Car Insurance for Young Professionals: Quotes, Discounts

Updated February 8, 2022

Reading time: 6 minutes

Updated February 8, 2022

Reading time: 6 minutes

If you’re a recent college graduate, now is probably a good time to replace your futon with a real sofa, stop ordering so much pizza, put that money into a retirement account, and reevaluate your car insurance options.

The good news is, your college degree will save you some money on your auto insurance premiums since insurance companies recognize that people with advanced degrees are less likely to file a claim. But while you’re no longer an inexperienced teen driver, you’re still considered a greater risk to insure than folks who have already spent a decade in the workforce.

That means higher car insurance premiums, especially if you’re a male and under 25. And since you haven’t yet entered your peak earning years, costly insurance premiums can put a dent in your salary. But car insurance premiums can vary greatly between insurance companies.

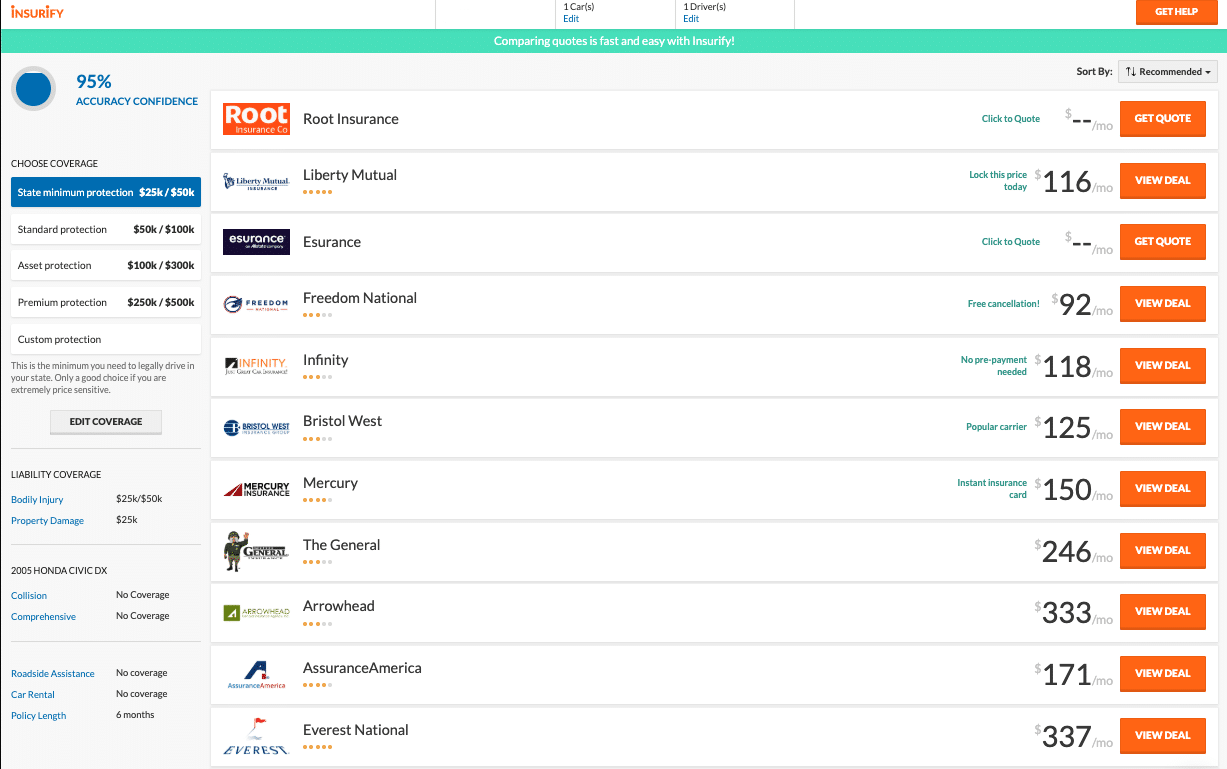

To find the best possible car insurance rate for the coverage that meets your needs, you’ll need to do some comparison shopping.

Comparing auto insurance quotes can be a lengthy and painstaking process if you don’t have the right tools. But with Insurify, you can view personalized quotes side by side, so you won’t have any doubts that you’re getting the best deal. It’s quick, easy, and free to compare quotes from top companies based on your personal information, vehicle, and driving record.

Not all car insurance policies are created equal. The best insurance provider for you will depend on factors such as your:

Occupation

Education level

Age

Driving history

Eligibility for discounts

However, certain auto insurance companies offer better rates for young adults than others. Here are some of our favorite insurance coverage options for young professionals:

GEICO offers some of the most affordable auto insurance rates for young people. If you have a new vehicle with certain safety features, you can expect vehicle equipment discounts from GEICO. The company also offers discounts for completing a driver’s education course or remaining accident-free. Bundling your auto insurance with another policy, such as home or renters insurance, can also save you a chunk of change.

It’s easy for young professionals to manage their policies online, and you can even access a customer service agent via Twitter. Just be aware that you won’t be talking to an actual gecko as the commercials imply.

In addition to providing affordable rates for young drivers, State Farm has some unique safe driving discount programs that can help offset the cost of your premium. The Steer Clear discount is available to drivers under the age of 25 who haven’t had any at-fault accidents for at least three years. And the Drive Safe & Save program uses your smartphone or OnStar service to collect information about your driving habits. You’ll save just for signing up, and you can receive a discount of up to 30 percent for safe driving habits.

