4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Companies for SR-22 Insurance in Wisconsin (2022)

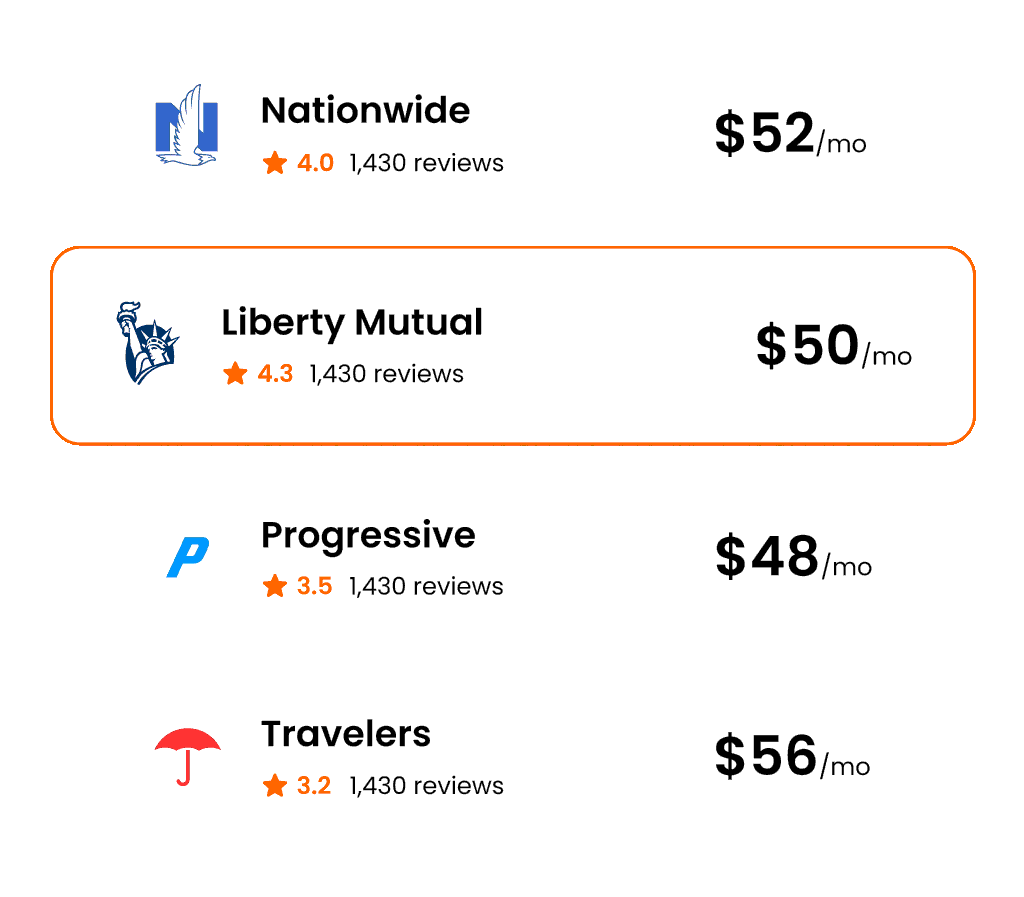

For drivers with SR-22 in Wisconsin, it’s important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate after an SR-22.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Wisconsin. The following are the best insurance rates from carriers that offer car insurance for drivers with an SR-22 in Wisconsin.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| The General | $104 |

| Travelers | $120 |

| Bristol West | $133 |

| Safeco | $138 |

| First Chicago | $146 |

| Kemper | $146 |

| Foremost Signature | $158 |

| Dairyland | $163 |

Table of contents

- How Much Does SR-22 Insurance Cost in Wisconsin?

- What Is an SR-22, and Who Needs One in Wisconsin?

- How Much Does Credit Score Affect SR-22 Insurance Costs in Wisconsin?

- How to Find the Best SR-22 Insurance Rate in Wisconsin

- Non-Owner SR-22 Insurance in Wisconsin

- Alternatives to an SR-22 in Wisconsin

- Frequently Asked Questions

- Compare Top Auto Insurance Companies

How Much Does SR-22 Insurance Cost in Wisconsin?

