Mortgage Protection Insurance: What to Know Before You Buy

Updated April 14, 2021

Reading time: 7 minutes

Updated April 14, 2021

Reading time: 7 minutes

Buying a home can be an overwhelming—and expensive—experience.

After you close on your humble abode, you may be left with even more questions than when you started house hunting. How do you protect your new home? What type of coverage do you need in a homeowners insurance policy? What happens if you lose your job and can’t afford your monthly mortgage payments?

Believe it or not, most of your new home concerns can be relieved with insurance products. Whether you’re looking for financial protection, home insurance, disability insurance, or life insurance coverage, there are a lot of ways to protect your family and your home if you lose your job, become injured, and even after you die. But you don’t have to sort through all of your options on your own.

When it comes to figuring out what insurance products are best for you, Insurify is here to help answer all of your questions. You can use Insurify’s comparison tools to find the perfect home insurance or life insurance company and make sure you have enough coverage and the best insurance premiums.

Mortgage protection insurance, also known as mortgage protection life insurance, mortgage life insurance, or MPI, is a type of life insurance that helps cover a homeowner’s mortgage balance if they die before paying off their mortgage. Some MPI policies even temporarily cover a homeowner’s mortgage payments in case of short-term disability or job loss.

These policies provide a safety net for the homeowner’s loved ones in case of death and peace of mind to homeowners who work in dangerous professions and those with health issues. Similar to life insurance, or any insurance policy, mortgage protection insurance policies come at monthly premiums that depend on factors like the homeowner’s age and credit score. The main difference between mortgage protection insurance and traditional life insurance is that an MPI policy only covers a homeowner’s mortgage balance.

Homeowners interested in MPI policies but looking for additional coverage can purchase contract riders, or add-ons, to their policy. There are various contract rider options, including long-term disability riders and return of premium riders. A long-term disability rider will help cover the cost of a mortgage (and sometimes helps with living expenses) if a homeowner loses their job due to an injury or health issue.

Return-of-premium riders allow policyholders who outlive their MPI policy to receive a cash value refund of their premium payments in a lump sum after their policy ends. These add-ons increase your monthly premium but allow you to customize your MPI policy to fit your unique needs. The best way to make sure you’re getting a great premium with the best mortgage protection insurance company is to check the MPI provider’s AM Best rating before purchasing an MPI policy.

Many homeowners confuse MPI policies with PMI, or private mortgage insurance, policies. PMI is intended to protect mortgage lenders if borrowers don’t make their mortgage payments on time, or at all. Mortgage companies will require homeowners to purchase a PMI policy if they can’t make a down payment of at least 20 percent of their mortgage loan. These PMI payments can help homeowners qualify for a mortgage even if they don’t have a ton of money to put down up front, and these payments end once a homeowner’s mortgage loan balance is less than 78 percent of their home’s original value.

MPI, on the other hand, is meant to protect homeowners if they can’t afford their mortgage payments. These policies are not required by mortgage companies but are available to homeowners seeking extra protection.

Mortgage protection insurance policies are great for homeowners with pre-existing health conditions and those with reasons to be concerned about dying and leaving their families with the financial burden of paying off their mortgage.

If you aren’t able to purchase a regular term life insurance policy or if medical conditions leave you facing high life insurance quotes, mortgage protection insurance may be for you.

MPI policies are granted based on “guaranteed acceptance,” so it is much easier to qualify for these policies than life insurance policies because nearly everyone qualifies for MPI. An MPI policy will also ensure you have the perfect coverage amount to cover the balance of your mortgage regardless of your mortgage amount or state of health.

When deciding whether a mortgage protection insurance policy is right for you, it’s important to keep in mind that MPI is a type of life insurance. A regular term life insurance policy will also include coverage for a policyholder’s mortgage balance but provides additional coverage and more flexibility than an MPI policy, and often at a much lower cost. There are various reasons that a homeowner would choose a term life insurance policy over an MPI policy, and just as many reasons for someone to choose an MPI policy over life insurance. It just depends on your personal finance options and coverage needs.

Aside from term life insurance coming at significantly cheaper premiums for healthy adults than mortgage protection insurance, the main differences between MPI policies and term life insurance policies are their death benefits, beneficiaries, and term lengths.

