Best Life Insurance for Children | Compare Quotes

Updated April 14, 2021

Reading time: 8 minutes

Updated April 14, 2021

Reading time: 8 minutes

One of the most responsible things we can do as parents is to purchase a life insurance policy for our children. While we can’t protect them from everything, we can protect their financial futures.

Buying a life insurance policy for your child can help them pay for college or potentially buy a house and even creates a financial safety net for them for the future.

There are many advantages to having your child covered, and you’ll be happy to find a diverse array of life insurance companies that offer to insure your child. That’s why Insurify encourages you to use its platform to compare life insurance prices and policies from top companies—all in one place.

Most people may believe that the main reason to get life insurance is to replace income or cover debt if someone passes. So that begs the question, why get it for your child?

Children’s life insurance protects both the child and the parent or guardian from unexpected hardship and can be the financial boost a child needs to get them to the next level in life. Their coverage secures future insurability by delivering policies and benefits that will stay with them regardless of their age or health condition.

When it comes to finding the best life insurance policy for your child, you first need a clear vision of how you want the policy to work for them. All life insurance policies are not the same, and children have a list of affordable options they could qualify for with customizable benefits. These childhood benefits can stay on their policy even after they reach adulthood, at no extra cost.

Whole life insurance policies are ideal for children, as they carry much more value when purchased for a child. Premiums are low and coverage is high.

Getting a life insurance policy is more expensive when you’re older, so people with children may find it safer to purchase a policy that their child can keep for the rest of their lives.

The cash value that grows in a whole life policy is especially useful for children. Cash value is the interest that grows on your policy, which you can borrow from and replace or withdraw permanently. Parents often let cash value grow for many years and then borrow the funds for things such as college tuition and school books for their children.

One of the best features available for a child’s policy is customization. You can get your child a custom whole life policy. Custom whole life allows you to build a policy that provides permanent life insurance while allowing you to choose how your long premium payments will last.

For example, you purchase a policy for your five-year-old but only want to pay premiums until they turn 25. You’ll pay premiums until they reach the set age, but the policy will remain in force. Your child will now have what’s called a paid-up policy.

With a custom whole life policy, parents pay premiums over a shorter period than a traditional policy, which requires premium payments until the insured reaches roughly 80 years old. This type of coverage comes at a higher cost but is a great long-term benefit.

Even after your child has a paid-up policy, they will still have coverage, and their policy will continue to grow in cash value.

Term life insurance is not a common choice for children when weighing life insurance options. Since term insurance prices increase with age, the policy will likely have a much higher premium once your child reaches adulthood. The most dependable way to purchase a term life insurance policy is to get a minimum 20-year term.

As a parent, a term life policy can bring you peace of mind that your child has fixed coverage for at least 20 years. Depending on the type of policy you decide on, you have the option to convert term life policies into whole life policies at the end of the term period and sometimes even before. This process can typically be done very easily with a life insurance agent.

Getting life insurance for your children is not complicated. If you already have life insurance for yourself, you may find it easier to just add your child as a rider.

A rider is an additional coverage available on most life insurance policies. Adding a child rider offers extra coverage on your policy for a designated benefit amount until your children reach a certain age. Adding this rider allows you to provide your child with valuable protection without starting a new policy. The rider secures funeral cost and medical expenses and protects their insurability.

A term rider is term insurance added to your whole life policy. This rider increases the death benefit on an adult policy or provides term coverage to the policyholder ’s children.

One of the best benefits of a child insurance rider is the ability to convert the rider into a permanent policy down the line, without the child having to prove their insurability. They won’t be required to complete the standard application. Adding the rider is a quick and simple process.

With just one rider added to your policy, you will protect your biological, step, or adopted children, along with any children you have in the future. It only takes filling out a form to add a child to the policy. Some companies make it just that much easier by not requiring information about the children. As long as they are under 18, they are automatically covered.

