4.8out of 3,000+ reviews

Updated August 4, 2022

Though The General is known for offering competitive rates to high-risk drivers, many of its policyholders decide to switch car insurance companies every year. Most customers decide to switch from The General when they’re no longer considered a high-risk driver (three to five years from their last traffic incident) and find a cheaper policy with another insurance company.

When you decide to switch, you should definitely make time to compare auto insurance quotes. With Insurify, you can compare personalized rates from the top providers within minutes. No sign-up is required, and your information is saved and kept confidential so you can return at any time for new quotes.

Quick Facts

In order to cancel your policy with The General, you’ll need to submit a cancellation request in writing.

In most states, The General is allowed to charge an early cancellation fee of up to 10 percent of unpaid premiums.

If you prepaid your policy, you’ll be entitled to a refund of unused premiums minus the cancellation fee.

Table of contents

- The General Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- The General Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving The General

- Step 4: Secure a New Policy

- Step 5: Cancel Your The General Policy

- Step 6: Follow Up on Your Refund

- Canceling Your The General Policy

- Frequently Asked Questions

The General Cancellation Policy

How do I cancel my insurance with The General?

To cancel your insurance with The General, you’ll need to submit a cancellation request in writing to its headquarters at 2636 Elm Hill Pike, Suite 100, Nashville, TN, 3724. Depending on what state you live in, The General can charge you an early cancellation fee of up to 10 percent.

You can cancel your car insurance policy with The General at any time. But it’s usually best to cancel closer to the end of your current policy term. You should also know that, like most insurers, The General automatically renews car insurance policies for its customers.

That means that you shouldn’t just allow your old policy to expire. Make sure that you have a new car insurance policy ready to start when your current policy ends.

If you’re mailing in your cancellation request, you’ll want to include your policy number, date of birth, and driver’s license number in your letter.

Special Considerations for SR-22 Drivers

Having continuous car insurance coverage is especially important with financed cars and for people who have to file proof of insurance. If you file an SR-22 (FR-44 in Florida), you’ll need your new car insurance company to take over filing this form on your behalf. Your insurance agent should be more than capable of ensuring this is taken care of, but always follow up.

You don’t want to be uninsured even for a day when you’re required to file proof of insurance. Doing so can result in fines and penalties, such as a suspended driver’s license. Always double-check that your new coverage starts before your old insurance policy ends.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

Knowing when your current policy ends is important for two reasons. First, you don’t want to have a gap in coverage. Second, The General charges a cancellation fee based on remaining unpaid premiums, so it’s best to cancel as close to the renewal date as possible. You can find the renewal date on your insurance card or the declarations page of your policy documents.

While you’re getting your renewal date, it’s also a good idea to review exactly what your policy covers. That means the types of coverage and the coverage limits. You should also note any perks or additional services, such as roadside assistance, included with your policy. This is so that when you compare policies, you can compare ones with the same coverages and limits.

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

Whether you’re set on switching your insurance company or simply think there is a better rate out there somewhere, comparing car insurance quotes is always a good idea. We suggest comparing quotes every time your policy renews. This is a great way to practice good financial health and stay on top of your budget.

Many people feel it takes too much time to get quotes, but with Insurify, you can get multiple real car insurance quotes in just a few minutes. If there’s a policy that beats The General, you can easily secure it via the company’s website or with one of our knowledgeable agents.

