Tesla Insurance Reviews: Consumer Reviews, Ratings (2023)

Updated June 15, 2022

Updated June 15, 2022

Should you insure your Tesla just like you would any other car? Well, it depends.

While Tesla’s own car insurance takes into account some features unique to Tesla, rates still vary based on things like car mileage, driving history, location, and other factors just like any other car insurance.

When shopping for car insurance for your Tesla, you should still compare auto insurance quotes to make sure you’re getting the best rate for your needs. With Insurify, you can get multiple personalized auto insurance rates from top providers in minutes.

Tesla offers insurance using real-time driving behavior.

Tesla car insurance is currently only available in 5 states.

Drivers who compare car insurance with Insurify save up to $996 annually by switching to a policy they found on the platform.

Tesla car insurance is designed specifically for Tesla drivers, and is available for the Tesla Model 3, Model S, Model X, Model Y, and Roadster. However, Tesla offers insurance in just five states: Arizona, California, Illinois, Ohio, and Texas.

When determining pricing, the company takes into account the standard safety features available on all Tesla vehicles. The company also has unique knowledge of the repair costs associated with its vehicles so it’s able to do away with fees charged by traditional insurance companies.

Tesla claims these factors can save drivers as much as 20 to 30 percent compared to the average cost of car insurance from other providers. The actual cost of coverage will vary based on factors such as your Tesla model, your driving history, where you live, and more.

Tesla’s car insurance provides typical insurance coverages like bodily injury and property damage liability coverage, collision coverage, comprehensive coverage, as well as some additional coverages designed for insuring electric vehicles.

For example, Tesla offers a protection package for self-driving vehicle owners that can provide you with wall charger coverage, reimbursement for identity fraud expenses, and electronic key replacement. Tesla also offers roadside assistance, gap insurance, rental reimbursement, and a total loss deductible waiver.

Additionally, Tesla provides insurance discounts based on your electric car’s autonomous driving functions. You may also be eligible for discounts common with other insurance programs, such as discounts for being a good driver, having anti-theft devices in your car, being insured with Tesla for a long period of time, and taking driver improvement courses.

In October 2022, Tesla launched a telematics program: Safety Score. Telematics programs take data like driver behavior, fuel consumption, and speed, and analyze it to determine your car insurance rate. Tesla’s telematics program is still being tested and is currently in its Beta stage.

Most telematics programs require you to install a device in your car to track driving behaviors, but Tesla’s Safety Score uses the technology in the car itself. Safety Score assesses five factors: forward-collision warnings per 1,000 miles, hard braking, aggressive turning, unsafe following, and force autopilot disengagement.

Tesla uses these factors as well as five other variables: what vehicle you drive, where you live, how much you drive, what coverage you select, and how many vehicles you insure to determine how much your premium costs.

If you drive a Tesla in Arizona, California, Illinois, Ohio, or Texas, you can get insurance coverage from Tesla Insurance in as little as a minute. To get an idea of the cost, you can get a quote on Tesla’s website.

