Life Insurance for Young Adults | Compare Quotes

Updated April 14, 2021

Reading time: 6 minutes

Updated April 14, 2021

Reading time: 6 minutes

As a young adult, you have health insurance, car insurance, and renters insurance, but do you have life insurance?

If you’re thinking, “Isn’t life insurance just for old people?” you are mistaken. Anyone with dependents who rely on them for financial support should have a life insurance policy to ensure financial support when they pass away.

You shouldn’t wait until you’re going gray to consider life insurance, nor does shopping for it have to be time-consuming or expensive. With Insurify, you can get life insurance quotes anytime and from anywhere using its online comparison platform. Insurify makes it possible to get quotes in minutes: between classes or meetings, on the subway, or late at night while watching Netflix.

There are three main types of life insurance policies: term life, whole life, and universal life. Term life is the least expensive because it only offers coverage for the length of your policy, and when the term is up, your coverage ends.

Whole life and universal life are types of permanent coverage and will only expire if you quit paying the premiums or cancel coverage. Premiums are higher because these policies almost always result in a payout from the life insurance company.

The general rule of thumb for determining the amount of life insurance you need is to multiply your annual income by 10. Then, adjust the amount based on your current and presumed future situation.

Let’s say you make $45,000 a year, your partner makes $50,000, and you have two young children. At minimum, you’d want a $450,000 policy for yourself and $500,000 for your partner.

On the other hand, if you’re single and plan to stay that way, buying a large life insurance policy isn’t necessary. But you need to consider your future life plans and whether a partner or kids might be a part of that, and adjust accordingly.

Since term life insurance is so cheap, especially the younger and healthier you are, getting a $500,000 policy on yourself won’t be a financial burden on you. You can get another policy if you want additional coverage.

Even if you plan a future with no dependents or debts to pay, your policy can cover your funeral and burial expenses, and the rest can go to your designated beneficiary. Beneficiaries can be anyone from close friends and family members, to institutions like charities and museums.

For millennials who have student loans, remember that if you have a co-signer, they are responsible for the bill if you don’t pay. When you pass away, a federal loan that’s only in your name will be forgiven, but a private student loan or a co-signed one will still need to be paid from your estate. Consider a policy that’s large enough to pay off these loans, credit card debt, or your car loan so that your family can pay the bills easily.

Finally, if you strongly believe you have no need for a full life insurance policy, consider a final expense policy. It will be large enough to cover funeral and burial or cremation costs and will ensure that your family isn’t left to worry about coming up with the money while they are grieving.

When your term life insurance policy expires, you need to decide if you need coverage for an additional length of time or not.

By now, you’re older, so your premiums will cost more, but you can still opt for another term policy, choose a permanent life policy, or if your current term policy allows, convert it to a permanent policy.

Ideally, when you buy coverage, you will choose a term length that will provide coverage until you have enough savings or investments that your dependents will be okay without your income. For someone with, or planning on, a family, buying a 25- or 30-year term policy at age 25 will cover you during the years your partner and kids are most reliant on your income. By the time you’re 55, your kids are now young adults and no longer dependent on your financial support.

