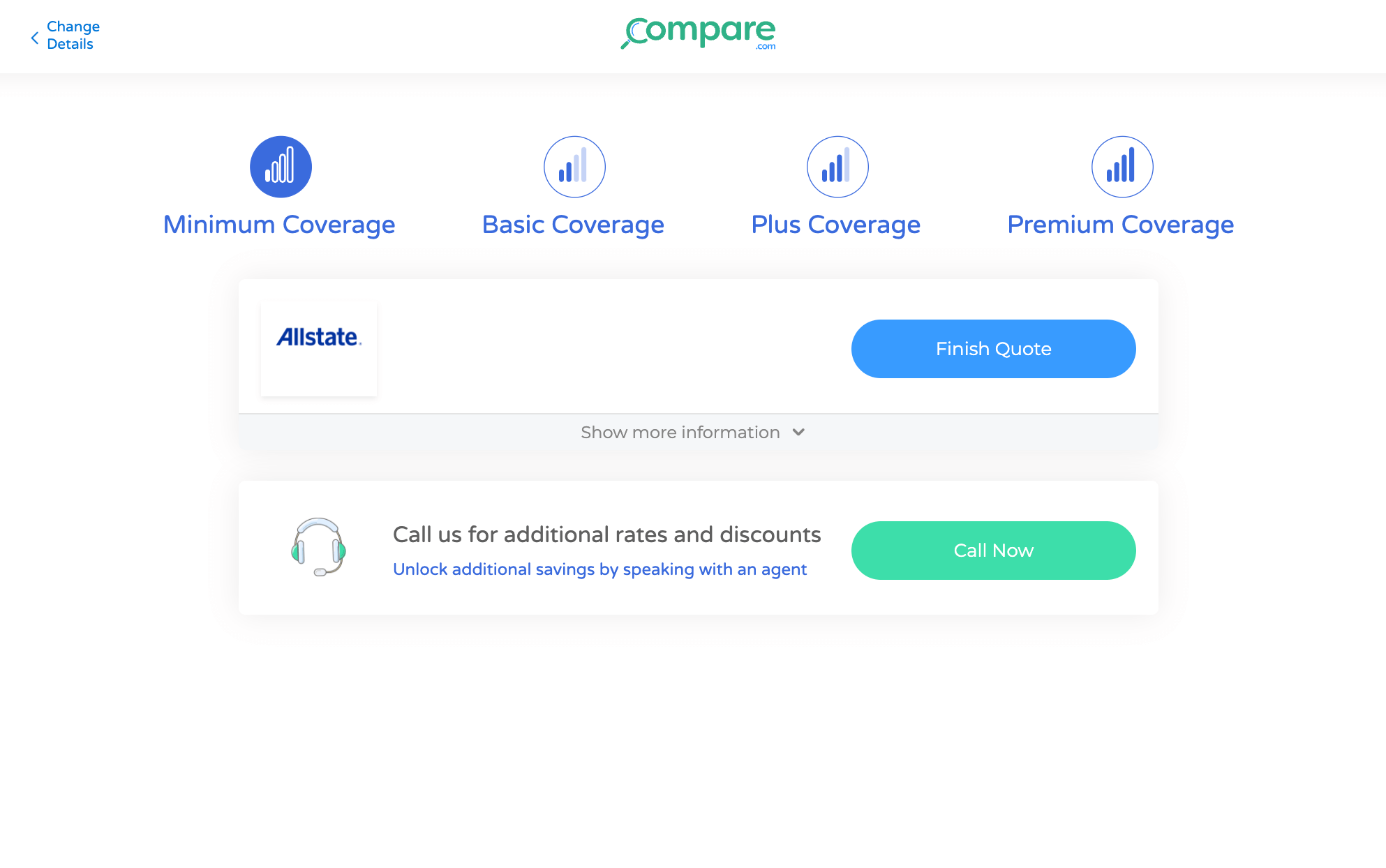

Compare.com provides options for minimum coverage, basic coverage, plus coverage, and premium coverage. Each level offers additional protection for you and your vehicle.

When shopping for car insurance through Compare.com, users don’t always get a quote. In this instance, no quotes were presented for any of the coverage levels. Compare.com’s quote list only presented one ad for Allstate, inviting users to get a quote from the insurance provider directly. Compare.com occasionally provides quotes instead of ads, depending on your location.

Users who click on the Allstate ad are sent to its website, where some of the information you shared with Compare.com is prefilled. However, you have to provide a lot of additional details before you can receive an actual quote from Allstate itself.

