4.8out of 3,000+ reviews

Updated February 8, 2023

If you perform an online search for car insurance, you’ll find a variety of providers. One of these is USAA, which serves the military community. Here’s what you need to know about USAA and its auto insurance offerings.

Quick Facts

USAA offers auto insurance and other products to military members, veterans, and their families.

Its rates are affordable, especially for good drivers and those who are eligible for its discounts.

USAA’s SafePilot program rewards policyholders for good driving habits and can save them up to 30% on their premiums.

What is USAA car insurance?

The United Services Automobile Association (USAA) made its debut in 1922 when 25 Army officers in San Antonio decided to insure each other’s vehicles. Today, the company provides a variety of financial products to current military members, former members, and their families. These include car insurance, homeowners insurance, life insurance, checking accounts, savings accounts, IRAs, annuities, and more.

You must join USAA to take advantage of its auto insurance policies and other offerings. Membership is limited to current and former military members, spouses, and children, so if this isn’t you, you’ll have to look for a different insurance provider. USAA is available in all 50 states and Washington, D.C.

How does USAA auto insurance work?

USAA sells car insurance as well as other types of insurance, banking, investment, and retirement products to its members, who are affiliated with the military. Compared to other auto insurance providers, the company offers affordable coverage, making it a popular option for those who are eligible.

In addition to cheap premiums for liability coverage, collision coverage, comprehensive coverage, and uninsured motorist coverage, USAA provides add-on insurance, such as accident forgiveness and rental reimbursement. It also has a SafePilot program, which allows drivers to track their driving and earn discounts for demonstrating responsible behavior behind the wheel.

USAA car insurance coverage

USAA offers four major types of auto insurance products:

Liability

Liability coverage helps protect your assets if you’re found legally liable for the injury or death of another person after a car accident. It can also help pay to repair or replace their damaged property. It’s the most affordable type of coverage and will cover you up to your policy limits.

Comprehensive

Comprehensive coverage is designed to repair or replace your vehicle if it sustains damage from an unexpected event like theft, fire, or hail. It’s a good option if you have a newer or high-value car and would like some extra protection for incidents that are outside of your control.

Collision

Collision coverage pays for the cost to repair or replace your vehicle if it’s damaged in an accident with another vehicle or object. It will ensure you’re covered, regardless of who’s at fault.

Uninsured and underinsured motorist

These coverages can come in handy if you get in an accident with a driver who doesn’t have enough car insurance or lacks insurance altogether. Without it, you may be on the hook for the cost of your damage and injuries.

Learn More: Compare Car Insurance by Coverage

How to get a USAA car insurance quote

It’s simple to get a USAA auto insurance quote. All you have to do is visit the USAA website and click “Get an auto quote.” Once you do, you’ll be directed to a page that will ask you for basic information like your name, date of birth, ZIP code, military affiliation, and vehicle type. You can also use an online quote-comparison tool to quickly compare USAA with other car insurance companies in one place.

Compare Car Insurance Quotes Instantly

USAA car insurance cost by state

Car insurance requirements and prices vary, depending on the state in which you’re insured. The table below shows the average monthly rate of a USAA full-coverage policy in 14 different states based on Insurify data. As you can see, you’ll pay more for car insurance in a state like New York than in Ohio or Virginia.

| State | Average Monthly Quote |

|---|---|

| Massachusetts | $35 |

| Indiana | $55 |

| Ohio | $71 |

| Tennessee | $90 |

| Washington | $102 |

| Virginia | $105 |

| Arizona | $117 |

| Illinois | $131 |

| Michigan | $134 |

| Texas | $149 |

| Georgia | $162 |

| Pennsylvania | $171 |

| California | $228 |

| New York | $345 |

USAA auto insurance rates by driving history

Car insurance rates change depending on your history as a driver. In this table, you’ll find that a driver with a clean record pays a lower premium for a full-coverage policy than someone with a serious violation, like a speeding ticket, at-fault accident, or DUI.

| Driving History | Average Monthly Quote |

|---|---|

| Clean record | $152 |

| Speeding tickets | $203 |

| At-fault accidents | $217 |

| DUIs | $302 |

USAA car insurance cost by age

Car insurance rates differ based on a driver’s age. In the table below, you’ll notice that a teen driver with less experience will pay more for a USAA auto policy than an older driver with more experience behind the wheel.

| Driver Age | Average Monthly Quote |

|---|---|

| 18 | $240 |

| 25 | $141 |

| 30 | $118 |

| 40 | $114 |

| 50 | $108 |

| 60 | $95 |

| 70 | $88 |

USAA car insurance discounts

Fortunately, USAA offers several discounts that can reduce the cost of a car insurance policy, including:

Bundle discount: The bundle discount is ideal if you plan to purchase auto insurance and a different policy, like home insurance, through USAA. You can save up to 10% by doing so.