Death benefits are the potential payouts available to the policy’s beneficiary after a policyholder dies. Most MPI policies ’ death benefits match the balance of your mortgage, meaning that if you die, your policy will pay off your entire mortgage—no more, no less. Some MPI policies offer level death benefits, meaning the value doesn’t decrease with your mortgage balance, but these come at higher premiums.

On the other hand, term life insurance policies allow policyholders to determine their necessary amount of coverage. This gives homeowners the freedom to include the cost of their mortgage, as well as costs like living expenses, any additional debt in the homeowner’s name, and anticipated education expenses for their children in their life insurance policy. This coverage comes with a much higher payout than an MPI policy alone, plus term life insurance policies often come at significantly cheaper premiums than mortgage protection insurance policies.

Mortgage protection insurance policies require the listed beneficiary—or the person who receives your death benefit —to be your mortgage lender. This ensures that your mortgage protection insurance company will send all mortgage payments directly to your mortgage lender until your home is paid off.

If you are looking for a policy to protect your family’s finances in the event of your injury or death, a term life insurance policy allows you to name beneficiaries who will receive and manage your death benefit. This means that you can designate a family member or friend to assist your children and dependents with handling your assets if you cannot. That way, your beneficiary can choose how to spend your death benefit, so it can cover the cost of your home and your family’s living expenses or be used as savings after your family members lose their primary source of income.

Term life insurance policies also offer more flexible term lengths than MPI policies. An MPI term length will match your mortgage (which usually comes with either 15-year or 30-year term lengths). With term life insurance, a policyholder can choose their term length. Some life insurance companies offer term lengths in 5- or 10-year increments, while others allow policyholders to choose any term length they like. Your age may also restrict your possible MPI term length, as some mortgage protection insurance companies have age restrictions. Some companies don’t allow homeowners over 45 years old to hold policies exceeding 15-year term lengths, and others don’t allow homeowners over certain ages to obtain MPI policies at all.

