The 5 Best and Worst Sites to Compare Renters Insurance

Updated June 1, 2021

Reading time: 8 minutes

Updated June 1, 2021

Reading time: 8 minutes

If you own valuables, but not the home they're in, renters insurance may be just the protection you need. Even if you don't own property, renters insurance will protect your personal property inside.

The COVID crisis has infected every part of the economy, and many families have more month than money come rent time. When every dollar counts, it’s even more important to protect your wallet while insuring your possessions with a renters policy.

But before you compare quotes, just what does renters insurance cover?

Personal Property. Pays to replace your personal belongings, such as clothing, electronics, or furniture, if they’re damaged or lost in a fire, break-in, act of vandalism, or other covered loss.

Liability. Takes care of lawsuits, judgments, and settlements up to the policy limits if you are found negligible for someone else’s bodily injury or property damage.

Medical Payments. Provides for your guests’ medical bills after an injury, regardless of fault, to avoid a larger legal issue.

Additional Living Expenses. Grants reimbursement from added costs, such as hotel bills, due to a covered loss that makes your home unlivable.

Other Coverages. Add protection for valuable items, identity theft, or home-based business equipment.

And while you’re saving, renters and auto insurance go together like a wink and a smile, and that’s precisely what you’ll do when you get cheap car insurance from Insurify.

Insurance comparison websites come in two types: quote-comparison sites and lead-generation sites. Renters quote-comparison websites give users rates based on the information they submit during the shopping process. Then, they can pick which quote makes the most sense, and the comparison site transfers the data to an agent or company website, speeding up the overall buying experience. These sites are preferable because they’re on the side of the customer; they don’t sell your info to agencies or insurance companies.

On the other hand, lead-generation sites make their moola selling user data to their advertisers, mainly insurance companies. Often, these sites don’t personalize quotes and offer little help when you’re searching for the best rates. Lead-generation sites sometimes help people, but along the way, you might get an avalanche of cold calls from insurance companies and agents hungry for a commission.

Insurance comparison websites break down further into ones that supply real-time insurance quotes and those that provide estimated ones. Sites that offer estimated quotes rely on historical data, which can give results like month-old milk. The estimates are often out of date and don’t pass the smell test. And if you chance it, you could end up with a sour taste in your mouth.

If you don’t want to have a cow, get the most accurate information for how much renters insurance costs from a real-time quote site. After you check on a renters policy, hop over to Insurify to get a real-time quote for car insurance.

We used a two-bedroom, one-bath apartment in Queens, NYC, for test data. We evaluated each site with a proprietary process that weighed credibility, speed, helpfulness, and results. We’ve ranked renters insurance comparison sites from best to worst and placed a summary table at the end.

