4.8out of 3,000+ reviews

Updated February 1, 2023

Living expenses are hard to juggle. But when it comes to financial security and peace of mind at home, you shouldn’t have to compromise. Home insurance is the first step to protecting your property investment. The problem is that shopping for a home insurance policy often leads to complex insurance jargon, confusing coverage limitations, and unclear pricing structures.

That’s where Insurify comes in.

Insurify helps homeowners compare quotes from top home insurance companies. We’ll guide you through complicated decisions to ensure your family and your home are always protected.

How do I compare home insurance quotes?

Comparing home insurance quotes using an online comparison platform like Insurify is the easiest way to find the best and cheapest coverage.

Home Insurance Companies

Whether you’re just window-shopping ahead of your first home purchase or ready to switch and save on your next homeowners insurance policy, it’s important to understand how much you should expect to pay. Check out this list of average annual premiums from some of the nation’s top homeowners insurance companies.

You can see how much you would pay by comparing home insurance quotes on Insurify.

| Homeowners Insurance Company | Average Annual Premium |

|---|---|

| Acuity | $2,389 |

| AIG | $1,005 |

| Allstate | $1,604 |

| American Family | $1,576 |

| Amica | $1,501 |

| Erie | $2,449 |

| Farmers | $2,386 |

| Foremost | $2,549 |

| Grange | $818 |

| The Hartford | $1,610 |

| Mercury | $2,227 |

| Nationwide | $1,346 |

| PEMCO | $649 |

| Plymouth Rock | $1,584 |

| State Auto | $1,766 |

| State Farm | $2,205 |

| Travelers | $1,640 |

| USAA | $1,544 |

| Westfield | $1,002 |

How to Compare Home Insurance Quotes

The easiest and safest way to compare homeowners insurance quotes is to use a top-rated home insurance comparison website like Insurify, but it hasn’t always been that easy.

Home Insurance Comparison before Insurify

Historically, shopping for homeowners insurance was a long, frustrating process. Homeowners were forced to fill out multiple forms for each home insurance company. They’d spend hours on the phone negotiating with insurance agents and dealing with bait-and-switch pricing, long hold times, and lots of spam calls and emails following their inquiries.