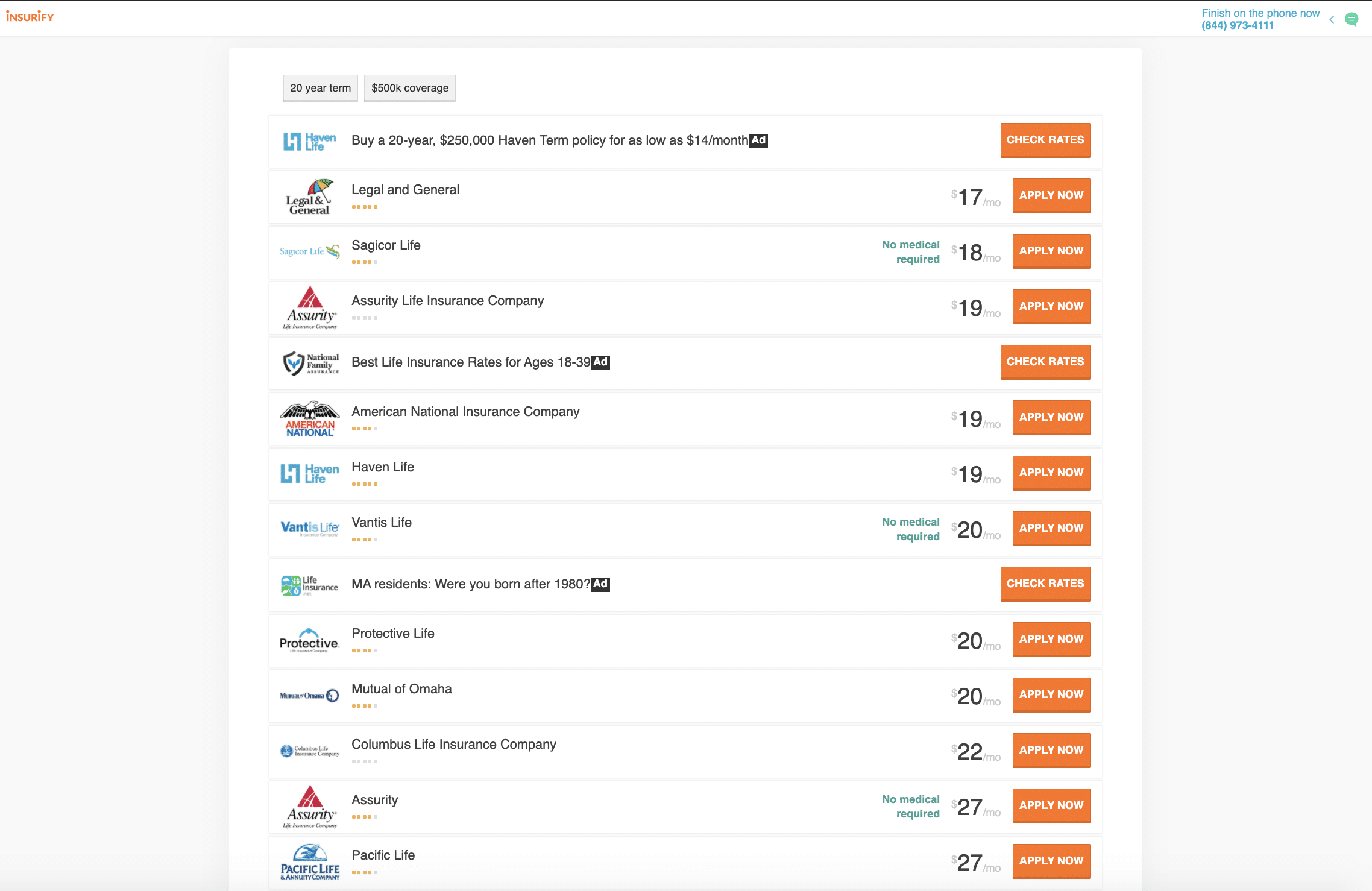

You can find out just how affordable life insurance is with Insurify’s comparison tool. In less time than it takes to order pizza, you can have a list of a dozen quotes from companies that will insure you.

Generally speaking, whole life and universal life policies are not ideal for young adults because they are permanent life insurance policies, which cost more because they offer lifetime coverage.

The added cash value benefit from a whole or universal policy doesn’t outweigh the savings you’ll get from buying a term life policy and investing the difference into an index fund. Additionally, upon death, your beneficiaries will only receive the face value of your life insurance policy. So, if you have a $500,000 policy with $15,000 of built-up cash value on the policy, your heirs still won’t get more than $500,000.

Few young adults are best served by a permanent policy. One exception is if you are a cancer survivor or have a medical issue that will prevent you from getting life insurance that requires a medical exam. Look for a guaranteed issue permanent policy that will insure you until you no longer have dependents who will rely on you financially.

Another situation in which a whole life or universal life policy would be beneficial is if you have a child who will need your financial support even as an adult. You can work with a financial planner to get advice on structuring your estate plan and assigning a beneficiary.

Here’s a quick look at the cheapest term life insurance quotes for young adults, for a 10-year term:

| Company Name | Average. Cost of Life Insurance |

|---|---|

| MassMutual | $9.86 |

| Mutual of Omaha | $12.63 |

| Bestow | $19.67 |

| Sagicor Life | $19.67 |

| Haven Life | $27.22 |

| Assurity | $31.88 |

| Penn Mutual | $32.03 |

| Pacific Life | $41.14 |

| American National | $44.90 |

| Vantis Life | $51.72 |

Use Insurify’s comparison tool to get a customized quote for your own life insurance policy.

Life insurance companies offer similar products, but some offer more specialized options. As a young adult, you will care less about a guaranteed issue or accelerated death benefit rider and more about price and coverage that will prevent your loved ones from experiencing financial hardship when you pass away.

The largest life insurance company in the United States, Northwestern Mutual has many life insurance options for millenials. One financial product that they offer is a term life insurance policy that converts to a permanent policy with no medical exam. This is a great way to take advantage of low life insurance premiums with the assurance of financial protection as you get older and without worrying about a health issue affecting your ability to get coverage in the future.

A huge name in the life insurance industry and one with an excellent financial strength rating, Guardian has a variety of life insurance products for which it offers underwriting. It offers an option to convert a term policy to a permanent one, as well as an add-on rider for waiver of premiums if you get a disability. It also offers a unique policy designed for individuals who have been diagnosed with HIV and may not be eligible for a policy with another insurer.

When buying life insurance, a 20-year term policy may be enough, but you might want to consider extra coverage. One area where Proactive stands out is with riders that can be added to term life, whole life, or universal life policies. Riders are add-ons to your policy that will slightly increase your cost of life insurance to offer additional coverages. You can get a rider to cover the final expenses of your kids or an accidental death rider, which gives your beneficiaries additional funds if your death is caused by a covered accident.

With over 100 years in business, AIG is a leader in the life insurance industry. One interesting fact about its term life insurance policies is that they can be converted to permanent life policies. Young people can more easily afford the low monthly premiums associated with a term policy. But if you want to continue coverage, you can have the policy and premium payment modified to give you permanent coverage.

When you purchase life insurance from Transamerica, you have many options at competitive rates, especially if you’re a non-smoker and in good health. One unique policy that it offers is a term policy with living benefits. This means that you, the policyholder, can take an advance payout on your policy if you have a terminal illness.

By now, you know the importance of having life insurance so that you leave behind enough money to provide for your dependents. Once you determine the best type of life insurance for your needs and coverage amount, Insurify is ready to help you get quotes from 10 or more life insurance companies.

Answer the simple questions and instantly get quotes from the nation’s top insurers. Compare them all in one place to find the one that’s best for you. Within minutes, you can begin the application process and have coverage today.

Insurance Writer

Charlotte Edwards is a freelance writer with a passion for educating others in the areas of personal finance, health, and education. An educator-turned-writer, she has written for publications worldwide over the past decade. In her spare time, she enjoys reading, watching classic movies, and spending time with her husband and two children. You can learn more about her work and life abroad at www.livinginchinawithkids.com.

Learn More