4.8out of 3,000+ reviews

Updated December 21, 2022

Comparing car insurance is an important step in finding coverage that’s both affordable and suitable for you. But when you enter a query for comparing car insurance into your favorite search engine, it may return some legitimate companies, as well as other sites that may prove unreliable.

If you’re looking for new coverage, here’s what you need to know about Otto’s quote-comparison tool, how it works, and what to watch out for.

Quick Facts

Otto insurance indicates it lets you compare quotes easily, but it doesn’t work like a traditional insurance-comparison site.

Otto shares your personal information with its partners, including legitimate insurers and other service providers.

You’ll likely be contacted by many companies if you use Otto’s quote-request tool.

What is Otto Insurance?

Otto is a lead-generation site connecting customers seeking auto, pet, home, life, or commercial insurance with its partners. Joshua Keller founded the company and it’s a wholly owned subsidiary of Global Agora, a venture capital firm.[1]

Limited information about Otto is available online, though recent news suggests the company is expanding. The Otto website also doesn’t share its company history or have an About Us page with information about its team or offerings.

How does Otto Insurance work?

Unlike other insurance marketplaces, Otto doesn’t let you view quotes once you enter your personal information. Instead, it acts as a lead generator, sharing your information with over 1,000 partners.[2] While some of its partners are real insurance companies, many partners seemingly have little to do with insurance. Otto’s partners include mortgage providers, solar panel companies, and energy providers.

When you share your personal information with Otto, it will try to match you with partners based on your needs. If it finds a successful match, Otto may receive compensation from its partners.

What type of insurance does Otto offer?

Otto provides options for auto, home, pet, life, and commercial insurance. It’s important to note that Otto doesn’t provide this insurance, but instead matches customers to other companies that do.

Otto’s car insurance partners may provide the following coverage options:

Liability: If you’re at fault in an accident, liability coverage can pay for the other driver’s medical costs or damage you cause to their property.

Collision: Collision insurance pays for damage to your vehicle, regardless of who’s at fault in an accident.

Comprehensive: Comprehensive coverage covers you if your car is damaged due to events outside of your control, like weather-related events, fires, vandalism, or theft.

Gap: This insurance protects you if your car is totaled after an accident. It covers the gap between your car’s current value and what you owe on your auto loan so that you can still pay it off.

Underinsured/uninsured motorist: If your car is hit by an underinsured or uninsured driver, this coverage may pay for the damages.

Personal injury protection: Commonly known as PIP, this insurance can cover medical expenses, no matter who’s at fault in an accident.

How to get an insurance quote from Otto Insurance

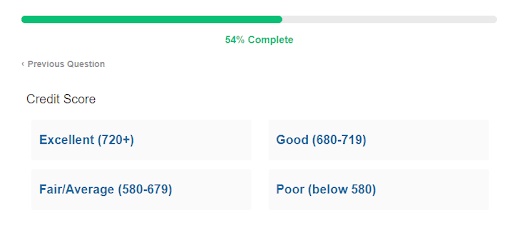

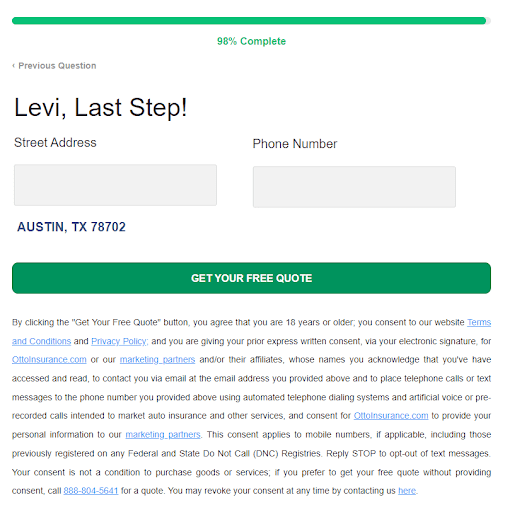

Otto doesn’t provide customers with quotes but directs customers to companies that can. When using Otto, you’ll begin by answering a brief series of questions about yourself, your car, and your driving record. You’ll also need to share personal information, including your gender, marital status, credit score, and whether you own a home. The final step is entering your address and phone number and clicking the “Get Your Free Quote” button.

