Homeowners Insurance Canceled Because of the Roof? Consumer Guide

Updated June 4, 2021

Reading time: 4 minutes

Updated June 4, 2021

Reading time: 4 minutes

our home insurance company can cancel your policy for many reasons, including the quality of your roof. If you've been canceled because of a faulty roof, you should compare quotes from other companies to find a new, even better rate.

Is your insurance being canceled because you didn’t do repairs? If you’re about to lose your insurance because you didn’t comply with your insurer ’s recommendations, you may still be able to salvage your coverage. Here’s how.

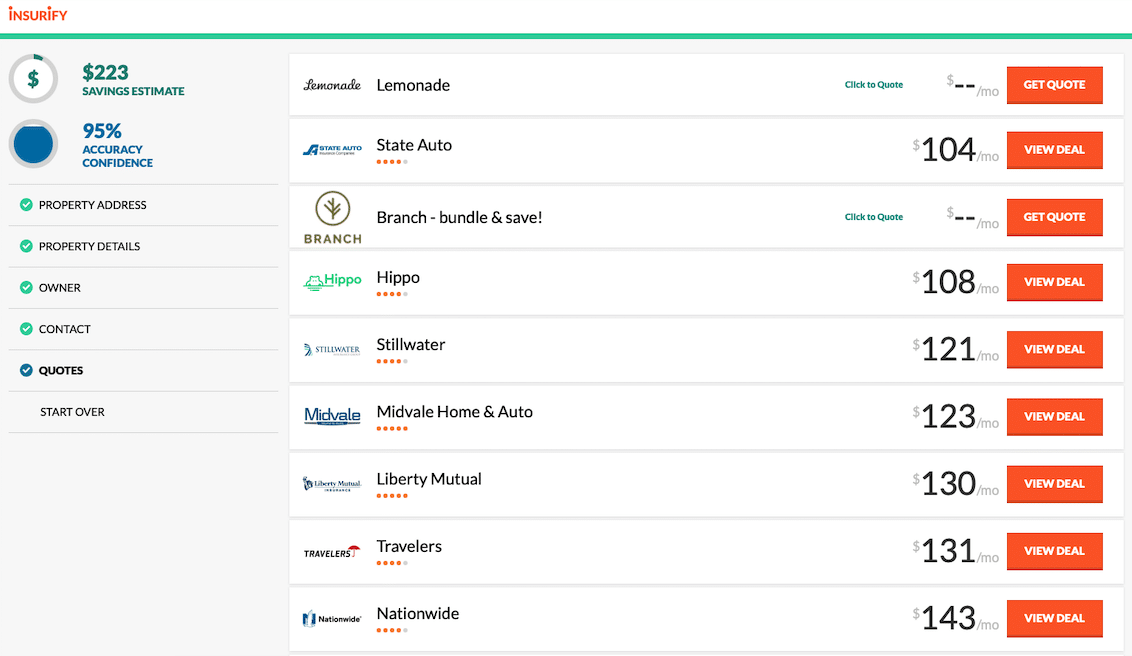

Need to find a new homeowners insurance policy? Insurify can help you find the quotes you need from multiple insurance providers. It’s easy to use and only takes a few minutes.

There are a few common reasons that insurance companies require you to do repairs on your home. They may have spotted liability issues or problems with the home’s general maintenance or safety during an inspection.

The insurance carrier may also take issue with the way you answered some questions when you applied for insurance—for example, noting that your home has an old roof or outdated plumbing. You may need a new roof before an insurance agent is willing to take on underwriting a policy. The homeowners insurance company may also become aware of a risk when you file a claim about something else; it’s common for them to make suggestions on how you can prevent having to file further claims. Insurers are looking for anything that could become a risk for the property or the people in it, especially if it doesn’t comply with today’s construction standards.

