Credit Karma Insurance Reviews: Consumer Reviews, Quotes

Updated April 28, 2021

Reading time: 6 minutes

Updated April 28, 2021

Reading time: 6 minutes

How is this financial industry game-changer doing after twelve years of business?

Way back in 2008, Credit Karma came along to offer something that no one else had before: basic, free credit monitoring. If you don’t recall, financial bloggers went berserk trying to decide if these services were part of a scam or a legit way to stay on top of personal finances. Soon, even mortgage bankers were advising customers to use Credit Karma to track their scores.

Over the years, Credit Karma has expanded its reach to include tax filing services, auto insurance guidance, personal loan recommendations, and a nifty tool to visualize the future impact of financial choices. Here is our take on how Credit Karma measures up to the hype.

The newest feature at Credit Karma is its auto insurance comparison tool. As a company that is always trying to disrupt the financial industry, this is no exception. However, it’s not the most successful attempt. (More on this below.)

Credit Karma is best known for other financial services, most famously for credit score monitoring. Here’s a rundown of their services:

Yes, free. No credit card information is required. And there is no “free trial” or other obligation to use the services. Simply sign up—which will require your social security number—and start monitoring. Full disclosure: I’ve been using Credit Karma’s services since 2011 and have not paid a cent for its free service.

It’s important to note that these free credit scores are only offered from two credit bureaus (aka credit reporting agency): Equifax and Transunion. You will not be able to find scores from FICO like you can with some competing services now offered by a few banks and credit card companies. This is important because your FICO score is the one that lenders use. And while you can estimate your FICO score based on the ones offered here, you can’t know it for sure. (The third credit bureau, Experian, does not work with Credit Karma.)

Another important note: your credit score is not the same as a credit report. A credit report will list payment history, opened and closed financial accounts, details of collections information or late payments, and more in-depth information about your financial history. Once yearly, you can access a free credit report from all three major credit bureaus. The credit score is based on the credit report but is a three-digit number between 300 and 850.

This is one of the best things about Credit Karma and the primary way customers can improve their finances. Not only do you get your score, but you also get the reasons behind your score. For example, if your score isn’t optimal, you’ll be given ideas as to why and how to fix it. Perhaps your credit utilization is too high, or you have a late payment.

Other tools include a Simple Loan Calculator and Debt Repayment Calculator. These are useful for calculating things like student loan payoff and the lifetime cost of a mortgage.

Hands down, Credit Karma’s best tool is the Credit Score Simulator. This tool allows users to see how financial choices can impact their score. Examples include the effect of a new car loan, hard inquiry, or completing a balance transfer from one credit card to a new one.

If you’d been wondering how Credit Karma makes money, here is your answer. Based on your credit score, and maybe a little upon your financial needs, Credit Karma will recommend financial services from its partners. Typically, this means matching you with an appropriate credit card or a loan provider to help refinance debts.

This can undoubtedly be useful to anyone who is building their credit history and/or in need of a new credit card. Not only do users get information about the credit card itself, but also about their likelihood of approval. The information offered about the card includes perks, interest rates, and fees.

This is the newest feature from Credit Karma, and (spoiler alert) it’s nothing to write home about. I tried it out in a few ways, and here’s what I found:

You will enter an “Auto Insurance Profile,” but “profile” is used lightly. The only personal information you’ll need is your age, marital status, gender, and ZIP code.

Based on this information, you’ll receive “results.” I was given seven results each time. Of these seven, three were among the largest insurance providers in the country, one was a small local company, and three were not insurance companies at all. In fact, these were quote comparison sites similar to yours truly: Insurify.

Below each result is a button labeled “Get Started” that will bring you to the affiliate’s website. There, you will be asked to fill out a form to receive a quote.

Now, during the launch of this new feature, it was intended to prefill your personal information into each form. However, thus far, this feature does not work. In the future, a more seamless experience may be possible. But as of this writing, it is a cumbersome task to compile quotes through Credit Karma.

Overall, the flow of suggested results is also not that straightforward. I say this because the actual insurance companies and the quote-comparison sites are not separated. They are formatted the same and, in that way, are a bit misleading. You might think you’re going to an insurance company’s website when you’re directed to a third-party site.

