Embrace Pet Insurance: Is it the right choice?

Updated January 11, 2021

Reading time: 7 minutes

Updated January 11, 2021

Reading time: 7 minutes

Cat and dog owners looking for accident, chronic illness, and specialist care

Pet owners looking into alternative treatment options

Pet parents whose pet gets sick often

Senior pet owners looking for illness coverage

Exotic pet owners

Most pet owners are familiar with the sinking feeling of realizing their pet is sick. Aside from the obvious emotional turmoil a pet owner faces when having to take care of a sick pet, the financial strain of emergency surgeries, constant vet visits, and prescriptions can put many in a tight spot.

Buying a pet insurance plan for your pet would give you peace of mind knowing that your pet will be taken care of regardless of your personal finances.

Apart from covering treatment costs for your sick pet, pet health insurance can also help cover vet bills, routine care, preventative measures to ward off parasites, and even alternative therapies.

If you’re considering pet insurance, be sure to check out Insurify. Insurify allows you to compare pet insurance quotes, policies, and companies all in one place for free!

Embrace offers pet insurance in all 50 states and can be used with any veterinarian, and provides the following policies for dog and cat owners.

For cats and dogs younger than 14 years old, the comprehensive pet insurance plan offers the most peace of mind with its nose-to-tail coverage. It pays for a wide range of veterinary costs like exam fees, allergy testing, prosthetics, chemotherapy, lab tests, behavioral therapy, and prescription drug coverage.

Only cats and dogs under the age of 14 are eligible for Embrace’s comprehensive pet insurance plan. But once your pet is enrolled in a plan, Embrace will not drop or alter your pet insurance for any policy regardless of your pet’s age or health.

Cats and dogs older than 14 years old are only qualified for accident-only coverage, which does not cover illness or chronic conditions. It primarily focuses on unexpected vet costs in the case of incidents like foreign body ingestion, being hit by a car, and cuts or lacerations.

Embrace’s Wellness Rewards plan can be purchased in addition to one of Embrace’s insurance plans to cover routine care. The plan is flexible and can be used to cover routine veterinary costs like wellness exam fees, spaying and neutering, microchipping, grooming, vaccinations, and veterinary recommendations like medicated shampoos or prescription diet food.

Depending on the policy you choose, Embrace’s insurance covers nearly every instance of veterinary care for your four-legged friend. Embrace offers reimbursements for most veterinary fees, treatments, surgeries, and testing, among other things. It also doesn’t exclude coverage, regardless of congenital, chronic, or breed-specific conditions.

Embrace offers coverage for both illnesses and injuries your dog might experience, including cancer, hip dysplasia, ear infections, poisoning, diabetes, and the occasional sock extraction.

Embrace also covers chronic and congenital conditions like allergies and brachycephalic airway syndrome, and routine veterinary treatments like vaccines, spaying and neutering, dental care, and flea, tick, and heartworm medication. In the case of emergencies, Embrace also offers reimbursement for surgeries, anesthesia, x-rays, MRIs, ultrasounds, and rehabilitation. These could end up costing you tens of thousands of dollars without pet insurance!

Like any other pet insurance company, Embrace doesn’t cover pre-existing conditions. But, unlike other pet insurance providers, Embrace offers to reinstate coverage for respiratory infections, urinary tract and bladder diseases, vomiting, diarrhea, gastrointestinal disorders, and other curable conditions on a case-by-case basis. It will not, however, cover pre-existing chronic conditions.

Embrace also offers comprehensive coverage for your feline friends that cover preventative, routine, and emergency care. It provides reimbursement for everything from routine veterinary exams and genetic conditions to cancer treatments.

Depending on the purchased plan, Embrace will cover illness, injuries, and congenital conditions in cats regardless of breed. It offers to reimburse you for common illnesses such as bladder infections, pancreatitis, feline diabetes, and hip dysplasia.

It also offers coverage for chronic and congenital conditions like asthma, allergies, progressive retinal atrophy, and polycystic kidney disease. And in case of emergencies, Embrace will also help cover emergency vet visits, surgery, chemotherapy, rehabilitation, and specialist care.

