Free Car Insurance Quotes From Top Companies (2023)

Updated June 16, 2022

Updated June 16, 2022

Purchasing auto insurance requires some thought, especially when drivers want specific car insurance coverage at an affordable price within their budget. The sheer number of factors that determine car insurance rates with various providers feels overwhelming for some. If you find yourself stressed, keep reading this page for a thorough guide to free car insurance quotes.

Don’t worry—we’ll walk you through everything. Before purchasing car insurance, individuals must learn all about free car insurance quotes and the intricacies of insurance providers and types of coverage. Once prepared, take the next step and compare free car insurance quotes with Insurify’s comprehensive quote-comparison tool—available now or whenever you’re ready.

See More: Best Car Insurance Companies

See More: Car Insurance Quotes

See More: Cheap Car Insurance

Before you head off to utilize Insurify’s handy quote-comparison tool, understanding the simple definition of a car insurance quote will provide you with necessary context. Car insurance quotes are estimates of how much an insurance policy will cost every month, year, or pay period. They give potential policyholders a good idea of how much insurance will cost through different providers.

Car insurance companies determine quotes using a number of factors, including location, driving history, location, age, credit score, and more. Ultimately, each provider calculates their quotes in a specific way, so quotes will vary by provider. Online quote-comparison sites like Insurify help individuals consider their options before committing to an auto insurance provider.

Auto insurance coverage options run the gamut to meet customers’ insurance needs, with most providers offering coverage to meet various state minimum requirements; full coverage offerings with liability, collision, and comprehensive coverages; and all the add-ons and specializations a driver needs. Costs of the various insurance options do vary by provider.

Liability insurance covers bodily injury and property damage due to an at-fault accident. Collision provides coverage for any object or vehicle damage occurring in a collision. Comprehensive coverage provides protection against non-collision-related issues like weather, natural disasters, vandalism, and more.

Additional coverages include roadside assistance, uninsured and underinsured motorist coverage, personal injury protection, gap insurance, medical expenses, and much more. Insurance costs increase as policyholders add on more coverage to their car insurance policy, so it is important for individuals to understand what they need.

| Category | Covers | Doesn’t Cover |

|---|---|---|

| Liability Coverage | Bodily injury or property damage if you’re at fault | Medial payments or damage to your car or property if you’re at fault |

| Collision Coverage | Damage to objects (not animals or people) and vehicles to due a collision, regardless of fault Hit-and-run accidents | “Acts of God” |

| Comprehensive Coverage | ”Acts of God” | Medical costs or vehicle damage do to a collision |

“Acts of God” include events out of a driver’s control such as fire, floods, or vandalism.

Car insurance providers calculate quotes by considering a number of different factors—though the primary factors center around the driving behavior of individuals and the types of coverage purchased. Each provider varies, but common factors used to determine quotes include age, gender, location, car type, credit score, education status, marital status, mileage, and more.

Teen drivers pay more for coverage due to less experience with driving, and young men have higher rates due to risky driving. Rates vary by state and are highest in urban areas. Drivers of luxury vehicles pay higher premiums. Low credit scores often increase premiums. Students, married people, and homeowners often have lower rates and discounts. High mileage increases rates as well.

The most influential factor considered in calculating quotes is an individual’s driving record. Good drivers with clean records pay less for premiums because providers trust that these drivers are less likely to have an accident. Drivers with any moving violations, DUIs, at-fault accidents, or speeding tickets typically pay higher rates for their car insurance coverage.

Insurify’s quick-and-easy quotes calculator provides general insight into how much your car insurance may cost depending on several different factors. For more in-depth quote comparisons, use Insurify’s quote-comparison tool to compare free quotes and insurance discount opportunities from various providers. Either way, get your free quote today!