The filing fee for an SR-22 is in the range of $15 to $35. But the real cost comes in the form of higher car insurance rates. After you've gotten hit with a reckless driving violation or a DUI, car insurance companies will believe you're more likely to file a claim in the future and charge you more as a result.

Luckily, Wisconsin is a very affordable state to drive in: drivers with no violations on their record pay $143 per month on average, which is one of the lowest averages in the country. Drivers with an SR-22 pay an average of $154, which means in Wisconsin an SR-22 costs only $11 per month more than if you had no violation, an increase of eight percent.

Of course, these are averages, and rates can vary dramatically, so be sure to use a quote-comparison tool like Insurify to find the best rate.

Insurify's comparison tool will help you make sure you're getting the best possible quote even after an SR-22. You can have peace of mind that you're reviewing all of your available insurance options and can confidently choose the one that is best for your situation.

What Is an SR-22, and Who Needs One in Wisconsin?

A serious driving offense—such as a DUI, a reckless driving violation, or an uninsured car crash—can lead to your license being taken away. After this happens, your state government will only reinstate your license after you receive an SR-22 form. Filed by your insurance company (and not you), the SR-22 lets the state know that you have at least bought minimum car insurance coverage and are paying your monthly premiums.

Not all car insurance companies in Wisconsin are willing to file SR-22 forms for drivers. And those that do might charge you a high rate, given your not-so-great driving history. That's why you'll need to do your research to find an insurance company willing to file this important form for you—then compare quotes to find a rate that meets your budget.

Compare Car Insurance Quotes Instantly

How Much Does Credit Score Affect SR-22 Insurance Costs in Wisconsin?

In Wisconsin, car insurance companies are allowed to factor in your credit score when determining your rates. As a result, having excellent credit when shopping for SR-22 coverage will likely lead to lower car insurance rates on average. In the case of Wisconsin, drivers with good or excellent credit only see their rates go up $16 and $26, respectively, compared to drivers without an SR-22. Meanwhile, drivers with poor or average credit pay $34 and $32 more, respectively.

| Credit Tier | Avg. Monthly Rate - No Violation The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Avg. Monthly Rate - SR-22 The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Difference |

|---|---|---|---|

| Excellent | $118 | $144 | $26 |

| Good | $132 | $148 | $16 |

| Average | $133 | $164 | $32 |

| Poor | $144 | $178 | $34 |

How to Find the Best SR-22 Insurance Rate in Wisconsin

As a Wisconsin driver who has filed an SR-22 form, you're probably concerned about your ability to find affordable car insurance. Don't worry—a free, easy-to-use quote-comparison tool like Insurify can take the work out of finding cheap car insurance. Simply input your driver information, and Insurify will deliver 10+ free car insurance quotes so that you can quickly compare and decide on the policy that works for you.

Non-Owner SR-22 Insurance in Wisconsin

Say you don't own a car but still want to drive legally as a person who lost their license. You'll still need an SR-22 form to get back on the road, though you can get non-owner SR-22 insurance if you don't own a car. This policy will be much cheaper than regular SR-22 insurance because your insurer knows you won't be driving regularly.

Alternatives to an SR-22 in Wisconsin

While some states offer different sorts of forms, Wisconsin offers only an SR-22 if you're trying to get back on the road. This form is so important because it proves you have the financial means to cover potential damages on the road. If you don't want to file this form, you'll likely have to wait three to five years to get your license back.

How Do I Get SR-22 Insurance in Wisconsin

If you don't know where to begin when it comes to an SR-22, Insurify is about to become your best friend. Insurify will let you know which car insurance companies actually sponsor SR-22 drivers. Then, you'll be able to generate quotes from each of these companies and put them side by side. After that, you're just minutes away from finding great car insurance that fits your budget.

Frequently Asked Questions

In Wisconsin, first-time offenders are required to have an SR-22 for three years, regardless of offense. Then, second-time offenders must deal with a five-year sentence. After that, each subsequent offense doubles the length.

Most of the time, moving won't affect the status of your SR-22—even if you move to a state that doesn't require one. Even so, you'll want to square things away with your insurance company to make sure your policy doesn't lapse in your new state.

If you aren't a car owner but still plan on driving in Wisconsin, you'll want a non-owner SR-22 insurance policy. Keep in mind, you possibly won't qualify for this policy if you live with the person whose car you'll be borrowing.

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.