4.8out of 3,000+ reviews

Updated August 4, 2022

Headquartered in Rhode Island, Amica Mutual Insurance company has a stellar reputation in the car insurance industry. It also offers no shortage of discounts and perks as well as the potential to earn dividends. If you have an Amica auto insurance policy, however, you don’t have to stick with it forever. In fact, you can cancel it at any time if it no longer meets your needs.

Before you do terminate your Amica car insurance, don’t forget to find a new plan. With this handy car insurance comparison tool, you can receive personalized quotes from leading car insurance companies, like Progressive, Allstate, and State Farm. Best of all, there are no fees or sign-ups, and your credit score won’t be affected. You truly have nothing to lose.

Quick Facts

To cancel an Amica car insurance policy, you’ll need to call the customer care line.

If you terminate mid-term, you may be on the hook for a $25 fee.

Be sure to enroll in a new car insurance plan before you officially cancel with Amica.

Table of contents

- Amica Cancellation Policy

- Step 1: Look Up the Renewal Date

- Step 2: Compare Car Insurance Quotes

- Amica Quotes vs. Competitors

- Step 3: Think about Why You’re Leaving Amica

- Step 4: Secure a New Policy

- Step 5: Cancel Your Amica Policy

- Step 6: Follow Up on Your Refund

- Canceling Your Amica Policy

- Frequently Asked Questions

Amica Cancellation Policy

How do I cancel my car insurance with Amica?

To cancel an auto insurance policy with Amica, you can call their customer care line. Not that if you cancel in the middle of your policy term, you will have to pay a flat fee.

While Amica hopes that its policyholders stay with them, the company understands that life happens and sometimes termination makes sense. Fortunately, its cancellation process couldn’t be any easier or more straightforward.

To cancel your policy, call the Amica customer care line at 1 (800) 242-6422 on any weekday from 6 a.m. to 1 a.m. ET or weekend from 7 a.m. to midnight ET. Once you do, a customer service representative will ask you a few questions and process your cancellation request.

When you do call to cancel your car insurance, make sure you have your policy number on hand. You can find this info on your auto insurance card or online by logging into your account. Also, be prepared to pay a flat, non-refundable fee of $25 if you decide to cancel in the middle of your policy term.

Compare Car Insurance Quotes Instantly

Step 1: Look Up the Renewal Date

Since Amica does charge a $25 cancellation fee if you cancel your policy early and switch car insurance companies, it’s important to know your renewal date, which you can find on your car insurance ID card. By doing so, you can be strategic about when you terminate and potentially avoid the fee. Ideally, you’d cancel as close to the end of your policy as possible.

Your renewal date will also come in handy when you purchase a different auto insurance plan. This is because the new provider will want to know when your current policy ends so you can avoid a lapse in coverage, which can be a serious issue if you get involved in an accident and are responsible for the property damage.

