4.8out of 3,000+ reviews

Updated August 4, 2022

Since its inception in 1864, Minnesota-based Travelers has earned a reputation as a leading car insurance company. If you have a Travelers auto policy but are no longer satisfied with it, don’t worry. As a policyholder, you have the right to cancel and move on to a different car insurance provider.

You may do so to save money on premiums or lock in a bundling discount with your homeowners insurance company. No matter why you decide to terminate, check out our car insurance comparison tool to help you find a new policy. It’s free, and there’s no need to sign up, so you have nothing to lose.

Quick Facts

You can terminate your Travelers auto coverage by phone, via mail, or in person.

In most cases, Travelers won’t charge a cancellation fee.

It’s important to secure a new car insurance plan before you leave Travelers.

Table of contents

- Travelers Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- Travelers Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving Travelers

- Step 4: Secure a New Policy

- Step 5: Cancel Your Travelers Policy

- Step 6: Follow Up on Your Refund

- Canceling Your Travelers Policy

- Frequently Asked Questions

Travelers Cancellation Policy

How do I cancel my Travelers car insurance policy?

You can cancel a policy with Travelers by calling their customer service support line or by meeting with a local agent. However, it’s a good idea to line up another car insurance policy first to ensure you don’t see a lapse in coverage.

Just like all auto insurance companies, Travelers hopes you stay with them forever. However, the provider knows that things change and some policyholders will want to terminate eventually. Fortunately, they make the cancellation process fairly simple. You may call Travelers, send a letter in the mail, or meet a local agent in person.

Depending on when you cancel, Travelers may charge you a cancellation fee. Don’t hesitate to contact Travelers customer service phone number at 1 (800) 842-5075 for more information on the termination policy and whether you’ll be responsible for any fees.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

First and foremost, you need to find out your renewal date. This is based on when your auto insurance went into effect and your policy term. Your plan will likely renew every six months. You may look for your renewal date on your printed or digital Travelers insurance ID card. Another option is to log in to your online account or contact an agent.

So why is your renewal date so important? If you cancel as close to your renewal date as possible, you can avoid a gap in coverage. By doing so, you’ll be able to prevent serious financial consequences in the event of a car accident. You’ll also ensure you’re driving legally, as most states require auto insurance coverage.