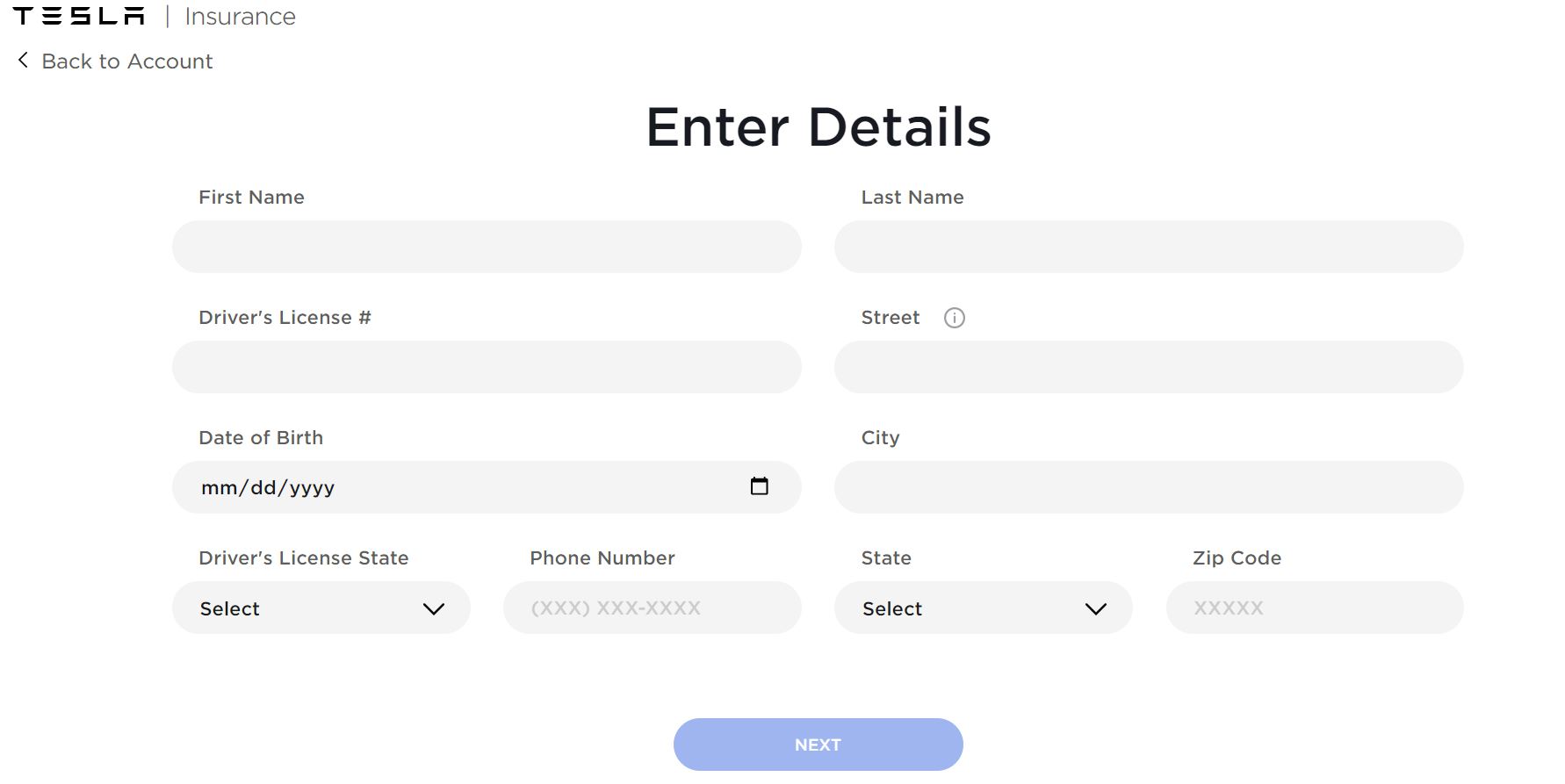

You’ll need to log in or create an account to get started, and will immediately be prompted to provide personal information, such as your driver’s license number and address. There are no anonymous quotes available, so you’ll need to have your information ready to see your car insurance rates.

Once you provide information about your vehicle and driving record, you’ll be able to purchase a policy instantly online unless you need assistance with adding supplemental coverages. If you need help, you can contact 1 (844) 34-TESLA to speak to a licensed agent.

More: Car insurance quotes

More: Cheap car insurance

Customer reviews about Tesla’s car insurance product are difficult to find. On third-party rating websites, customers mostly reviewed the company in general, citing poor customer service and the repairs process as reasons for their negative reviews. Tesla received the following ratings:

ConsumerAffairs: 3.8/5 from 542 reviewers

Trustpilot: 2.3/5 from 854 reviewers

Better Business Bureau: 1.18/5 from 266 reviewers

State National Insurance Company, the company that handles the underwriting of Tesla’s insurance policies has an above-average number of complaints with the National Association of Insurance Commissioners, and there are concerning customer service reviews about Tesla in general.