Pros

Shows some quotes in real time

Partners with some well-known insurance providers

Easy-to-navigate form

Cons

Doesn’t offer as many quotes as Insurify

Users get multiple phone calls and texts within minutes of signing up

Users can’t complete their purchase on the site itself

SmartFinancial

SmartFinancial offers more than auto insurance. You can also get home, life, health, Medicare, and commercial business coverage.

The company partners with over 200 insurance companies. SmartFinancial claims to sort through all 200 providers to find the best rates while also checking for discounts.

How SmartFinancial works

After entering your type of car and answering questions about your driving history, you must enter a valid address and phone number to view your rates.

The online form was quick and simple to fill out. It is one of the most user-friendly options when it comes to online insurance comparison sites.

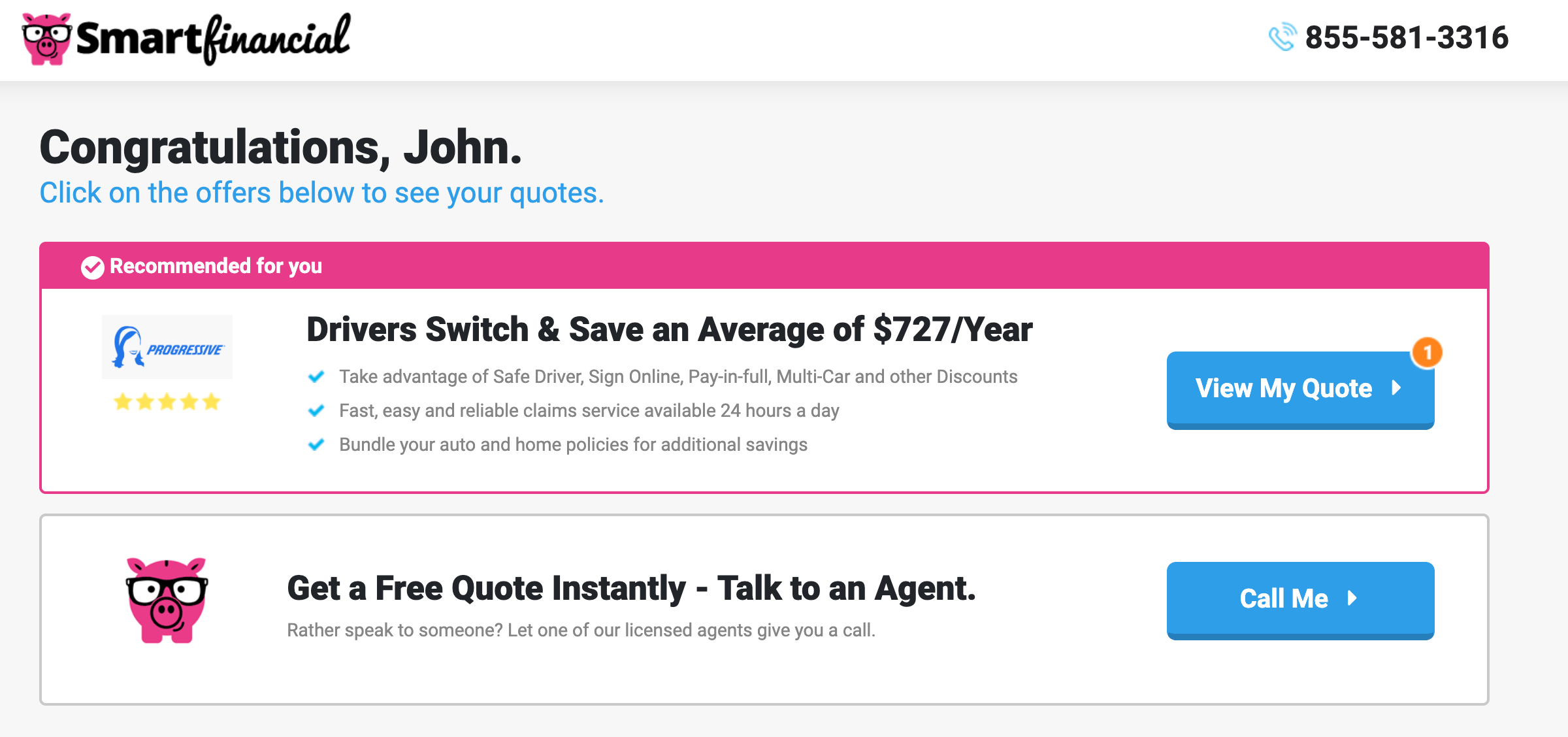

Results

After going through the process, SmartFinancial showed three results. Getting so few results was disappointing, considering the company claims to work with over 200 insurance companies. The results didn’t include car insurance premiums. It also didn’t show details about the amount of coverage or policy limits.

