Variable Life Insurance | Should You Buy It?

Updated April 14, 2021

Reading time: 6 minutes

Updated April 14, 2021

Reading time: 6 minutes

Life insurance policies come in many different shapes and sizes, and variable life insurance policies have their own respective traits.

Variable life insurance serves as a permanent life insurance policy and a securities instrument. Financial professionals who offer variable life insurance products must be broker-dealers because of this securities aspect.

Variable life insurance offers a death benefit and cash value; the cash value is dependent on the performance of investment accounts. The insurance premiums are also fixed, meaning the price of the policy remains the same throughout the life of the policy.

If you have investment objectives in a savings option and would like a guaranteed death benefit, then a variable life insurance policy is a good match for you.

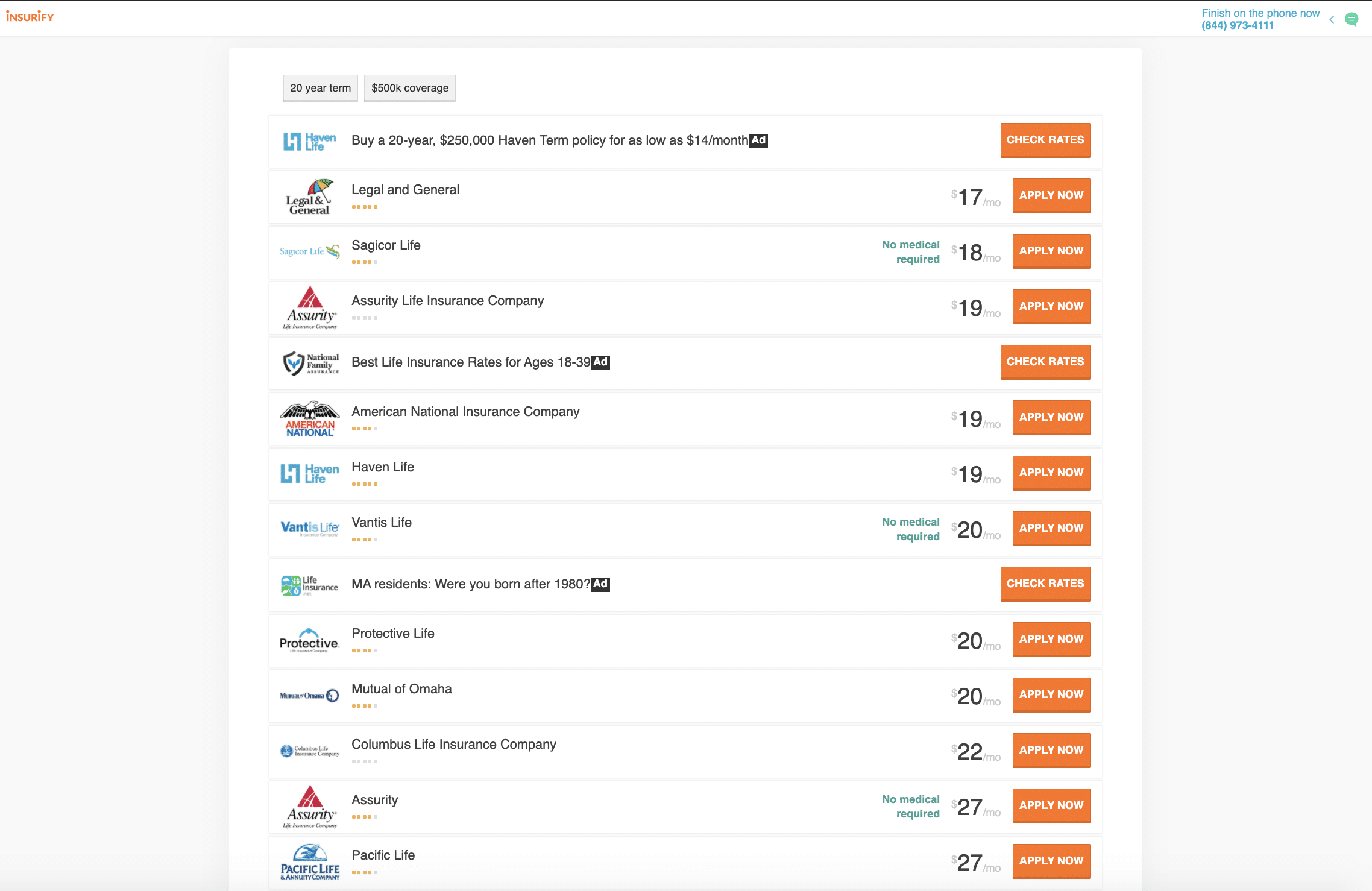

Using Insurify to help determine which policy premium is the best fit for you and your budget is a snap. Just input your information, and in minutes Insurify will deliver a list of quotes from choice life insurance companies.

Variable life insurance policies are a form of permanent whole life insurance that pay out a face-amount death benefit, as with most traditional permanent life insurance.

But unlike a traditional whole life policy, a variable life insurance policy’s cash value is not guaranteed. Traditional whole life insurance policies have a guaranteed minimum interest rate of cash value, whereas the insurer assumes all the investment risk of the premiums placed in their general accounts. With variable life insurance, you as the policyholder own the sub-accounts, rather than the insurer; therefore, the insurer cannot guarantee cash value.