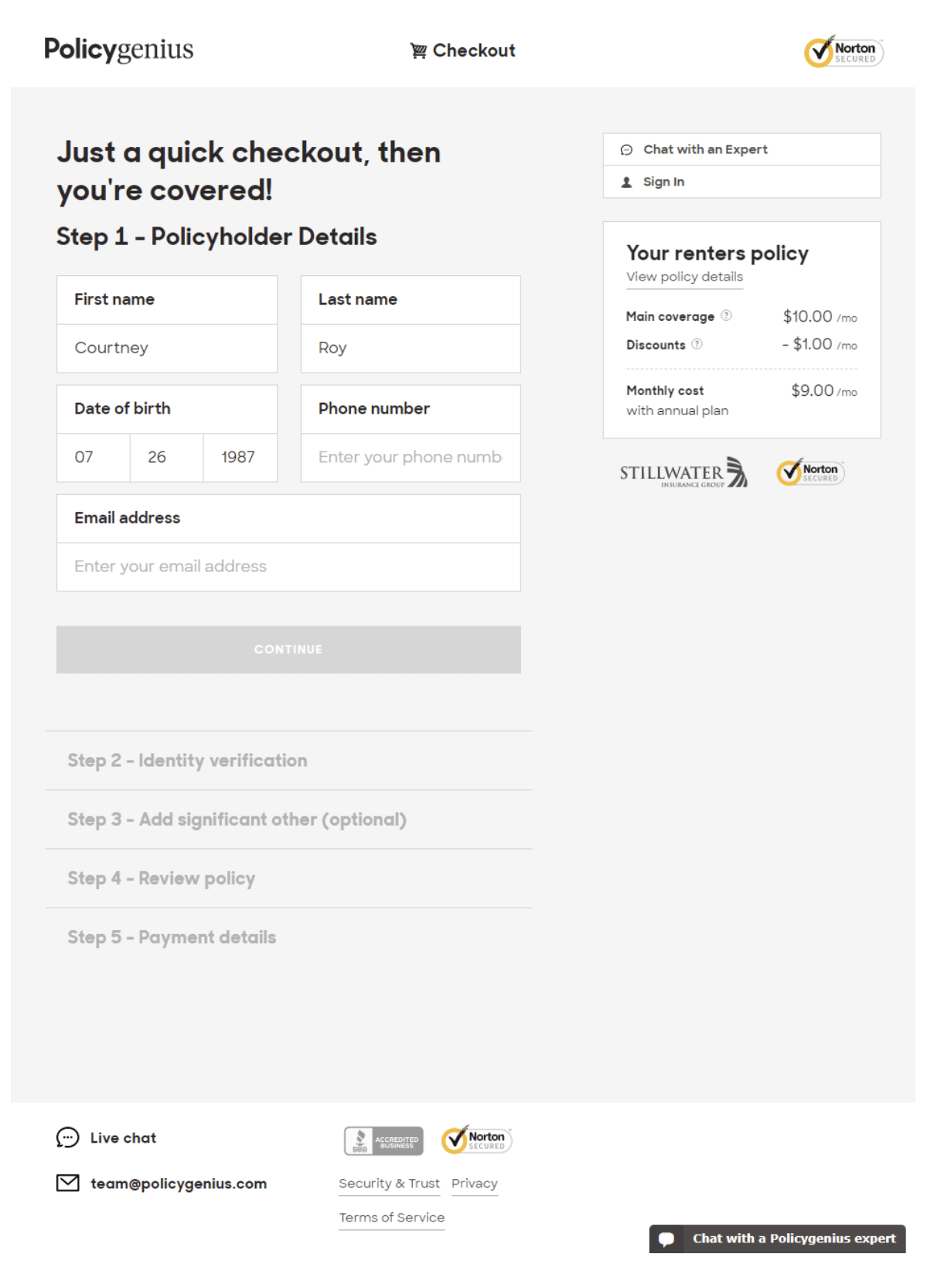

PolicyGenius wants its site visitors to have real-time quotes from multiple insurers. The company doesn’t stop at renters insurance and sells auto, disability, health, homeowners, life, pet, and more. PolicyGenius lets you buy online or through its app on both Apple and Android.

How it works: Once you get to the home screen, click on the “renters” icon. From there, you navigate four different tabs of information starting from “home,” where you’ll input your personal details and address. After that, it goes over “your stuff,” PolicyGenius recommended $25,000 in coverage, but you can adjust.

From there, under the “protection” tab, you pick your deductible, personal liabilities, medical payments to others, and loss of use. Answer a few quick questions about safety for added discounts and then add-on protections if you want identity theft, water backup/ water damage, or earthquake coverage. Finally, you reach the checkout, which allows you to enter credit card or bank info and buy the policy.

Speed: 5 minutes

Results: On the very last tab, I was offered a quote from Stillwater for $9 a month. I breezed through the process but only received one quote.

