Hartville Pet Insurance: Is it the right choice?

Updated January 11, 2021

Reading time: 8 minutes

Updated January 11, 2021

Reading time: 8 minutes

Pet parents looking for behavioral issue coverage

Pet owners looking for accident-only coverage

Owners looking for wellness add-ons

Pets with cured pre-existing conditions, other than knee or ligament issues

Pet owners looking for dental disease coverage

Pet parents looking for the cheapest rates.

Most families across the United States have opened their doors to new furry family members. The pet healthcare industry has been on the rise for the last few decades, and that’s because everyone knows that pet parents would do anything for their furry friends. While there might be a debate about pet-friendly hair dye, food brands, and the safest toys, every pet owner can agree that access to quality vet care is essential. Still, as medicine continues to advance, it also gets more expensive. That means when unexpected accidents and illnesses happen, they can get costly very quickly.

That is why so many new pet parents turn to pet insurance policies to provide extra peace of mind when it comes to guaranteeing the best care. One out of every three pets will need some kind of critical care every year, which doesn’t bode well for multi-pet families. Just like human health insurance, pet insurance can help pay for vet bills. Finding the best pet insurance policy for you and your pet can mean the difference between receiving the best possible vet care and potentially going into debt.

Every family wants what’s best for their furry friends. Whether they’re dealing with hereditary conditions, the common cold, or even cancer, pets can benefit from pet insurance in almost every instance of vet care. Some owners simply cannot afford a substantial vet bill, which can lead to improper treatment or even economic euthanasia.

Buying a pet insurance policy can mean saving up to 100 percent on qualifying vet bills for critical care, surgery, rehabilitation, and even behavioral treatment.

Unfortunately, all dogs and cats will need vet care at some point, and everyone knows the importance of accessing the best possible healthcare.

Finding the best pet insurance policy can mean continuing a long and happy life with your beloved pet. Compare pet insurance policies and get a quote today with Insurify .

Hartville offers comprehensive pet insurance and accident-only policies in all 50 states.

The company doesn’t require new policyholders to undergo a vet exam before enrollment in any plan. However, submitting any claims gives Hartville the right to access all of a pet’s medical records. That allows Hartville to determine any pre-existing conditions, which it won’t cover. If policyholders do not disclose this information, Hartville may deny claims.

Hartville’s comprehensive insurance brand offers to reimburse pet parents for accidents and illnesses. Policyholders can adjust the monthly premium by changing the maximum annual limit, reimbursement percentage, and deductible. The coverage includes prescriptions, stem cell therapy, and end of life expenses.

That means Hartville will reimburse you if your dog or cat needs any unexpected, expensive medical procedures. Treatments for conditions like cancer, kidney disease, or FIV can get pricey, and having an excellent insurance policy in your corner can mean a world of difference. Hartville will also help with more common accidents and illnesses like broken bones, heartworm, poisonings, or diabetes.

Unfortunately, Hartville will not cover pre-existing conditions but will reinstate coverage for “cured” conditions. No traditional pet insurance companies cover pre-existing conditions, but alternatives like Pet Assure or Pawp offer coverage. Hartville will also not cover preventative care, breeding costs, cosmetic procedures, dental cleanings, or organ transplants.

Policyholders can adjust factors of the complete coverage plan to change the monthly cost. Typically, lessening the amount of coverage lowers the monthly premium. Pet parents can choose a maximum annual payout between $5,000 and $20,000, or an unlimited amount. They can also pick a coinsurance rate of 10 percent, 20 percent, or 30 percent. Coinsurance is the amount of the vet bill pet owners pay out of pocket. Pet parents can also change the annual deductible, which is the amount that they must pay toward vet bills before receiving any reimbursements. They can choose $100, $250, or $500.

Pet parents with younger, healthier pets may want to consider buying an accident-only policy. These plans are perfect for families who aren’t as worried about expensive illnesses but still want coverage. Hartville will pay for fees related to car accidents, foreign object removal, or lacerations. These plans are also significantly cheaper compared to full coverage policies.