See More: Cheap Car Insurance

Step 2: Compare Car Insurance Quotes

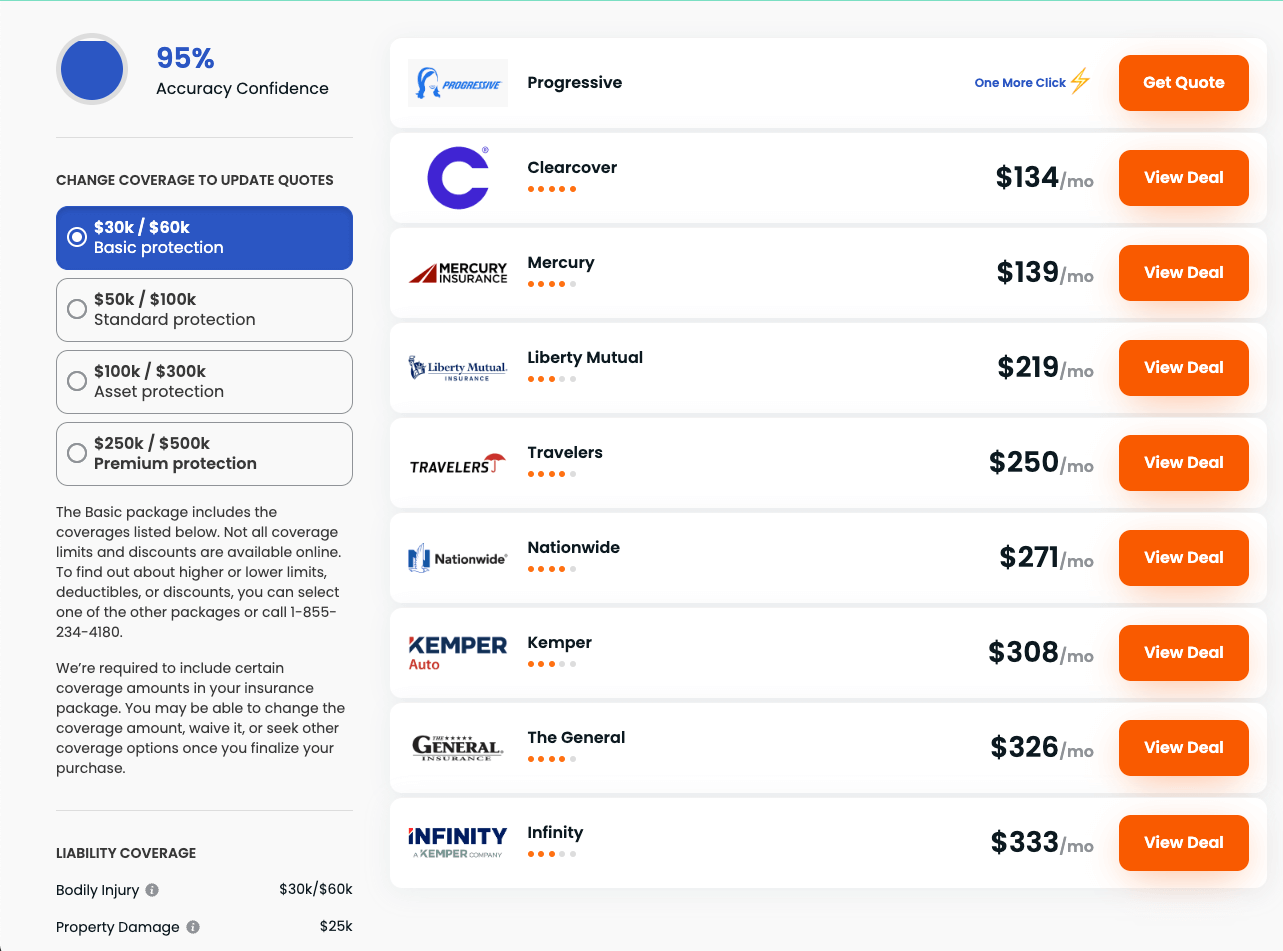

Once you decide that you want to cancel your Amica car insurance, do your research so you can find the best new policy for your particular budget and needs. While it may be tempting to only look at well-known car insurance companies, like GEICO, USAA, and Liberty Mutual, you should also explore smaller options, such as American Family and Metromile.

Insurify can take the time and hassle out of car insurance shopping. Simply fill out a short form and compare auto insurance coverage options and rates in minutes. If you come across a provider that piques your interest, Insurify will provide you with their contact information so you can learn more or move forward with your purchase.

