4.8out of 3,000+ reviews

Updated August 4, 2022

If you have an auto insurance policy with AAA, you’re not stuck with it forever, and there may come a time when you want to cancel. Maybe you found a lower car insurance premium elsewhere, or perhaps you’re displeased with the customer service. No matter what your situation is, rest assured that canceling your AAA insurance policy is a breeze.

Before you cancel, however, make sure you shop around and explore different car insurance companies. The best way to find the best company and policy for your needs is by comparing auto insurance quotes with Insurify. You can compare multiple quotes from top providers within minutes, all for free.

Quick Facts

Canceling a car insurance policy with AAA is easy.

You can cancel via phone or in person at a local AAA branch.

Before you cancel, make sure you find a new car insurance plan.

Table of contents

AAA Cancellation Policy

How do I cancel my AAA policy?

To cancel a policy with AAA, you’ll need to call the customer support number at 1 (800) 387-8378. You can also cancel in person with an agent at the nearest AAA location. Either way, you’ll need to have your policy number on hand.

AAA doesn’t disclose any type of cancellation fee on its website. Despite this, some customers have reported that they had to pay a fee equal to 10 percent of the remaining balance left on their policy. For this reason, you’d be better off canceling later in your policy term. Note that this fee might only be applied regionally, and you may not have to pay it.

Fortunately, you can cancel your AAA auto insurance policy and still keep the towing coverage and other benefits that come with a AAA membership. AAA allows anyone to take advantage of its roadside assistance program, regardless of who they choose for their car insurance provider.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

Ideally, you’d cancel your AAA car insurance policy as close to the renewal date as possible. The closer you are to your renewal date, the easier the process will be. To find your renewal date, search your account information on AAA’s website or call 1 (877) 387-8378 to speak to a customer service representative.

In addition to simplifying your cancellation, knowing your renewal date can help you lock in new car insurance coverage before your policy ends. If your AAA policy is up and you don’t have a new policy, you’ll face a coverage gap, which can be problematic if a police officer pulls you over or if you get into an accident.

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

As we mentioned above, it’s important to avoid a gap in your auto insurance coverage. If you cancel your AAA policy before you sign up for a new one, you may face steep penalties for driving uninsured. Also, if you’re held liable for a car accident without auto insurance, you’ll have to pay for any damages out of pocket.