Military on-base discount: USAA will reward you with a discount of up to 15% on comprehensive coverage for parking your car on a military base.

Annual mileage and storage discounts: If you only drive on occasion and store your vehicle, you may qualify for an annual mileage and storage discount of up to 60%.

Automatic payments discount: As long as you sign up to have your premiums automatically deducted from your bank account, you can score a 3% discount.

MyUSAA Legacy Discount: Do your parents have USAA car insurance? If so, USAA will reward you with up to 10% off your own policy.

Good student discount: If you’re a teen driver with good grades, you may be eligible for a good student discount.

Multi-vehicle discount: USAA will offer you a multi-vehicle discount if you insure more than one vehicle with the company.

USAA insurance bundling options

Chances are you could use more than one type of insurance policy. If you pair USAA car insurance with another type of insurance, such as home insurance or renters insurance, you’ll be eligible for a bundle.

This can lead to up to 10% off your premiums. USAA says on its website that its members have saved $814 million when they bundled their insurance products. If you’re interested in a USAA bundle, you can get a free quote online.

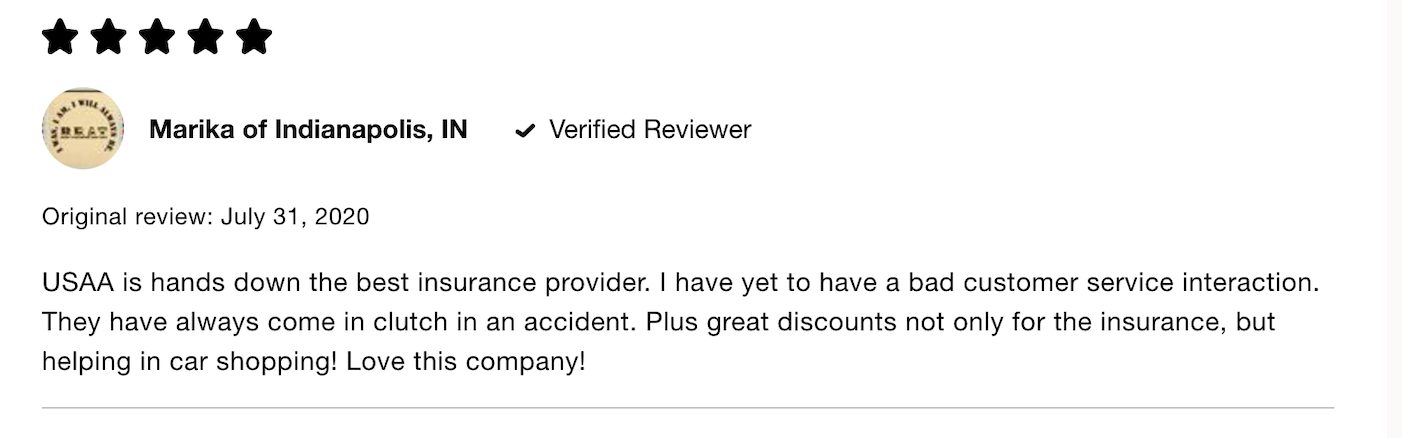

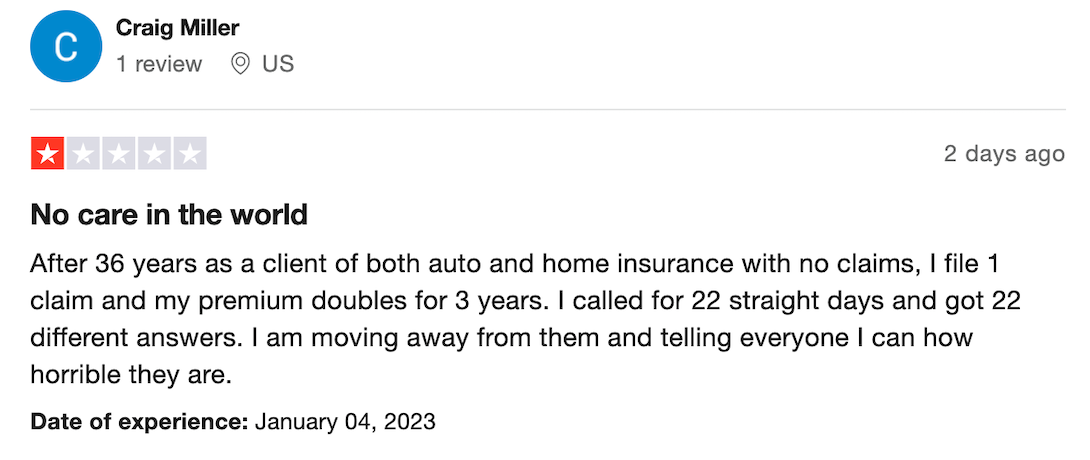

USAA insurance reviews and ratings

Before you move forward with a USAA car insurance policy, it’s well worth your time to read various reviews and ratings from reputable sources. This way, you can get an idea of what current and former policyholders like and dislike. Below are several examples of USAA insurance reviews and ratings.