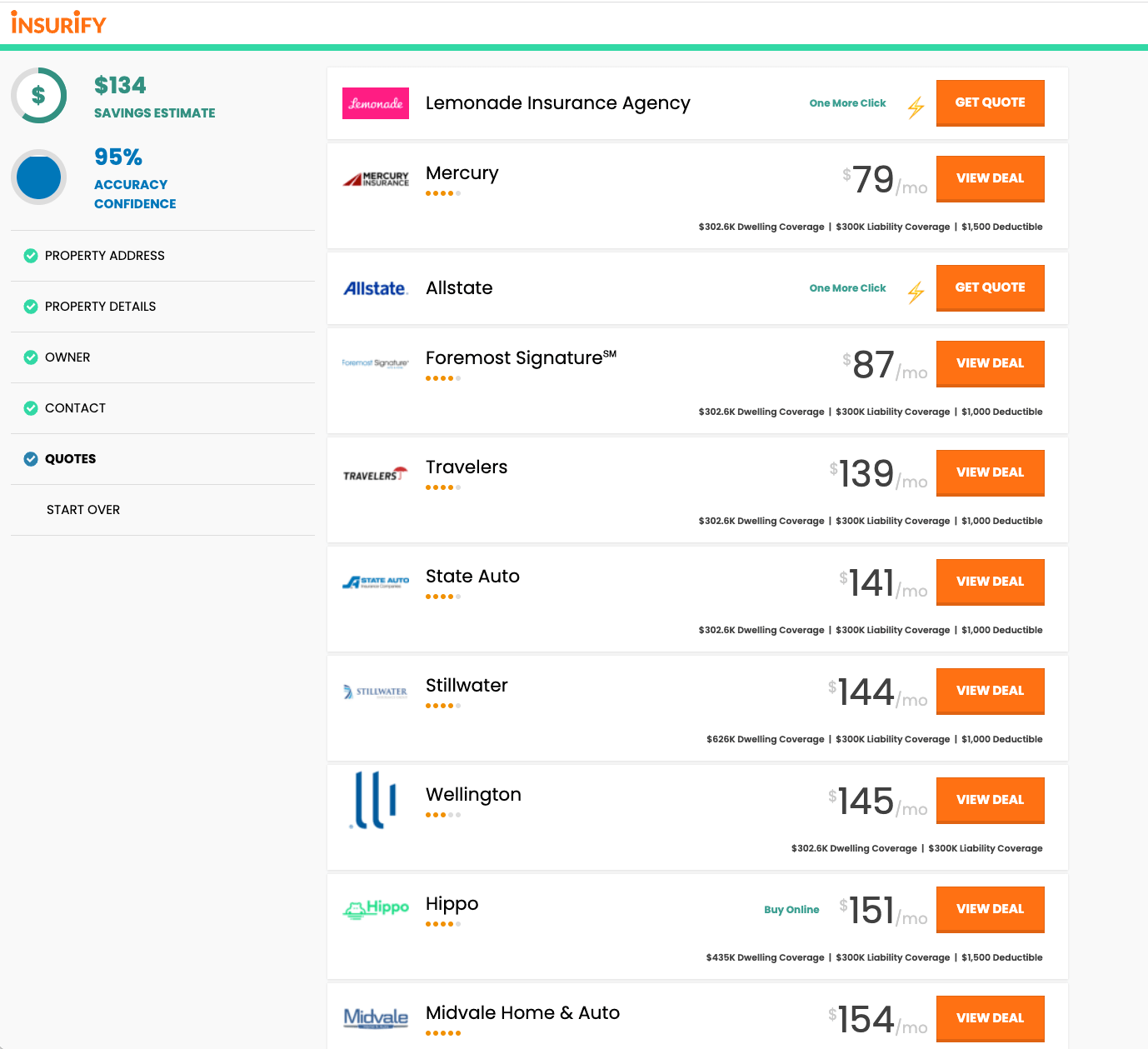

Home Insurance Comparison with Insurify

Now, homeowners can save time and money when they compare home insurance quotes on Insurify. Simply fill out one short questionnaire about your home and coverage preferences. Insurify will present you with real quotes from the nation’s top home insurance companies. Unlock discounts and toggle between coverage options to select the best option for your home.

Compare Home Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required

Factors That Affect Home Insurance Rates

Home insurance companies weigh multiple factors to determine how much to quote you for coverage. If your home is in an area with a high risk of extreme weather or flooding, they may reject your application altogether. Insurify can help you find home insurance coverage regardless of where you live or the risks your home is subject to.

Your Neighborhood

Geographic variables like population density, crime rates, and weather patterns may affect home insurance costs. More frequent natural disasters in your region may result in higher home insurance rates due to the higher risk of severe property damage to your home. The more likely you are to file a claim, the higher home insurance companies will charge you for coverage.

Your Home

What’s your home made of? Brick houses typically cost less to insure than those made of wood, which is more flammable and prone to rot. Older homes with structurally unsafe foundations will result in higher insurance premiums as well. Similarly, the value of your home will impact rates—customized elements usually result in higher quotes from home insurance companies.

Your Demographics

Married? Single? Divorced? Who lives in your home? These details may affect your policy rates. If you work from home or spend a significant number of daytime hours in your home, you may benefit from lower homeowners insurance rates. That’s because the majority of home break-ins occur during daylight. If you’re home more often, insurance companies will cut you a break.

Your Credit Score

Insurance companies in most states are legally permitted to use your credit score as a rating factor for homeowners insurance quotes. In a few states, companies are barred from refusing coverage due to a low credit score. If you have good or excellent credit, some homeowners insurance companies will grant you significant discounts on your coverage.

Your Deductible Amount

The higher the deductible you choose, the lower your premium will be, and vice versa. Just be sure not to set your deductible amount higher than you can afford if you need to file a claim. Raising your deductible a reasonable amount can be an excellent way to cut monthly homeowners insurance costs.

Your Roof

Roofs are one of the most important elements of a home’s structural integrity. Home insurance companies will want to know when your roof was last replaced and the material it is made of. Quality roofing prevents flooding and other calamities from impacting your home in times of extreme weather.

What does homeowners insurance cover?

Home insurance includes coverage that repairs or replaces your property if it is damaged by perils like theft, fire, or weather. Home insurance policies also cover medical expenses if someone is injured while on your property. Some policies may even pay for costs incurred when you accidentally damage someone else’s property. Depending on your unique home insurance policy, the following coverages are generally standard inclusions.

Liability Coverage

This covers medical bills, lost wages, and legal costs associated with injuries that take place on your property, up to the predetermined coverage limits specified in your policy.

Dwelling and Other Structures

Your physical home and other structures on your property (such as sheds and garages) are covered in the event of theft, fire, or other weather events. If you live in a high-crime area, an area that falls victim to frequent storms, or a mobile home, expect to pay more for this type of coverage.

Personal Property

The value of belongings stolen in a theft or lost or damaged after weather events may be reimbursed by your homeowners insurance company depending on predetermined personal property coverage levels. Keeping a detailed home inventory, especially focused on the valuable items in your home, can help you get the most coverage in case of a claim.

Additional Living Expenses (ALE)

This coverage type helps homeowners handle expenses associated with living in your home (or usually elsewhere) while you await claim-related repairs, restoration, or reimbursement. If you are unable to stay in your home during this time, ALE helps homeowners pay for hotel stays and car rentals while they await insurance payouts.

What does homeowners insurance exclude?

