Extended Replacement Cost: What It Is and How It Works

Updated June 4, 2021

Reading time: 4 minutes

Updated June 4, 2021

Reading time: 4 minutes

Homeowners insurance policies use a lot of technical terms, and understanding them can impact your coverage. One of the policy options is extended replacement cost. This can be crucial to protecting you and your family if you ever need to file a home insurance claim.

If a fire, lightning strike, windstorm, or plumbing mishap damages your home or personal property, replacing what was lost can be time-consuming and expensive.

But understanding extended replacement cost and how it works before disaster strikes can make all the difference.

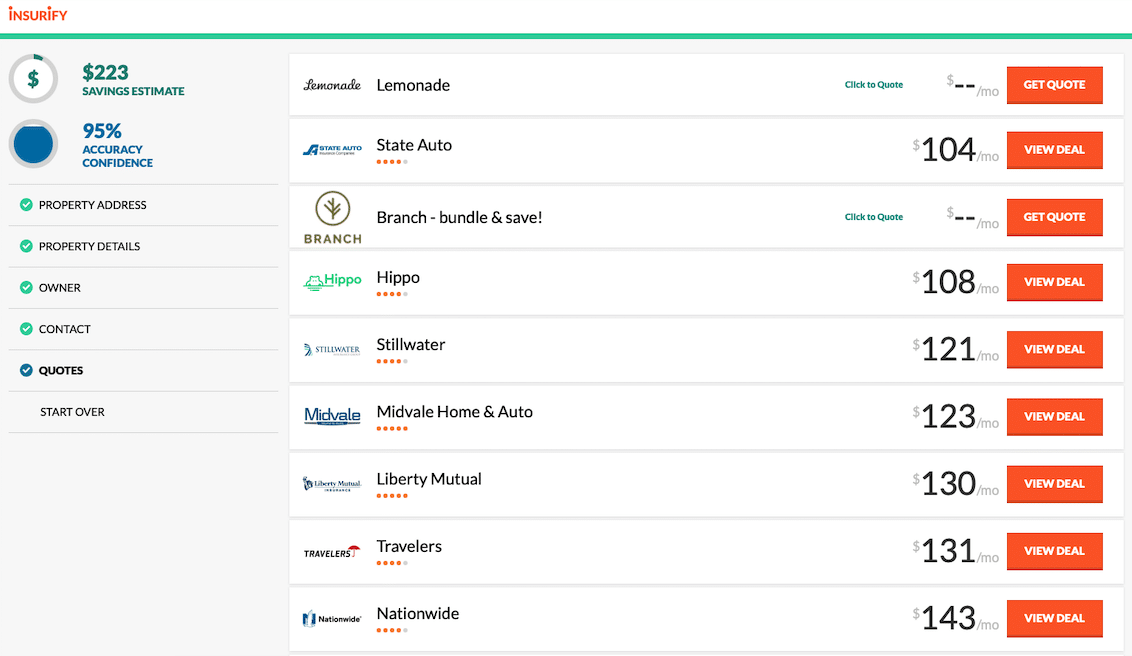

Having the right insurance coverage in place can give you peace of mind. Insurify can help you compare home insurance options and home insurance quotes to protect what matters most.

Extended replacement cost is an endorsement on your standard home insurance policy. It determines how your insurance company will calculate the maximum coverage amount for an insurance claim.

Every homeowners policy has a coverage limit. It caps how much the insurance company will pay to repair or replace your home and property. With extended replacement coverage, they’ll pay a certain percentage over the coverage limit to rebuild your home.

Homeowners insurance policies include dwelling coverage that protects a home’s structure. Dwelling coverage has a policy limit based on the home’s replacement cost.

Keep in mind that the replacement value is based on how much it would cost to rebuild the home. It’s a different amount than what the market or assessed value of your home might be.

Most policies include standard replacement cost. Standard replacement cost pays to replace or restore the home to its condition before it was damaged.