Policyholders can again adjust the amount by changing the max annual payout between $5,000 and $20,000, or an unlimited amount. The yearly max payout is a vital choice when considering the amount of coverage a pet may need. They can also choose reimbursements of 70, 80, or 90 percent. The deductible choices are also the same: $100, $250, or $500. Again, the less coverage pet parents are willing to have, the less the monthly premium costs.

Pet owners that purchase full coverage or accident-only can round out their coverage with a wellness plan. Wellness coverage refers to preventative and routine care treatments like vaccines, parasite control, and wellness exam fees. Pet insurance plans with wellness add-ons guarantee financial support for every instance of veterinary care.

Hartville offers two wellness plan options: the basic plan for $9.95 per month and the prime plan for $24.95 per month. The basic plan provides $250 in annual benefits, and the prime plan offers $450 in annual benefits. Preventative care coverage splits by specific treatment, which is different from pet health insurance. All wellness care reimbursements have set benefit limits, like $50 for wellness exam fees.

When it comes to the lengths pet parents are willing to go for their dogs or cats, there doesn’t seem to be a limit.

And with the perfect pet insurance policy, going into debt for your cat’s experimental surgery doesn’t have to be the only option.

Hartville’s insurance policies can help with virtually any financial limitations you might encounter with emergency vet care. Pet owners can have up to 90 percent of their qualifying vet bills covered by any licensed vet, specialist, or emergency clinic.

According to Hartville’s website, it doesn’t have upper age limits or breed restrictions.

Hartville’s coverage options are relatively extensive when considering the cost and frequency of unexpected health issues. Common diseases like kennel cough, upper respiratory infections, dermatitis, or ringworm can happen multiple times a year and really add up. Coverage for severe, chronic conditions, like cancer, diabetes, epilepsy, or FIP, can also keep pet parents from worrying about financial constraints when it comes to care.

Combining a comprehensive insurance plan with a wellness plan can cover almost every instance of veterinary care a pet may need. Hartville is also one of the only pet insurance providers to offer coverage for treatments for behavioral issues. Hartville will cover treatments for destructive chewing, excessive licking, fur pulling, and other behavioral problems if performed by a vet or through a vet referral.

Like every other pet insurance policy, Hartville will not cover aesthetic or cosmetic operations, breeding-related fees, or pre-existing conditions. Luckily, it will reinstate coverage for certain conditions that are deemed cured. It will also not cover anal gland expression or dental cleanings.

Hartville does not offer insurance for birds or exotic pets. Currently, Nationwide is the only traditional pet insurance company to provide pet insurance for exotic animals. Pet Assure is the only alternative pet insurance company that covers birds or exotic pets.

Compared to competitors, Hartville policyholders have a lot of flexibility when it comes to their policies. Pet parents choose the max annual payout, coinsurance rate, and deductible. By adjusting these aspects, pet owners can change the monthly premiums and coverage limits.

Policyholders can choose annual payouts of $5,000, $10,000, $15,000, $20,000, or an unlimited amount. These amounts are available for both the comprehensive plan and accident-only plan. The higher the maximum payout, the more policyholders pay each month. While $5,000 is higher than other insurance providers, it may limit accessible vet care if met too soon. If your dog needed emergency surgery and the bill for hospitalization was $10,000, pet parents would have to pay $5,000 out of pocket.

Pet owners can also choose a deductible of $100, $250, or $500. The deductible refers to the amount of money spent out of pocket on qualifying medical treatments before the insurance policy will kick in. That means policyholders will have to file claims for treatments without receiving reimbursements until they meet the annual deductible. The higher the deductible, the lower the monthly premium.

Like other insurers, Hartville allows pet parents to pick the reimbursement rate. Traditional pet insurance only pays for a percentage of the vet bill, rather than the entire thing. Hartville members can choose 70, 80, or 90 percent. Typically, the more Hartville will have to cover, the more the monthly premium costs.