Embrace offers reimbursement for most veterinary fees, tests, treatments, surgeries, and rehabilitation options. By adding on Embrace’s Wellness’ Reward plan, you could also get coverage for vaccines, exams, microchipping, spay/neuter costs, and sterilization.

And while Embrace won’t necessarily cover pre-existing conditions, it will reinstate coverage for respiratory infections, urinary tract and bladder infections, vomiting, diarrhea, other gastrointestinal disorders, and other curable conditions on a case-by-case basis. It will not cover pre-existing, chronic conditions, breeding, injuries from intentional abuse and neglect, or cosmetic procedures.

Check out: What Is Emergency Pet Insurance and What Does It Cover?

Embrace offers a lot of flexibility when it comes to building a policy. Pet owners get to customize how much they want to spend each month, their annual limits for reimbursement, if they want prescriptions covered, and how much of the veterinary costs are covered per claim.

Embrace’s comprehensive insurance plan offers annual deductible rates of $200, $300, $500, $750, and $1,000, which determine your monthly payment. This means that your Embrace pet insurance policy will kick in once you’ve spent the chosen amount of money on something like vet visits, vaccinations, or tests. Since this is an annual deductible and not a deductible per claim, once you’ve paid the chosen amount, your Embrace policy should kick in for the rest of the year up until you reach your maximum annual limit.

Embrace offers reimbursement options for the amount of coverage per expense. Reimbursement percentages are similar to co-pay. So if you pick a 70 percent reimbursement percentage, Embrace covers 70 percent of the costs while you pay the remaining 30 percent.

Pet owners can choose between a 70 percent, 80 percent, or 90 percent reimbursement option for their Embrace policy, which will adjust the monthly cost. The higher the reimbursement percentage, the higher your monthly premium.

You can adjust your deductible depending on how much you would like to spend each month. If you set a lower deductible, you pay a higher monthly fee and vice versa. Lowering your reimbursement could also reduce your monthly premium, but this also means you will get less of your money back when you file a claim.

Your annual reimbursement amount depends on the pet insurance policy you pick and can range from $5,000 to $15,000. An annual reimbursement is the maximum amount of money an insurance company will pay to cover your costs for the year. For example, the whole pet plan has a $10,000 reimbursement, so once you’ve paid your chosen deductible, Embrace will pay up to $10,000 a year to cover the cost of your pet treatments, vet visits, and so forth.

Embrace will reimburse your claim for money spent on veterinary treatment after it receives an upload or copy of your veterinary invoice. These can be mailed to Embrace Pet Insurance, Claims Dept, PO Box 22188, Beachwood, OH 44122-0188, emailed to [email protected], faxed to 1 (800) 238-1042, or uploaded electronically on the MyEmbrace portal.

According to Embrace’s website, Wellness Rewards claims are usually processed within five business days of receiving all the required information, and injury or illness claims are usually processed within 10 to 15 business days of receiving all the required information. After a claim is processed, it typically takes two to three business days for reimbursements through direct deposits and five to seven business days for checks via the mail.

Embrace should reimburse you for covered expenses up to the annual maximum limit you chose when you signed up for your policy.

Embrace requires your pet’s medical history review from a veterinarian within 12 months prior to the final day of your pet’s waiting period to accept a claim.

Embrace offers a $50 discount on your annual deductible for every year that you don’t file an accident or illness claim. It works like a vanishing deductible and is included with every policy at no additional cost. The discount is automatically taken off every year until it hits $0 and is only reset after a claim is filed. For example, if your dog has a $300 deductible and goes an entire year without filing a claim, the following year, the deductible is $250.

This discount is only applicable to accident and illness claims, and using the Wellness’ Rewards will not impact the discount.

Embrace implements a 48-hour waiting period for accidents, a 14-day waiting period for any illnesses, and a six-month waiting period for orthopedic conditions. If your pet were to fall ill or get injured before the end of these waiting periods, any claim filed would not be covered by your Embrace plan, and you would have to pocket those costs.