Overall Score: 9.4/10

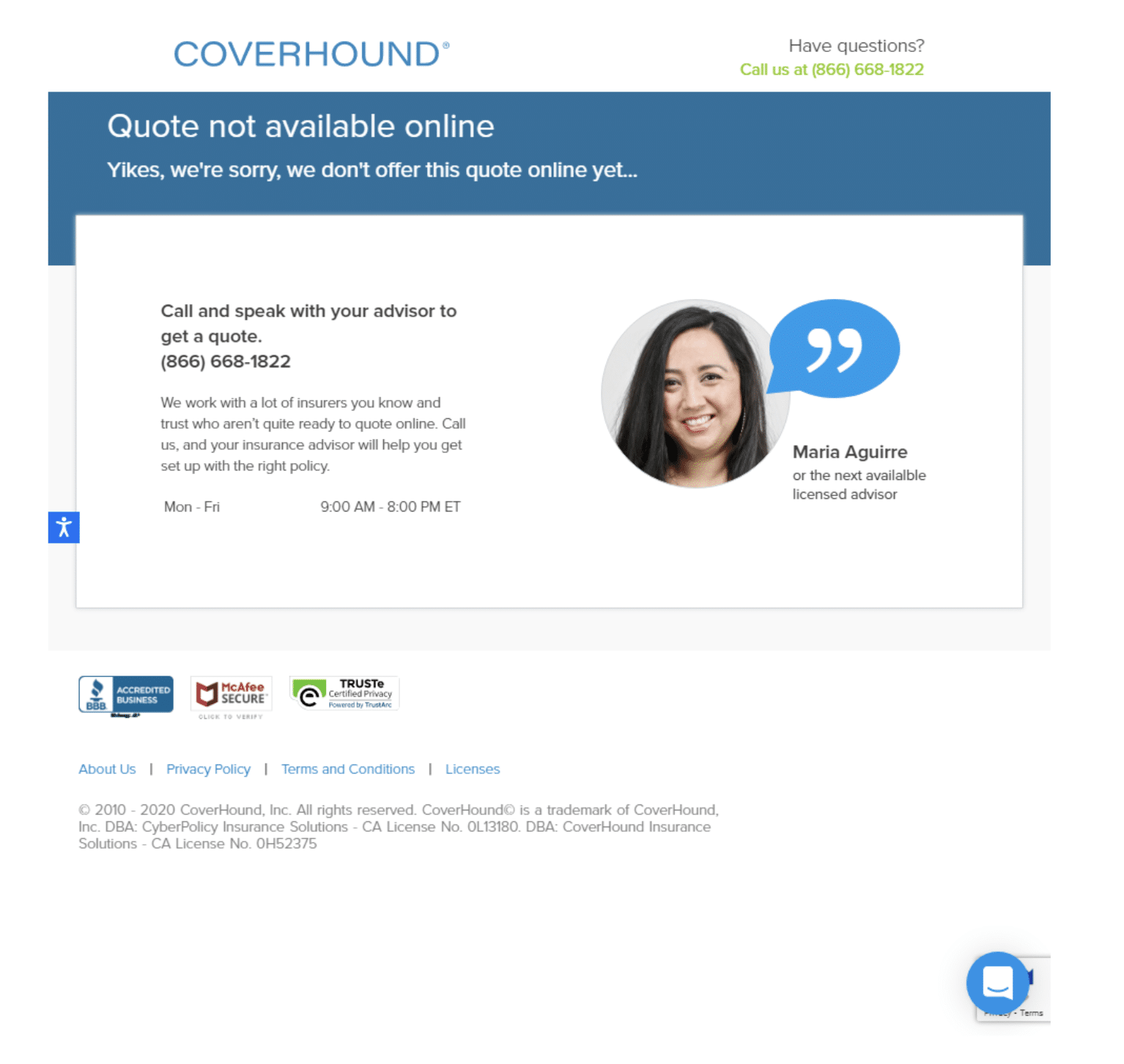

CoverHound offers a free online comparison tool that calculates quotes for both personal and business insurance. Its Learning Center answers insurance-related questions with articles that help sell its policies. The company prides itself on compensating its advisors based on service rather than commission, which hopefully translates into better recommendations for policyholders.