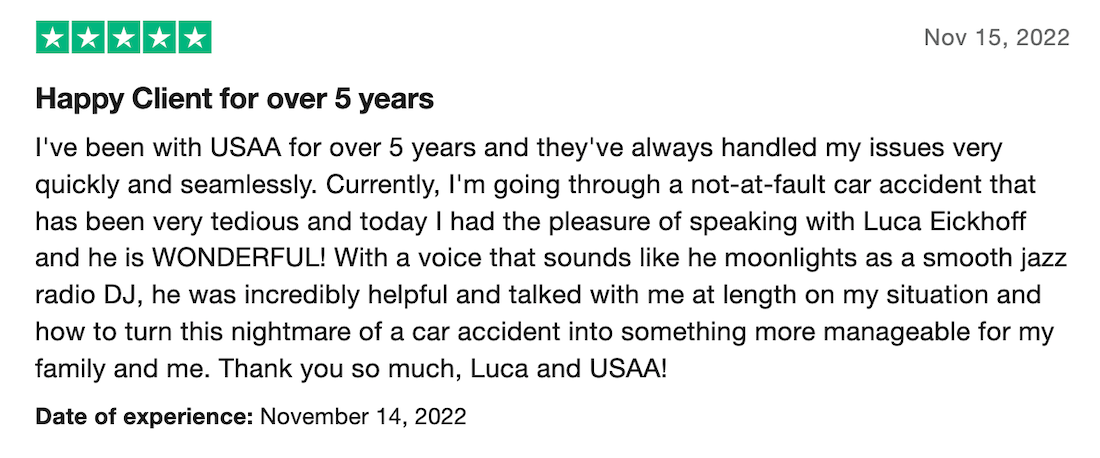

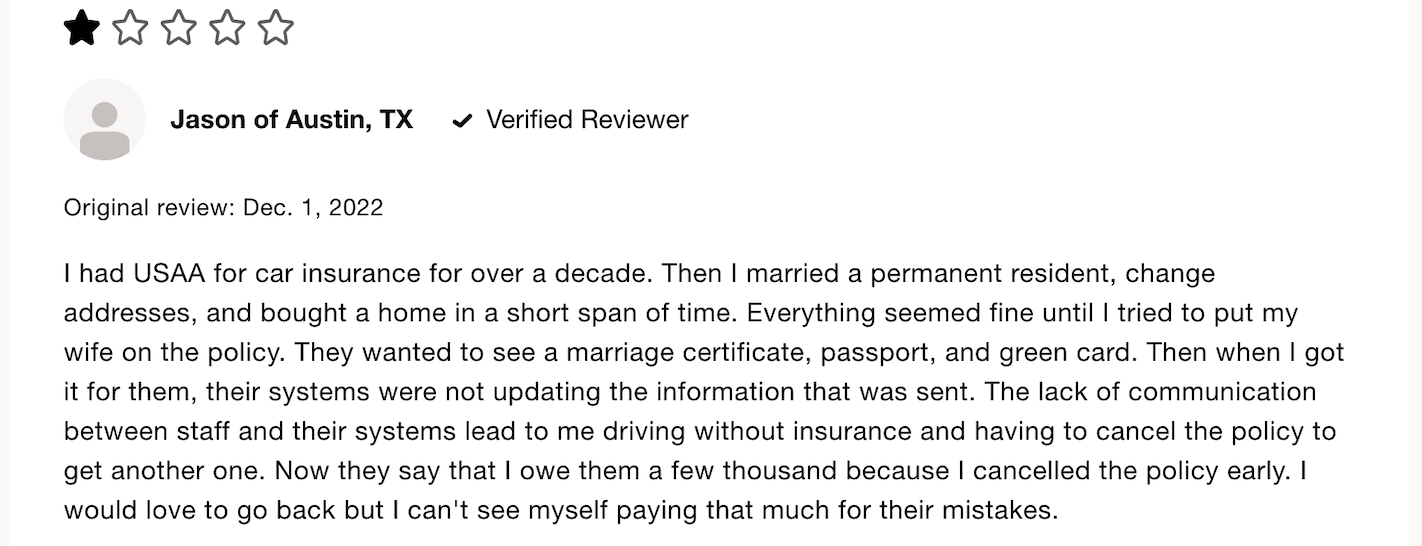

USAA customer reviews

USAA ratings

Here’s how USAA stacks up on various rating sites as of February 2023.

