4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Companies for SR-22 Insurance in Hawaii (2022)

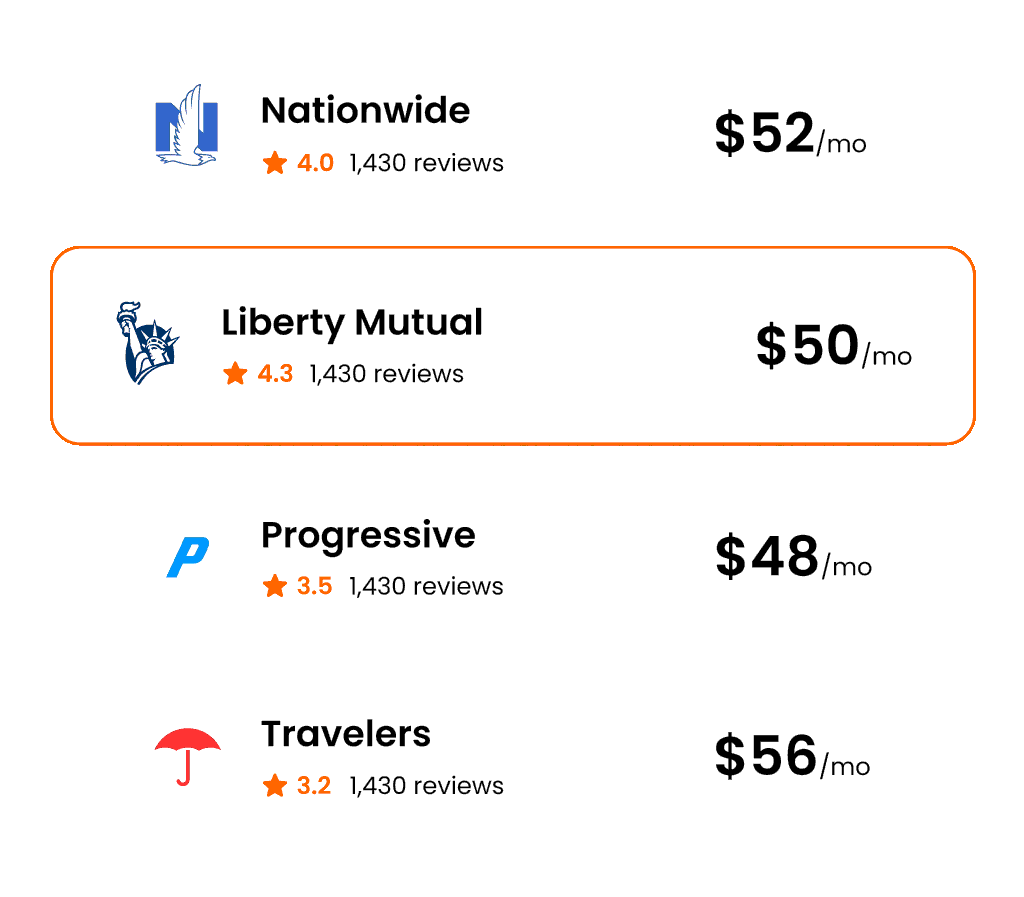

For drivers with SR-22 in Hawaii, it’s important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate after an SR-22.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Hawaii. The following are the best insurance rates from carriers that offer car insurance for drivers with an SR-22 in Hawaii.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| Farmers 21stCentury | $142 |

Table of contents

- How Much Does SR-22 Insurance Cost in Hawaii?

- What Is an SR-22, and Who Needs One in Hawaii?

- How Much Does Credit Score Affect SR-22 Insurance Costs in Hawaii?

- How to Find the Best SR-22 Insurance Rate in Hawaii

- Non-Owner SR-22 Insurance in Hawaii

- Alternatives to an SR-22 in Hawaii

- Frequently Asked Questions

- Compare Top Auto Insurance Companies

How Much Does SR-22 Insurance Cost in Hawaii?

Usually, insurance companies charge about $25 for filing the SR-22 with the state or DMV. In Hawaii, there's also a $20 reinstatement fee.

The good news is that Hawaii has the cheapest car insurance prices in the nation. So drivers with no violation start at the low rate of $113, and then the price gets kicked up by $37 to $150 per month on average. Although the increase is a 33 percent change, the final price is still cheaper than the premiums in most states.

Insurify's comparison tool will help you make sure you're getting the best possible quote even after an SR-22. You can have peace of mind that you're reviewing all of your available insurance options and can confidently choose the one that is best for your situation.

What Is an SR-22, and Who Needs One in Hawaii?

Maybe you got pulled over and ended up with a ticket for driving without insurance, a DUI, or other serious offense that took away your driving privileges. In Hawaii, you will now you need an SR-22. It's a form the insurance company files on your behalf with the state to prove that you meet the minimum coverage the law requires.

In Hawaii, the SR-22 is not a type of insurance, and it doesn't make your rates sky-high. It's simply paperwork, and the violation or conviction that led to it is what raises prices. To get back behind the wheel, shop around for companies that help SR-22 drivers.

Compare Car Insurance Quotes Instantly

How Much Does Credit Score Affect SR-22 Insurance Costs in Hawaii?

Hawaii is one of the few states that prohibit using credit when setting rates. That means other factors, such as location and insurance history, may explain why those with better credit seem to generally pay less. The average price increase for an SR-22 across the board is about $30. And $31 is the difference between having poor and excellent credit as an SR-22 driver.

| Credit Tier | Avg. Monthly Rate - No Violation The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Avg. Monthly Rate - SR-22 The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Difference |

|---|---|---|---|

| Excellent | $114 | $141 | $27 |

| Good | $127 | $158 | $30 |

| Average | $128 | $159 | $31 |

| Poor | $139 | $172 | $33 |

How to Find the Best SR-22 Insurance Rate in Hawaii

How do you find the best SR-22 rate without the headache? No one wants to spend countless hours visiting insurance agents, calling customer service reps, or searching websites. Insurify takes the pain out of the process and allows you to compare quotes for your unique driver profile in just a few minutes. When everything else about the SR-22 procedure costs money, you'll be glad Insurify's online quote-comparison tool is absolutely free.

Non-Owner SR-22 Insurance in Hawaii

Even if you don't own a vehicle, you'll still need to meet the law's SR-22 requirements. You should check out non-owner policies. They are much cheaper than standard car insurance policies because they're designed for occasional driving only. Perfect candidates include people who use rentals or periodically borrow vehicles from people outside their household.

Alternatives to an SR-22 in Hawaii

If you have the cash, you can post a surety bond with the state or get a certificate of self-insurance. Then, you let them keep the money for the three years while you meet your SR-22 requirement. If that sounds too expensive, you can always buy traditional insurance and have the company file an SR-22 on your behalf.

How Do I Get SR-22 Insurance in Hawaii

The first thing you want to do is find an insurance company with a reasonable rate. Once you find one that fits your budget, you can ask them to file the paperwork for you. Insurify's free quote-comparison tool can help you find the right company and unlock the savings and discounts you need to make the price affordable, all in just a few minutes.

Frequently Asked Questions

The state will decide just how long you need an SR-22, depending on your conviction. The typical minimum is three years, while some serious offenses can require longer periods.

Your SR-22 requirements will follow you to the next state. Because states have different minimum coverage levels, you can expect your price to change. So relocation is a smart reason to compare quotes and coverages to find your new home state's best rate.

Yes, even if you don't own a car, you'll need an SR-22 to reinstate your license. Each month you have insurance gets you one step closer to meeting the three-year requirement. A non-owner policy is a cost-effective way to make the state happy and not break the bank.

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.