4.8out of 3,000+ reviews

Updated August 4, 2022

It’s not hard to cancel State Farm insurance, and you’ll most likely be refunded on the premiums you’ve already paid. Follow these quick steps to make sure you’re cutting ties without leaving any loose ends.

Do you have your next auto insurance policy ready? If you’re not sure how to switch car insurance companies and don’t know which insurance company to choose next, you’re in luck. Insurify is an award-winning car insurance quote comparison website that brings you a full slate of personalized quotes so you can get your cheap new policy lined right up.

Quick Facts

State Farm has no cancellation fees.

Cancel your State Farm insurance policy over the phone, by mail, or in person.

Make sure your new insurance begins before your State Farm insurance ends, or you’ll have a lapse in coverage.

Table of contents

- State Farm Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- State Farm Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving State Farm

- Step 4: Secure a New Policy

- Step 5: Cancel Your State Farm Policy

- Step 6: Follow Up on Your Refund

- Canceling Your State Farm Policy

- Frequently Asked Questions

State Farm Cancellation Policy

How do I cancel my auto insurance with State Farm?

To cancel your car insurance policy with State Farm, you can either call their customer support support line or visit a local agent. Be sure to secure a new car insurance policy before canceling with State Farm to avoid a lapse in coverage.

State Farm provides three ways to cancel your auto insurance policy: by mail, over the phone, and in person with your local State Farm agent. The phone seems easiest, but it’s nice to have options, and maybe you’re old-fashioned or have too many stamps!

No matter what method you choose, when you’re ready to cancel your policy, you’ll want your policy number in hand, along with a bunch of other information detailed in step 5 of this article. You may need to contact your DMV, but check with your insurance agent or your state DMV’s website to make sure.

Make sure you’ve been careful to avoid a lapse in coverage and have your new insurance starting before your policy cancellation goes into effect. Once everything is in place, it’s a quick process to cancel your State Farm auto insurance.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

When is your State Farm insurance coverage up for renewal anyway? Canceling on that renewal date would make for a convenient transition, though there’s no financial cost to canceling in the middle of your policy term. Check your mobile app or log in at statefarm.com to find your renewal date, or call your local State Farm insurance agent.

It may be easiest to cancel your State Farm Policy on the renewal date and set your new insurance policy to start the next day. But as long as you don’t have a lapse in coverage, the day isn’t very important. And if you’ll be saving a lot of money on premiums, it’s best to cancel ASAP!