If pet parents want to purchase a wellness add-on, they can choose between yearly payouts of $250 for $9.95 per month or $450 for $24.95 per month. Hartville determines how much of the payout goes toward each procedure, which might not save pet owners as much money. For example, prime plan members will only receive $150 toward dental cleanings. Dental cleanings require anesthesia, which might end up costing much more.

Hartville will reimburse each eligible claim after receiving a copy of its completed claim form, an itemized invoice, and your pet’s medical records. These can be uploaded to Hartville’s member center or faxed to 1 (866) 888-2495. Hartville members can receive payment through direct deposit or directly to the vet.

Hartville has a 14-day waiting period for all accidents and injuries. That includes knee and ligament conditions, which is substantially less time than most competitors. Most insurers have a six-month waiting period for orthopedic and ligament problems. Pet owners that purchase a wellness policy have coverage immediately.

Any condition contracted before the end of the waiting period is considered a pre-existing condition. That means if your cat were diagnosed with hip dysplasia during the waiting period, you would not receive any coverage for any future treatments on either side.

To see how Hartville quotes stacked up against its competitor, Insurify’s data team compared pet insurance quotes from Nationwide, Healthy Paws, and PetPlan.

Below are the pet insurance quotes for a two-year-old purebred golden retriever named Sally who lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| Hartville | $54/mo |

| Nationwide | $54/mo |

| Healthy Paws | $66/mo |

| Petplan | $89/mo |

These are the pet insurance quotes for a one-year-old German shepherd named Jerry who also lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| Hartville | $49/mo |

| Nationwide | $63/mo |

| Healthy Paws | $63/mo |

| Petplan | $84/mo |

Finally, these are the quotes for a three-year-old labradoodle named Sandy in San Jose. Mixed breed dogs usually have lower insurance premiums since they aren’t as susceptible to genetic conditions:

| Company Name | Quotes |

|---|---|

| Hartville | $43/mo |

| Nationwide | $38/mo |

| Healthy Paws | $53/mo |

| Petplan | $68/mo |

And for cats, these are the quotes for a three-year-old British shorthair named Simon, who lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| Hartville | $30/mo |

| Nationwide | $15/mo |

| Healthy Paws | $16/mo |

| Petplan | $20/mo |

Remember, cat insurance premiums tend to be cheaper than dog insurance premiums.

And these are the quotes for a five-year-old mixed breed long-haired cat named Wesley, who also lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| Hartville | $27/mo |

| Nationwide | $15/mo |

| Healthy Paws | $14/mo |

| Petplan | $23/mo |

Remember to compare pet insurance quotes on Insurify before buying a policy for your pet—you may get a better deal on a great policy!

