Pumpkin Pet Insurance: Is it the right choice?

Updated January 20, 2021

Reading time: 7 minutes

Updated January 20, 2021

Reading time: 7 minutes

Pet parents looking for a preventative care add-on

Pets with cured pre-existing conditions

Pet owners who want dental disease coverage

Those looking for behavioral issue treatment coverage

Pet owners looking for no annual limits

Between the cultural domination of cat videos on YouTube, the market for dog toy delivery boxes, and the influx of viral pet celebrities, one thing is clear: people love their pets. Over 60 percent of households in the United States have opened their doors to new companions, and that number rises every year.

Still, every pet parent knows that danger lurks around every corner. Whether they have a new puppy or a senior cat, unexpected accidents and illnesses could happen at any moment.

That’s why so many pet families are turning to pet insurance to provide that extra peace of mind when it comes to providing the best possible care. As veterinary technology continues to advance, it also gets more expensive. That means when incidents occur, they can add up very quickly. Like human health insurance, pet insurance providers can help pay for portions of vet bills. Finding the best pet insurance can mean a huge difference in the medical care they receive. It can even mean the difference between life and death.

Statistically, many of the euthanasias that vets perform each year are due to pet parents ’ inability to afford any further treatments. Luckily, whether your pet is fighting a bad cold, a case of gingivitis, or even a ruptured knee, they can benefit from a good pet insurance policy. Buying a policy can mean saving up to 100 percent on qualifying vet bills for emergencies, surgery, rehabilitation, and even dental treatment.

Unfortunately, all dogs and cats will get sick at some point, and all pet parents know the importance of accessing the best possible healthcare. Keeping your pet healthy while also keeping costs low means you can get back to doing what you love: putting your money toward spoiling your pet.

Pumpkin Pet Insurance offers comprehensive pet insurance and accident-only policies in all 50 states.

Pumpkin doesn’t require new policyholders to undergo a vet exam before enrollment in the comprehensive plan. However, submitting any claims gives Pumpkin the right to access all of a pet’s medical records. That means Pumpkin can determine any pre-existing conditions, which it won’t cover. If policyholders do not disclose this information, Pumpkin may deny claims.

Pumpkin’s pet insurance offers its comprehensive accident and illness plan for all cats and dogs over eight weeks old. The policy covers accidents, illnesses, alternative therapy, prescriptions, behavioral therapies, and chronic conditions, among others. It’ll also pay for the exam fees that pet parents might forget about, like any testing, anesthesia, and prescriptions, which can really add to the cost.

That means Pumpkin pet health insurance will reimburse you for unexpected, expensive vet bills. Treatments for chronic conditions like diabetes, cancer, or FIV can get very costly, very fast. Luckily, having a strong pet insurance plan in your corner can mean a world of difference for pet parents. Some pets experience multiple health scares each year, but Pumpkin can help with each instance of medical care. Whether your dog has gingivitis, accidental poisoning, or upper respiratory disease, Pumpkin can save pet parents hundreds of dollars.

Unfortunately, Pumpkin will not cover pre-existing conditions, but it will reinstate coverage for “cured” diseases or injuries. Pet insurance companies do not ever cover pre-existing conditions, but alternatives like Pet Assure and Pawp offer coverage. Pumpkin will also not cover any breeding fees, cosmetic work, or regular dental cleanings.

Pumpkin doesn’t offer a ton of flexibility, but policyholders can still adjust the comprehensive plan’s factors to lower the monthly cost. Every pet owner receives a 90 percent reimbursement rate, which policyholders can’t change. Typically, lowering the amount of coverage lowers the monthly premium. Cat parents can choose a maximum annual payout of $7,000 or $15,000, and dog parents can choose between payouts of $10,000 and $20,000. Pet owners can also change the annual deductible, which is the amount that they pay out of pocket before receiving any reimbursements. They can choose $100, $250, or $500.

Pet owners with a full-coverage plan can upgrade their coverage with a preventative care plan, which refers to treatments like checkups, vaccines, and parasite control, like heartworm. Pet insurance plans with routine and preventative add-ons guarantee financial support for every instance of veterinary care.

Pumpkin’s wellness plan is different from the typical routine add-on. Pet parents can pay $18.95 per month for dogs and $11.95 per month for cats. The plan only covers the cost of one annual wellness exam, one vaccine, and one fecal test. That means Pumpkin’s plans offer a lot less coverage while costing a lot more than competitors.