Under the green button, you’ll probably notice some fine print that indicates you’re giving Otto’s partner companies permission to contact you at the phone number or email you’ve provided. Given the high number of partners Otto has, you could end up receiving several calls and messages.

Is Otto Insurance a scam?

Otto insurance is a legitimate company, though it has many partners that aren’t insurance providers. As a result, you could receive calls and emails from companies that don’t offer insurance if you share your information with Otto.

Better Business Bureau

Otto isn’t currently accredited by the Better Business Bureau, and while this isn’t necessarily a red flag, it’s still something worth considering as you shop around for insurance.[3]

Website safety

Otto doesn’t specify which tools it uses to keep its website secure. But it does mention it uses certain tools to collect information about users, including cookies and log files that track your IP address and online behavior.

Data handling

Otto outlines how it handles safeguarding users’ personal data in its privacy policy. It mentions that it limits access to your data to certain employees only and that the information is protected by secure processes and technologies. Otto also indicates that its partners each have their own privacy and security policies, though policy specifics will vary.

Compare Car Insurance Quotes Instantly

Otto Insurance reviews and ratings

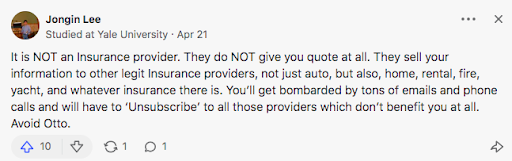

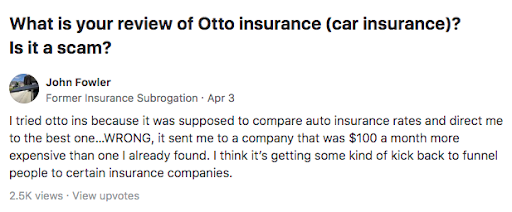

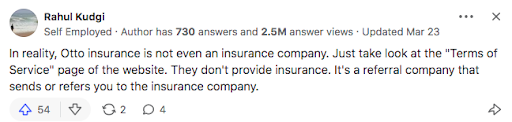

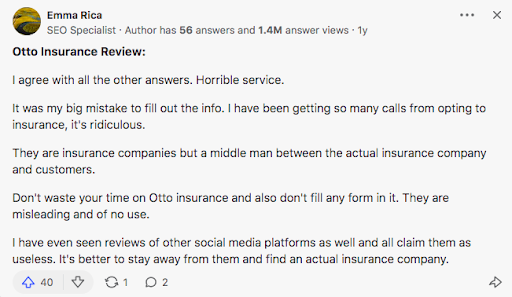

Customer reviews for Otto Insurance are mostly negative. Dissatisfied reviewers mention getting bombarded with calls, texts, and emails after providing their information to Otto. Others say the platform is misleading.

Otto Insurance Reviews: Here’s what customers are saying

Otto ratings

While Quora users shared some feedback about Otto, consumer reviews of the company are scarce, and it doesn’t have a presence on popular third-party sites like Trustpilot or WalletHub. Otto does have a Facebook page, though it doesn’t have a star rating and the reviews feature appears to be disabled.[4]

Otto vs. other insurance sites

Certain sites that claim to offer insurance quotes, like Otto, use a lead-generation model. With this model, the site shares your information with specific insurers — typically its partners. The original site may receive compensation for providing your information or if you use the partner’s product.

Other companies don’t follow a lead-generation model, offering real quotes from insurance providers directly on the site. These are real quote-comparison sites that make comparing and buying policies a lot easier.

Otto vs. Insurify

Insurify is a quote-comparison website that provides users with real insurance quotes from top insurers, including household names like Progressive, Liberty Mutual, and Travelers. It’s a licensed agency in all 50 states, the company’s information is readily available, and feedback from its customers is excellent. Insurify is accredited by the BBB and has an A+ rating on the site.[5]

While Otto does allow you to get quotes from its partners, you’ll receive few if any quotes on its website after entering your information. Instead, insurance companies will contact you directly to provide quotes, which could lead to several unwanted or irrelevant phone calls and messages.