Each recommended car insurance company had a “view my quote” button to get more information. But clicking it redirects users to that provider’s website to complete yet another form to get a quote from that company.

Pros

Very quick sign-up process

User-friendly form

Cons

Doesn’t display quotes in real time

Primarily displays ads

Bankrate

Bankrate is an online content hub that provides readers with guides and tools to help with all things personal finance, from mortgage rate calculators to credit card reviews. Now, users can compare car insurance quotes by using its online quote-comparison tool.

The comparison tool is powered by Bankrate’s corporate affiliate, homeinsurance.com, and while it offers a route to quotes from top companies, most quotes displayed to users are advertisements.

How Bankrate works

Using Bankrate’s comparison tool is a little confusing. After filling out a basic questionnaire about yourself, your car, and your insurance history, you can either click “continue,” or choose to search directly with insurance companies like Progressive, Liberty Mutual, and Allstate.

The “continue” button will take you to a secondary form where you will fill out a few more questions about your vehicle. “Searching directly” takes you to a pop-up with advertisements.

Results

Bankrate’s comparison experience didn’t render any quotes. Instead, the site displayed ads directing users to insurance companies’ websites. Overall, Bankrate’s tool isn’t very helpful for comparing quotes.

Pros

Partners with well-known insurance providers

Numerous guides and online tools for personal finance topics

Cons

Doesn’t display quotes, primarily displays ads

Users have to migrate to provider websites to get a quote

More: Bundle Home and Auto Insurance

QuoteWizard

QuoteWizard started as a family-owned company in 2006. LendingTree bought the platform in 2018, and QuoteWizard is now a LendingTree company[3].

LendingTree is a well-known company that owns nine different brands, including CompareCards, DepositAccounts.com, Magnify Money, Student Loan Hero, and Ovation Credit Services.[4]

Here’s why it matters: the platform can share your information with LendingTree affiliates and network partners, financial companies, and other business partners.

If you use QuoteWizard, be aware that it may distribute your personal and contact information, which could result in unwanted telephone calls and offers in your mailbox.

How QuoteWizard works

You can check rates from QuoteWizard online or by phone. The online process claims to give you a quote in a matter of minutes. You also have the option to speak to an agent by phone.

QuoteWizard asks for the information you’d expect: vehicle year and type, current insurance company, date of birth, name, and address. However, you must enter a valid phone number to continue with the quote process.

If you’re a homeowner, you have the option to bundle your homeowners insurance and get a multi-policy quote.

