The Best Car Insurance Advice from Reddit Posters (2023)

Updated June 15, 2022

Updated June 15, 2022

There’s one person in every friend group who gets most of their information about the world from Reddit. Maybe that’s you. Reddit is one of the internet’s largest and friendliest discussion boards, and many users reach out with questions about their car insurance—often when they’re in a tricky situation or looking for ways to save money.

These Reddit posts are so helpful because they let you read about someone else’s insurance issue before it happens to you. That way, you learn the lesson without the headache. We put some of the most helpful ones in this article.

It’s always smart and never a bad time to shop around for car insurance.

When in doubt, you’ll be better off with additional coverage.

Understanding your coverage will help you act in an emergency.

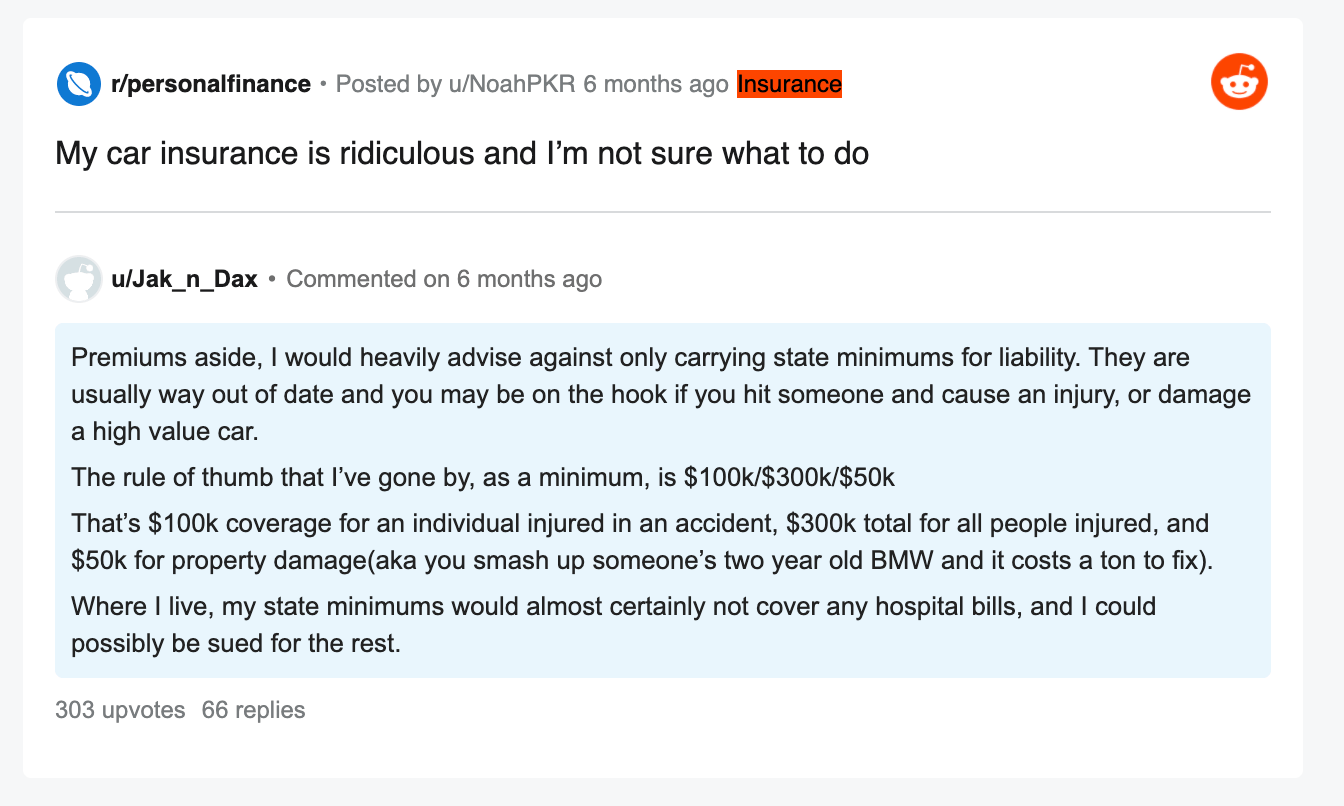

State minimum liability insurance is tempting because it’s cheap. But most people don’t know that state minimum liability coverage leaves you exposed to major costs that you can potentially be sued for if you get in a terrible at-fault accident. Most minimum limits for bodily injury liability don’t break $50,000, and a bad accident can cost as much as $1 million.

The poster in the above comment thread recommends liability coverage limits over $100,000 for bodily injury and $50,000 for property damage. This is good advice because even if your insurance premium for minimum liability coverage is cheap, it’s a waste of money if it’s not enough to even begin to pay the costs of an accident.

Some states require you to cover your own medical bills regardless of fault with personal injury protection (PIP). Uninsured motorist coverage is often required, and if it’s not, you’ll still want it. Unless your car is very old, comprehensive coverage and collision coverage are two more necessary add-ons, even though they raise your insurance cost.

See More: Best Car Insurance Companies

Before setting a deductible, ensure it’s an amount you’d be able to shell out in case of an emergency. Meaning, make sure you have that much cash laying around to use after a car accident.

It’s really nice when professionals from the insurance industry chime in on Reddit. This user is smart to point out that if you can’t pay a deductible, you won’t be able to respond to the insurance process quickly and get your car fixed. If your car has $4,000 of damage, don’t let paying a $1,000 deductible get in the way of getting that $3,000 from your insurance company.

When you’re buying an auto insurance policy, you can talk to your insurance agent about what deductibles they have available. Choosing a higher deductible will lower your premium, but often not enough to make it worth it, even if you can pay it easily.