Otto vs. Jerry

Jerry is an app that lets you compare auto refinancing loans and insurance quotes from top providers. Similar to Insurify, it’s a licensed insurance agency in all 50 states, and customer reviews are generally positive. Jerry has an A- rating from the BBB. You can download the Jerry app and put in your info to get a quote, and Jerry indicates you won’t receive unwanted phone calls after sharing your information.

With Otto, you may receive unwanted phone calls. Its partners include service providers across several categories, including home repair professionals, solar companies, and more.

Otto vs. QuoteWizard

QuoteWizard is an insurance-comparison site owned by LendingTree, a financial services company. Users can enter their information to get quotes from LendingTree partners, though several customers report being flooded with calls after sharing their info with QuoteWizard. While QuoteWizard has an A+ BBB rating, the company’s reviews are poor overall, with the company earning only one out of five stars.

Otto is not rated on the BBB, nor does it have customer reviews offering insight into past users’ experiences. Similar to QuoteWizard, customers complain of unwanted phone calls after using the website.

More about Otto

Information about Otto is scarce online, and available customer reviews are mostly negative. Given this, it likely makes sense to proceed with caution when using this company for auto insurance quotes. Those looking for legitimate car insurance quotes are better off using other comparison websites.

Check Out: 10 Best and Worst Sites to Compare Car Insurance

What states does Otto Insurance cover?

Otto doesn’t specify which states its partners offer coverage in, though it does mention in its terms of service that users who live in the U.S. can get quotes.

Otto Insurance discounts

While discounts can help lower your insurance premiums, Otto doesn’t offer discounts directly. However, its partners may offer discounts. Common options include safe driver, good student, low mileage, and policy bundling discounts.

The pros and cons of Otto Insurance

Pros

Option to receive quotes from many providers

Process to request quotes is quick

Cons

No option to view quotes on the site

Personal information is shared with third parties, which could result in unwanted calls or emails

How to maximize savings

You can reduce the cost of your car insurance in a variety of ways, including:

Improving your credit rating: In a lot of states, insurance companies look at your credit score when determining your monthly premiums. In general, the better your credit, the less your coverage may cost.

Maintaining a clean record: Your driving record also plays a role in your insurance rates. Those with no at-fault accidents or moving violations will likely receive lower-cost coverage options.

Bundling policies: Many insurers offer discounts if you sign up for multiple policies. For instance, if you appreciate your current home insurance provider, you might also opt to get an auto policy from them to take advantage of a bundling discount.

Seeking discounts: In addition to bundling discounts, many insurers offer other discounts, including good student discounts, safe driver discounts, and more.

Comparing providers: Shopping around for insurance can help you find an affordable policy that best meets your needs.

Otto Insurance FAQs

Otto is not accredited by the BBB. While this doesn’t mean Otto isn’t trustworthy, BBB accreditation does serve as proof of a company’s legitimacy. Reviews shared by consumers through the BBB website can also offer insight into a particular business’s offerings and service.

Otto seems to be a legitimate lead-generation company, though information about it is fairly scarce. The company has no About Us page offering insight into its team or history, and its online footprint is fairly small.

As a lead-generation business, Otto likely makes money when it matches consumers with service providers. So for instance, if someone submits a quote request through Otto and purchases coverage through a partner insurer, Otto may receive a commission.

Otto is a lead-generation site, while Insurify is a more traditional quote-comparison tool. When you complete a profile through Insurify, you’ll receive up to 20 real quotes from insurance providers. You also have more control over your data with Insurify and don’t need to worry about receiving spam calls from insurance agents or service providers that don’t align with your needs.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Sources

- Global Agora. "Wholly Owned Subsidiaries." Accessed December 20, 2022

- Otto Insurance. "Carriers." Accessed December 20, 2022

- Better Business Bureau. "Otto Insurance Listing." Accessed December 20, 2022

- Facebook. "Otto Insurance Page." Accessed December 20, 2022

- Better Business Bureau. "Insurify Business Profile." Accessed December 20, 2022