How it works: It’s just seven pages to go from the homepage to the quote screen. At the bottom, you see BBB, McAfee Secure, and TRUSTe certificates. And when you provide your personal details right before the quote, there’s an obvious pre-fill authorization that says it will read your insurance history and credit history.

Speed: 2 minutes

Results: It took about 15 seconds of processing, and the quote tool came back with no results. They didn’t try to trick me into a quote or send me to an insurance company ‘s homepage. Instead, they gave me a friendly face for a licensed insurance advisor and a phone number I could call along with hours of operation.

Overall Score: 7.4/10

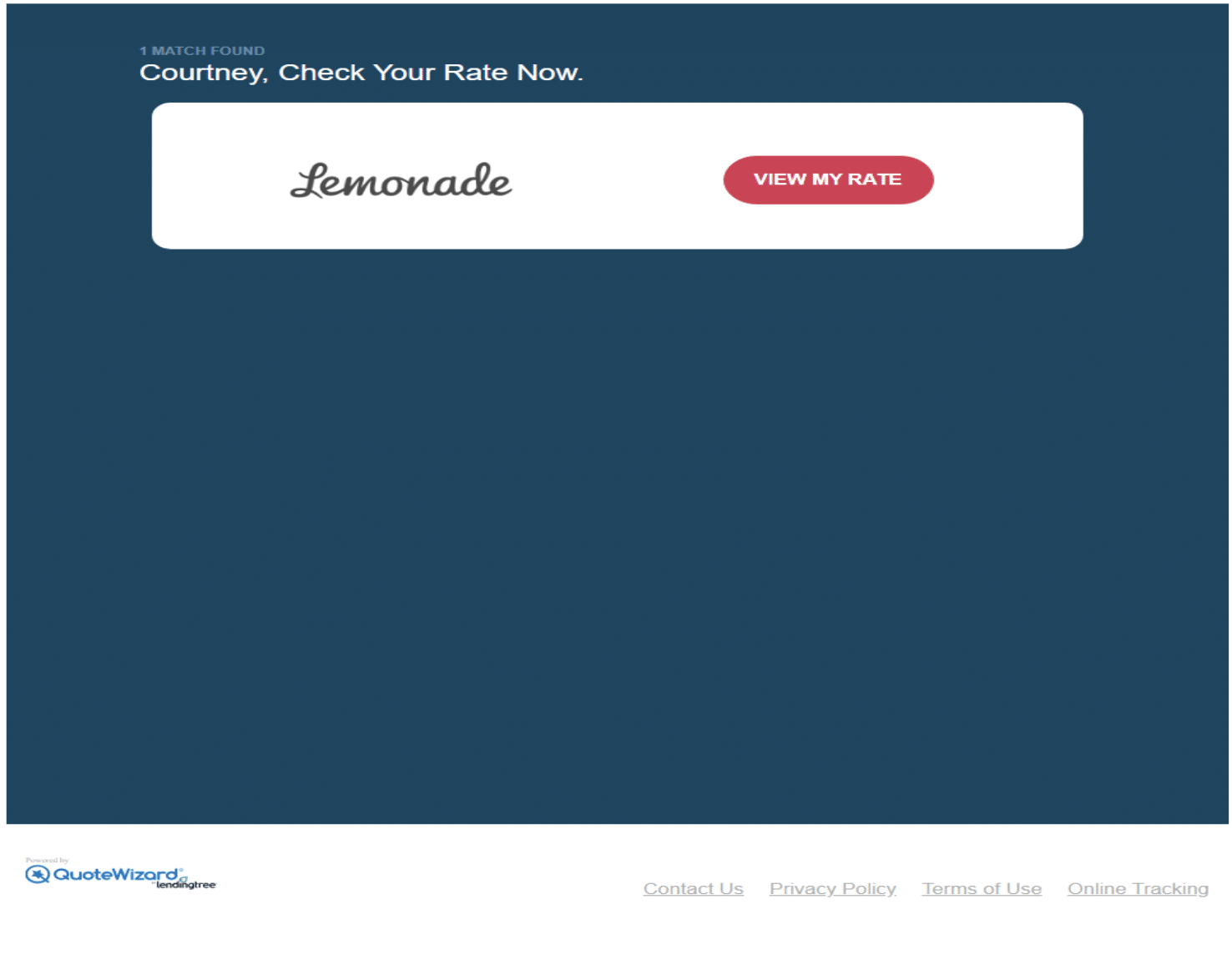

QuoteWizard sells leads to insurance agents with a business model like its parent company, Lending Tree, which helps people with mortgages. The lead-generation site supplies blog articles to answer insurance questions and review top-tier companies such as State Farm, USAA, and American Family Insurance. Besides renters, the company also offers auto, health, life, and home insurance.

How It Works: From the homepage or the renters insurance page, you can quickly get a quote by starting with your ZIP code. From there, it’s 12 fast screens to get all your personal information and selections for renters insurance coverage.

Speed: 2 minutes

Results: You click the “Get My Renter Quotes.” On that page, the fine print says you agree to “telemarketing calls, text messages, emails, and postal mail.” The only result redirected to an insurance company ‘s site where I’d have to reenter the info all over again.

Overall Score: 7.3/10

SmartFinancial’s homepage has a cute pink pig who swears to compare quotes in minutes. Auto, commercial health, home, Medicare, and life insurance are listed as free quote options. Scroll down, and you’ll find recent insurance guides and articles designed to help you make the right decision.

How it works: You zip through a snappy user interface to input your basic personal information and the rental home address. But it asked no questions about renters insurance other than the amount of personal property you want to protect.

Speed: 2 minutes

Results: I get two options. One is a quote from AIG that says coverage is as low as $14 a month. I click that, and it leads to a life insurance quote. Bait-and-switch is not cool. I asked for renters, not life insurance. The other choice is talking to an agent by clicking “call me.”