Results

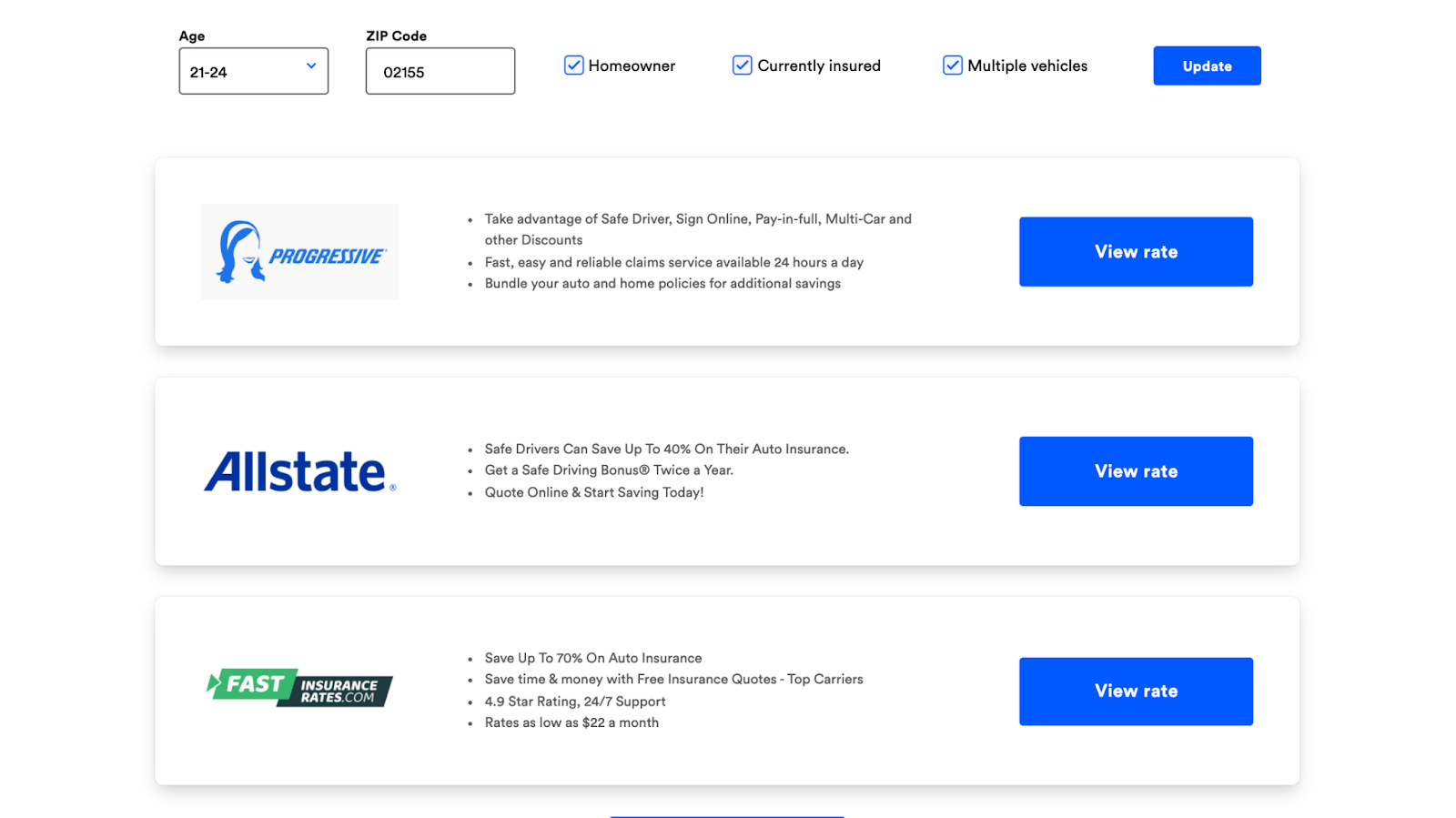

QuoteWizard returned four results but didn’t list the rate for any of the four options. Instead, it offered a “view my rate” button to click through and continue the quote process.

The site requires you to reenter your information when visiting the recommended insurers. Filling out online forms can be rather tedious. Rather than saving time, QuoteWizard seems like an extra step when comparing insurance quotes. Most results were ads.

Pros

Offers the option to speak to an agent

Homeowners can request a quote for bundling home and auto coverage

Cons

Doesn’t display quotes, primarily displays ads

Sells your information, resulting in unsolicited phone calls

ValuePenguin

ValuePenguin claims to help you “find clarity in your financial decisions.” The site goes beyond auto insurance and offers home insurance, health insurance, and credit card recommendations.

Like QuoteWizard, ValuePenguin is owned by LendingTree. It became part of the LendingTree family in 2019.

That means the same information-sharing applies — ValuePenguin can give your name, address, and other information to its affiliates, partners, and financial companies.

How ValuePenguin works

ValuePenguin is unique in that it lets you pick your auto coverage level before starting the quote process. You can choose full coverage or liability only.

The form asks just three questions to begin: ZIP code, age, and whether you have insurance already. From there, you’ll enter vehicle details, driving history, your name, and your address.

The quote process is exactly like QuoteWizard — ValuePenguin has the same questions, form layout, and provider results. The similarity is likely because LendingTree owns both companies[5].

Results

ValuePenguin showed the same four results that QuoteWizard provided, and the experience was pretty much the same.

Users don’t get quotes or policy information. Instead, you must click “view my rate” and then visit the provider’s website to complete the process and get a quote. Overall, ValuePenguin showed ads, not actual quotes.

Pros

Offers the option to speak to an agent

You can pick your auto coverage level before starting the quote process

Cons

Doesn’t display quotes, primarily displays ads

Sells your information, resulting in unsolicited phone calls

Otto

Otto is a policy-comparison website claiming to use “cutting edge technology” to help save users money on their car insurance policies. It doesn’t offer up much information on its team, tech, or other details that help legitimize the product.

With a quick search, users can see that Otto has received quite a few negative reviews for its service, with many customers claiming that the website is a scam to gather users’ personal information.

