Pawp: Is it the right choice for your pet?

Updated November 9, 2020

Reading time: 9 minutes

Updated November 9, 2020

Reading time: 9 minutes

Pet owners looking for pre-existing condition coverage

Pet parents looking for multi-pet coverage

Those looking for low monthly premiums

Pet owners looking for wellness coverage

Pet parents who want coverage for more than one veterinary trip per year

Pet parents want to provide the best possible care for their four-legged friends, but as veterinary technology continues to advance, this care can come at a high price. One out of every three pets will need emergency vet care every year, and pet owners know they can get very sick, very fast. Dealing with emergency care can make pet parents feel like they don’t have options and often end up costing hundreds or thousands of dollars out of pocket.

For the last 10 years, stories about grief-stricken pet families turning to creditors, personal loans, and even crowd-funding sites have flooded the internet. Today, pet parents can turn to pet insurance companies and other financial alternatives to help pay for expensive vet bills. Traditional pet insurance companies work like human health insurance and can help save money for critical care.

Depending on the plan and company, pet insurance can reimburse pet owners for accidents, illnesses, emergency care, and routine or preventative treatments. These reimbursements mean saving between 25 and 100 percent of the entire qualifying vet bill. Pet parents not having to face the emotional and financial turmoil of unaffordable vet bills can mean a world of difference.

Pet owners would do anything for their cats and dogs, but with the perfect insurance policy, that doesn’t have to include going into debt. Compare companies to find the best policy for you and your family with Insurify today.

Pawp offers emergency fund coverage for cats and dogs in all 50 states.

The company does not require new policyholders to undergo a vet exam before enrollment. That is because policyholders can use the emergency fund for pre-existing conditions. However, Pawp must approve any treatment coverage as an emergency, which means it won’t cover any scheduled surgeries or appointments.

Pawp is not a traditional pet insurance company.

Rather than reimburse pet owners for specific treatments throughout the year, Pawp is an emergency fund that can be accessed once a year for up to $3,000. Coverage for cats and dogs is $19 per month and covers up to six pets in a household. That means pet owners have immediate access to $3,000 for a single expensive treatment in cases of left ventricular failure, stroke, poisonings, or broken bones.

According to Pawp ’s website, it won’t restrict coverage regardless of age, breed, or medical history. Still, policyholders cannot change any aspects of Pawp ’s emergency fund. That includes a $0 deductible and $0 co-pay. The plan covers any situation deemed serious, unexpected, and dangerous, including pre-existing conditions, accidents, and illnesses. It won’t cover any scheduled treatments, which means it won’t cover cancer, rehabilitation, prescriptions, or wellness care.

Pawp will cover 100 percent of any emergency, up to $3,000, if your dog or cat needs critical care. That includes immediate treatments for organ dysfunction, kidney disease, heart failure, and high blood pressure. It’ll also pay for vet fees like catheters, cardiac pressure tracing, anesthesia, and sterilization.

Unfortunately, Pawp won’t cover scheduled appointments or surgeries regardless of the necessity of the treatment. That includes cardiology treatment, which can end up being super expensive. Let’s say your dog has heart valve stenosis, which is present at birth and restricts blood flow. Your vet would need to run multiple tests to check the cardiac index and cardiac output. If the right ventricular pressure was too high or the atrial pressure was too low, the vet would have to address these problems, too. Pawp would not cover any of these treatments or tests because the company wouldn’t consider it an immediate emergency.

However, if your cat were to develop pulmonary edema or systolic heart failure, Pawp would pay up to $3,000 toward treatment. Both conditions require immediate, emergency treatment; otherwise, your cat may die.

Pawp ’s plan provides a $0 deductible, a $0 co-pay, an annual maximum of $3,000, and a yearly one-use limit. That means it will pay for the entirety of a single emergency vet bill up to $3,000. A single policy can be used to cover six different pets without paying any additional fees but can only be used once per year. Policyholders cannot change any aspects of this plan.