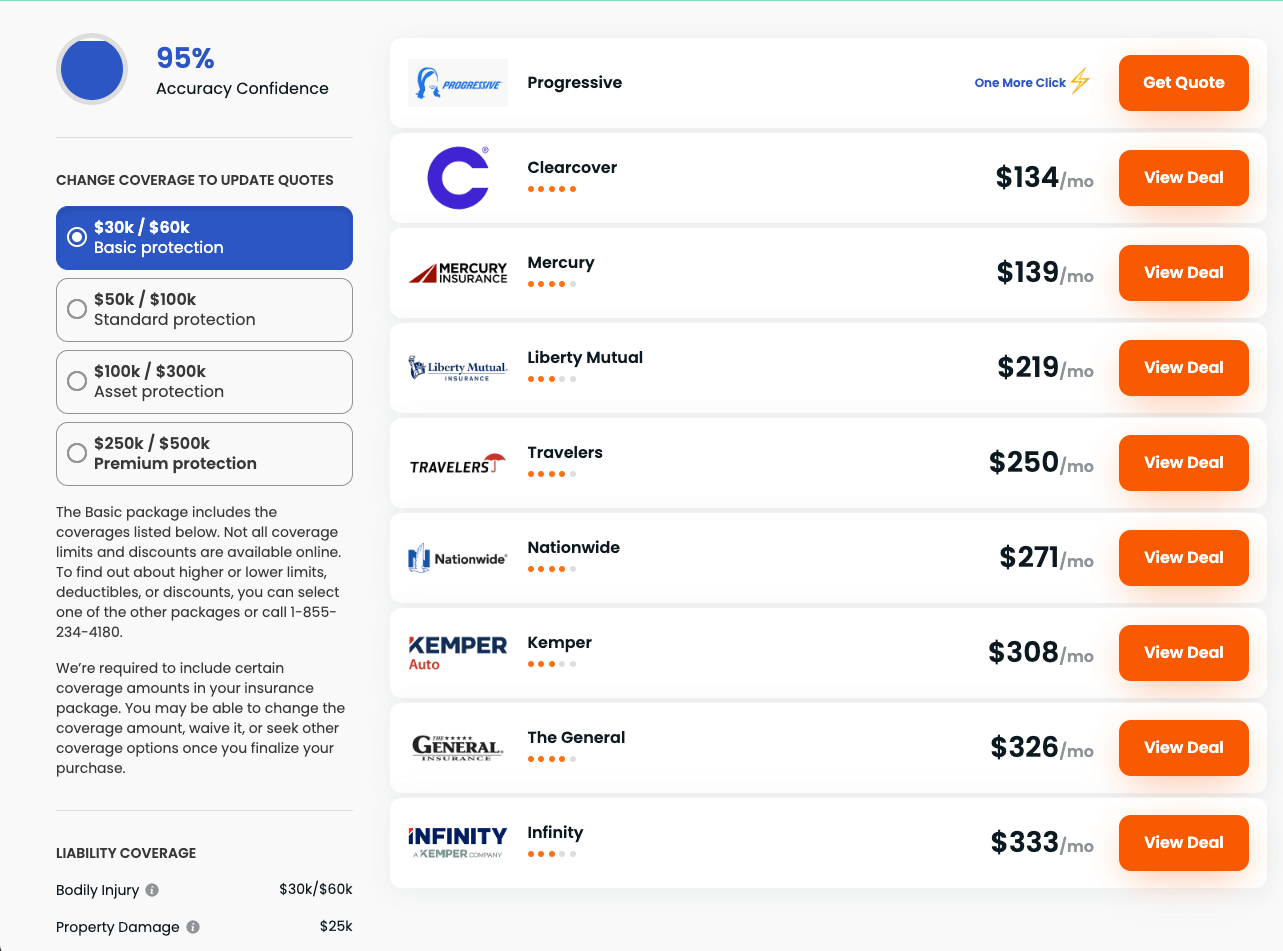

The General Quotes vs. Competitors

The General is best known for offering low rates to high-risk drivers, but it’s not the only company that can accommodate policyholders with a spotty driving record. As you practice safe driving and avoid accidents, your risk profile begins to change. Insurers who might have charged a lot more last year could offer you a policy for a lot less this year.

| Insurance Company | Average Monthly Quote |

|---|---|

| The General | $197 |

| GEICO | $52 |

| State Farm | $50 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| National General | $139 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Amica | $105 |

| Esurance | $114 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Erie | $52 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| Travelers | $81 |

| NJM | $64 |

| American Family | $84 |

| Mercury | $114 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving The General

Most of the time, policyholders choose to switch insurance companies because they can either get a lower rate or a better customer experience. Customer reviews of The General suggest that, despite great technological services, customer service is lacking. Even so, many people choose The General because it simply had the best rate for their situation.

The lowest quote you’re offered can change quickly, though, especially if you’ve maintained a clean driving record, improved your credit score, or moved to a new state. You can also speak to a customer service agent about your reason for canceling. They may be able to offer you a discount or benefit that makes it worth staying.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

Getting a new insurance policy is a crucial part of canceling any insurance policy. It is unlawful to drive without insurance. Even if you don’t plan to use your car, having a gap in insurance coverage can affect your car insurance rate in the future or violate the terms of your car loan agreement. You can find your new policy quickly using Insurify’s quote-comparison tool.

Enter your information in Insurify’s confidential form to receive your list of real quotes from the best companies in your area. When you find the right one, you can buy your policy in just a few minutes, depending on the company’s procedures. Be sure to start your new policy when most advantageous for you, and double-check all your policy documents when you receive them.

Step 5: Cancel Your The General Policy

To cancel your policy with The General, you’ll need to send a written cancellation request to The General’s headquarters at 2636 Elm Hill Pike, Suite 100, Nashville, TN, 3724. Make sure to include your policy number with your request.

Be sure to set the cancellation date for the day after your new policy starts, or even later, to avoid any gaps in insurance coverage. If you have any questions or concerns, you can work with an independent Insurify agent to make sure you switch your policy the right way the first time.

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

If you paid your policy in full or are canceling in the middle of a month you already paid for, you are entitled to a refund (minus the cancellation fee). When you cancel, you should be sure to note the refund amount you’re expecting and the estimated arrival date of your refund. If possible, get this information in writing (via email is fine) so you have something to refer to.

If you don’t receive your refund on time, or you receive the wrong amount, you can follow up with customer service over the phone or through the chat service on the website. You may need to log into your account for faster service. Be sure to have your written confirmation and any other information you’ve collected regarding your cancellation and refund ready.

Canceling Your The General Policy

Whatever your reason, canceling your car insurance policy with The General is fairly easy. Keep in mind that canceling closer to the end of your current policy can save you money on unpaid premiums. If you file proof of insurance with your department of motor vehicles (DMV), make sure that your new auto insurance company can file your SR-22 paperwork on your behalf.

Remember that car insurance comparison is your friend when you decide to switch insurance providers. It’s the best way to make sure you’re getting the best policy for the best rate. Insurify’s tools make this process easy and even automatic if you save your profile and set up notifications.

Frequently Asked Questions

Most car insurance policies, including ones from The General, last either 6 or 12 months.

Unfortunately, no, you can’t cancel your insurance with The General online. To cancel your policy, you’ll need to mail a written cancellation request to The General’s headquarters at 2636 Elm Hill Pike, Suite 100, Nashville, TN, 3724.

Because The General only allows policy cancellation via postal mail, it typically takes two to three weeks from the day you mail in your cancellation letter to the day it is processed. If you can, set your cancellation far in advance and set the start date for your new policy on or a few days before the end date. This allows for extra time to cover any administrative hiccups.

Yes, you can cancel your auto insurance with The General at any time. You should allow at least three weeks for the company to process your cancellation, so be sure you set your cancellation date at least three weeks in the future. And, because there may be a fee to cancel early, you should consider canceling close to the end of your policy.

The General reserves the right to charge up to 10 percent of your remaining premiums, depending on your location. When you make your cancellation request, be sure to ask about fees. You should also request a fee waiver or ask if there is any way to avoid the fee.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.