How Otto works

Using the Otto product is relatively simple. Similar to other car insurance comparison websites, users must fill out a short questionnaire about their vehicle, driving history, and insurance coverage needs. Otto requires users to create an account in order to view quotes.

Results

After completing the short questionnaire and registering with the website, Otto offered no real quotes. Instead, it displayed advertisements that redirected to other websites, including for home and life insurance quotes—not exactly what users searching for auto insurance need.

Otto is a lead-gen site that sends users to other websites instead of showing them the real quotes they were promised. Plus, there are no promises of data privacy or security addressed on the Otto website.

Pros

Relatively short sign-up process

You can request quotes from many providers

Cons

Doesn’t display quotes in real time

Lists options for life and home insurance, even if you’re just looking for car insurance

See More: Insure.com Car Insurance Review

Compare Car Insurance Quotes Instantly

Best apps to compare car insurance quotes

The average American spends over five hours using a phone every day,[6] booking flights, buying clothes, playing games, and trading stocks. Why not compare car insurance quotes, too? With these apps, you won’t even have to put down your phone to find great car insurance quotes.

Insurify

Insurify, the highest-rated online comparison platform, is available on the iOS App Store and Google Play. Now users can enjoy the ease of comparing insurance quotes with Insurify in the palm of their hands.

How the Insurify app works

Just download the app, complete a short form, and choose from a list of customized car insurance quotes from different providers. You’ll be able to set your desired coverage limits to meet or exceed your state’s minimum insurance requirements, compare available deals, and secure coverage, all within the app.

Complete your shopping experience 100 percent in-app or get help from one of our licensed insurance agents over the phone.

Top 5 Insurify app features

Excellent user experience

Multiple car insurance quotes in one place

Ability to complete the shopping journey entirely in-app

Option to call a licensed agent for assistance

Guaranteed data privacy

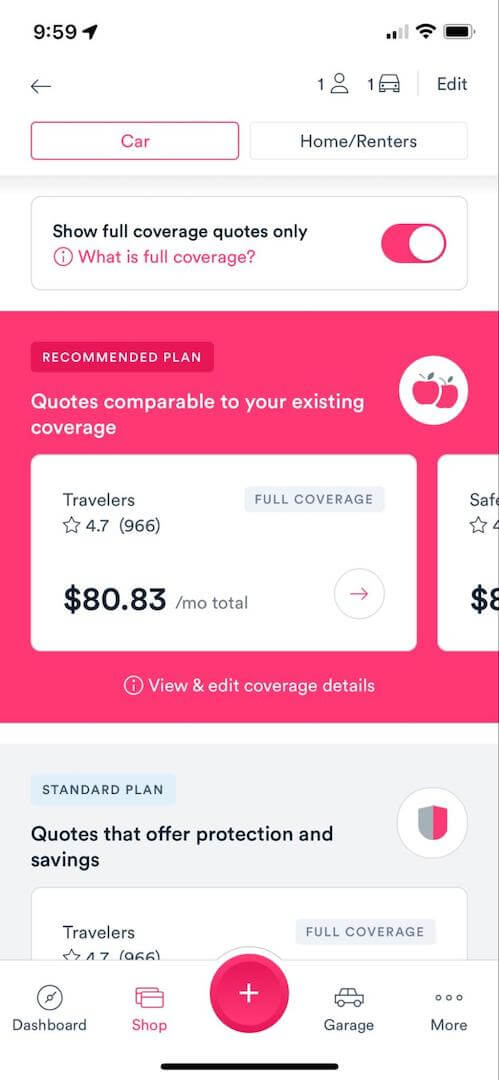

Jerry

GetJerry, also known as Jerry.ai, is designed to work like a personal insurance shopper. It takes less than a minute to sign up, and Jerry does most of the insurance research for you.

The tool can compare auto, home, renters, and umbrella insurance quotes from 45 insurance partners. When it comes time for you to renew your policy, Jerry will send you three options to choose from so you don’t have to compare again. Jerry can be used on a desktop or through a mobile app.

How Jerry works

The sign-up process for Jerry is relatively painless. You’ll simply answer a few questions about your car insurance and claims history and enter your name and other demographic information. Jerry requires a valid phone number to sign up.

Once you authorize your account using a PIN that the website sends you, Jerry can analyze your existing policy and promises to send you a text if it finds a better, cheaper option.

