4.8out of 3,000+ reviews

Updated February 14, 2023

Erie Insurance is a well-established car insurance provider that has served customers for nearly 100 years. Erie has a reputation for providing high-quality auto policies at a price below the national average — $111 per month on average for liability-only coverage. What is Erie Insurance?

Quick Facts

Erie Insurance is a well-established car insurance provider with a 100-year history.

It offers competitive pricing on high-quality auto coverage.

Customers can choose from a variety of policy options and discounts.

What is Erie Insurance?

Erie Insurance is one of the largest auto insurance providers in the United States. The company was founded in Erie, Pennsylvania, in 1925 and has since grown to serve customers in 12 states. Other than car insurance, it offers home insurance, life insurance, and commercial insurance.

Erie Insurance provides quality coverage at an affordable price. And the company has a long history of supporting local organizations and causes through charitable giving.

How does Erie auto insurance work?

A standard insurance provider, Erie Insurance collects premiums from policyholders in return for providing insurance coverage. To make a profit, the company relies on its more than 6,000 employees and more than 13,000 independent insurance agents to maintain low operating costs and carefully manage its underwriting and risk management practices.

Erie car insurance coverage

Policyholders can choose from a variety of coverage options from Erie, including:

Bodily injury liability insurance: This pays for injury or death you cause to someone else while operating your vehicle. It helps cover the cost of medical bills, lost wages, and legal fees if you’re at fault in an accident. It doesn’t cover your own injuries or damages to your own vehicle.

Property damage liability: This pays for damages you cause to someone else’s property — like another driver’s vehicle — in an accident. But it doesn’t cover damages to your own vehicle.

Personal injury protection: This pays for your and your passengers’ medical expenses and other related costs. It can pay regardless of who’s at fault, but it may not cover all expenses after an accident.

Uninsured and underinsured motorist coverage: This is coverage that protects you if you’re in an accident with a driver who doesn’t carry insurance or doesn’t have enough auto insurance to pay for damages or injuries. It helps pay for your medical expenses and other related costs. Some states make coverage optional, while others require high policy limits.

Comprehensive coverage: This pays for damages to your vehicle from non-collision events, such as theft, fire, and natural disasters. It helps cover the cost of repairing or replacing your vehicle but can have a high deductible.

Collision coverage: This pays for damages to your vehicle due to a collision with another vehicle or object or if you experience a single-car rollover. It’s helpful especially if you own a newer vehicle, still owe on your car loan, or have a lease. It doesn’t cover natural disasters.

Windshield repair: This pays for the repair or replacement of your vehicle’s windshield. Erie also waives your comprehensive deductible if you choose windshield repair over total replacement.

Motorcycle insurance: This coverage is specifically for motorcycle owners. It protects you and your motorcycle in an accident and includes $3,000 in coverage for damage to gear and accessories. However, it’s only available in some states.

New car replacement: This coverage pays for the cost of a brand-new vehicle if Erie declares your current vehicle a total loss. It doesn’t account for the depreciation in your car’s value. Erie considers a vehicle to be “new” only if it’s 2 years old or newer. Plus, coverage isn’t available in New York or North Carolina.

Rental car coverage: This covers the cost of a rental car while a shop repairs your vehicle. Most states automatically include this coverage if you buy comprehensive insurance, but in other states, it costs extra.

Roadside assistance: This coverage pays for roadside assistance services. For about $5 per year per vehicle, it offers towing, flat tire repair, battery jump-start, and fuel delivery services. But policies can have limits and exclusions regarding the distance of towing or other services.

Coverage costs differ based on location, age, driving history, and other factors. You should get a quote to determine the actual premium for the coverage you want.

How to get an Erie car insurance quote

Getting a car insurance quote from Erie starts with visiting the Erie Insurance website and entering your ZIP code. Then, you’ll enter your name, date of birth, address, and information about your vehicle and any other drivers you want to add to your policy. You can see your quote and discounts immediately and customize your coverage in just a few clicks.

A quote-comparison platform like Insurify can help you compare insurance quotes more quickly. It can give you quotes from Erie and other insurance providers in one place. For the most affordable coverage, enter your information and receive personalized quotes from multiple insurance companies.