See More: Car Insurance Quotes

This poster is wisely keeping their finger on the economic winds. And now that inflation and fuel costs are in flux, keeping your everyday costs under control and finding ways to save money are more urgent than ever. And one super-simple way to reduce your car insurance rate is to look elsewhere to see if you can get a better deal.

One easy way to find a deal is to compare auto insurance quotes from all the important companies. Spend only a few minutes entering your information, and you’ll receive a list of quotes personalized to you. If you’ve moved recently, there are even better odds you’ll save money when you shop around.

See More: Cheap Car Insurance

Spend a little time on Reddit looking for harrowing car insurance stories, and you’ll see this one is more common than you might expect: drivers buy or lease a new car, and before they can make it home, they immediately find themselves in an accident. Luckily, the driver in this post had gap insurance, which stands for “guaranteed asset protection.”

If your car gets totaled and you have comprehensive coverage and/or collision coverage, your insurer will reimburse the car’s cash value. The problem is, the moment you drive the car off the lot, it depreciates quickly, so you might owe more on the car than it’s worth. Gap insurance makes up the difference.

Fender benders are incredibly common, and because they often leave subtle damage and both drivers can drive away from the scene, people try to come to an arrangement without insurance companies. This is rarely a good idea, if ever. In the example above, the driver’s car didn’t show obvious damage, but the body shop hit them with a big bill. Be careful, young drivers.

When you find yourself in a fender bender, get all the documentation you can, and try to get the police to come file a report. Don’t trust a spontaneous idea from a creative stranger and make a split-second decision you might regret. Instead, gather information meticulously and let car insurance companies do the work for you.

With a full-coverage auto insurance policy, you’ll get your car replaced by the insurance company if it gets totaled. But this is a very critical time to know your rights as a policyholder. The insurance company will send you an offer of how much they want to reimburse you.

But because the value of a car is fluid and in some ways arbitrary, that number is up for negotiation, and you should do your research to know if it’s fair.

Reddit users often comment that Kelley Blue Book (referenced as KBB in the post featured) is not a very accurate starting point for your car’s value. To find the going rate of cars like yours in your area, check for local listings that match your car’s attributes, and ask your car insurance company to match it if they’re offering something lower.