On a positive note, you can look up your auto insurance score. This is the score that insurance companies use to evaluate the likelihood of you’ll file a claim. I’d like to tell you more about this very intriguing feature, but for the last three days, I’ve been getting a site error. Hopefully, we will be able to update you as soon as this glitch is fixed.

Lastly, please note that no quotes are generated through Credit Karma. You won’t know what you’re getting into when you click “get started,” meaning you’ll need to enter your information several times to receive a handful of quotes from which to choose.

If you’re looking to monitor your credit score, Credit Karma can undoubtedly help you with that. However, if you’re looking for the best car insurance coverage for the best price, you’re better off going to a site that specializes in that service.

Your auto insurance quotes comparison experience doesn’t have to start or end with Credit Karma.

You could just use Insurify to compare auto insurance quotes in less than two minutes. Totally free, no-hassle, all secure, no obligation. For real.

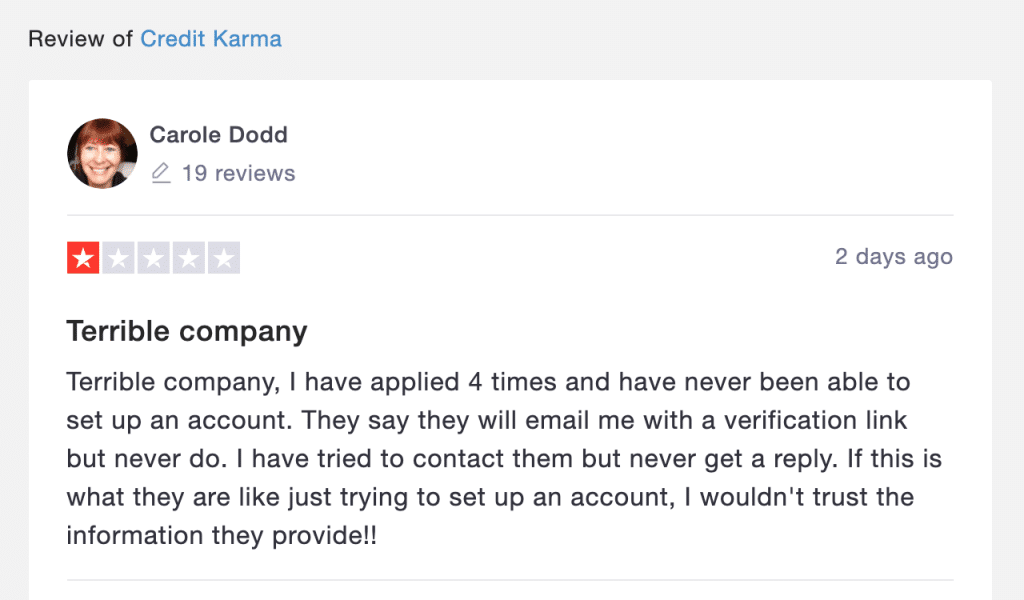

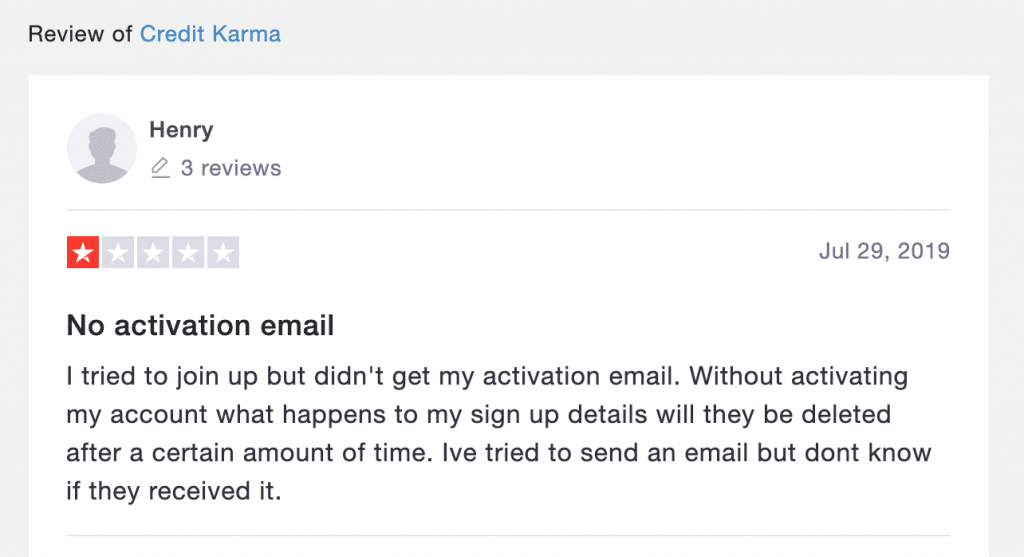

According to the 162 reviews on TrustPilot, Credit Karma is just okay. Seventy-three percent of the reviews gave excellent marks to the company. However, a recent spike in negative reviews claims that the site itself is not working as it should:

Even so, customers generally find Credit Karma “easy to use” as “free” as it claims it is, and “accurate.” Most of the positive reviews reference only credit monitoring services, but with much praise. No reviews were found to mention auto insurance quoting features.

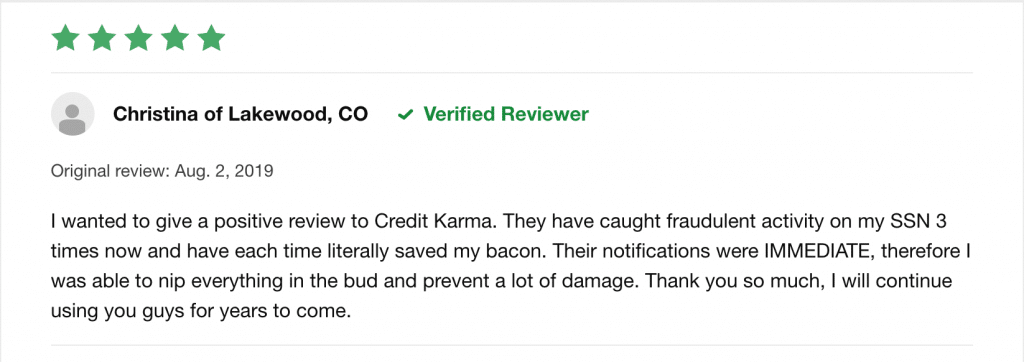

The 370 reviews over at Consumer Affairs tell a slightly better story. Again, the reviews focus on credit monitoring. This glowing review showcases the power of using a credit monitoring site:

This table shows Credit Karma’s official Insurify Composite Rating, based on a combination of reviews from aggregator sites:

| Site | Customer Rating | Number of Reviews |

|---|---|---|

| Consumer Affairs | 3.4 / 5 | 370 |

| TrustPilot | 3.25 / 5 | 162 |

| Sitejabber | 3.2 / 5 | 84 |

| Clearsurance | 4 / 5 | 1 |

| Total Score | 3.3 / 5 | 617 |

Credit Karma is rated 3.3 out of 5 based on 617 reviews.

Over at the Better Business Bureau, some troubling information is found. Despite its 12 years of business, the BBB does not offer a rating for Credit Karma due to closed complaints that have yet to receive a response. You can learn more about the BBB’s rating system with this overview.

But what will immediately grab your attention is the alert about government action taken against Credit Karma.

It’s important to note that Credit Karma has not admitted to any wrongdoing. The Desist and Refrain order against Credit Karma is a little complicated. To boil it down to the basics: Credit Karma acted as a broker for third-party loan providers but did not have the proper licenses to do so.

Credit Karma was founded in 2007 by Kenneth Lin. Since its founding, it has expanded its services beyond credit reporting into tax services, budget tracking services, and money reclamation services.

Articles about Credit Karma have appeared in Forbes, Insurance Journal, and TechCrunch.

Contact Information

| Headquarters | 760 Market St, San Francisco, CA 94102 |

| Phone number | 1 (415) 692-5722 |

| Website | www.creditkarma.com |

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

J.J. Starr is a health and finance writer with a background in banking, lending, and financial advising. She holds a Series 6, FINRA, and life insurance licensure and a master's degree from New York University. Through her writing, she strives to use her decade of experience to help consumers make sound financial choices. Connect with J.J. on LinkedIn.

Learn More