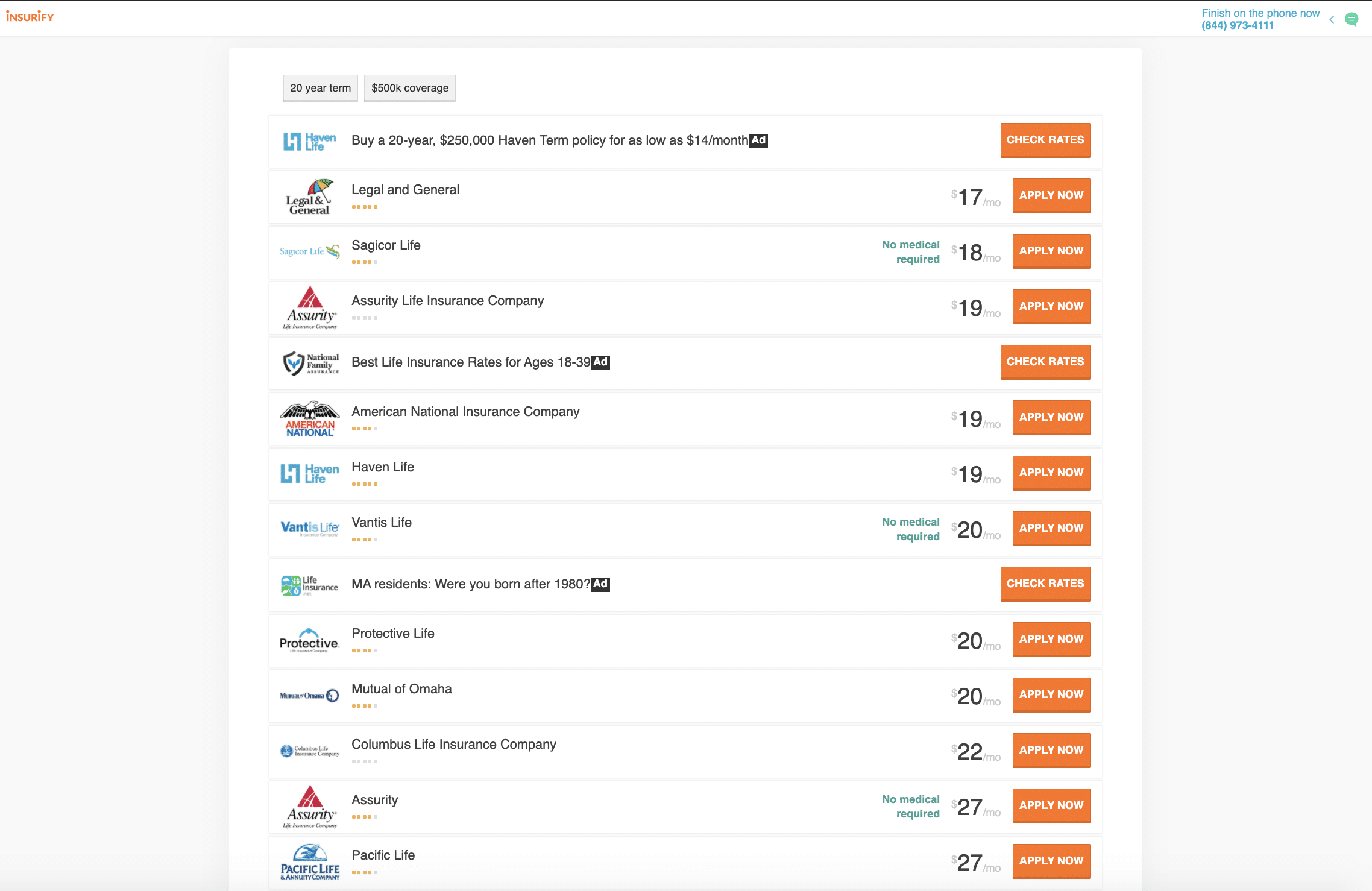

If you haven’t yet decided whether you want an MPI or term life policy, consider comparing quotes on Insurify for free.

The first and most important factor to consider when deciding whether a mortgage protection insurance policy or a regular term life insurance policy is best for you is your current state of health. If you are in good health, a term life insurance policy will likely come at a much cheaper monthly premium than an MPI policy.

But if you have existing health issues or work in a high-risk job environment, it may be difficult to qualify for a life insurance policy—at least at a good price. Homeowners aren’t required to take medical exams to qualify for an MPI policy, which makes them a much easier option for homeowners who have health concerns.

MPI policies are also easy to maintain. With mortgage protection insurance, you don’t need to worry about how much coverage you need, who to pay, or what term length will work best. Your policy matches your mortgage, and MPI providers directly pay your mortgage lender so you and your family don’t have to worry about handling money and disbursing payments.

But if your mortgage is mostly paid off or if you plan to make extra mortgage payments to pay it off faster, an MPI policy ’s price won’t be worth the payout (mostly because you likely won’t need a payout at all). If you plan to make any improvements to your home that require taking out a home equity loan, an MPI policy probably isn’t for you, either. Mortgage protection insurance only covers the initial cost of your mortgage, so if injury or death leaves you unable to pay your mortgage balance, your family will still be responsible for paying the cost of any additional loans incurred for fixing up your home.

Overall, regular term life insurance policies are the better option for homeowners who qualify for them. These policies are generally cheaper than MPI policies, offer more coverage, and allow policyholders to choose their named beneficiaries, whereas MPI policies require the mortgage lender to be the policy beneficiary.

Make sure you compare life insurance quotes on Insurify before settling on a policy!

Mortgage protection insurance covers the cost of your mortgage balance if you lose work or die. This means that your family won’t need to worry about covering the cost of your home but will still have to pay for any living expenses or additional debt out of pocket. The best way to ensure all of your family’s expenses will be covered when you’re gone is with a regular term life insurance policy.

Legally, no. Homeowners are not required to have MPI policies to purchase a home or get a mortgage. If you are concerned about your health and want to ensure that your family isn’t left responsible for the cost of your mortgage after you die, then an MPI policy might be a good option for you. But if you are in good health, a term life insurance policy will likely offer more benefits (including mortgage coverage) at cheaper premiums.

The cost of an MPI policy depends on various factors, including the policyholder’s age, credit score, and the balance of your mortgage. Some MPI policies have costs that change over time, as well, so it’s best to shop around and find various mortgage protection insurance quotes before deciding on an MPI policy.

Protecting your home and your family’s finances can be a stressful task, but finding the best insurance policy doesn’t need to be. Whether you’re looking for mortgage protection insurance or a regular term life insurance policy, Insurify can help you decide what the best insurance products are for you and find the best insurance companies to provide them. That way, you can rest assured knowing that your family is covered, even after you’re gone.

Insurance Writer

Jacklyn Walters is a personal finance writer. She has a bachelor's degree from SUNY-Buffalo and specializes in home insurance, striving to help customers make informed decisions about their insurance policies.

Learn More