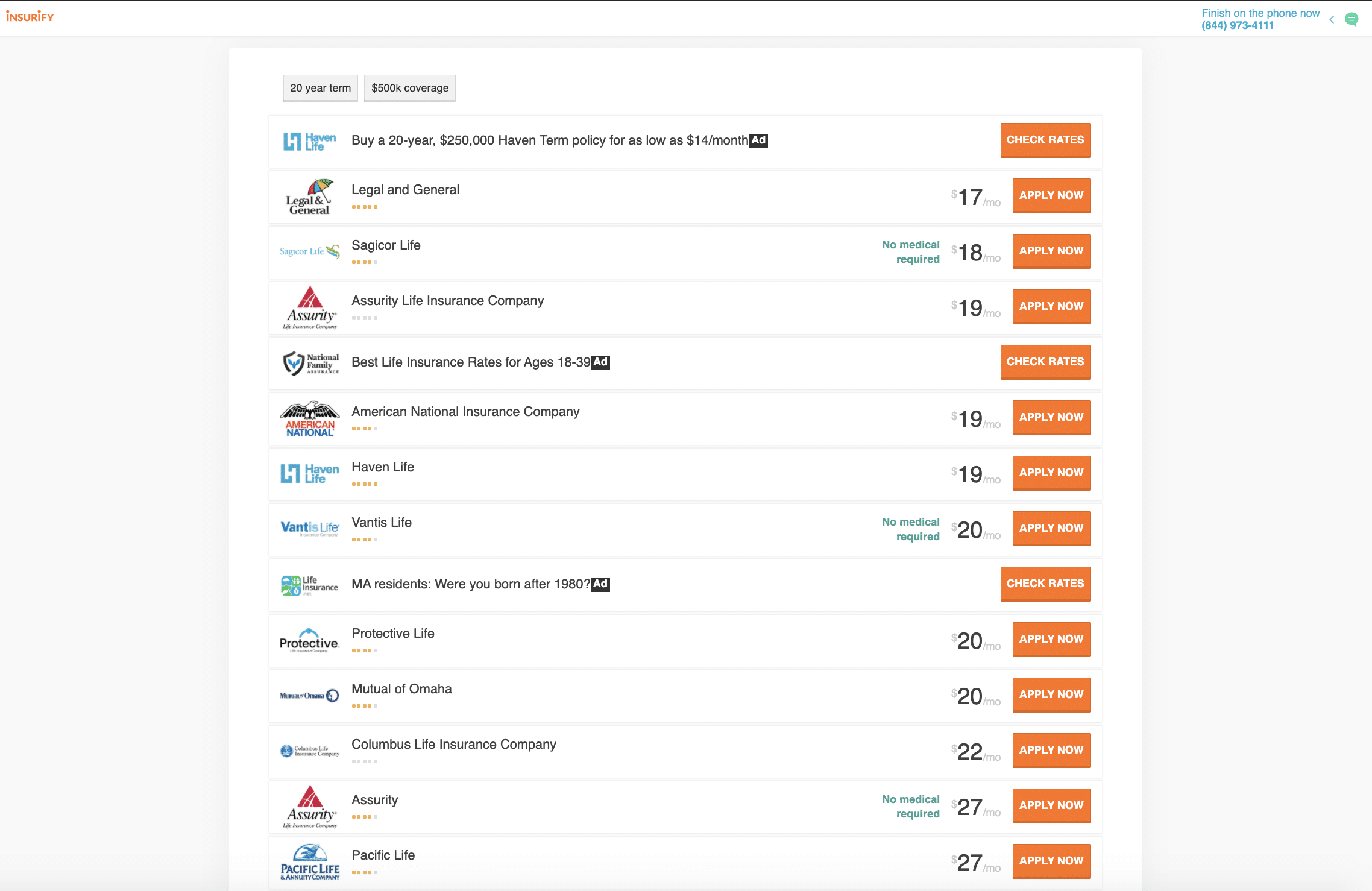

Imagine the advantage your child has by being eligible for a lower insurance rate as an adult because of the steps you took for them as a child. Insurify makes it easy to view what’s out there. Explore all your options today by comparing life insurance quotes on Insurify.

A trust-owned policy is pretty self-explanatory. Your life insurance policies, whether on your life or the lives of your children, are owned by the family trust. When a loved one passes, the death benefit will go into the trust. Funds can only be withdrawn with approval from the designated trustee.

A trust-owned policy is useful when families have policies exceeding $500,000 or parents pass while their children are still young and need guardianship. Since the trust owns the policy, this policy can grow in value and safeguard the future of many generations. Since the policy beneficiary is the trust rather than any one person, the policy and financial protection can stay in the family forever.

Some companies have great life insurance options for children, with many offering an array of products and benefits to consider. You want to choose the best possible option and assure your satisfaction with not only the policy but the insurer as well. The company you choose is as important as the decision to buy life insurance in the first place. Below is a list of companies that we routinely recommend based on policies and prices.