But it may not be enough if building costs go up unexpectedly. For instance, wildfires, earthquakes, and other natural disasters can cause a shortage of building materials and labor, pushing up the price. The additional expense may be more than what your policy limit will cover.

That’s where extended replacement cost comes in. It extends the cap, giving you extra funds to cover the bill. Your policy can cover a certain percentage above the limit. It varies by insurer, but it could increase the amount by 20 percent or more.

That way, if the additional cost is more than you expect, your insurance will cover more of the bill, and you’ll pay less out of your own pocket.

Extended replacement cost covers additional expenses needed to repair or rebuild your home to its condition before the damage occurred. It can cover:

Building materials

Supplies

Appliances

Labor costs

The coverage amount depends on the percentage increase your policy includes. Remember that there’s still a limit. If the cost is more than the extended replacement cost will cover, you’ll be responsible for paying the difference.

The amount of extended coverage you buy depends on the rebuild cost of your home. Remember that replacement cost is different from market value. The rebuilding cost could be more (or less) than what you paid or what it might sell for today.

Construction costs and the kind of house you own impact your home’s replacement cost. Factors can include:

Type of exterior wall construction

Square footage of the home

Number of rooms

Room features, such as a fireplace

Type of roof and roofing materials

Attached garage

Exterior trim

Special features, like arched windows

Insurance agents typically calculate rebuilding costs when you purchase a policy. You could also hire an appraiser to do it.

Most homeowners should consider extended dwelling coverage. The probability of your house being completely destroyed might be low, even if you live in an area prone to natural disasters. But weather catastrophes and rising building costs are out of your control.

Without extended replacement cost, you may not have enough money available to rebuild your house.

Ask your insurance agent about adding the endorsement to your homeowners policy. It could save you from being financially devastated if your home is destroyed.

Extended replacement cost is one type of coverage available with homeowners policies. It offers more coverage than actual cash value. But guaranteed replacement cost gives you the most coverage.

An extended replacement cost policy is based on the cost to rebuild your home. It provides a percentage above your policy limit to cover increased expenses.

Actual cash value (ACV) considers depreciation. To calculate how much your ACV coverage would be, consider the cost to rebuild your home and subtract depreciation for factors like the home’s age, condition, and obsolescence.

Guaranteed replacement cost provides coverage beyond what you get with extended replacement cost.

With guaranteed replacement, your policy will pay any amount to rebuild your home. It would restore your home to the condition it was in before the damage, even if it costs more than the policy limit.

Read More: Replacement Cost vs. Market Value

Insurance agents typically calculate replacement costs for you when you purchase a policy. An appraiser could do it, too. To get a ballpark estimate, multiply the square footage of your home by the average building cost per square foot. A local real estate agent should be able to tell you what the building cost per square foot is in your area. For example, the National Association of Home Builders estimates the average construction cost for a typical home in the U.S. is $114 per square foot. If your home is 2,200 square feet, your replacement cost would be about $250,800.

Extended dwelling coverage is another name for extended replacement cost. It can compensate you for a total loss if the cost is more than your policy’s dwelling coverage limit. The coverage can add 20 percent or more to your coverage limit.

Yes. Renters insurance policies generally let you choose between actual cash value and replacement cost coverage. A renters policy that includes extended replacement cost can help you pay to replace your items at today’s prices.

Generally, extended replacement cost is a better choice for homeowners. An actual cash value policy may not have enough coverage to rebuild your home or replace your belongings, because it takes depreciation into account. Extended replacement cost doesn’t factor in depreciation. It also increases your coverage amount by an additional percentage.

Nearly every homeowner should consider adding extended replacement cost to their policy. The increased policy limit can help cover the added expenses to rebuild your home.

After a covered loss, the stress of losing your home can be substantial. You shouldn’t have to worry about whether you can afford to rebuild. The extended replacement cost endorsement can provide additional coverage over and above your policy limit to better match today’s prices.

Amy is a personal finance and technology writer. With a background in the legal field and a bachelor's degree from Ferris State University, she has a talent for transforming complex topics into content that’s easy to understand. Connect with Amy on LinkedIn.

Learn More