The six-month waiting period for orthopedic conditions can be reduced to a 14-day waiting period following an orthopedic exam by your general veterinarian. Embrace will not cover this exam unless you have purchased the Wellness Rewards in addition to your plan.

To see how Embrace’s quotes stacked up to those from its competitors, Insurify’s data team compared pet insurance quotes from Nationwide, Healthy Paws, and PetPlan.

Below are the pet insurance quotes for a two-year-old purebred golden retriever named Sally who lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| Embrace | $46/mo |

| Figo | $54/mo |

| Nationwide | $54/mo |

| Trupanion | $133/mo |

These are the pet insurance quotes for a one-year-old German shepherd named Jerry who also lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| Embrace | $61/mo |

| Figo | $65/mo |

| Nationwide | $36/mo |

| Trupanion | $121/mo |

These are the quotes for a three-year-old labradoodle named Sandy in San Jose. Mixed-breed dogs usually have lower insurance premiums since they aren’t as susceptible to genetic conditions:

| Company Name | Quotes |

|---|---|

| Embrace | $36/mo |

| Figo | $37/mo |

| Nationwide | $38/mo |

| Trupanion | $99/mo |

And for cats, these are the quotes for a three-year-old British shorthair named Simon, who lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| Embrace | $28/mo |

| Figo | $28/mo |

| Nationwide | $15/mo |

| Trupanion | $63/mo |

Remember, cat insurance premiums tend to be cheaper than dog insurance premiums.

Finally, these are the quotes for a five-year-old mixed-breed long-haired cat named Wesley, who also lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| Embrace | $32/mo |

| Figo | $20/mo |

| Nationwide | $16/mo |

| Trupanion | $73/mo |

As you’ve probably gathered, pet insurance premiums change depending on the age, breed, and location of your dog. There’s also quite a bit of variation in insurance premiums across different companies. Just because Embrace had the best deal for your friend’s Persian cat, doesn’t mean it’ll have the best deal for your Yorkshire terrier.