Erie car insurance cost by state

Since car insurance costs vary by location and ZIP code, it’s important to compare the rates among different states. For Erie Insurance, the cheapest average quotes are in Ohio, at $64 a month, and the most expensive are in New York, at $331 a month.

| State | Average Monthly Quote: Full Coverage | Average Monthly Quote: Liability Only |

|---|---|---|

| Ohio | $64 | $48 |

| Wisconsin | $76 | $59 |

| North Carolina | $80 | $47 |

| West Virginia | $83 | $56 |

| Pennsylvania | $97 | $75 |

| Tennessee | $111 | $58 |

| Virginia | $120 | $79 |

| Illinois | $122 | $89 |

| Maryland | $170 | $151 |

| Washington, D.C. | $193 | $138 |

| New York | $331 | $395 |

See Also: Cheapest States for Car Insurance

Erie auto insurance rates by driving history

Your driving history greatly influences your premiums. Drivers with clean driving histories are more likely to pay lower premiums than drivers with accidents and infractions. If you have a clean record, you may pay an average rate of $132 with Erie Insurance. But if you have speeding tickets or accidents in your history, you can expect to pay more. Here are the average monthly quotes from Erie by driving history:

| Driving History | Average Monthly Quote: Full Coverage | Average Monthly Quote: Liability Only |

|---|---|---|

| Clean record | $132 | $107 |

| With Speeding ticket | $177 | $143 |

| With at-fault accident | $189 | $153 |

| With DUI | $263 | $213 |

Erie car insurance cost by age

Teenage and new drivers are more likely to be in an accident, and thus, are a higher risk to insure. If you’re younger than 25 years old, you can expect your rates to be higher than older drivers. But if you maintain a clean driving record, your rates may drop in your mid-20s and well into your 30s. Here are the average monthly quotes for drivers from Erie Insurance by age group:

| Driver Age | Average Monthly Quote |

|---|---|

| 18 | $223 |

| 25 | $126 |

| 30 | $112 |

| 40 | $102 |

| 50 | $92 |

| 60 | $83 |

| 70 | $77 |

Read More: Compare Car Insurance by Age and Gender

Erie car insurance discounts

Erie Insurance offers various discounts to policyholders to help reduce the cost of their policies. Ask an Erie Insurance agent whether you qualify for these savings opportunities:

ERIE Rate Lock: This discount guarantees your rate won’t increase, even if you file a claim. You can’t get Rate Lock in every state, but it’s automatic if it’s available for your area.

Multi-policy: Savings are available for having multiple policies with Erie Insurance. Insure more than one car or add home or life insurance coverage to unlock multi-policy discounts.

First accident forgiveness: This waives the surcharge the first time you’re in an at-fault accident. You must be an Erie customer for at least three years to qualify for forgiveness.

Diminishing deductible: This decreases the deductible amount each year you don’t file a claim. Depending on your state, you can reduce your deductible by $100 per year, up to $500.

Vehicle storage: This offers a lower premium if you put your vehicle in storage. To qualify for savings, you must store your car for at least 90 consecutive days.

Safety: Discounts are available for vehicles with safety features. Your car may qualify with airbags, anti-theft devices, anti-lock brakes, or other safety systems.

Payment discounts: Certain payment discounts are available for paying your policy in full. By skipping the monthly installments, you can save money and pay it in one lump sum.

Youthful driver: Discounts are available for unmarried drivers under 21. If you have unmarried young drivers, ask about discounts for living at home, loyalty, and driving training.

College student: These discounts are for full-time students who attend school without access to a car. The time your college student is away from home and isn’t driving could qualify you for a discount.

Erie Insurance bundling options

Buying many policies with Erie will unlock savings — like how you can save money buying in bulk at the grocery store. For example, if you bundle car insurance with homeowners or renters insurance from Erie, you can save up to 20%.

Compare Car Insurance Quotes Instantly

Erie Insurance reviews and ratings

Insurance industry experts and customers have left a variety of ratings and reviews about their experience with Erie Insurance. Their feedback offers insight into the company’s service quality and value. For example, even though Erie is a regional insurer, it’s the 13th-largest auto insurer in the U.S.