Unlike typical pet insurance companies, Pawp offers an emergency fund for cats and dogs to help with financial emergencies that pet parents might face regarding pet care. The emergency fund is similar to preloading a Visa card with accessible funds that pet owners don’t have to pay back. Policyholders can have a single, emergency vet visit completely covered for up to $3,000 by any licensed vet or clinic.

According to Pawp ’s website, it won’t exclude coverage for age, breed, or medical history. However, many negative reviews cite Pawp ’s strict denial of claims due to the company’s required confirmation of an emergency.

Pawp ’s emergency fund offers great coverage when accessible, especially as one of the only companies to offer coverage for pre-existing conditions. Vet visits for critical care are among the most expensive medical pet scenarios, making the trip more stressful. Having an emergency fund can take some of the financial stress away by providing options other than creditors or personal loans.

For example, if you bring your cat to an emergency clinic after it has a stroke, the bill could get very expensive, very quickly. The vet team would need to run multiple tests to determine what caused the stroke and any reactions, including the diastole, heart’s stroke volume, or pulmonary circulation. The team would also have to stabilize the cat’s mitral valve to prevent any further damage. Any of these aspects could cost thousands of dollars, depending on your cat’s health.

But by using Pawp to help cover these expensive treatments, pet parents don’t have to restrict access to vital treatments due to a lack of funds. Almost 66 percent of pet euthanasias are due to a lack of finances for necessary procedures, and pet insurance can help prevent this awful choice from being necessary. Pawp can help protect everything from your cat’s nose to its right and left ventricles to its tail.

Before settling on buying a pet insurance policy from Pawp, make sure you compare pet insurance quotes and policies on Insurify.

Check Out: How Much Is a Vet Visit for a Cat Without Insurance?

Pawp does not offer insurance for birds or exotic pets. Currently, Nationwide is the only traditional pet insurance company to provide pet insurance for exotic animals. Pet Assure is the only alternative pet insurance company that covers birds or exotic pets.

Pawp policyholders cannot change any aspects of their policy, which has a fixed rate of $19 per month. However, they can choose whether to purchase individual plans for each pet or cover up to six pets under one plan. Purchasing individual plans guarantees coverage for at least one emergency vet trip per pet per year.

Pawp does not have a deductible, which is not the norm in the pet insurance industry. The deductible refers to the amount of money policyholders need to spend out of pocket before accessing any insurance funds. Deductibles usually range between $100 to $1,000, so Pawp policyholders save hundreds.

Pawp also doesn’t have a co-pay, which is the percentage of the vet bill that pet parents have to pay. Pet insurance companies, most of which don’t pay vets directly, primarily used the reimbursement model of payment. Pawp will pay for 100 percent of the vet bill and will pay the clinic directly. That means pet parents can leave their emergency clinic without paying a dime toward a vet bill.

However, Pawp ’s $3,000 annual limit is relatively low compared to other companies and cannot be adjusted. Fortunately, it does not have a lifetime maximum. Another significant disadvantage is the annual one-time use, which means Pawp will only cover one vet trip per year. So, if your dog has a bad case of regurgitation in June, Pawp won’t cover pulmonary hypertension in November.

The perfect pet insurance policy could mean the difference between paying a few dollars every week or going into debt because of a veterinary emergency. That is why it’s so important to compare pet insurance quotes and plans before buying a plan.

Unlike other pet insurance companies, Pawp policyholders don’t have to file any claims to pay their vet bills.

That is because Pawp pays vet clinics and hospitals directly, rather than through reimbursements. The company will pay for a vet visit after a Pawp vet confirms an emergency through its portal in real time. After treatment, the clinic receptionist can coordinate payment over the phone.

According to Pawp ’s website, it will review and approve payments before a client leaves the clinic.

Pawp ’s waiting period for all emergency pet coverage is five days after signing up. That means pet owners cannot purchase a Pawp policy while at the vet. Still, a five-day waiting period is significantly shorter than many other companies. Competitors usually range from 14 days to six months.

Pawp is not traditional pet insurance, but just like every other alternative financing option, its goal is to help pet parents save money in emergencies. Pawp is an emergency fund that can be used once a year for immediate cases of critical care. Alternative companies like Pet Assure and Eusoh use similar coverage options and pricing formats.