Some of the most common requested repairs include:

A roof that’s old or damaged

Tree branches hanging over the house that could fall and damage the roof

Broken windows

Aging electrical wiring

Stairs that don’t have a handrail

Note that not all repairs are mandatory. When the insurance company issues a recommendation, you should ask them if it’s mandatory or suggestive. Mandatory repairs are required, but suggestive repairs are more like tips and won’t put your policy at risk.

When the insurance company tells you a repair is mandatory, they expect you to take care of it quickly. If you don’t comply or simply don’t provide the proof they need within the timeline they give you, two things can happen. You may receive a non-renewal notice, which means your policy will be canceled on its renewal/expiration date. If the situation is serious enough, they may even cancel your policy mid-term, which means it’s canceled immediately rather than when it expires.

This can put you in a bad spot. Not only will you be unprotected if something happens to the house, but your mortgage lender will take exception to this situation, too. Homeowners insurance is usually required to have a mortgage. Not having insurance may also affect your insurance score, which can drive up your insurance premiums later.

Are you facing a notice of cancellation because the insurance company is requiring repairs? Start by getting a second opinion from a licensed professional. If the insurance company is saying the roof on your older home is too aged at 20 years old, for example, bring in a professional roofer and have them do a roof inspection. A licensed electrician can weigh in on whether the wiring in your home is really as dangerous as the insurance company is saying. This can help you present a stronger argument to the insurance company.

If the professionals agree with the home insurance company, then you need to make the repairs or replacements necessary to restore your home insurance policy, whether that means new shingles or an updated electrical system. No insurer will want to cover you if your home has an older roof that needs to be replaced because there’s a high risk they’ll have to pay out for damages. Water damage to a home’s interior is very common with a bad roof, and a windstorm coupled with an old roof could do serious damage to your home. Address all the unacceptable risks that your insurer points out.

If you feel the home insurance cancellation is unjust, you can file a complaint with your state’s department of insurance. In the meantime, you need to find a new insurer. If your old insurer won’t take you back, start shopping around. You likely can find another underwriter to issue you an affordable policy with a fair deductible, though you may be facing slightly higher premiums. Insurify is great for this since it helps you filter the best insurance industry options in a short period of time.

Can’t find affordable insurance coverage? See if your state offers any relief. Many states have Fair Access to Insurance Requirements (FAIR) plans. FAIR plans are part of a government program that helps high-risk homeowners find basic coverage. These policies don’t cover as much as private plans do, and they tend to be expensive. But if you can’t get anything else, they’re a good last resort to find coverage and satisfy your mortgage lender ’s requirements.

If you can’t get your old policy back, talk to your neighbors and find out which insurance companies they use. Explore Insurify to get quotes from multiple insurers. You can also call your state insurance department, which can give you a list of insurers that underwrite policies in your area.

If your home insurance is canceled or you receive a non-renewal notice, you need to get a new policy as soon as you can. If you don’t, you risk defaulting on your loan. Your mortgage lender may also find an insurer for you, but you should try to avoid this because lender-placed policies are usually more expensive and less comprehensive than a policy you could find yourself.

There are many reasons insurance carriers may cancel or non-renew insurance policies. Some of the most common ones are too many insurance claims or a claims history that’s too expensive, non-payment of premiums, bad credit, living in a high-risk area with a lot of natural disasters or crime, or owning certain dog breeds.

You can keep your homeowners insurance from being canceled or non-renewed by taking good care of your home. But if you receive a cancellation or non-renewal notice, you may still be able to find the coverage you need to protect your biggest investment.

Need to find a new insurance company? Start by exploring a home insurance comparison site like Insurify. Find the home, life, and auto insurance you need with this simple tool, which takes just a few minutes to use.

Jackie Cohen is an editorial manager at Insurify specializing in property & casualty insurance educational content. She has years of experience analyzing insurance trends and helping consumers better understand their insurance coverage to make informed decisions about their finances.

Jackie's work has been cited in USA Today, The Balance, and The Washington Times.

Learn More