4.8out of 3,000+ reviews

Updated January 20, 2023

No one looks forward to shopping for insurance, but comparing rates every six months or so is an important practice to maintain the health of your personal finances. If you choose reputable companies with low rates, you’ll have an easier claims process and more money to put toward your goals. And while you might rather binge Netflix than check your insurance rates, new tools have made comparing quotes so easy that you can have time for both.

One of these tools is Savvy, an insurance comparison site that claims to show quotes from hundreds of insurance providers without requiring any paperwork. What’s unique about Savvy is that you don’t need to fill out any forms providing your driving history or vehicle information. Instead, you log in with your credentials for your current insurance provider, and Savvy uses the information to pull quotes from other companies. They’ll even help you switch, and it’s 100 percent free to use.

Another option is Insurify. The trusted car insurance comparison site helps people save an average of $585 on their annual premium. It’s also the top-ranked insurance-comparison platform in the U.S. with regard to customer satisfaction. With Insurify, you will need to provide some information, but that means you’ll be able to test quotes for different circumstances, such as adding a teen driver or a new car.

What is Savvy?

Savvy bills itself as a tool that can save you money on car insurance in less than a minute. To get started with Savvy, you just need to enter your insurance policy log-in credentials. From there, the company will instantly get quotes from hundreds of insurance companies. If you need help switching, Savvy has a dedicated team to make the process smooth. You can reach assistance by phone, email, or text. And Savvy doesn’t sell your personal data. However, if you click a third-party link from Savvy’s website, your information will be shared, and you may receive communications from the insurer, according to the company’s terms of use.

How does Savvy work?

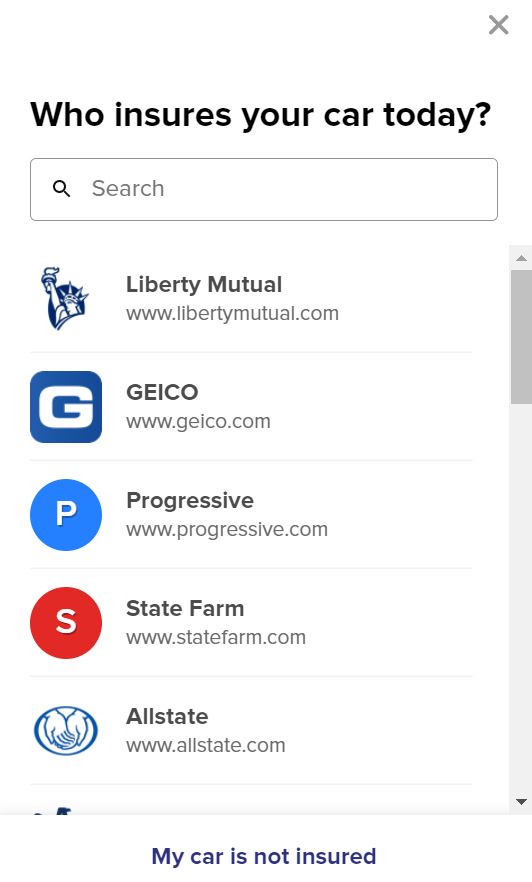

You’ll start by choosing your insurer from Savvy’s drop-down menu or searching for your provider. Popular auto insurers like GEICO, Allstate, and State Farm pop up right away. If you’re not insured, there’s an option for that, too.

More: Auto and Home Insurance Quotes

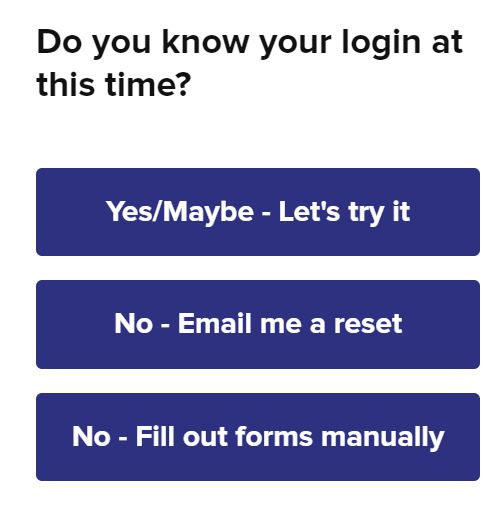

Savvy uses Trellis to check your insurance information, so it’s entirely secure, and Savvy will never gain access to your account. You’ll need to agree to the Trellis Privacy Policy to continue. After that, Savvy will ask if you’ve ever logged in with your current auto insurance provider. If you have, you’ll get three options: fill out the forms manually, log in right away, or get a reset email.