Variable life insurance policy premium payments are placed into separate investment sub-accounts similar to mutual funds. You can choose which investment options are good for you since you retain ownership. The cash value of the policy fluctuates with the investment performance of your sub-accounts due to market conditions. The only thing variable life insurance cash value has in common with a traditional permanent life insurance policy’s cash value is that the cash value growth is tax-free.

The benefit of a variable life insurance policy’s cash value is that on a good market day, you could have a high return, which you could then withdraw and use as you please. With traditional whole life policies, you will receive a minimum rate of increase to your cash value, which could take a long time to accumulate before it would be practical to withdraw. On the other side of the coin, you could lose the entire cash value of a variable life insurance policy when market performance is poor.

An annuity is a contract between you and an insurer that grows and issues a sum of money. Annuities have aspects of both investment products and life insurance products. As an insurance product, annuities provide life insurance coverage in the form of a guaranteed death benefit and the ability to withdraw cash value and distribute income.

Annuities provide a stream of income when the contract is annuitized. When the contract goes through this annuitization process, withdrawals can no longer be made, and the premiums paid plus cash value are converted into income payments to the policyholder, also known as the annuitant. Annuities are divided into two periods: the accumulation period and the payout period. The accumulation period is the time when premiums are paid and cash value grows on a tax-deferred basis, and the payout period is when the distribution of funds begins.

Annuities are also identified by their underlying investment options, such as fixed annuities and variable annuities:

Fixed annuities behave similarly to whole life insurance policies. The insurance company guarantees a rate of interest at which cash value grows in a general account and the annuity principal. The annuity principal is the premiums paid and invested to grow cash value.

Fixed annuity contracts pay out a death benefit if you pass away during the contract’s accumulation period. The death benefit is the accumulated value of the contract at the time of death. The formula to determine the death benefit of a fixed annuity is total premiums paid plus interest minus withdrawals and charges. If annuitized, fixed annuities are paid out in fixed periodic payments, like income.

Variable annuities do not guarantee an annuity principal or a growth in cash value. Like variable life insurance, variable annuity premiums are invested into a separate account where the activity of the cash value relies on the performance of the account’s related stock, bond, and money market sub-accounts. Variable annuities can offer between 20 and 30 sub-accounts, which you as the annuitant can choose to designate and even re-designate your premiums into.

If you purchase a variable annuity contract, you fully assume all risk of the sub-accounts. There is potential for a higher return than with a fixed annuity, but there is no guarantee. The value of the account could also decrease.

When you decide to start the annuitization process of a variable annuity contract, you are usually offered a choice between a fixed settlement option and a variable settlement option. Fixed settlements are level payments, and variable settlement payments depend on the contract’s sub-accounts. A variable annuity ‘s death benefit pays similarly to a fixed annuity. If you pass away before the annuitization of the contract, your beneficiaries will receive the value of the contract as a death benefit.

Fixed annuities and variable annuities both offer a stream of income over a period of time or for life. They also provide a death benefit to your beneficiaries should you pass away before the annuitization of the contract. The difference between the two policies comes into play in the manner of cash value accumulation. Fixed annuities, as the name suggests, have a guaranteed minimum rate of interest, and variable annuities ‘ cash value is dependent on the market performance of the sub-accounts.

Variable universal life insurance ( VUL ) integrates features of a universal life insurance policy and a variable life insurance policy (VLI).

A universal life insurance policy is a type of permanent life insurance where the cost of insurance and the death benefit can be increased or decreased. A universal life policy uses cash value to cover the costs of the policy. This is great to secure yourself from policy termination. However, the cash value must be funded enough to cover the cost of the policy, or it may lapse.

Variable universal life insurance, like variable life insurance, utilizes separate investment accounts whose cash value accumulation is dependent on market performance. It is also a life insurance and securities product. To sell VUL, life insurance agents must be a member of FINRA, as well as a state-licensed insurance producer.

Corresponding with universal life insurance, VUL policies have flexible premiums. Furthermore, as long as the cash value of the policy covers the cost of insurance, the policy stays in force; if not, the policy lapses. With VUL insurance, cash value can be attained through withdrawals, policy loans, or surrender. Surrender charges may apply in the policy’s initial years.

VLI and VUL mimic each other but not entirely. VLI policies have fixed premiums, and VUL policies have flexible premiums. A VLI policy has a guaranteed death benefit regardless of the investment account’s performance, whereas a VUL policy’s death benefit is not guaranteed. With VLI, you can receive cash value through loans or surrenders but not withdrawals. VUL allows withdrawals, loans, and surrenders.

Variable life insurance policies come with their fair share of good and not-so-good characteristics.

Like most permanent whole life policies, variable life insurance is more costly than a term life insurance policy. To help you determine whether or not a variable life insurance policy is a good fit for you, let’s examine the pros and cons of a VLI policy in the chart below.

| Pros | Cons |

|---|---|

| Level premiums for the life of the policy | Higher cost of premiums |

| Chance of high returns | Policyholder assumes investment risks |

| Guaranteed death benefit | Cash value is not guaranteed |

Use Insurify to ensure you have all the information you need to purchase the right insurance policy with the right insurance company. Easily fill out the required information on the site, and Insurify will generate a list of insurance company policies and their premiums so you can evaluate your best options.

Not all insurance policies are created equal; with Insurify, you can assess the different shapes and sizes of life insurance policies and their premiums to get the right model for you.

Insurance Writer

Aissa Martell is a licensed insurance producer in the State of New York. She is a creative writer and has been freelance writing for five years. She’s happy to share her knowledge of the insurance industry and its products.

Learn More