Globe Life offers premiums for children as low as $2.17 a month. Parents and grandparents find its coverage affordable and fast. Its policies offer full coverage on the first day and don’t require a medical exam. You can explore coverage amounts ranging from $5,000 to $30,000. The application is simple and there’s no agent visit.

For the first month of the policy, you’ll only pay $1. There’s no risk if you decide it’s not right for you or your child. Globe Life also offers a money-back guarantee. Starting for $1 is available for any coverage amount on a child’s policy.

Customers appear to be very satisfied with Globe Life, based on online reviews from policyholders. It’s consistently recommended specifically for children due to its lower coverage amounts and wide range of accidental death benefits.

Most parents are comfortable getting their children smaller coverage amounts. Globe Life encourages families to stay safe and even offers tips and tools, with articles like “Top Ten Child Safety Issues.”

Gerber Life Insurance hasn’t been around for as long as other companies in the business, but it competes well and offers great coverage. When considering life insurance for children, Gerber is often the first company that comes to mind.

With products like the Grow-Up Plan, Gerber motivates parents to begin planning their children’s financial future. You will have a college savings and emergency fund all in one.

The Grow-Up Plan is a whole life policy that offers a lifetime of protection. The coverage amount goes as high as $50,000. When your child turns 18 years old, the coverage doubles at no additional cost. You’ll be paying the same low rate while your child has increased benefits. This policy is also built with cash value that grows over time.

The online application is hassle-free with just a few questions and gets approved in seconds. When you choose to sign up to have your premiums automatically deducted, you’ll be eligible for a 10 percent discount.

A stable life insurance company that has been around for over a century, New York Life has the “highest financial strength rating in the business.” New York Life lets policyholders reimagine life insurance by offering larger coverage amounts and great custom children’s whole life policies so you can decide how long premiums last.

New York Life is an ideal organization to choose when your vision of financial security is generational. You can design a policy that is beneficial to your children, grandchildren, and even your great-grandchildren. You can explore creating trust-owned policies that will support your financial goals.

There is a quick and simple purchase process on children’s whole life policies with American Family Insurance.

The DreamSecure policy works great for parents or grandparents on a budget. The plan is designed to be affordable and lasts until adulthood. American Family Insurance keeps in mind that your children will one day have children of their own who can benefit from this policy. You can lock in low rates now to avoid paying high premiums later.

Locking in a whole life policy while a child is young maximizes the amount of cash value they will have access to when they get older. There are three coverage levels that let policyholders pay off premiums in 10 or 20 years. With a guaranteed purchase option benefit built into the policy, your child can buy more coverage without a medical exam.

Policyholders have a sense of community when they join the Transamerica family. With its online platform, you can discuss important topics, seek help, and have inspiring conversations about health and wealth. Parents who are still not sure if they should buy life insurance for their children find peace in talking to other parents who are making the same decision or who have already been down this path.

Transamerica’s pricing is above average, and customers often say they’re satisfied with the amount of coverage they have for what they are paying.

Transamerica’s Trendsetter Super policy can exceed $10 million, while the Trendsetter LB goes up to $2 million. Most post people will never buy that much life insurance for a child, but the coverage is available depending on personal financial obligations.

To make sure you find the most affordable policy with the right coverage amount, compare quotes now with Insurify . It’ll save you a ton of time and keep costs low.

On average, life insurance rates for children under 18 are about $29 a month. That being said, how much you pay for life insurance will vary depending on the coverage amount. Some companies even have policies as little as $2 a month. Make sure you compare life insurance rates on Insurify to find the best life insurance deals available.

Whole life insurance is perfect for children. The premiums are low and never increase. You can customize the policy to stop paying premiums when you want and lock in permanent benefits. Choose from a list of products that will help your children in the long run.

You should absolutely buy life insurance for your children. Outside of the fact that tragedies do happen, think about the advantage you are giving to your child by purchasing life insurance at a very low rate that will last a lifetime. By the time your child is an adult, they will have access to thousands of dollars for investments, travel, college, or even buying their first home. The underwriting process is simple, and you’re going to secure the financial future of not only your children but also your grandchildren.

If you’re interested in getting the best deals on a life insurance policy, Insurify is quick, easy, and secure. Compare quotes from the highest rated companies and products in minutes.

Insurance Writer

Brooke Taylor is a freelance writer with a passion for storytelling and educating others. She has experience in life insurance and has been active in helping consumers make more informed decisions. When she's not writing, Brooke is reading a good book or being a mom of four. To learn more about Brooke you can visit her website www.brookeuniverse.com.

Learn More