Tesla’s insurance product is still relatively new and only available in Arizona, California, Illinois, Ohio, and Texas. The company doesn’t list average rates, so you won’t know whether you might get lower insurance premiums from Tesla until you get a quote, which requires that you provide your personal information.

While Tesla certainly has unique expertise in covering its vehicles, insurance prices from Tesla may not necessarily be lower than at companies like GEICO, Liberty Mutual, and Progressive. If you get a quote from Tesla, you should also get quotes from Insurify.

Insurify’s artificial intelligence technology makes it easy to view rates from multiple insurance companies side by side. You’ll get customized quotes from both major providers and local insurers so you can find a policy that meets your needs and fits your budget.

Rideshare drivers should note that Tesla’s insurance policies only cover your Tesla for personal use. If you use your car for ridesharing or for any other commercial use, you’ll need to purchase insurance elsewhere. With Insurify, you can elect to see quotes from companies that provide rideshare coverage.

Coverage and cost are not the only factors to consider when choosing a car insurance provider. You’ll also want to consider customer service reviews and third-party ratings. The Insurify Composite Score, calculated by analyzing multiple factors that reflect an insurance company’s quality, reliability, and health, makes it easy to assess whether a particular insurer is reputable.

Insurify’s data scientists took these variables, weighted them, and combined them into a single, easy-to-understand numeric score for each insurance company. Before you buy your next auto insurance policy, make sure to check out the ICS for the insurance provider you’re considering.

When you know where to look, it’s easy to find a car insurance rate that fits your needs and budget. Insurify works to make the process easy, safe, and fast. You can also save money by:

Searching a wide range of insurers to find the best rate

Bundling multiple insurance policies, such as home insurance and auto insurance.

Changing your coverage or deductible

It’s always great to save on your auto insurance and the best way to find lower rates is to compare car insurance quotes. With Insurify, you can compare quotes from multiple insurance providers all in one place and in only a few minutes.

Tesla was founded in 2003 by a group of engineers that included Elon Musk, J. B. Straubel, Marc Tarpenning, and Martin Eberhard. The company builds electric cars and also provides clean-energy generation. In 2019, the company launched Tesla Insurance, which is currently only offered to Tesla drivers in Arizona, California, Illinois, Ohio, and Texas.

You can get a quote, manage your policy, and pay your bills online with Tesla Insurance. You can also call a Tesla licensed agent if you need assistance, and there’s a general online form for questions as well.

Phone: 1 (844) 34-TESLA

Website: www.tesla.com/support/insurance

Online Quote: www.tesla.com/insurance

Online Form: www.tesla.com/contact

Yes. Though Tesla has only been providing car insurance since 2019, policies are underwritten by State National Insurance Company, which has been around for decades and has an A financial strength rating from A.M. Best. However, unlike top insurers like State Farm and Allstate, State National Insurance Company isn’t rated by J.D. Power.

To find out your annual premium for Tesla car insurance, you’ll need to get a quote. Tesla claims to save drivers up to 30 percent compared to traditional insurers through its understanding of its vehicles and reduced fees. While it’s possible a Tesla insurance policy could save you money, you should always compare quotes before signing up.

Insurify is a quote-comparison site that doesn’t issue insurance policies but rather helps motorists find and compare car insurance quotes whereas Tesla insurance simply provides a single quote. In about the same amount of time it takes to get a quote from Tesla, Insurify lets users compare car insurance rates from multiple different insurance companies.

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Danny is an insurance writer at Insurify. Specializing in auto insurance, he works to help drivers navigate the complicated world of insurance to find the best possible policy. He received a bachelor's degree from the University of Massachusetts Amherst. You can connect with Danny on LinkedIn.

Learn More