Trustpilot: 1.3 out of 5 stars with 1,792 reviews

Better Business Bureau: No BBB accreditation, 1.15 out of 5 stars with 997 reviews

Google Play Store: 4.1 out of 5 stars with more than 195,000 reviews

Apple App Store: 4.8 out of 5 stars with more than 1.6 million reviews

USAA vs. other insurance providers

The car insurance market is highly saturated. With so many auto insurance providers, it’s wise to see how USAA stacks up to the competition.

USAA vs. Allstate

Just like USAA, Allstate is available in all 50 states and Washington, D.C. However, it doesn’t limit its car insurance products to the military community. You can get an Allstate auto policy even if you’re not affiliated with the military. Allstate also offers a number of support options and discounts for safe driving. But its auto insurance premiums are typically higher than USAA’s.

Just like USAA, Allstate is available in all 50 states and Washington, D.C. However, it doesn’t limit its car insurance products to the military community. You can get an Allstate auto policy even if you’re not affiliated with the military. Allstate also offers a number of support options and discounts for safe driving. But its auto insurance premiums are typically higher than USAA’s.

USAA vs. GEICO

GEICO is known for its friendly gecko. Unlike USAA, which only serves the military community, GEICO serves all types of drivers. It also offers a variety of discounts and lower premiums on auto policies. GEICO’s DriveEasy telematics app provides rewards for safe driving and is similar to USAA’s SafePilot program. But it’s not available in all 50 states.

USAA vs. State Farm

Compared to USAA, State Farm is a larger car insurance company. It offers two telematics programs called Drive Safe and Steer Clear, which are a lot like USAA’s SafePilot program. Drivers may save up to 30% on their premiums and don’t have to be part of the military to take advantage of these programs.

More about USAA insurance

Over the years, USAA has earned several awards. It won awards for “Claims Champion” and “Policyholder Experience Knockout” after it successfully launched its SafePilot program. These awards were given by Insurity, a leading provider of cloud-based software for insurance providers, brokers, and managing general agents.

What is USAA SafePilot?

USAA SafePilot is a usage-based telematics program. If you sign up, the company will use a tracking system to keep tabs on your driving behaviors. Once you prove safe habits on the road, you may be rewarded with a discount. While anyone who participates will receive an initial discount of up to 10%, top performers can land up to 30% off their car insurance rates.

USAA pros and cons

Before signing up for a USAA car insurance policy, here are some pros and cons to consider.

Pros

Low premiums: USAA offers affordable rates for all types of drivers, including those with traffic violations like speeding tickets, at-fault accidents, and DUIs.

Rewards safe driving: With the SafePilot program, good drivers can lower their auto insurance costs by up to 30%.

Variety of discounts: A number of discounts are available for bundling, being a good student, enrolling in automatic payments, and more.

Convenient mobile app: The company’s highly rated mobile app is a great option if you’d like to manage your USAA auto policy on the go.

Cons

Not everyone qualifies: USAA car insurance is only available to active military members, veterans, and their families.

No gap insurance: Gap insurance, which can come in handy if your car is stolen or considered a total loss, is not available.

Limited customer service: Unlike some other car insurance providers, USAA doesn’t offer 24/7 live customer support over the phone.

How to reduce your car insurance costs

You can lower your auto insurance premiums in a number of ways. Try them all to see how much you could save.

Seek discounts. USAA, along with most other car insurance providers, offers a number of discounts. Make sure you take advantage of the ones that apply to you. Most companies list their discounts online.

Bundle. If you bundle your auto policy with another policy, like home insurance or renters insurance, you can land a great discount. USAA will reward you with up to 10% off.

Improve your credit. In many states, car insurance companies look at credit-based insurance scores when they determine premiums. With a good credit score, you may be able to lock in a lower rate.

Comparison shop. Not all auto policies are created equal. That’s why it makes sense to shop around and compare all your options. An online quote-comparison tool can help you do just that.

USAA insurance FAQs

Here are answers to several of the most frequently asked questions about USAA car insurance.

Yes, USAA is a legitimate company. It’s served the military community with a variety of products since its inception in 1922.

USAA earned an Insurify Composite Score (ICS) of 96 out of 100. This means it’s worth considering if you’re affiliated with the military and looking for a reliable car insurance provider.

For a USAA liability policy, you can expect to pay anywhere from $22 to $412 per month. Full-coverage policies range from $35 to $345. Your rate will depend on where you live, your driving history, your credit, and a number of other factors.

A.M. Best rated USAA an A++, or Superior. This means it excels in the claims department and is deemed a reputable auto insurance provider.

Unfortunately, USAA restricts its membership and insurance offerings to military members and their families. You’ll have to look for a different car insurance provider if you’re not affiliated with the military.

Methodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers’ vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on a Quadrant Information Services database of auto insurance rates. With this data, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.