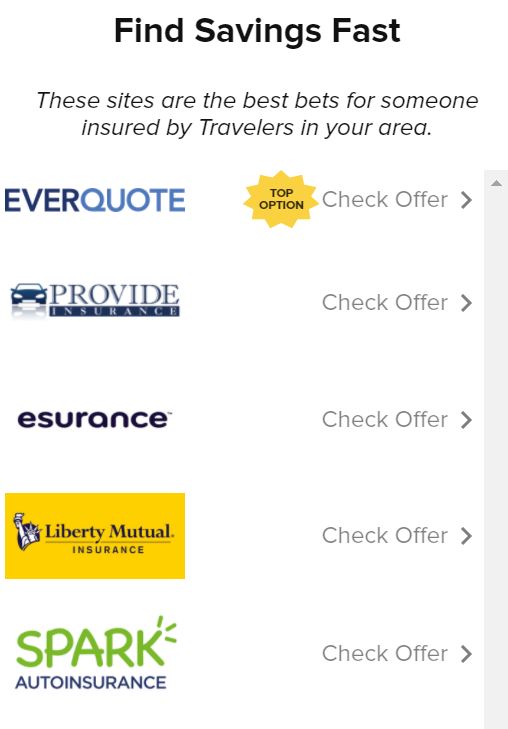

I chose to fill out the forms manually, and after I did, Savvy directed me to some of the top alternatives to my current auto insurance policy in my area but didn’t provide auto insurance quotes. Instead, I would have to check auto insurance rates at other websites against my current policy to see if I could save money. For this reason, Savvy won’t be the best option for people who don’t currently have an online account with their insurance provider.

More: Car insurance quotes

More: Cheap car insurance

Compare Car Insurance Quotes Instantly

Savvy Reviews: Here's what customers are saying…

Finding the best rate isn’t the only reason to use a comparison tool to find car insurance quotes. You’ll also save yourself the hassle of speaking with an insurance agent to try to pin down your insurance costs. But since Savvy will market to you via text and be there to assist you with switching, you’ll want to evaluate what other customers are saying about their internal team before choosing to use Savvy to find your insurance coverage.

Unfortunately, customer service reviews for Savvy are difficult to find. The company doesn’t have any reviews on Trustpilot or ConsumerAffairs. It is not accredited with the BBB, nor does it have any customer reviews on the site. And there’s no mobile app, so reviews on the App Store and Google Play are nonexistent as well. As such, you won’t know what type of customer experience to expect. Insurify, on the other hand, has thousands of positive reviews, with an average rating of 4.73/5 across several sites.

Savvy vs. Insurify: The Facts

Motorists shopping for the best car insurance might find the most auto insurance companies listed with Savvy since the site researches hundreds of providers. And those who already have an online account for their current policy might find that it’s the quickest way to get quotes. For example, you won’t have to think back about your driving record or check your credit score to answer any questions on the site.

However, this can also lead to inaccurate quotes if your circumstances have changed since you signed up for your current policy. For example, if you were once a renter and now you’re a homeowner, you may want to explore other insurance options that factor in discounts. Or if you’re interested in adding collision coverage or comprehensive coverage but you’re not sure how it’ll affect your insurance costs, you’ll want to use a tool that lets you easily toggle between coverage limits and deductible amounts.

Insurify can help you estimate your costs more accurately because our artificial intelligence technology takes into account more current information that you provide. You can even test insurance costs for different vehicles you’re considering purchasing or see what it would cost to add rideshare coverage. In short, there’s a lot more flexibility in terms of how you can utilize the tool.

| Savvy | Insurify | |

|---|---|---|

| Sign-up Process |

|

|

| Providers Compared |

|

|

| Customer Reviews |

|

|

| Features |

|

|

How to Save on Car Insurance

The easiest way to save money on car insurance is to use a comparison tool to shop around for the best rates. But even after you’ve used Insurify to snag the cheapest premium, there may be ways to lower your rates even further.

Ask about safe driving and low mileage programs: Some companies use telematics or mobile apps to monitor your driving behavior and give you rewards or discounts for safe driving and low mileage.

Take advantage of payment discounts: Some insurers will give you discounts if you use a credit card to set up automatic payments or pay your annual premium in full.

Raise your deductible: A higher deductible means lower premiums, and vice versa. Just make sure you have enough in savings to cover your share of the responsibility for repairs.

Improve your credit: If you can pay down debt, you might get a lower quote from some companies. In most states, insurance providers use your credit-based insurance score to determine your premium.

Stick with liability coverage: If you have an auto loan, your lender will require full coverage car insurance. But if you own your car outright, you can lower your premium by dropping collision and comprehensive coverage. However, this is not typically advisable, as it can leave you financially unprepared after an accident.

More about Savvy

Savvy was founded in 2019 in San Francisco. The company is licensed in all 50 states. The site doesn’t provide any information about the founders or current team. In fact, though Savvy promises to provide 100 percent free assistance by phone, email, or text, you’re blocked from accessing their contact information until you sign up. If you just have a question about how to use the platform, you’re out of luck. However, California residents can first opt out of having their personal data shared with third parties.

Frequently Asked Questions

Yes. Savvy partners with institutions such as Chime Bank, TrueBill, and Acorns. It also works with Trellis so that you can securely log into your insurance provider, and its links to quotes lead to legitimate insurance websites.

Savvy currently only compares car insurance. If you’d like to shop rates for home or life insurance premiums, Insurify is a great tool to use.

Savvy is an insurance-comparison platform that’s new to the space, and there isn’t any customer satisfaction information available online for the site. While Savvy has a couple of unique features, including allowing users to sign in directly to their insurance provider and providing users with free help switching, Insurify provides more flexibility and accuracy that leads to a better experience. For example, Insurify will factor in things like rideshare costs and homeowners discounts when calculating your premium.

While it might seem easier to log into your current insurance provider and compare premiums from there, Insurify will give you access to a lot more options when it comes to customizing your quotes. And it really only takes a few minutes to provide your information. Consider the thousands of glowing customer reviews for the Insurify platform and the average $585 in annual savings that Insurify users receive when choosing between the two sites.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.