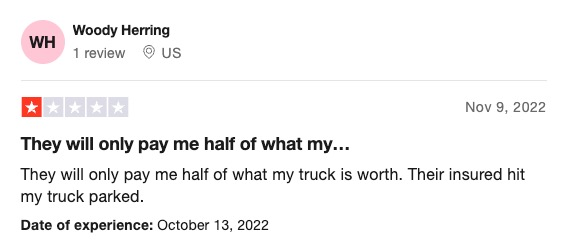

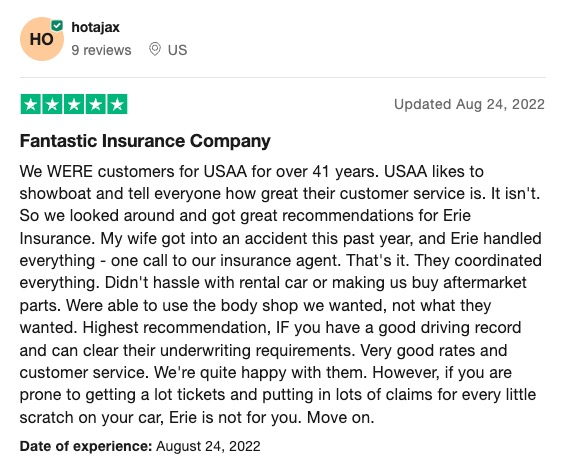

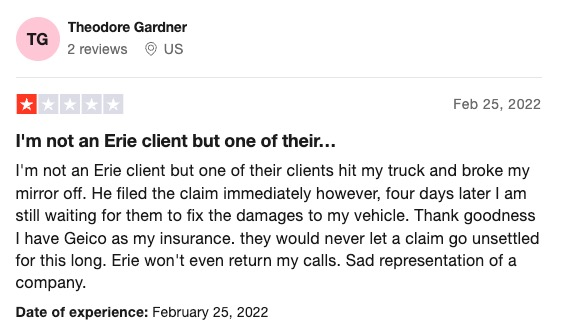

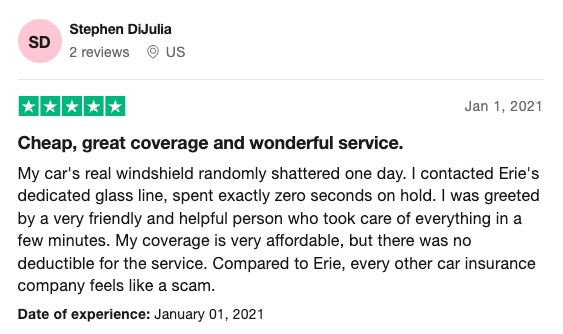

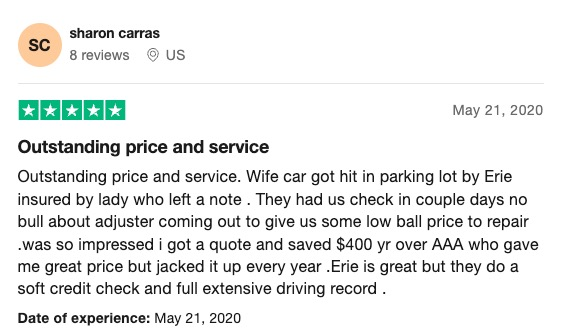

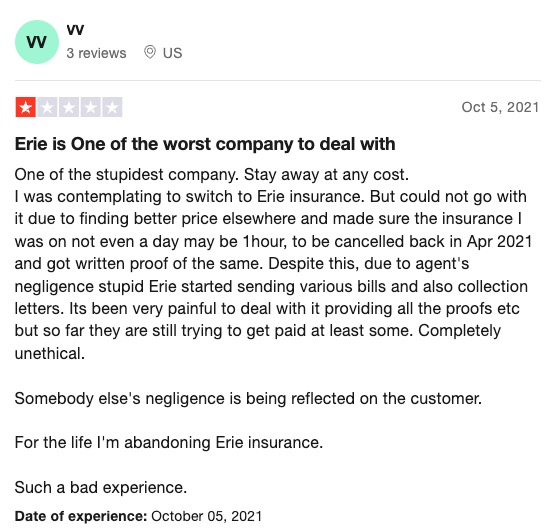

Erie Insurance customer reviews

Erie Insurance has a mixture of positive and negative reviews, as is common with most insurance companies. Here’s what Erie customers have shared about their experience with the company.