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

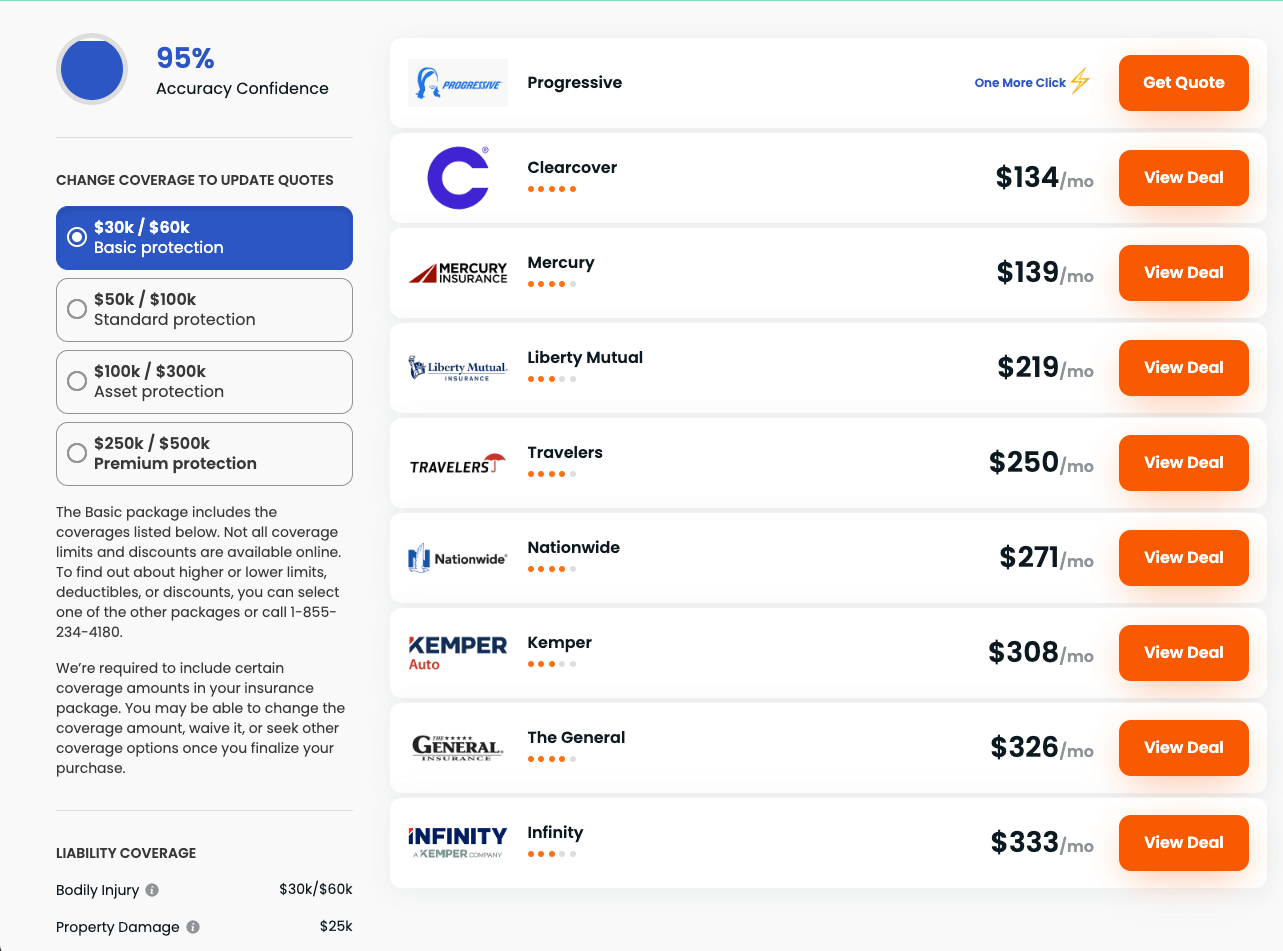

Now that your cancellation date is set, find your new insurance provider. You’ve heard about GEICO, Allstate, Progressive, and other huge name brands. But the insurance industry has some amazing regional companies that you may not have heard about!

So you’ll want to look around widely for the best car insurance rates in your area. Luckily, you have access to Insurify, which helps you compare auto insurance quotes by inputting your information to just one website. It saves you hours of soliciting quotes by yourself and will help you discover companies with great premiums that you may not even know about!

State Farm Quotes vs. Competitors

| Insurance Company | Average Monthly Quote |

|---|---|

| State Farm | $50 |

| GEICO | $52 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Erie | $52 |

| Esurance | $114 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Mercury | $114 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| National General | $139 |

| NJM | $64 |

| Travelers | $81 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Amica | $105 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving State Farm

As a State Farm customer, what did you like? What pushed you away? Maybe you took on credit card debt and your premiums went up. State Farm can be hard on policyholders who don’t have great credit scores. Our review of State Farm auto insurance found that customer service can leave a little to be desired. Perhaps a bad phone call made you look elsewhere.

It’s helpful to reflect on what you want in your next auto insurance company. Insurance premiums are always an important priority. If you also buy home insurance, renters insurance, life insurance, or other policies, you’ll want to find a place you can bundle. Homeowners should take note that some insurance companies offer homeowner insurance discounts.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

Be careful: A gap in your auto insurance coverage could skyrocket your rates! You also need to have proof of insurance when driving. So before you cancel the State Farm policy you still have, it’s a very good idea to buy your new auto insurance policy in advance. When you buy a policy, you can set the start date in the future so you don’t have to worry about the timing.

There’s a whole world of insurance companies out there, and finding the right one can be daunting. Save time and lock down your ideal policy with Insurify’s free car insurance quote comparison tool. In minutes, you’ll have a list of real quotes at your fingertips.

Step 5: Cancel Your State Farm Policy

Now that your new policy is good to go, you can use any of the below three methods to cancel State Farm insurance. Whatever you choose, you’ll want this information in hand:

Your policy number for your current policy with State Farm

Your contact information (address, phone number, date of birth)

Your preferred cancellation date

Your new insurance information (if you’ve secured a new policy): the insurance company and policy number, along with the effective date the policy begins on your new insurance

If you’ve sold your car, a bill of sale or proof of license plate forfeiture

You can cancel by phone by calling 1 (800) STATEFARM, by mail by sending the above information to Corporate Headquarters, One State Farm Plaza Bloomington, IL 61710, or in person by finding your nearest local State Farm agent.

Before you cancel State Farm car insurance, it’s best to have your new policy ready to go so you don’t risk a lapse in insurance. Let Insurify be your companion on your search for a new car insurance policy. Our car insurance comparison tool has helped millions of drivers save money. Try it out today!

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

It would be a shame to lose out on money you already paid for an insurance policy you don’t have anymore. So set a calendar notification or make a note to check your bank statement or follow up on your refund with State Farm if you don’t receive it after the time your insurance agent says to expect one.

When you cancel your State Farm insurance policy, you’ll probably be told by your insurance agent how much you’re due to receive back and a ballpark of when. Write this down, and call State Farm customer service if you don’t receive your refund in the specified time frame.

Canceling Your State Farm Policy

If you have more questions on how to cancel State Farm insurance that this article can’t answer, call your local State Farm insurance agent to get the details on your policy. It’s really important to buy your new insurance policy before you cancel, so use the best car insurance comparison tool, Insurify. It keeps your data safe and provides a full list of free, fast quotes.

Frequently Asked Questions

With your cancellation date, policy number, contact information, and new insurance in hand, along with a bill of sale for your car or other proof that you sold it (if you have sold your car), call 1 (800) STATEFARM, visit your local State Farm office, or send a letter to One State Farm Plaza, Bloomington, IL, 61710.

There is no cancellation fee at State Farm. And if you are canceling a policy that you have prepaid, you’ll be reimbursed for the fraction of the policy that you didn’t finish. Don’t hesitate to cancel a policy for financial reasons because there’s no cost to switching, especially if your new insurance has a lower premium.

Yes. It can be more convenient to just wait until the renewal date of your current policy, but it’s not necessary. Find your renewal date online at statefarm.com or in your mobile app.

If you are uninsured for even one day, car insurance companies will note a lapse in coverage, and you may be immediately put in the high-risk category. This can be devastating to your insurance premiums, and you should avoid this fate at all costs!

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.