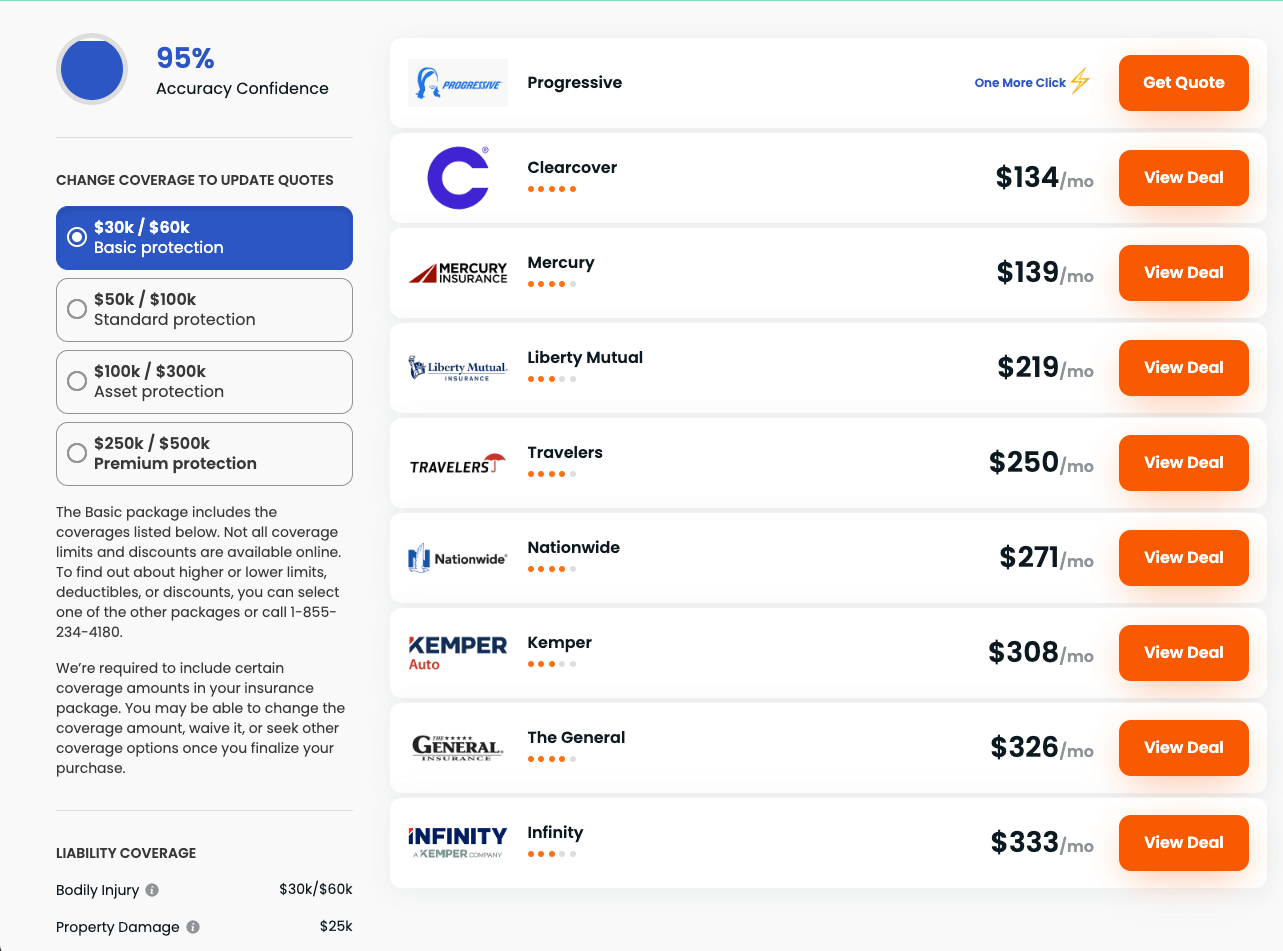

Since car insurance policies can vary greatly, it’s well worth your time to shop around and compare car insurance rates. Insurify makes this process fast and easy. Once you answer a few short questions, you’ll receive free auto insurance quotes from the leading providers.

AAA Quotes vs. Competitors

To give you an idea of what AAA’s competitors charge for car insurance, here is a list of average quotes from our proprietary database:

| Insurance Company | Average Monthly Quote |

|---|---|

| AAA | $118 |

| GEICO | $52 |

| State Farm | $50 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Amica | $105 |

| Esurance | $114 |

| National General | $139 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Erie | $52 |

| Clearcover | $172 |

| AARP | $112 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| Travelers | $81 |

| NJM | $64 |

| American Family | $84 |

| Mercury | $114 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving AAA

As you explore various car insurance policies, you’ll find no shortage of options. While some plans are more economical, others are pricier with more comprehensive coverage. Before you finalize your decision to cancel your AAA auto insurance policy, think about why you’re ready to move on.

This will help you find the ideal plan for your new circumstances. Whether you’re in search of a more affordable policy, want better customer service, or anything in between, keep your goals in mind as you compare quotes and weigh your options.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

Before you cancel your AAA car insurance, don’t forget to enroll in a new plan so you can avoid a gap in coverage. Once you’ve found your ideal auto insurance policy, reach out to the car insurance provider and let them know you’d like to sign up. Depending on the company, you may have to work directly with an agent.

Be prepared to provide your new insurance company with some basic personal details as well as financial information. Most providers will pull your credit score and ask for the following to determine your premium.

Your desired effective date

Your date of birth

Your vehicle identification number (VIN)

Your payment info, such as your credit card number

Step 5: Cancel Your AAA Policy

Once you’ve signed up for a new car insurance plan, it’s time to cancel your AAA policy. Keep in mind that when you tell AAA you’re ready to cancel, an agent might try to get you to stay by offering you a lower rate. Be sure to remember your intentions for canceling and decide whether the extra savings are worth it. Here’s how to cancel if you decide to do so:

Cancel by Phone

To cancel your coverage via phone, you should call the AAA office in your local area. Visit the AAA website and enter your ZIP code on the “Find a Location” page. Once you do, you’ll know which phone number to call. You can also call AAA’s general car insurance line at 1 (877) 387-8378. Just be prepared to wait and follow prompts, as this is an automated system.

Cancel in Person

Since AAA has agents throughout the country, you can visit a local branch and go through the cancellation process in person. If you live close to a location and think you’ll need some extra help from an agent, canceling in person is a good idea, especially if you have the time for it.

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

You may have paid all your premiums upfront to land a discount or to simply get it off your plate. If so, you may be eligible for a refund. Since refunds aren’t a priority for AAA (it is a business, after all), you may have to wait a while before receiving your money.

If it’s been a few weeks since you’ve canceled your AAA insurance policy and you still haven’t received your refund, don’t hesitate to follow up with your insurance agent or contact AAA directly. The money is yours, and you deserve to receive it in a timely manner.

Canceling Your AAA Policy

We know you lead a busy life and might not have a lot of time to cancel your policy and find a new one. Luckily, canceling your AAA policy is straightforward and quick. Finding new insurance can take longer, however, and that’s where Insurify’s car insurance quote comparison tool comes in. After answering a few basic questions, you’ll receive multiple personalized quotes from top providers.

Frequently Asked Questions

After you cancel your AAA car insurance policy, you’ll receive a final notice via mail and email. Depending on how you paid for your coverage, AAA may also issue you a refund. This refund will be prorated from your cancellation date to the end of your term. Follow up with AAA if you haven’t received confirmation within a few weeks.

Before you go ahead and cancel your AAA insurance plan, there are some things to think about. Consider whether you’ll miss any special discounts or perks. Also, have an idea of what type of coverage and features you’d like when you shop for a new policy. In addition, if you have a big life change coming up, like a marriage or a new house, you may want to wait a bit.

The ideal time to cancel your AAA insurance coverage is three to four weeks before your renewal date. This way, you’ll have time to shop around, compare insurance rates, and find a new provider. Of course, life happens and you may have to cancel at a different time, and that’s perfectly fine.

It’s important that your auto insurance policy meets your budget and needs. If your circumstances have changed since you first purchased your plan or you’re unhappy with it for any reason, canceling makes sense. However, if you’re pleased with AAA but wish you had lower premiums, for example, you might want to talk to them about your options.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.