Pet Assure: Is it better than pet insurance?

Updated January 22, 2021

Reading time: 5 minutes

Updated January 22, 2021

Reading time: 5 minutes

Pet owners looking for discounts, instead of coverage on veterinary services

Those with access to participating veterinarians

Pet parents looking for pre-existing condition coverage

Exotic pet owners

Those looking for higher reimbursement

Pet owners that want to use a veterinarian out of network

When it comes to guaranteeing the best possible veterinary care for your pet, it can be tough to choose between purchasing a pet insurance policy, a wellness plan, a discount plan, or all three. We know you love your pet, but we also know they can get very expensive, very quick. That’s why so many pet parents find themselves turning to these services to help keep veterinary costs low.

But sometimes pet insurance policies and wellness plans don’t offer enough coverage or charge a hefty sum every month that outweighs the benefits of even having a policy. Whether you’re preparing your new puppy for his first round of shots or bringing your pot-bellied pig in for her third round of chemotherapy, veterinary bills can rack up very quickly. And depending on the situation, you might find yourself paying for these medical services out of pocket.

Discount plans are similar to pet insurance policies, but instead of covering specific treatments, it discounts the entirety of your accident, illness, or routine veterinary invoice.

This means you won’t find yourself paying a veterinary bill outright because of a treatment exclusion hidden in the fine print of your insurance contract. Discount plans often cover various treatments that pet insurance companies will not, including pre-existing conditions, breeding costs, and hereditary conditions.

Pets are a part of your family and deserve the best possible healthcare. Check out affordable pet insurance plans today, by comparing pet insurance quotes from different companies on Insurify.

Pet Assure is different from pet insurance companies because it offers a 25 percent discount on all veterinary fees without any exceptions, regardless of pre-existing, chronic, or hereditary conditions. This discount works on all accidents, illnesses, and routine care treatments. Pet assure charges a flat rate per month regardless of breed, age, or pet health history. However, this discount plan will only work with affiliated veterinary practices, specialists, and emergency clinics.

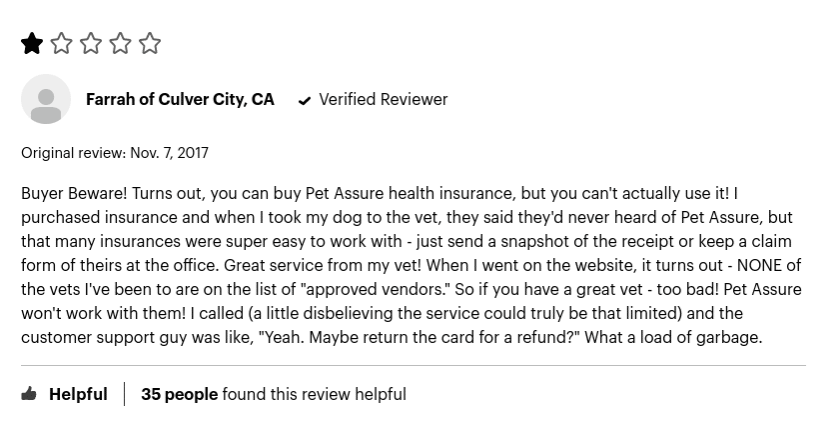

Pet Assure is available in all 50 states and Puerto Rico and is available in thousands of veterinary practices across the country. There is a map on the Pet Assure website that highlights all of the affiliated practices in a certain area. Customers whose preferred veterinary practice isn’t affiliated with Pet Assured are asked to invite the practice to join and accept the discount program.

Pet Assure does not require a veterinary exam before enrolling in any of its plans. It also doesn’t require any pet’s medical history to receive the discount.

Pet Assure offers four veterinary discount plans that give a 25 percent discount on all accidents, illness, and routine care costs from an affiliated practice. This includes emergency surgery, vaccinations, allergy treatments, dental cleanings, spay or neutering, x-rays, hip dysplasia treatment, and others.

Unlike many pet insurance companies, Pet Assure’s discount is applied immediately on any vet bills, rather than through a reimbursement system. This means you can avoid waiting for claims to process or receiving reimbursements in the mail. Pet Assure also doesn’t have any annual deductibles or waiting periods for treatments.

According to the Pet Assure website, it won’t exclude coverage regardless of breed, age, or medical history. These factors will also not raise your monthly premium from the flat-rated monthly cost, but your premium might go up depending on your location.

These plans are determined by the size of your pet or the number of pets you’d like covered. This means that plans for a cat cost the same as plans for a guinea pig. Each plan has the same amount of coverage, and prices are a flat rate depending on the aforementioned factors.

The small animal plan offers coverage for singular cats, birds, ferrets, reptiles, rodents, skunks, and turtles, as well as others. This plan starts at $9.95 per month, depending on the policyholder’s location. The cost can be brought down to $6.58 per month by paying for the entire year outright.

The large animal plan offers coverage for singular dogs, horses, llamas, farm animals, or pot-bellied pigs. This plan starts at $11.95 per month, depending on the policyholder’s location. It can be brought down to $8.25 per month by paying for the entire year outright.

Pet Assure’s multi-pet plans provide significant price reductions for multi-pet homes. The family plan offers coverage for two to four animals, regardless of size. This plan starts at $16.95 per month, depending on the location. This price can be brought down to $12.42 per month by paying for the entire year outright.

The unlimited plan provides coverage for every pet in a single household, regardless of size. This plan starts at $21.95 per month and can be brought down to $16.58 per month by paying for the entire year outright.