State Farm also offers vehicle equipment discounts in addition to standard customer loyalty discounts, such as multi-policy and multi-vehicle discounts.

Esurance makes it easy for young people to get car insurance quotes and manage their policies online, and the company features several discounts geared toward new drivers. You can get a discount just for enrolling in the DriveSense safe driving program, and as the app tracks your driving behavior, you’ll get a customized discount in each term. If you’re still in college, you’ll also receive a good student discount for maintaining a B average or higher.

Furthermore, Esurance offers several standard discounts that can save you even more on your car insurance premium:

Vehicle safety features discounts

Multi-policy discount

Multi-car discount

Paid-in-full discount

Claim-free discount

Homeowners discount

Progressive is known for offering cheap car insurance to young drivers, and you can get quotes and sign up for coverage completely online. If you’re on a tight budget, the Name Your Price tool can help you find a policy that you’ll be able to afford.

Progressive also offers huge discounts for good drivers. The Snapshot program saves drivers an average of $145 on their premiums by analyzing driving behavior and adjusting rates for safe driving. If you limit your nighttime driving and avoid hard brakes and acceleration, you could potentially save even more than that.

Progressive also offers accident forgiveness, which can help new drivers avoid premium increases. And several other standard discounts are available as well:

Paperless and automatic payment discounts

Homeowners discount

Good student discount

Multi-car discount

Multi-policy discount

Continuous insurance discount

Liberty Mutual provides some of the cheapest car insurance rates for young adult drivers. They offer several discounts for safe drivers, including an accident-free discount and a violation-free discount, which can help reduce the cost of your auto insurance policy. You can also enroll in the RightTrack program, which will snag you an initial discount plus savings up to 30 percent for good driving behavior. It’s an app that works with a telematics device to track your driving and provide suggestions.

Liberty Mutual also offers payment discounts, such as automatic payment, pay-in-full, paperless, and online purchase discounts. The company provides standard multi-policy and multi-vehicle discounts as well.

USAA generally has low auto insurance rates for adults in their 20s. It also tends to offer lower premiums to bad drivers than other companies, so if you’ve been in an accident, consider getting a quote from USAA. Its SafePilot safe driving program offers an initial five percent discount for joining and up to 20 percent off at renewal for safe driving behavior.

You can also earn discounts for having a clean driving record for five years, taking a driving training course before you turn 21, maintaining a 3.0-grade point average, and even having family members who purchase insurance through USAA. That’s in addition to the payment discounts, multi-policy discounts, and new vehicle discounts offered by most insurers.

Average rates for Allstate tend to be higher than some other companies when it comes to new drivers, but the company is known for its reliable customer service and roadside services. They also offer a unique mile-based premium program called Milewise, which allows you to pay a daily rate plus a per-mile rate. It makes sense for young professionals who don’t drive often.

Allstate also has a telematics program called Drivewise. The insurer will give you a three percent discount just for signing up, and you can save up to 15 percent cash back every six months for safe driving. You’ll earn by keeping your speed safe, limiting nighttime driving, and avoiding hard braking.

That’s all in addition to standard discounts you would expect from most insurance providers, including:

Safety feature discounts

New car discount

Payment discounts

Smart student discount

Multi-policy discounts

With Nationwide, you have the option to add accident forgiveness, which can help you avoid an average 37 percent increase in your premiums if you get into an accident. Safe drivers, infrequent drivers, and good students can save on insurance costs as well. Nationwide uses telematics to offer SmartRide and SmartMiles programs, which track your safe driving behavior and your mileage, respectively. Both can earn you significant driving discounts. And if you’re a good student age 24 or younger, maintaining a B average will help reduce premium costs.

Nationwide also offers a generous multi-policy discount, saving drivers an average of $710 per year. And there are accident-free discounts, anti-theft device discounts, and payment discounts as well.

When it comes to finding the best auto insurance for you, you’ll also need to take into account factors outside your age. Your credit score and driving history can have a huge impact on your premiums. Certain professions are even considered to be more high-risk than others.

For example, if you’re a security guard or construction worker, you can expect higher rates than if you were a police officer or a secretary. Some occupations that are considered high-risk may surprise you; waiters and barbers both pay more than the average Joe for car insurance. So while it may be helpful to consult the average rates for young drivers at different companies, you should also get personalized quotes that take into account all your information.

We love that some insurance companies offer cheap auto insurance to young drivers, and we’ve called out insurance providers that offer safe driving discounts as well. Now that you have a sense of what each company provides, you’ll want to compare insurance quotes side by side. You can view up to 20 car insurance quotes at one time free with Insurify, and it just takes a couple of minutes.

Rather than getting separate quotes from each insurer’s website, you’ll save time and energy by entering your information just once. From there, you’ll be able to see which discounts you are eligible for so you can get the cheapest auto insurance for your coverage needs.

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.

Insurance Writer

Lindsay Frankel is a content writer specializing in personal finance and auto insurance topics. Her work has been featured in publications such as LendingTree, The Balance, Coverage.com, Bankrate, NextAdvisor, and FinanceBuzz.

Learn More