Though homeowners insurance is the best way to protect your property in the case of unforeseen events, not everything will be covered. Damages arising from earthquakes and floods usually require separate insurance policies or supplemental coverage.

Home Insurance Discounts

Every homeowners policy is different, but discounts abound if you know where to find them.

Policy-Related Discounts

Bundling or Multi-Policy Discounts

If you bundle multiple policies with the same insurance company, you may be eligible for significant savings on all of them. Of course, insurers value loyalty and will reward you in the form of multi-policy discounts.

Loyalty Discounts

Over time, if you stick with the same homeowners insurance provider, you could earn a loyalty discount. This usually only applies after several years on the same policy.

Payment Discount

If you’re demonstrably able to pay for your homeowners insurance in one lump sum, insurance providers may mark down the price of your annual premium.

Identity-Based Discounts

Married or Widowed Discount

As is the case with other types of insurance policies, sometimes it pays to get hitched. Many homeowners insurance companies offer married couples discounted rates on their policies.

Mature Homeowners Discount

Older homeowners are more likely to be home during daytime hours. Since most burglaries happen during the day, being present can protect your home. Insurance companies will reward this with a discount.

Homeowners Association Discounts

If you’re part of a homeowners association (HOA) in your community, it’s likely that you’re subject to high home maintenance standards. Insurance companies see this as an asset.

Safety- and Security-Based Discounts

Monitored Burglar System Discount

A house equipped with a proper burglar alarm system to stave off theft is seen as a less risky investment to insurers, which have to pay partial or full replacement cost for your stolen property.

Monitored Fire Alarm System Discount

Have an up-to-date smoke alarm system installed in your home? Expect some savings from your home insurance provider.

Impact-Resistant Roof Discount

If you live in a heavily forested area or are otherwise at risk for roof damage, make sure the structural integrity is up to snuff. Your insurer may thank you with a discount.

Home Improvements Discount

If you’ve taken action to improve any aspect of your home since purchasing your policy, let your insurance company know, and you may be eligible for further discounts thanks to your upgrades.

Gated Community Discount

For an insurance company, the fewer threats to the safety of your home, the better. And gated communities work to keep your home safer.

New Home Discount

Older homes are prone to degradation; buying a new home that’s 100 percent up to code may lower your risk profile.

Non-smoker Discount

Smoking is one of the top causes of house fires. Eliminating that risk is a huge benefit to home insurers.

Average Home Insurance Rate by State

| State | Average Annual Premium |

|---|---|

| Alabama | $3,205 |

| Alaska | $1,361 |

| Arizona | $1,803 |

| Arkansas | $4,133 |

| California | $1,240 |

| Colorado | $3,009 |

| Connecticut | $1,158 |

| Washington, D.C. | $1,211 |

| Delaware | $1,111 |

| Florida | $1,410 |

| Georgia | $2,673 |

| Hawaii | $372 |

| Idaho | $1,226 |

| Illinois | $2,093 |

| Indiana | $1,547 |

| Iowa | $2,488 |

| Kansas | $4,025 |

| Kentucky | $3,620 |

| Louisiana | $2,226 |

| Maine | $1,179 |

| Maryland | $1,080 |

| Massachusetts | $1,177 |

| Michigan | $2,141 |

| Minnesota | $3,342 |

| Mississippi | $2,302 |

| Missouri | $2,351 |

| Montana | $1,785 |

| Nebraska | $3,195 |

| Nevada | $1,336 |

| New Hampshire | $1,140 |

| New Jersey | $921 |

| New Mexico | $3,202 |

| New York | $1,138 |

| North Carolina | $1,463 |

| North Dakota | $3,750 |

| Ohio | $2,242 |

| Oklahoma | $5,397 |

| Oregon | $1,218 |

| Pennsylvania | $1,184 |

| Rhode Island | $1,610 |

| South Carolina | $2,785 |

| South Dakota | $3,656 |

| Tennessee | $2,039 |

| Texas | $3,645 |

| Utah | $1,475 |

| Vermont | $956 |

| Virginia | $1,863 |

| Washington | $1,345 |

| West Virginia | $1,666 |

| Wisconsin | $1,358 |

| Wyoming | $1,821 |

Frequently Asked Questions

Insurify lets homeowners compare home insurance quotes and save money on their policy in a matter of minutes. Unlock discounts and save on your annual premium with a real quote from a large or small homeowners insurance provider.

Comparing home insurance quotes on Insurify saves you time, money, and stress. Entering the same personal information directly on many company or lead-generation websites may leave you susceptible to unwelcome spam calls and emails. With Insurify, users can compare homeowners insurance quotes on one secure platform without the risk of spam.

The best homeowners insurance policy for you will vary based on multiple factors. Even so, some home insurance companies get uniformly high marks. Insurify’s official list of the best home insurance companies deems COUNTRY Financial, USAA, and Allstate the best home insurers of 2022.

Compare Home Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required