When it comes to a beloved cat or dog, there isn’t much a pet parent wouldn’t do for them. Still, they shouldn’t have to go into debt to pay for a necessary emergency vet bill. Luckily, pet parents can now turn to pet insurance providers, unlocking the door to accessible veterinary healthcare.

Depending on the policy you choose, Pumpkin Pet Insurance can cover almost every instance of veterinary care for your furry friend. Pumpkin insurance covers 90 percent of all unexpected vet care by any licensed vet, specialist, or emergency clinic.

According to Pumpkins’s website, it doesn’t have upper age limits or breed restrictions. Policyholders don’t even need to disclose the breed when initially applying for a policy because the plan depends on weight.

Pumpkin’s coverage is pretty standard when it comes to accidents and illnesses. Statistically, one in three pets will need vet care each year, and Pumpkin offers coverage ranging from common diseases, like kennel cough, to severe conditions, like cancer. Some unlucky pets have to suffer through multiple illnesses or injuries each year, and some have to battle long-term chronic diseases, like diabetes or arthritis. Pet insurance coverage can provide the peace of mind pet parents need during these difficult, emotional times.

Pumpkin is also one of the only pet insurance providers to cover treatments for behavioral issues. That means Pumpkin will cover treatments for destructive chewing and other behavioral problems if performed by a vet or through a vet referral. It is also one of the few providers that offer coverage for dental diseases, which are typically very expensive.

Like every other pet insurance policy, Pumpkin will not cover cosmetic procedures, breeding-related fees, or pre-existing conditions. Luckily, it will reinstate coverage for certain conditions it considers “cured.” It will also not cover anal gland expression or routine dental cleanings.

Pumpkin does not offer insurance for birds or exotic pets. Currently, Nationwide is the only traditional pet insurance company to provide pet insurance for exotic animals. Pet Assure is the only alternative pet insurance company that covers birds or exotic pets.

Compared to competitors, Pumpkin policyholders don’t have a ton of flexibility regarding their policies. Pet parents choose the max annual payout and deductible, but they don’t have many options. By adjusting these factors, pet owners can lower the monthly premium.

Cat and dog owners receive a 90 percent reimbursement on all qualifying vet bills, a number that policyholders can’t adjust. That means Pumpkin will repay you for 90 percent of your vet bill after you file a claim.

Cat owners can choose annual payouts of $7,000 or $15,000, while dog owners can choose between $10,000 or $20,000. Many competitors typically offer more than two options. The higher the maximum payout, the higher the cost each month. While $7,000 is higher than other insurance providers, it may limit access to vet care if pets meet the annual maximum too soon. If your cat needed emergency surgery and the bill for hospitalization was $14,000, you would have to pay $7,000 out of pocket.

Pet owners can also choose a deductible of $100, $250, or $500. The deductible is the amount of money pet parents have to spend out of pocket on qualifying vet visits before the policy will kick in. That means policyholders will have to file claims for treatments like prescription food or blood tests without receiving reimbursements until they meet the annual deductible. The higher the deductible, the lower the monthly premium.

If pet parents want to purchase a wellness add-on, they can pay $18.95 per month for dogs and $11.95 per month for cats. Pumpkin’s wellness plans cover a set amount of routine and preventative essentials. Unfortunately, the plan only covers the cost of one wellness exam, one vaccine, and one fecal test each year, which is significantly less than other insurance providers. That means dog parents have to spend $227.40 each year for limited coverage, which might not even save that much in the end.

Pumpkin will reimburse each eligible claim after receiving a copy of its completed claim form, an itemized invoice, and your pet’s medical records. Policyholders can upload these to Pumpkin’s member center. Pet parents can also fill out the forms and email them to claims@ pumpkin.care.

If your vet doesn’t require full payment up front, you can also opt to have Pumpkin send payments directly to a vet. That takes the stress out of any upcoming charges.

Unlike many competitors, Pumpkin offers a multi- pet discount. Families with multiple pets qualify for a 10 percent discount for each additional pet that is enrolled.

Pumpkin has a 14-day waiting period for all accidents and injuries, including knee and ligament conditions, which is substantially less time than most competitors. Most traditional insurance providers have a six-month waiting period for any orthopedic and ligament issues. Pet owners who purchase a wellness policy have coverage immediately.

Any condition that appears before the end of the waiting period is considered a pre-existing condition. That means if your dog were diagnosed with kidney disease during the waiting period, you would not receive any coverage for any future treatments or treatments for related issues.

Pumpkin has several positive reviews on its website, each adorned with pictures of customers’ cats and dogs. The reviews don’t list any specifics, but many cite peace of mind and gratitude for saving money and providing strong coverage.