Amica Quotes vs. Competitors

| Insurance Company | Average Monthly Quote |

|---|---|

| Amica | $105 |

| GEICO | $52 |

| State Farm | $50 |

| Allstate | $62 |

| Liberty Mutual | $216 |

| Farmers | $140 |

| USAA | $149 |

| Nationwide | $97 |

| The General | $197 |

| Metromile | $93 |

| Costco | $84 |

| Wawanesa | $66 |

| Erie | $52 |

| Esurance | $114 |

| AssuranceAmerica | $225 |

| American National | $117 |

| Good2Go | $86 |

| Hallmark | $151 |

| West Bend | $43 |

| Commonwealth Casualty | $228 |

| Infinity | $272 |

| Mercury | $114 |

| Clearcover | $172 |

| AARP | $112 |

| AAA | $118 |

| Safeco | $173 |

| Elephant | $148 |

| Dairyland | $209 |

| National General | $139 |

| NJM | $64 |

| Travelers | $81 |

| SafeAuto | $102 |

| Safeway | $106 |

| Auto Owners | $60 |

| The Hartford | $112 |

| Alfa | $112 |

| COUNTRY Financial | $54 |

| Grange | $103 |

| The Hanover | $248 |

| Shelter | $88 |

| Westfield | $55 |

| Bristol West | $231 |

| Root | $82 |

| Noblr | $171 |

| Amigo USA | $77 |

| Kemper | $280 |

| Freedom National | $216 |

| Safety | $104 |

| Milewise | Cost determined by miles driven per month |

| Freeway | Varies based on the company a driver is matched with |

Step 3: Think about Why You’re Leaving Amica

Amica has earned high customer satisfaction ratings from J.D. Power and fewer-than-expected complaints for an auto insurance company of its size. Therefore, you’ll likely want to leave because of the cost of your premium, not the customer service.

While this is a valid reason, it may be worth your while to speak to Amica about any discounts that can lower your car insurance rate. If price isn’t your motivator for leaving, it might be because you’re moving to a state like Alaska or Hawaii and the policy you’d like isn’t available there.

You may also decide to terminate because your driving habits have changed and you prefer a pay-per-mile plan that will save you more money in the long run. In addition, you may score a bundling discount with your homeowners insurance company. Regardless, be sure to hone in on why you’re leaving Amica and its high financial strength ratings for a new insurance provider.

See More: Best Car Insurance Companies

Step 4: Secure a New Policy

After you’ve used Insurify to compare auto insurance and find the perfect policy, it’s time to purchase. The tool will take you directly to the company’s website so you can complete the enrollment process right away. With Insurify, you don’t have to jump through hoops to secure a new policy. It was designed to make your life as easy as possible.

You may be wondering why you’d invest in a new plan before you cancel your old one. Since most states require car insurance to drive legally, this strategy will ensure you follow the law. It will also help you avoid a gap in coverage, which can leave you financially responsible for an accident.

Step 5: Cancel Your Amica Policy

You’ve shopped around, compared auto insurance rates and deductibles through Insurify, and found the right policy for your new circumstances. Now, you can go ahead and finally cancel your policy. To do so, call the Amica customer care line at 1 (800) 242-6422 and speak to a customer service representative who can stop your autopay and finalize your cancellation.

Make sure you have your policy number nearby, as the representative will ask you for it. You can find it on your ID or through the mobile app. Note that Amica may also try to keep your business by offering you a lower rate or a special good student or safe driver discount, so be prepared for a small sales pitch. Remember, it’s your right to cancel, so don’t feel obligated to stay.

See More: Compare Car Insurance

Step 6: Follow Up on Your Refund

If you cancel your car insurance policy in the middle of the term, you may be owed a refund for the unused portion of the insurance cost, minus the cancellation fee. When you terminate your plan via phone, make sure to ask how much your refund will be as well as when and how you’ll receive it.

Check your bank account or credit card statement often to find out if your refund has been processed. If you don’t get your refund within a few weeks after canceling, don’t hesitate to call customer care for a status update.

Canceling Your Amica Policy

While Amica may have been the best choice for you in the past, it’s perfectly okay if things have changed and you want a policy from a different provider. It’s your right as a consumer to cancel and move on if you’d like. Thanks to our car insurance quote comparison tool, the process of finding a new plan is a breeze.

Frequently Asked Questions

If you cancel in the middle of your auto insurance policy, Amica will likely charge a $25 cancellation fee. To avoid the fee, do your best to terminate as close to your renewal date as possible. No matter when you decide to cancel, make sure your new policy’s start date aligns with your current policy’s end date.

There’s no denying that Amica is a reputable car insurance company. It’s a particularly good option if you’re a safe driver and can qualify for many of its discounts. You may also benefit from Amica if customer service is your top priority. However, whether you should continue your auto insurance coverage with the company depends on your unique circumstances.

Even though you might not be interested in Amica’s car insurance anymore, you might want to consider its other insurance products. These include umbrella insurance, renters insurance, condo insurance, and home insurance. Amica also offers health insurance, small business insurance, and life insurance plans. You can visit Amica.com to learn more about its offerings.

Before you search for a better car insurance plan, you need to establish what the word “better” means to you. It may mean lower rates, a faster insurance claims process, more robust roadside assistance, glass coverage, an accident forgiveness program, or pay-per-mile options. Once you determine what you’re looking for, you can use Insurify to compare coverage limits.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.