What Is Condo Insurance? Guide to What Is Typically Covered

Updated June 7, 2021

Reading time: 3 minutes

Updated June 7, 2021

Reading time: 3 minutes

Condo insurance is also known as HO-6 insurance and is designed to provide protection to condo units against covered perils, such as theft, fire, and vandalism, as well as liability coverage and additional living expenses coverage.

Condo living is a great option if you want luxury living without the expense of purchasing a home. Your maintenance and upkeep are taken care of for you. All you have to do is move in and enjoy! Still, you can’t truly enjoy worry-free living unless you know your condo unit and belongings are properly protected. One way to do this is by purchasing a condo insurance policy.

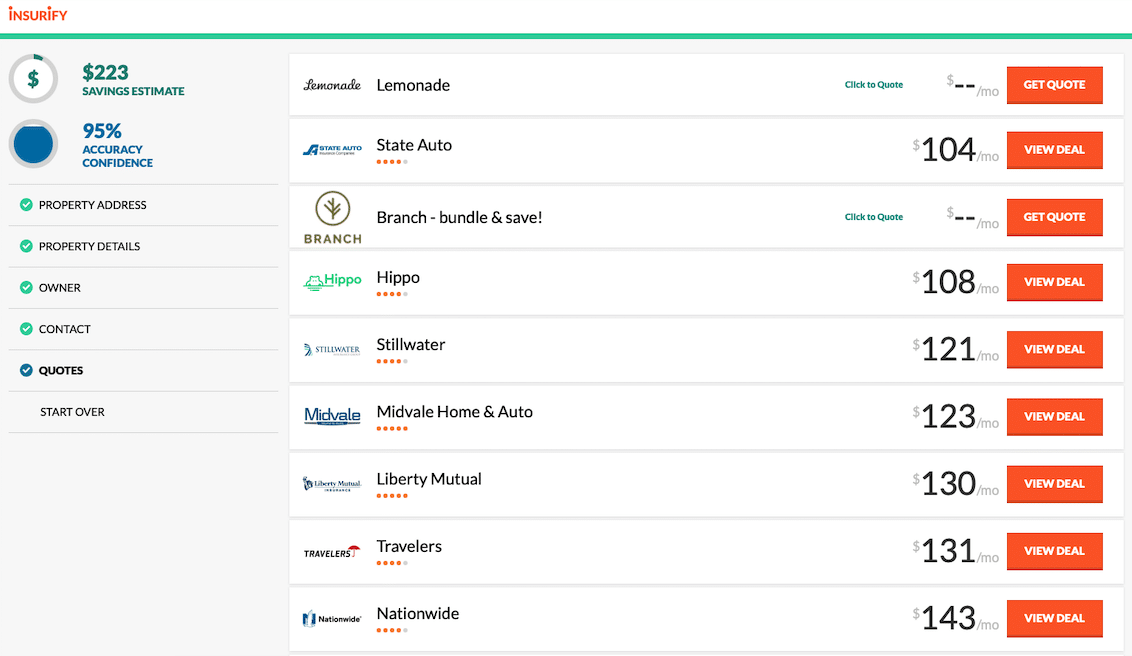

Insurify is here to help you find affordable and comprehensive condo coverage through a top-rated condo insurance company. It only takes a few minutes to compare costs and coverage options.

Repair costs for a condo unit can be very expensive. You never know when an unexpected event like a fire could occur and destroy your belongings and even your condo. With the costs of construction materials especially high in areas like New York, the replacement cost could be staggering. Even though the condo association carries insurance that covers the condo building, condo-owned properties, and liability, the condo association’s master policy doesn’t provide any protection for the inside of your unit or your contents. You are responsible for damage inside your individual unit.

Just as renters insurance is designed specifically for renters, condo owners insurance is designed specifically for people who own condos. It differs from a standard homeowners policy in that it only covers the inside of your condo unit and your personal property located inside or outside of the unit. Homeowners insurance not only provides coverage for inside the home and covers personal property, but it also provides coverage for the entire property. The condo association ’s coverage will not cover damage to the inside of your condo unit, so you need to purchase your own condo insurance coverage. Buying a separate condo insurance policy will protect your individual unit and contents against damage from covered perils.

Your HO-6 condo insurance policy provides coverage for the following categories:

Dwelling coverage for interior walls, floors, and ceiling (for the inside of your unit only) against damage caused by common perils like wind, hail, theft, fire, and lightning

Personal property coverage for all perils except those specifically excluded, with policy coverage limits for your contents and personal belongings both inside and outside of your condo

Loss of use coverage ( additional living expenses ), depending on the policy provisions, to pay for your cost of living like hotel bills and food while your unit is being repaired

Additional coverage for other items the same as you would find in a standard homeowners insurance policy, including debris removal or loss assessment coverage, which could help pay for your portion of the deductible if the condo association assesses the deductible out to its members after a loss has occurred

Liability insurance coverage for medical expenses for bodily injury and legal costs to guest injured or damage to someone else’s personal property inside your condo unit for which you are legally responsible

Guest medical payments can help pay medical bills for guests who are injured while inside your condo unit even if you are not at fault

The common areas owned by the condo association, including the condo building, roof, hallways, stairwells, and elevators, are covered by the condo association’s master policy.

Typically, the cost of the master insurance policy is shared by all the condo unit owners through homeowners association ( HOA ) fees. There are three basic types of condo master insurance:

Bare walls coverage is protection against property damage for the structure, fixtures, and furnishing of common areas and any commonly owned property of the condo association.

Single entity coverage adds to bare walls coverage by providing coverage for built-in structures inside individual condo units.

All-in coverage is the most comprehensive form of coverage and applies coverage to all collectively owned properties of the condo association. This coverage pays for any and all additions or condo improvements.

The coverage amount for your personal belongings in the condo insurance policy will have a limit for certain valuable items, such as jewelry, fine art, and coin collections. If you feel that the coverage provided by your condo insurance policy is inadequate and that you may have trouble replacing expensive personal items after a covered loss, you can add a policy endorsement to schedule expensive personal items on your condo insurance policy. Check with your insurance agent for more details on how scheduling personal property will affect your condo insurance premium.

You have a certain amount of personal liability protection that comes with a standard condo insurance policy, but is it enough? Whether you need to purchase umbrella insurance is up to you, but it can help pay for things like medical expenses and legal costs if someone gets hurt at your condo and the expenses add up to more than your personal liability coverage limits. With the costs of legal fees and medical expenses increasing every year, it never hurts to have extra personal liability protection.

Neither a condominium insurance policy nor a home insurance policy covers water damage caused by a flood. If your condo is located in an at-risk region for flooding, you may want to purchase a flood insurance policy to protect your home and belongings from flood damage. Flood insurance is administered through the National Flood Insurance Program (NFIP). You can purchase a flood policy from an NFIP-approved insurance agent.

Moving into your own condo can provide worry-free living, but you want to make sure your condo and belongings are secure by purchasing your own HO-6 policy.

It’s easy to get a quote and even get proof of insurance online. Before you buy a policy, it’s a good idea to compare several condo insurance quotes side by side to make sure you are getting the best coverage at the most affordable price. Compare on Insurify today.

Insurance Writer

Janet Hunt received her B.S. in Business Administration with the University of Phoenix. She has worked in the insurance industry for over 20 years. Janet likes to spend her spare time coming up with gourmet recipes and trying them out on her guests. So far, all have survived.

Learn More