Erie Insurance ratings

WalletHub: 3.4 out of 5 stars

Google Reviews: 4.6 out of 5 stars with 1,674 reviews

Better Business Bureau: A+ rating

Apple App Store: 3.0 out of 5 stars with 129 reviews

Google Play Store: 3.3 out of 5 stars with 229 reviews

Erie vs. other insurance providers

The car insurance market is competitive, with many companies offering a wide range of products and services. Considering the market saturation, drivers must compare and choose the option that best suits their situation and budget.

Erie vs. Allstate

Like Erie, Allstate operates through a network of local agents. However, Allstate also sells directly to drivers when buying online or through the company’s call center. Keep in mind that your premiums may differ depending on how you buy, even for the same coverage options.

Allstate has many discount options to help you lower your cost, including new car and paperless discounts. Drivers with Allstate pay an average of $212 for full coverage, which is 38% more than Erie’s average cost of $132.

Erie vs. Farmers

Farmers has a robust online presence, as well as agents customers can visit in person in around 45 states. While Farmers doesn’t advertise any specific discounts, it does state that where you live can influence what discounts you can find. Compared to Erie’s average premiums, Farmers is more expensive, with an average cost of $159 for liability-only coverage and $210 for full coverage.

Erie vs. State Farm

State Farm lets you buy coverage online or through a local agent. But Erie only lets you start your quote online — you must work with an agent to complete your purchase. Discounts from both providers are similar, yet you may pay more with State Farm: The average State Farm premium for full coverage is $175 compared to Erie’s $132.

What is Erie’s YourTurn app?

The YourTurn app from Erie is a telematics program that gathers and analyzes driving data as you go. It focuses on braking and accelerating habits, speeding, and phone use. It can help you become more aware of your driving habits so you can make adjustments to improve your safety and save money on insurance premiums.

Learn More: Car Insurance Discount Guide

Erie Insurance pros and cons

As you’re shopping for car insurance, consider some pros and cons of Erie Insurance:

Pros

High marks in J.D. Power customer service and satisfaction

Rate Lock guarantees premiums won’t increase

Affordable premiums for teens and drivers with speeding tickets

Cons

Limited availability to 12 states

Doesn’t offer usage-based auto insurance

Lack of online service; customers can’t buy a policy or file a claim online

Filing an auto insurance claim with Erie

An auto insurance claim is a request for payment of benefits under a car insurance policy. You make a claim when you’ve had an accident or when your vehicle has damage from some other event, such as theft or vandalism. The insurance company will assess the damage and decide whether to pay the claim based on the policy terms and conditions.

Erie doesn’t have an online claim-filing process. Instead, you need to contact your local Erie agent or call 1-800-367-3743 to file a claim. Have your insurance policy number on hand to speed up the process.

Erie Insurance FAQs

To help you make an informed decision, here are answers to some frequently asked questions about Erie auto insurance.

Yes, Erie Insurance is a legitimate insurance provider. The company has been in business for nearly 100 years and isn’t linked to fraudulent practices. It holds an A+ ranking from the Better Business Bureau, and leading independent agencies, such as J.D. Power and A.M. Best, give Erie high marks for customer satisfaction and financial stability.

Drivers pay an average of $111 a month for liability and $131 a month for full coverage from Erie. How much you pay depends on various factors, such as where you live, your age, and your driving history. Drivers with speeding tickets pay a higher average rate of $177 a month, while drivers younger than 25 spend an average of $223 a month.

A.M. Best gives Erie Insurance an A+ “superior” rating for financial strength, indicating its ability to pay out claims now and in the future. The company also has high marks from J.D. Power, scoring 893 out of 1,000 for overall customer satisfaction in the 2022 U.S. Auto Claims Satisfaction Study.

Erie Insurance offers auto, home, life, business, and other kinds of insurance products, such as motorcycle, boat, RV, and mobile home insurance. It also offers specialty lines, such as flood insurance, Medicare supplement insurance, and umbrella insurance.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.