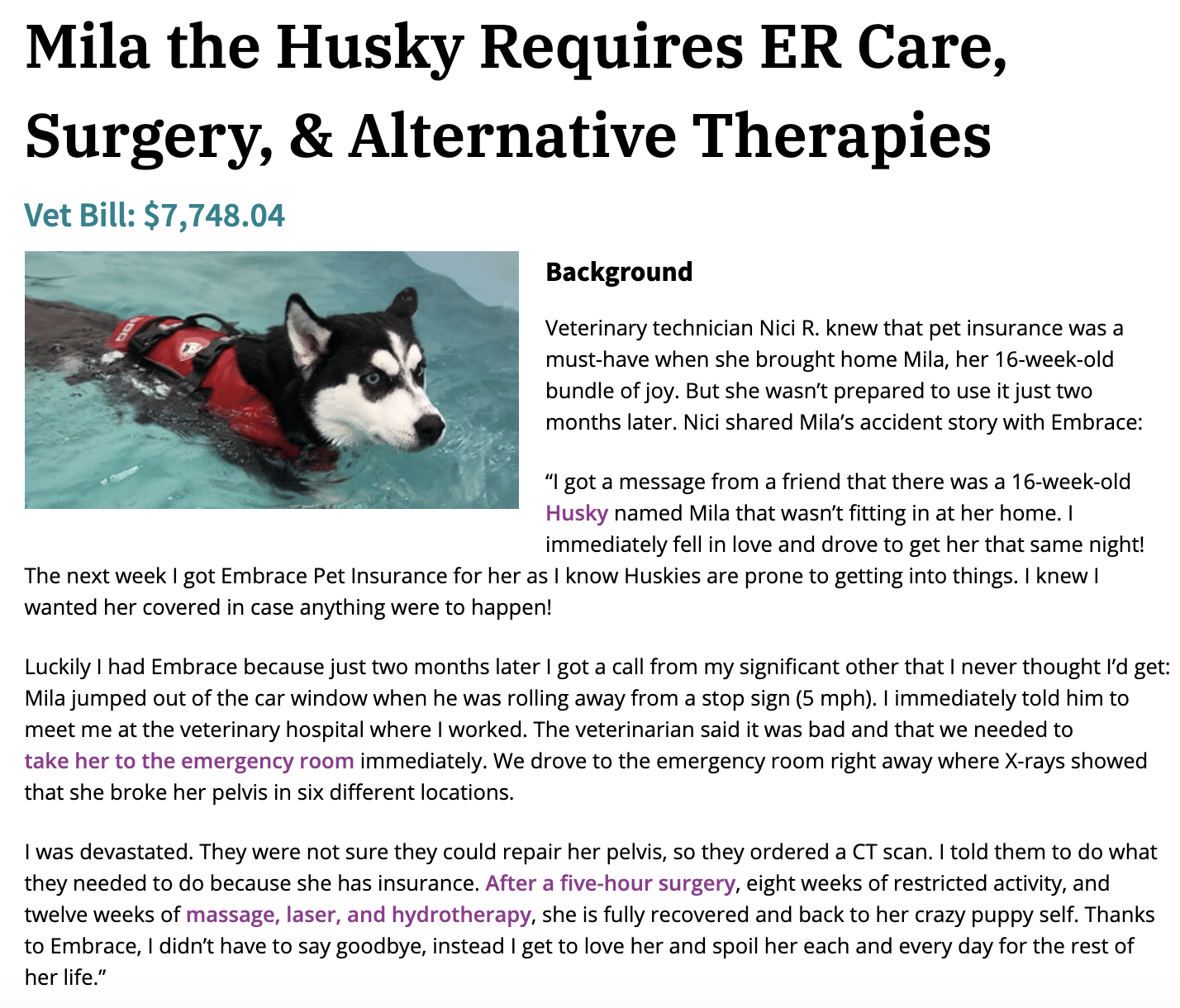

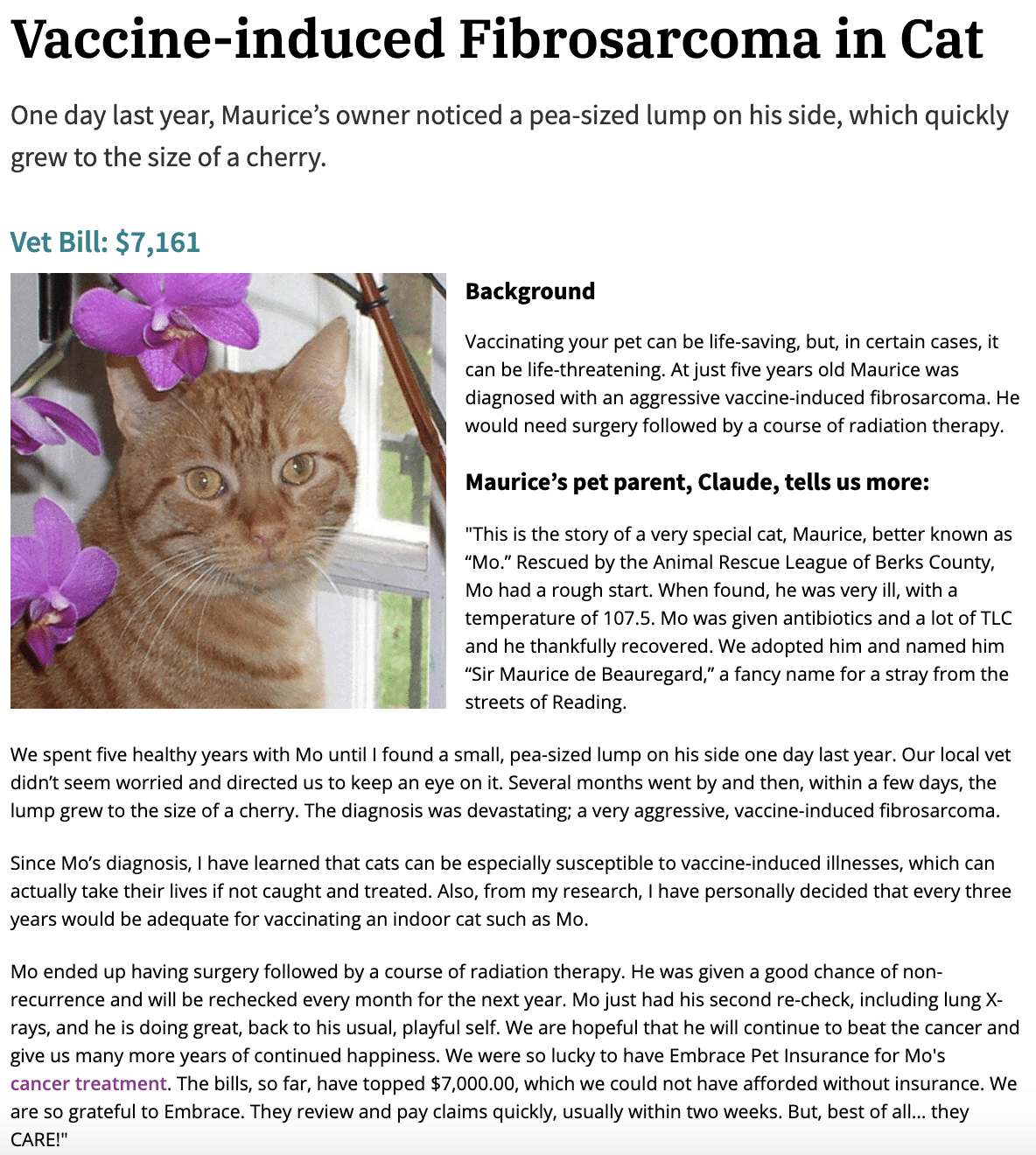

Embrace’s website is full of success stories where pet owners share their gratitude with reimbursement for everything between routine check-ups and expensive surgeries, each adorned with adorable pet photos.

Unsurprisingly, Embrace does not publish any negative reviews on its own website, but sites like ConsumerAffairs give unhappy patrons a platform for their grievances. Embrace holds a four-star rating on ConsumerAffairs, significantly higher than competitors like Trupanion and Nationwide. A representative for the company has replied to every negative review providing explanations and methods of contact.

Negative reviews for Embrace typically complain about how the company’s stance on “pre-existing” conditions, specifically for claiming undiagnosed symptoms like diarrhea as a pre-existing conditions. Other reviews criticize Embrace’s denial of claims and raising costs at policy renewals.

| Customer care | 1 (800) 511-9172 |

| 24/7 Pet Health Line | MyEmbrace Portal |

| Online Form | |

| Website | www.embracepetinsurance.com |

It depends. While pet insurance isn’t mandatory, it helps to know your vet bills and treatments are going to be covered regardless of your personal finances. Aside from protecting your pet from future illnesses, pet insurance can also help pay for your regular vet bills and any vaccinations or preventative treatments you want for your pet. In other words, pet insurance can help you prepare for unforeseen medical emergencies and help you pay for regular pet upkeep costs.

Pet insurance rates depend heavily on your pet’s breed, age, pre-existing conditions, and location. On average, however, dog insurance costs about $38 a month, cat insurance costs about $27 a month, bird insurance about $15 a month, and reptile insurance about $8 a month. Again, these rates are heavily subject to the aforementioned factors, as well as the insurance plan you choose. Embrace tends to be on the less expensive side, but you should compare pet insurance plans before settling on one policy.

Embrace is able to keep its rates relatively low, while maintaining a good relationship with its policyholders through efficient customer service and competitive considerations. But there are also people who say that its pre-existing condition policy is too strenuous and the Wellness’ Rewards add-on is too expensive to justify routine veterinary work. Whether Embrace is a good choice for you comes down to what you can afford and what kind of coverage fits you and your pet best. That’s why you should make sure you compare quotes before settling down on a single pet insurance policy.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More