Results

After keying in all your information, Jerry will display three policy options, including ones from big-name companies like GEICO and Progressive. Once you’ve secured a policy through Jerry, you’ll be able to store your digital insurance cards in its mobile app.

The Better Business Bureau does not accredit Jerry, and there are some complaints online regarding price changes after customers purchase policies and discrepancies between the policies bought and the ones actually provided.

Pros

Offers an app to manage your insurance policy

Partners with well-known companies

Cons

Only partners with a few insurance providers

Tips to make comparison-shopping a better experience

Comparison-shopping for car insurance coverage is one of those time-consuming tasks that most drivers hate. But it doesn’t have to be so bad.

Follow these tips to make comparison-shopping easier and more fruitful:

Gather basic information like driver’s license numbers, VINs, and previous policy coverage limits ahead of time.

Determine your coverage needs and whether comprehensive or collision insurance is right for your situation.

Shop on reputable insurance comparison sites that provide real-time quotes, like Insurify.

Ask about discounts and other ways to lower premiums.

Be prepared to pay the policy in full or pay a down payment and set up a monthly payment plan.

Keep in mind that new cars are generally more expensive to insure than older cars. Teen drivers, young drivers, and drivers with speeding tickets and other infractions on their driving records also tend to pay more.

However, with good information at your fingertips, you’ll be better equipped to choose a great rate on car insurance coverage. It’s important to look at the customer service reputation of the platform you choose to use. Insurify is the most-rated and top-rated insurance comparison marketplace on the internet.

Shopping for auto insurance online

Getting and understanding your car insurance coverage is super important, but it can be difficult to find a great deal when it comes time to renew.

First and foremost, remember that shopping for car insurance is more than just comparing rates. Many factors come into play, such as the kind of car you drive, where you live, your marital status, and even your age and level of education.

Even if you have poor credit or a spotty driving history with an at-fault accident or DUI on your record, cheap rates are out there if you know where to look. To save money on your premiums, you’ll need to know which sites help you compare car insurance quotes in an easy way—and which ones don’t. But Insurify doesn’t keep you guessing.

Insurify takes the hassle out of comparing quotes and quickly shows you how much you can save on car insurance. In two minutes or less, you could be driving off with better coverage for less cash than your previous policy.

More comparison site reviews

Car insurance comparison site FAQs

Insurance comparison sites help make the process of finding and buying a policy straightforward. Some of the benefits you can get are savings, tools to compare policies side by side, and expert advice on lowering your car insurance costs.

Insurify, The Zebra, and Gabi are the only websites that allow users to compare car insurance rates in real time. Insurify, which partners with top national providers like Liberty Mutual, Nationwide, and Travelers, displays the most car insurance quotes.

Meanwhile, The Zebra and Compare.com display only about two to three quotes, and Gabi only returns one to two quotes and follows up with more via email. Other sites, like Policygenius, ValuePenguin, and Bankrate, say they provide a car insurance comparison experience but are actually lead-generation sites that don’t display real-time quotes.

Insurify is the top-rated car insurance quote comparison website in the U.S., according to Shopper Approved. Insurify has a 4.8 out of 5 customer satisfaction rating on Shopper Approved and over 3,600 customer reviews. Thanks to Insurify's personalized policy quotes, drivers in all 50 states save an average of $585 per year. Other auto insurance comparison sites include Compare.com and The Zebra.

It’s good practice to get at least three car insurance quotes before purchasing a policy, just to make sure you’re getting a good deal and to get a better idea of policy perks other companies may offer. Use an insurance comparison site to save time and find cheap car insurance.

The easiest way to find the best and cheapest car insurance is to compare quotes and policy options from at least three or four companies. Many factors determine how much you’ll pay for auto insurance, so it’s important to shop around and consider all of your options.

Insurify has the best car insurance prices, as it partners with America’s top national and regional insurers to provide personalized quotes that factor in any discounts a driver may be eligible for. It’s free and easy to use and can provide cheap car insurance quotes for drivers of all ages, backgrounds, and driving records.

Insurify is a legitimate insurance comparison website and digital insurance agent. The platform partners with most of America’s top insurers, has over 3,600 verified user reviews on Shopper Approved, and has an A+ rating from the Better Business Bureau.

Methodology

The Insurify team tested the insurance comparison process for each of the sites featured in this article, keying in real information to best assess the effectiveness of each website. Each insurance comparison platform was judged on the following parameters: the length of its information-gathering process, its ability to produce real-time quotes, the number of quotes presented, and the variety of insurance providers displayed in the real-time quotes.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.