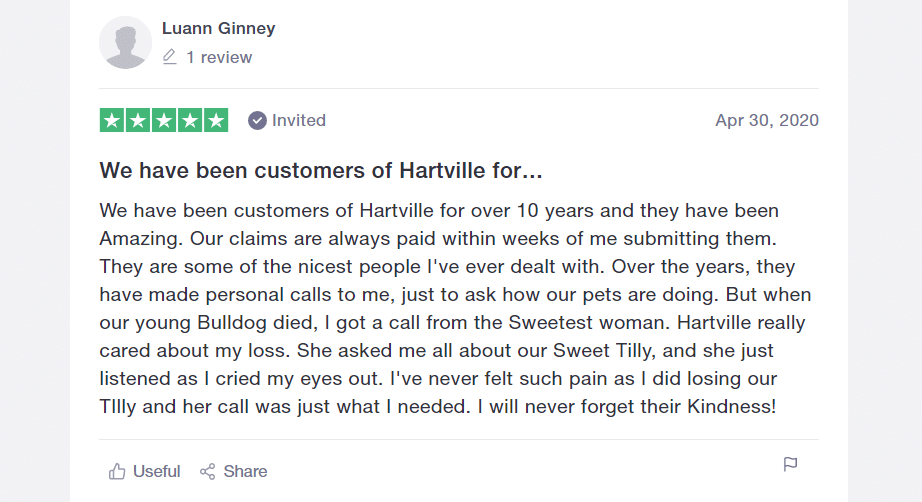

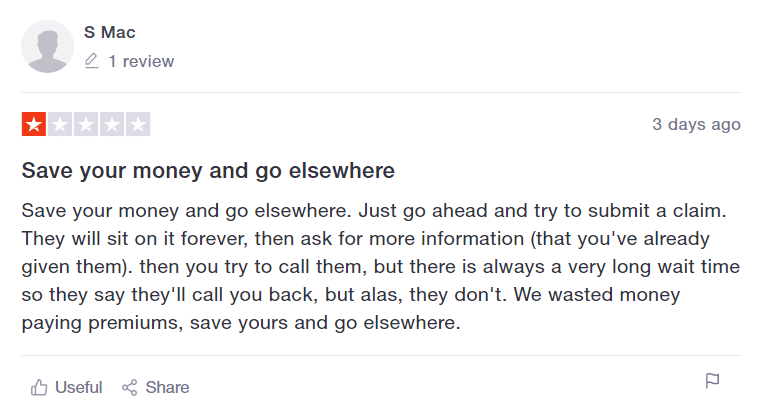

Hartville doesn’t have any reviews directly on its website; however, it invites customers to leave their thoughts on Trust Pilot. Trust Pilot is a third-party website that lets consumers voice their opinions. Hartville holds a 4.5-star rating with 199 reviews, which is relatively higher than many other companies. Positive reviews usually cite quick turnaround and exceptional customer service.

Still, there are a handful of negative reviews. Like many other insurers ’ review pages, these negative reviews refer to the denial of claims and the exclusion of pre-existing conditions. Some claim the company doesn’t fulfill reimbursements.

Hartville insurance is produced by the Crum & Forster pet insurance group, which is also responsible for ASPCA and 24Petwatch. It is rated A (Excellent) by A.M. Best.

| Customer Service | 1 (800) 799-5852 |

| Fax | 1 (866) 888-2497 |

| cservice@ hartvillepetinsurance.com | |

| Member Portal | https:// www.hartvillepetinsurance.com /portal/#/login |

| Website | www.hartvillepetinsurance.com |

Hartville’s policies are underwritten by the United States Fire Insurance Company, produced and administered by C&F Insurance Agency, Inc., a Crum & Forster company.

Hartville insurance rates depend heavily on a pet’s breed, age, and location. On average, Hartville’s rates can range from $20 to upwards of $130 per month. These rates are heavily subject to previous factors that are out of an owner’s control and chosen plan. Still, Hartville offers a lot of flexibility and options when it comes to adjusting the monthly premium. Compared to other pet insurance companies, Hartville’s cost is pretty average. Still, you should compare pet insurance plans and prices before settling on one policy.

Hartville’s coverage is pretty standard, but behavioral issues coverage is a huge bonus. Most companies exclude any treatments related to destructive behavior, even if related to an underlying medical problem. The treatment must be administered by a licensed vet or through a written referral from a vet to a certified behaviorist. Since these issues have to be unlearned, they usually require multiple treatments. That can end up costing much more out of pocket.

Hartville offers the standard amount of coverage for most pet insurance companies, but its behavioral coverage really sets it apart. Although its premiums are pretty average and cheaper options are available, it still allows pet owners to customize their coverage and premiums. But many policyholders believe that a Hartville policy is not worth the high monthly cost, especially when it comes to the denial of claims and reimbursement amount. Some policyholders believe they don’t actually receive the proper amount back in certain cities. Whether Hartville is the best company for you comes down to what you can afford and what kind of coverage fits you and your pet best. That's why you should make sure you compare quotes before settling down on a single pet insurance policy.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More