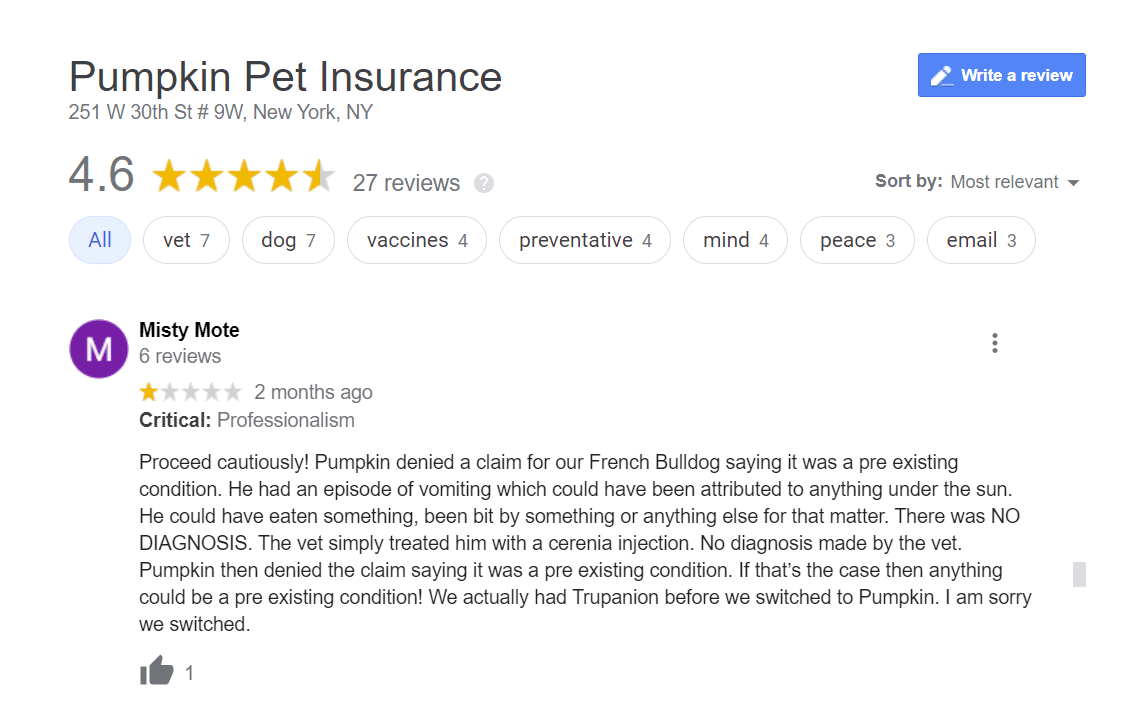

Pumpkin doesn’t seem to have a presence on any of the bigger consumer review sites. Luckily, there are 27 Google reviews of the company. Pumpkin holds a 4.6-star rating, which is very high. Still, there are a handful of negative reviews. These negative reviews cite long turnarounds and denial of claims. A representative for Pumpkin has replied to every Google review.

Pumpkin insurance is produced by the Crum & Forster Insurance Group, which is also responsible for ASPCA, Hartville, and 24PetWatch. It is rated A (Excellent) by A.M. Best.

| Customer Service | 1 (866) 273‑6369 |

| help@ pumpkin.care | |

| Member Portal | Login |

| Website | pumpkin.com |

Pumpkin’s policies are underwritten by the United States Fire Insurance Company, produced and administered by C&F Insurance Agency, Inc., a Crum & Forster company.

Pumpkin’s insurance rates depend heavily on a pet’s size, age, and location. On average, the rates can range from $25 to over $200 per month. These rates are heavily subject to previous factors out of an owner’s control. Pumpkin also doesn’t offer a ton of modifiable factors to impact the monthly premium. Compared to other pet insurance companies, Pumpkin’s cost is pretty high. Still, you should compare pet insurance plans and prices before settling on one policy.

Pumpkin offers the standard amount of coverage for most pet insurance companies, but its behavioral coverage and dental coverage really stand out. Although its premiums can get pretty high, smaller, younger pets can really benefit from a Pumpkin policy. Still, many policyholders believe that a Pumpkin policy is not worth the high monthly cost, especially when it comes to denying claims and slow turnaround. There also aren’t many benefits to choosing Pumpkin over other Crum & Forster insurance providers. Whether Pumpkin is the best company for you comes down to what you can afford and what kind of coverage fits you and your pet best. That's why you should make sure you compare quotes before settling on a single pet insurance policy.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More