Overall Score: 7.0/10

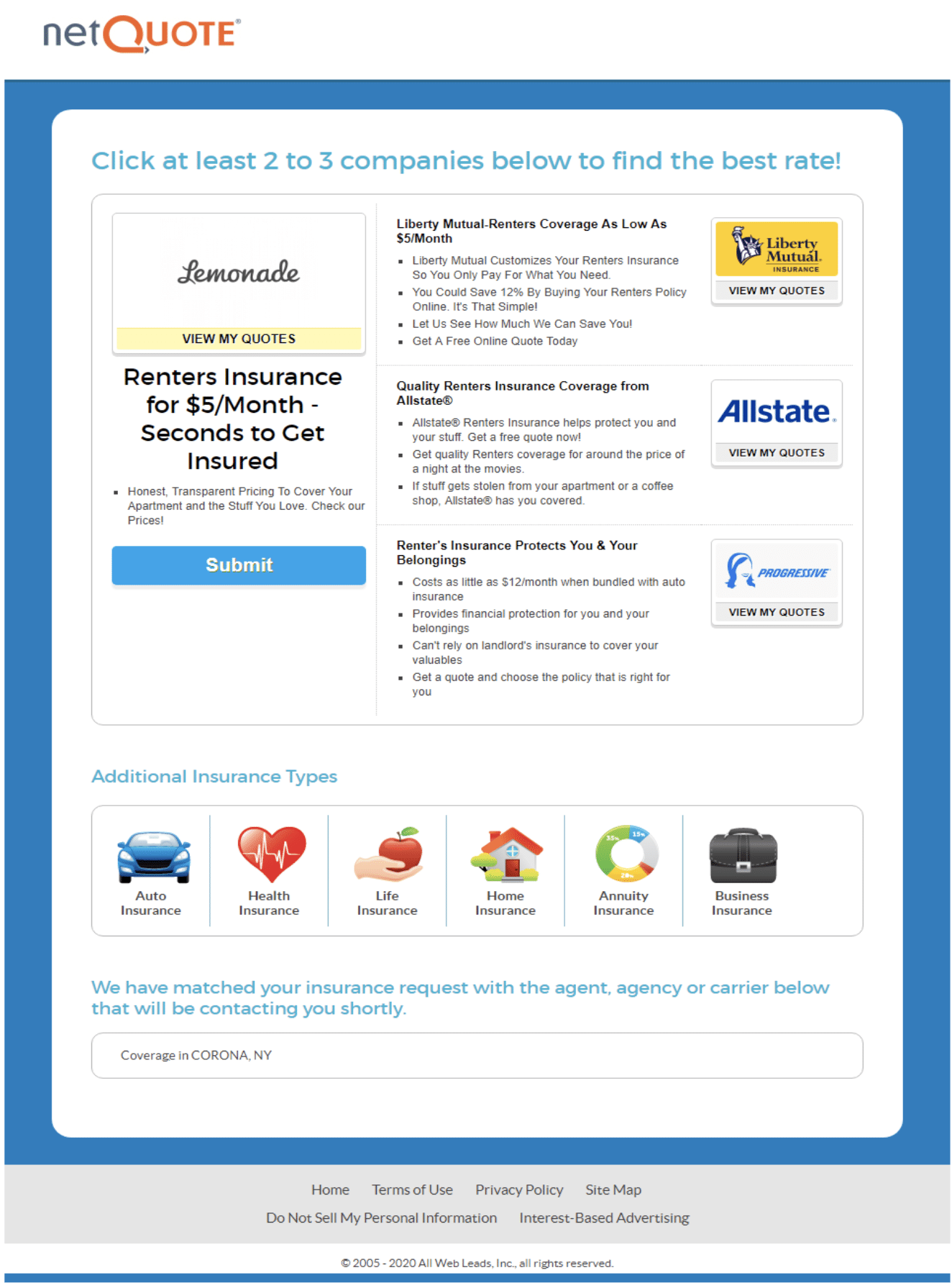

NetQuote gives consumers nationwide a free online insurance comparison tool, and in exchange for their queries, they become leads for insurance agents. The company also quotes auto, business, health, homeowners, and life insurance. The company has been around since 1989 and claims to be the most visited insurance shopping site on the web.

How it works: From the homepage, I clicked renters insurance. From there, I was prompted to enter my ZIP code and my personal details, including name and address. After that, at the bottom, there is a huge chunk of small print. Reading it, I find out they would sell my information to up to eight different companies.

Speed: 2 minutes

Results: I was told to “click 2 to 3 companies to find the best rate.” I got Lemonade, Liberty Mutual, Allstate, and Progressive links. Clicking the links restarts the process at the respective sites. I could get the same results by skipping NetQuote altogether.

Overall Score: 6.8/10

| Company | Legitimacy | Speed | Helpful Information | Results | Overall |

|---|---|---|---|---|---|

| PolicyGenius | 9 | 10 | 10 | 8.5 | 9.4 |

| CoverHound | 8 | 10 | 9 | 2.5 | 7.4 |

| Quote Wizard | 7 | 10 | 9 | 3 | 7.3 |

| SmartFinancial | 7 | 10 | 9 | 2 | 7.0 |

| NetQuote | 6.5 | 10 | 8 | 2.5 | 6.8 |

For many renters, the pros outweigh the cons, but look at these pointers to help you decide:

Freedom. Access more rental properties because many landlords put renters insurance in the lease agreement.

Net worth. Protect your savings, rainy day fund, and any other assets if you’re in a nasty bodily injury or property damage lawsuit.

Peace of Mind. Rest assured, and don’t worry about break-ins, fires, or negligent neighbors.

Possessions. Cover your personal belongings, get new replacements, and save thousands after a loss.