Pet Assure offers flat-rate pricing that depends on the number of pets covered and their location and sizes. Like Pawp, Pet Assure can keep its monthly premium as low as $10 per month. Both companies cover emergencies and pre-existing conditions; however, Pet Assure also covers scheduled appointments, surgeries, and routine care. Both companies also allow multi-pet families to use a single plan to protect multiple pets.

Eusoh is a crowd-sharing platform, which means all funds used to reimburse members come directly from other community members. Pet owners pay $65 maximum each month, depending on how much is spent by other users each month. Eusoh covers accidents, illnesses, and routine care but will not cover pre-existing conditions.

To compare price and coverage options: Pawp ’s quote for a three-year-old cat named Pumpkin Pie, who lives in Rochester, New York, would cost $19 per month. Pumpkin Pie would have coverage for emergency accidents and illnesses but could only receive funds once a year. That means if he needed surgery to lower his central venous pressure in July, Pawp would not cover any arterial surgeries in December.

For the same pet, Pet Assure would quote $9.95 per month, which could be brought down to $6.58 by paying for the year up front. Pet Assure offers a 25 percent discount on all veterinary procedures but can only be used within Pet Assure’s vet network.

Eusoh would initially quote $65. Pet owners then have to pay $17 per month and maintain a $48 deposit, which Eusoh uses to fund other group members. Eusoh covers 80 percent of a vet bill, which the company bases on the average cost of the treatment in your area. If Pumpkin Pie developed heart cancer and needed surgery to put in a pulmonary artery catheter, Pet Assure would only pay 25 percent. Eusoh would pay 80 percent of the average procedural cost, which is significantly more.

Finding the right health insurance plan or alternative option for your pet requires a lot of research and comparison. Using Insurify helps make the process easier, cutting down on the time and effort by letting pet parents compare pet insurance and alternatives all in one place within minutes.