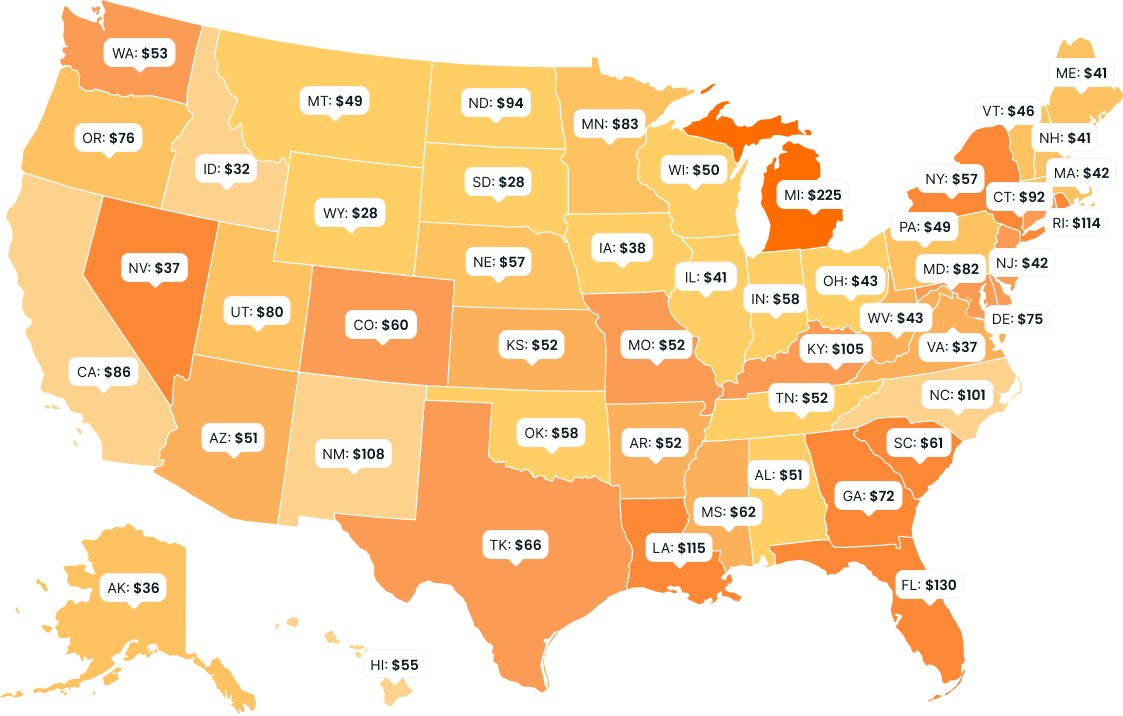

Auto quotes vary for policyholders depending on the state they reside in. Factors that influence state costs include weather and climate, certain state regulations, population density, crime rates, and driving conditions. The heat map below provides average rates per state. Shop around for cheap car insurance within your state, regardless of how your state influences rates.

Similar to how costs fluctuate depending on a policyholder’s state, insurance quotes increase for policyholders living in cities—New York, Los Angeles, and everywhere in between. Policyholders pay more for coverage in cities due to factors related to population density, theft and vandalism, and other driving conditions. Providers see cities as higher-risk than rural areas.

Most states—excluding Hawaii, Massachusetts, and California—allow insurance companies to consider an individual’s credit score when calculating their car insurance premiums. Insurers who seriously consider credit score as an indicator give customers with low credit scores higher rates. Alternatively, customers with good credit scores pay lower premiums for their coverage.

If you live in a state that allows providers to examine credit scores when calculating insurance rates, you’re not totally out of luck. Some insurance providers do not factor in credit scores when providing insurance quotes. These so-called no-check insurers give customers with bad credit histories an opportunity to pay lower premiums and more affordable car insurance overall.

Potential policyholders have a few different ways to receive free car insurance quotes. Consider the options provided below to decide which process makes the most sense for you.

The best place to find free auto insurance quotes is Insurify. See quotes from top companies all in one place to do a side-by-side comparison.

Speaking with insurance agents in person used to be the most common way for people to receive a car insurance quote. These agents may be captive agents working for a specific company or independent agents or brokers working with multiple insurers. Generally, people purchasing insurance in person will be offered fewer options than if they looked online.

Insurance providers almost always offer their customers the opportunity to speak to an agent over the phone in order to get a free quote and potentially commit to a new policy. This option is great for people with unreliable internet or discomfort using a computer, or those who simply prefer speaking on the phone. Reach an Insurify agent at (866) 405-5518.

Finding free insurance quotes online offers potential policyholders an extremely convenient option to access the information they need whenever they need it. Trusted quote-comparison sites like Insurify ensure that users can compare quotes from various providers and learn about potential car insurance discounts without worrying about any violation of data privacy.

Though it may vary by provider, individuals typically need to share a common set of information about themselves to receive a free car insurance quote. This includes their name, address, date of birth, current car insurance company, current job or occupation, driver’s license number and driving history, current and annual mileage of their car, and the amount of desired coverage.

After you’ve looked at and compared various car insurance quotes, you will have to decide which one works best for you. This decision often feels overwhelming, but as long as you know your insurance needs, you have nothing to worry about. No one-size-fits-all insurance plan exists on the market, so recognizing the factors most important to you is absolutely crucial.

Coverage levels, one of the greatest factors to consider when purchasing insurance, range from state minimum requirements to more comprehensive full-coverage plans. Though drivers hate to think about their likelihood of experiencing an accident, weather incident, or another issue, purchasing a more comprehensive plan for a higher cost may save them money in the long run.

Drivers must also factor in the affordability of various quotes to ensure they will be able to pay for their premium and deductible without breaking the bank. Often overlooked, the customer service of an insurance company may make or break whether an individual wants to do business with them. Knowing you’ll have a helpful, communicative team helps ease any worries.

The quote-comparison tool at Insurify provides users with a no-stress experience to compare claims from dozens of the country’s top insurance providers in a matter of minutes. We value saving customers money on car insurance, so trust that you will be able to find affordable car insurance rates for coverage that satisfies your insurance needs. Compare with us today!

Policyholders pay a premium for their coverage, typically in monthly installments, though not always. This amount is paid even when the purchased coverage is not technically used. A deductible, on the other hand, describes the predetermined amount of money a customer pays when using their coverage after an accident before the insurer pays the rest.

Most insurance companies do provide options to discuss free quotes over the phone or in person. In those cases, customers may not hear the full list of coverage options, which is something to be aware of. A trusted quote-comparison site like Insurify provides the easiest, most accessible option for users comfortable using a computer to compare insurance quotes.

Though this varies depending on the company or website a person uses, you will have to provide some personal information to receive an accurate quote. This includes factors such as age, location, marital status, education level, vehicle information, homeowner status, credit score, driving record, and more. All of these factors provide more accurate quotes for users.

Car insurance providers calculate insurance quotes by utilizing a number of factors related to an individual’s driving history and desired levels of coverage. Companies vary in what they consider, but factors often include age, gender, location, car type, credit score, education status, marital status, mileage, and more. Quotes are then calculated based on the whole driver profile.

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Katie Powers is an insurance writer at Insurify with a producer’s license for property and casualty insurance in Massachusetts and expertise in personal finance and auto insurance topics. She strives to help consumers make better financial decisions. Prior to joining Insurify, she completed her undergraduate and graduate degrees at Emerson College. Her work has been published in St. Louis Magazine, the Boston Globe, and elsewhere. Connect with Katie on LinkedIn.

Learn More