It’s very much the case that drivers with a history of accidents and frequent claims will receive higher auto insurance rates. But how much higher is a matter of where you get your insurance. If you get in an accident and your auto insurance provider bumps up your rates to an absurd level, it’s a better time than ever to look around for a lower quote.

More likely than not, you’ll still pay higher rates than you did before you got in your accident. But if you take the time to get quotes from a number of auto insurance companies, you may find that some are more forgiving than others. And you’ll have a better chance of a lower cost when you switch companies.

Thinking about getting in a car accident is scary. It’s one of the most traumatic experiences in many people’s lives. So the last thing you want to be confused about in the wake of a wreck is insurance logistics. When you’re in a crash, make sure you are physically safe and that proper medical help is on the way.

When people get seriously hurt, the medical costs can pile into the tens and sometimes hundreds of thousands. You’ll never be more grateful you got proper coverage than in the moments you really need it. With a full-coverage car insurance policy, you won’t go bankrupt from the results of a car crash, no matter who is at fault.

If your car needed to be in the shop for an extended period of time, would you need to borrow a car on a daily basis to get to work? Maybe you’d rent a car or hail a rideshare car twice a day (or more). If you know that you can’t go through daily life without a car, you should make sure that your auto insurance company will help.

With supply chain issues slowing car repairs, rental cars experiencing a shortage, and rideshare prices higher than ever, you’d be smart to find a car insurance policy that picks up the tab for your loss of use while your car is in the shop for a covered loss. Nationwide, Liberty Mutual, GEICO, State Farm, Progressive, and many other providers offer this coverage.

Take it from this devastated driver: make sure you pay all your bills on time and that your policy is always active. Mix-ups can occur, so don’t hesitate to check in. Letting your insurance lapse can earn you high-risk status, and that will disrupt your auto insurance premiums in a big way. This Redditor saw their insurance premium triple from a lapse in coverage. That’s quite a change.

Once you’re in the high-risk insurance category, you can probably say goodbye to low rates, even with bundling, good credit, a clean driving record, and all the other insurance discounts under the sun.

The insurance stories that Reddit users share emphasize a crucial lesson about car insurance: accidents happen, and having the right insurance can make a huge difference. Thinking through these situations in advance puts you in a great position to avoid major emotional and financial hardship if the unthinkable should occur. And reading these posts will tell you that it does.

Yes, with an account on Reddit, you can post on discussion boards organized by category called subreddits. Your insurance questions will be most appropriate on the subreddits titled “personal finance” and “insurance.” There’s also lots of chatter about renters insurance, life insurance, health insurance, home insurance, and anything else you’re curious about.

Average rates for drivers with accidents on their driving records are quite high. A DUI will hit you harder than other incidents. But even though safe drivers get lower rates in general, you can find a suitable insurance premium by hunting for as many insurance quotes from all the car insurance companies you can contact.

In most states, a bad credit score will get you higher rates from car insurance companies, even if you’re a good driver. Homeowners tend to receive an insurance discount, and plenty of auto insurance companies offer decent car insurance premiums to drivers with poor credit scores. You just have to shop around and get all the auto insurance quotes you can.

The best car insurance quotes don’t always come from GEICO, Progressive, USAA, Allstate, State Farm, and the other insurance giants. To get the cheapest car insurance you can find, you have to get quotes from as many providers as you can. Insurify gives you free quotes from the best car insurance companies in your area, not just from the ones you’ve heard of.

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Charlie Mitchell is a journalist, researcher, and writer specializing in personal finance subjects. He holds a degree from Middlebury College. His work can be found in Vox, Mother Jones, The New Republic, and other publications. Charlie uses his expertise in home, renters, and auto insurance subjects to help inform people to make better financial decisions. Connect with Charlie on LinkedIn.

Learn More