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

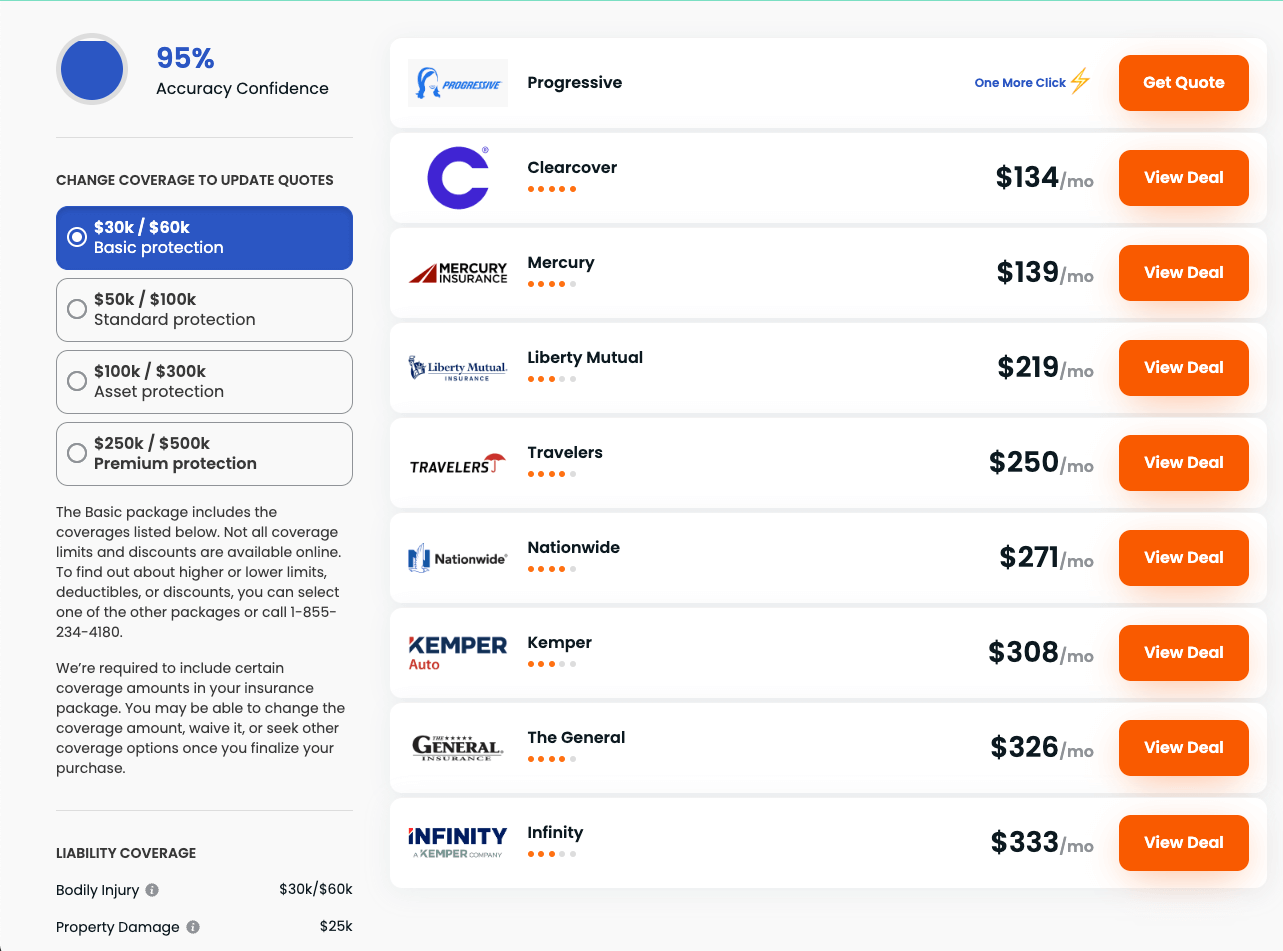

There is no shortage of car insurance companies on the market. Since each provider offers its own unique coverage options, deductibles, discounts, and premiums, it’s essential to shop around for a new policy. You can visit various websites and read auto insurance reviews. But this strategy will take a lot of time and effort.

Let Insurify simplify the auto insurance shopping process. Once you answer a few questions about your vehicle and driving history, this intuitive tool will send you personalized car insurance quotes from leading providers, like Progressive, Liberty Mutual, Allstate, and State Farm. If you find an offer you like, Insurify will take you directly to the company’s website so you can enroll.

Travelers Quotes vs. Competitors

| Insurance Company | Average Monthly Quote |

|---|---|

| Travelers | $81 |

| GEICO | $52 |

| State Farm | $50 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Amica | $105 |

| Esurance | $114 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Erie | $52 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| National General | $139 |

| NJM | $64 |

| Mercury | $114 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving Travelers

While Travelers auto insurance has its pros, like various coverage options and the chance to work with an agent, it’s not perfect. It’s earned below-average customer satisfaction ratings and has an outdated mobile app. Before you terminate your Travelers policy, think about why you’re doing so.

It might be because of the bad customer service or the poorly designed app. Or you may want to leave because you’ve scored a great bundling discount with the company you use for home insurance, renters insurance, or life insurance. Or perhaps you found much lower auto insurance premiums elsewhere.

You don’t have to inform Travelers of your reasoning for leaving if you don’t want to, even though your agent will likely ask. However, if you hone in on it, you can simplify your search for a new car insurance policy because you ’ll know exactly what to look for in a new provider.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

Don’t cancel your Travelers car insurance until you use Insurify, compare your coverage options, and lock in a new policy with a different insurance agency. If you do terminate before you have a new plan in place, you may put yourself at risk, as it’s illegal to drive without car insurance in every state except for New Hampshire.

Also, if you cause an accident that results in property damage and injuries, you’ll be responsible for hefty out-of-pocket costs that can wreak havoc on your finances. With a new car insurance policy, you can avoid these situations and gain the peace of mind that comes with being an insured driver.

Step 5: Cancel Your Travelers Policy

Once you’ve used Insurify to find a new car insurance policy, it’s time to terminate your current plan. Before you go through the process and cancel your Traveler’s auto insurance, however, make sure you have the following information on hand:

Your first and last name

Your policy number

Details on your new plan and its effective date

The easiest way to terminate your policy is via phone. Simply call Travelers customer service at 1 (800) 842-5075, and a representative will help you out. Another option is to meet with a Travelers insurance agent in person or send a letter in the mail to this address: Travelers, PO Box 5600, Hartford, CT 06102. Allow a few weeks for processing if you choose the mail route[1].

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

Depending on how you paid for your Travelers car insurance and when you cancel it, you may qualify for a refund for the unused portion of your policy. When you go through the termination process, make sure you ask the customer service representative or agent whether you’ll receive a refund.

If Travelers does owe you a refund, find out how the company will distribute it. They might send a check in the mail or deposit the correct amount to your account. Don’t hesitate to reach out for a status update if you don’t receive your refund within a few weeks of canceling.

Canceling Your Travelers Policy

In a perfect world, Travelers would meet your car insurance needs until the end of time and you wouldn’t have to switch to a different car insurance provider. The reality is that life happens and auto coverage that might have worked for you in the past may no longer be the best option. Canceling your Travelers policy can be a great choice, as long as you find the ideal plan to replace it.

With our intuitive car insurance comparison tool, you can shop around, compare auto insurance rates, and discover a policy that works well for your unique budget, driving habits, and circumstances. You’ll enjoy access to personalized quotes in minutes without any sign-ups or payments.

Frequently Asked Questions

Whether you’ll be on the hook for a cancellation fee will depend on when you terminate your Travelers plan. In most cases, however, you won’t have to pay a fee. Travelers may even owe you a refund for the unused portion of your policy. Feel free to double-check with a customer service representative or agent.

The best way to find a new car insurance provider is through an online quote-comparison tool like Insurify. All you have to do is answer a few basic questions. You’ll receive personalized quotes in minutes for free. No matter how you look for new coverage, enroll in it before you cancel to avoid a gap in coverage and the consequences that come with it.

You can use your online account to manage your existing Travelers car insurance policy. But the auto insurance company does not allow you to cancel online at this time. You may call customer service, meet with a Travelers agent in person at a nearby location, or send a letter in the mail. The fastest way to cancel is to call customer service.

It would be convenient to be able to pause a month or two of your Travelers car insurance plan. Unfortunately, however, this is not an option. You’re responsible for paying your premiums or canceling your policy. Keep in mind that if you fail to make your payments, Travelers might cancel your plan on their own.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Sources

- Travelers. "Car Insurance FAQs." Accessed May 10, 2022