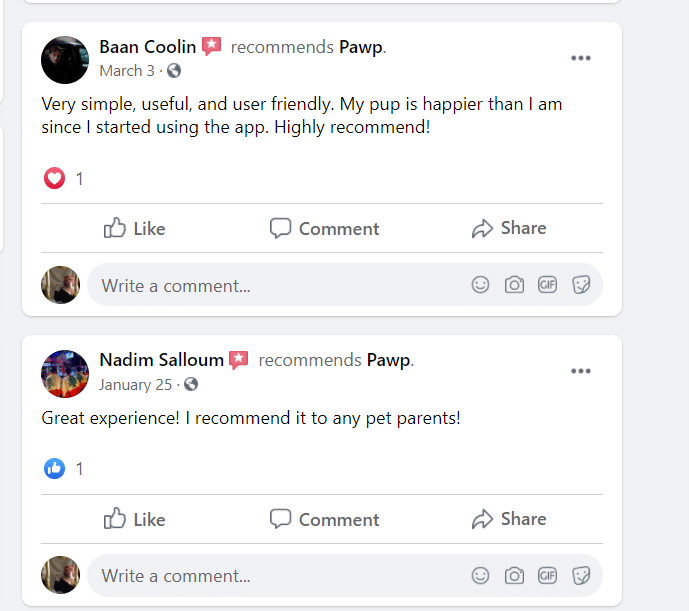

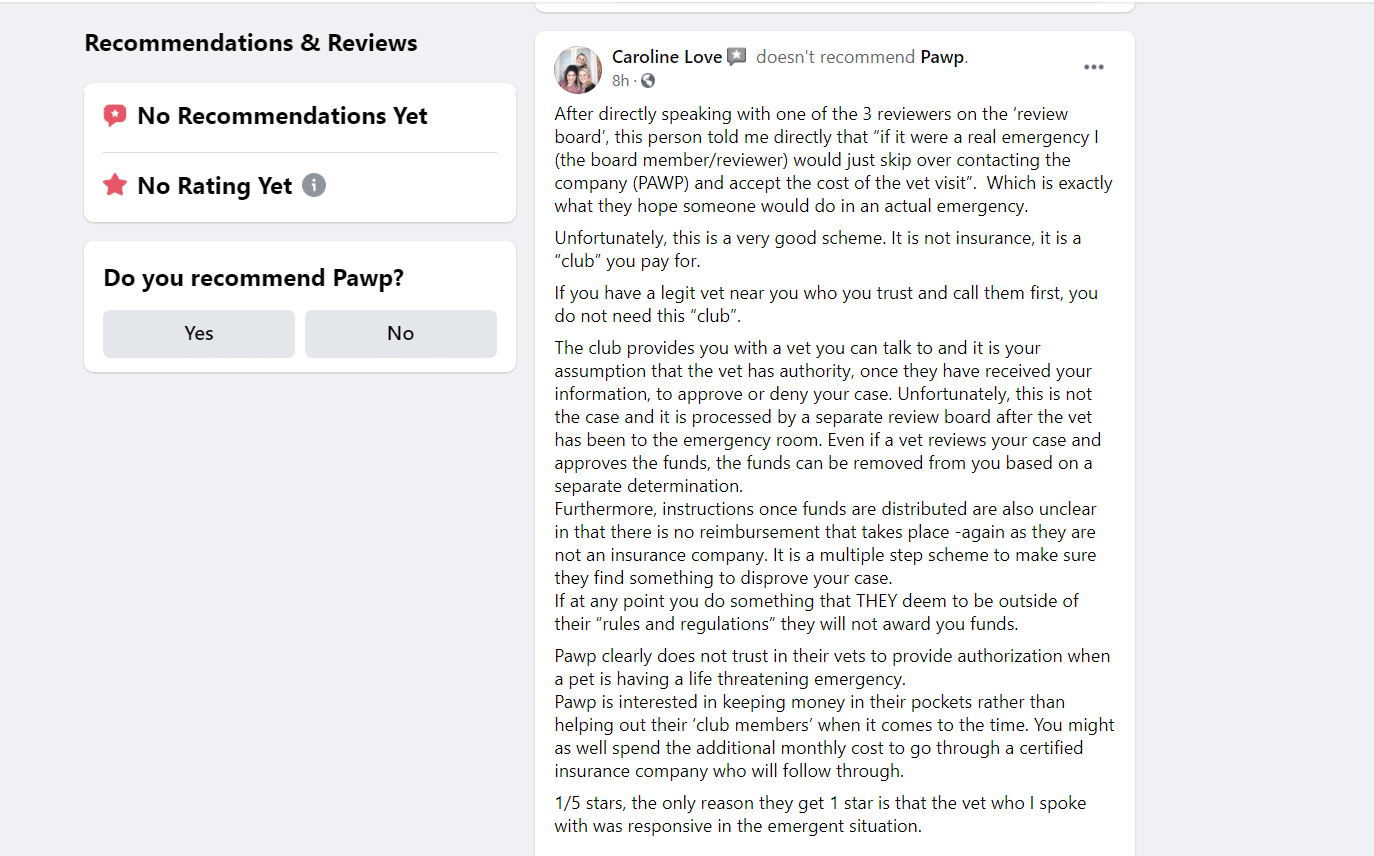

Pawp is a relatively new company, which means it doesn’t have many reviews. However, many users can take to social media like Facebook to express their feelings about Pawp. Many reviews discuss the ease and low cost of the company.

Unfortunately, many of the reviews Pawp has are negative. Consumers are able to share their distaste with the company on its Facebook page, where it does not have enough reviews to hold a user rating. Many cite unprofessionalism and denial of claims in their complaints.

| Text Line | 1 (646) 822-1294 |

| support@ pawp.com | |

| Website | Pawp.com |

When pet parents decide to bring a new furry friend into their lives, they want to provide the best possible care for their dog or cat. The best care pet parents can provide is access to the best possible vet care, especially when it involves medical emergencies. Purchasing a pet insurance policy or alternative can mean a world of difference for a sick pet, and finding the best policy can prevent pet owners from having to choose between their finances and beloved pet.

Luckily, Insurify makes finding the perfect policy simple with its online tool. Pet parents can compare pet insurance quotes from multiple companies at once and see the policy that fits both your and your pet’s needs.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More