Time. Spend 15 minutes or less with most insurance carriers to get the protection you deserve at a price you can afford, and you don’t even need to buy from the green gecko.

Value. Shell out less than you pay for your monthly Netflix subscription for insurance that protects your family, finances, and favorite things with coverage in hand that not even a fire can melt away. According to the Insurance Information Institute, the average cost of renters insurance is just $15 per month.

Money. Kick out cash every month for a policy you hope to never need.

Out of pocket. Pay the deductible, often $500 or $1,000, before the insurer goes to work.

TMI. Try to avoid the “too much information” companies who need your credit score, Social Security number, and blood type for a quote (OK, maybe not the last one, but it’s almost as painful as a prick in the arm).

Wait. Sometimes filing an insurance claim can feel like a waiting game; some companies jump into action like a cheetah, and others would make a sloth impatient.

First, never feel you’re inconveniencing a company or an agent to get a quote. Second, only a scam would charge you for one. Third, check out the three best ways to get a quote:

Internet. Your smartphone or computer makes it quick and easy to check multiple companies, but the downside is if you don’t speak directly to another human, you may miss essential coverages or recommendations.

Phone. Your chance to make a quick call and speak with an agent, but the drawback is that dialing multiple companies can be a hassle.

In-person. Your opportunity to look your agent in the eye, shake hands and get the personal touch, but it’s by far the most time-consuming option (and pretty much 9 a.m. to 5 p.m. only).

No matter how you get quoted, these factors will decide your rate:

Amount. Select the right amount of coverage for personal property, liability coverage, or additional coverage for your valuables, such as a top-of-the-line mountain bike, wedding ring, or DSLR camera.

Deductible. Choose a higher deductible to get a lower monthly premium.

Discounts. Qualify to save for deals if you have a claims-free history, a paid-in-full policy, burglar alarms, deadbolts, fire extinguishers, smoke detectors, sprinklers, or any other thing that makes the insurance providers smile.

Location. Live in a crime-heavy, high-traffic, earthquake-prone, flood-zoned, expensive, rural, or urban area—where you reside matters.

Type. Pick between two types of coverage: actual cash value (ACV) or replacement cost coverage (RC) for claims. RC would give you the $1,000 you paid for your 4K TV three years ago, and ACV would pay you the $500 it’s worth today. RC is the better coverage, but you’ll pay more for it.

While there are several different sites to compare renters insurance quotes, PolicyGenius offered the best comparison experience for this writer, providing a real-time quote in just five minutes. However, PolicyGenius only provided a single quote.

Check out the three best ways to get a quote: Internet. Your smartphone or computer makes it quick and easy to check multiple companies, but the downside is if you don’t speak directly to another human, you may miss essential coverages or recommendations. Phone. Your chance to make a quick call and speak with an agent, but the drawback is that dialing multiple companies can be a hassle. In-person. Your opportunity to look your agent in the eye, shake hands, and get the personal touch, but it's by far the most time-consuming option (and pretty much 9 a.m. to 5 p.m. only).

Quote comparison sites like Insurify use cutting-edge AI technology to provide free personalized quotes in just minutes to customers. With an average user rating of 4.8/5 from 2,900+ reviews, Insurify is the #1 highest-ranked insurance comparison platform in America. And, unlike other quote comparison companies Insurify never sells your data to scammers.

While we all adjust to the “new normal,” you can enjoy the old-fashioned notion of saving a buck on your renters insurance premiums. The right renters insurance policy protects your stuff, and the right deal grants you the insurance you need at a price you can afford. To maximize your savings, consider bundling your renters insurance with an auto policy from Insurify. In just a few minutes, you can compare renters insurance quotes today.

Insurance Writer

Courtney Roy is a financial and technology writer. He creates content that makes an actionable difference in the lives of his readers by helping them understand matters of personal finance. In addition to years of experience across multiple industries, Courtney has insurance licenses, a real estate license, and a degree in electrical engineering.

Learn More