Pet Assure’s 25 percent discount will not work on prescription costs and non-medical treatments like routine grooming, training, or boarding. It will also not work on out-sourced treatments like diagnostics or blood work that requires a lab or specialist referrals out of network.

Pet Assure is not a pet insurance policy and does not use a traditional reimbursement system. All policyholders are issued a Pet Assure discount card after signing up, which can be shown at any in-network veterinary clinic to have 25 percent immediately take off the bill. This means that pet owners don’t have to worry about reimbursement amounts because every plan offers a 25 percent discount. This also means that policyholders do not have to file claims to receive any savings.

Pet Assure also doesn’t have a limit on the number of times policyholders can use their discounts, and it doesn’t have an annual deductible either. This means that the discount can be applied immediately, which means you don’t have to spend a certain amount of money out-of-pocket before your policy kicks in.

Pet Assure offers a 45-day guarantee for all policyholders, so it will refund all plans if you change your mind within 45 days of signing up.

Pet Assure does not have waiting periods on any of its plans.

Pet Assure offers flat-rate pricing that depends on a policyholder’s location. Interested customers can use the website’s price calculator, which lays out all the plan options and flat-rate prices.

For example, Pet Assure’s quote for a five-year-old male golden retriever named Spot, who lives in Brooklyn, New York, would cost $11.95 per month for the large pet plan. Since Spot is the only pet in the home, he would only qualify for the large pet plan. The price could be brought down to $8.25 per month if the year is paid upfront.

But if Spot were to get a quote from Embrace pet insurance, a traditional pet insurance company with a wellness plan add-on, Mushroom’s quote would be $57.85 per month for the accident and illness coverage with a wellness plan add-on. This plan would cost $694.40 per year. The quote includes a $15,000 annual reimbursement line, a $750 annual deductible, an 80 percent reimbursement, and no prescription drug coverage.

Make sure you compare pet insurance plans on Insurify before settling down on a policy! Checking out different companies never hurts.

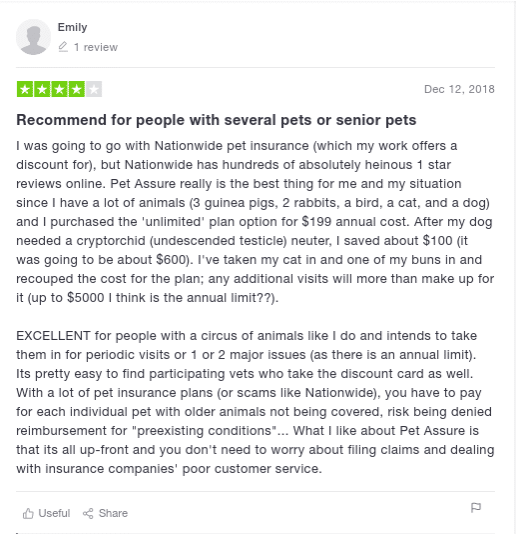

Pet Assured does not have any reviews on its website, but there are many positive reviews from customers on websites like Trustpilot, where it holds a four-and-a-half star rating. Many of the positive reviews cite customer’s appreciation from not having to file claims and good customer service.

Trustpilot might not have many negative reviews, but other consumer reviewing sites like the ConsumerAffairs also gives patrons a chance to air their grievances. Pet Assure does not have enough reviews to have a score on ConsumerAffairs website, but most reviews have one-star ratings. These reviews typically complain about the availability of the discount service in their area, the ability of in-network veterinarians to deny the discount, and the perception that veterinary clinics that participate in the program cost more than competitors.

| Customer Service | 1 (888) 789-7387 |

| Online Contact Form | Contact form |

| Pet Assure Corp 211 Boulevard of the Americas, Suite 403 Lakewood, NJ 08701 | |

| Website | http://www.petassure.com |

Pet Assure’s discount program can compete with traditional pet insurance because it takes away the annual deductible and medical exclusions. Pet insurance policies are often able to deny countless claims through complicated exclusions, and require pet owners to pay hundreds of dollars out-of-pocket before their insurance even kicks in. This means that some pet insurance policyholders don’t even receive coverage because they can’t meet their annual deductible in a year. Pet Assure does not have any exclusions and can be used immediately on any medical procedure.

Veterinary practices choose whether or not they want to participate in Pet Assure’s discount program. However, if the vet you currently use does not accept Pet Assure’s discount card, they can be formally invited to join the network by filling out a request form on Pet Assure’s website. According to Pet Assure’s website, veterinarians can gain new clients, increase patient compliance for otherwise expensive treatments, and receive exclusive offers from affiliated companies like Staples and DMV Galaxy.

Pet Assure offers a unique discount plan that can provide serious financial assistance to pet owners. Although certain areas might not offer many options for in-network veterinary practices, many of the negative reviews seem to be from customers that just didn’t understand how the company worked or had a bad experience with an affiliated veterinary practice, rather than the discount program itself. Pet Assure is one of the few companies that offer financial assistance to pets with pre-existing conditions, which is a major setback for most pet insurance companies. It’s also one of the few companies to use set pricing, which can help keep costs low compared to competitors. Discount programs can be especially beneficial to pet parents with over four pets because it doesn’t require each pet to be individually insured. But pet insurance policies can be equally as beneficial, depending on the nature of a pet’s medical history. Whether Pet Assure is a good choice for you comes down to what you can afford and what kind of coverage fits you and your pet best. That’s why you should always compare quotes before settling down on a single pet insurance policy.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More