ASPCA Pet Insurance: Is it the right choice?

Updated January 11, 2021

Reading time: 8 minutes

Updated January 11, 2021

Reading time: 8 minutes

Pet owners looking for expansive coverage for prescription drugs and alternative therapy

Those looking for just accident-only coverage

Equine owners

Exotic pet owners

Unexpected illnesses and injuries can creep up on any pet parent and can be devastating for them and their furry companions.

What can be an emotional strain on your mental health can also be a financial strain on your bank account. When faced with a suffering pet, the cost of multiple vet visits, and a cocktail of expensive prescriptions, many pet parents can find themselves in a difficult spot.

Buying a pet insurance policy can relieve some of the financial pressures from pet owners during these difficult times by reimbursing up to 90 percent of their medical bills.

Pet insurance can cover a variety of expenses depending on the company and policy, including preventative care, emergency care, rehabilitation, surgery, and prescription cost. Quality vet care can come at a high price as it continues to advance, and having a good insurance policy in your corner can guarantee the best care for your pet.

To check how much pet insurance would cost for your pet, compare quotes on Insurify today.

ASPCA offers pet insurance for dog and cat owners in all 50 states and U.S. territories.

Policies for horse insurance are only available in California, Colorado, Connecticut, Kentucky, Oklahoma, Texas, New York, New Jersey, Ohio, Pennsylvania, Virginia, and Wisconsin.

ASPCA doesn’t require an initial veterinary exam or any medical records to begin enrolling your pet. It offers the following policies for dog, cat, and horse owners:

ASPCA pet insurance offers its complete coverage policy for any cat or dog over eight weeks old, and for any horse over six months old. It offers coverage for accidents, illness, hereditary conditions, and behavioral issues, among others.

This means ASPCA will reimburse you for veterinary fees like tooth extractions, lab tests, MRI’s, hip dysplasia treatment, surgeries, microchipping, prescriptions, cancer treatment, and medical supplies like casts and splints.

ASPCA also offers a preventative care add-on for routine veterinary coverage like vaccines, heartworm and flea prevention, and routine testing. There is no upper age limit for pets on any of its policies.

Pet owners can opt to have accident-only coverage, which will lower your monthly premium but severely limits what your pet insurance covers.

ASPCA’s accident-only coverage will solely cover costs related to unexpected injuries and treatments. This includes tests and procedures like X-rays, foreign object removal, surgery, and applying casts. Under this plan, ASPCA won’t cover veterinary fees related to illness or chronic conditions.

ASPCA offers a preventative and wellness care add-on that can be purchased in addition to the complete coverage policy or accident-only plan for as low as an additional $9.95 per month. This add-on would help you keep costs down on annual exams, vaccinations, and dental cleanings.

Depending on the policy you choose, ASPCA insurance can cover nearly every instance of veterinary care for your furry friend. The company offers up to 90 percent reimbursement for services provided by any licensed veterinarian, specialist, or emergency clinic.

According to ASPCA’s website, it won’t exclude coverage for old age, congenital, chronic, or breed-specific conditions.

The complete coverage policy offers coverage for costly accidents and illnesses your dog may suffer, like cancer, canine pneumonia, poisoning, and foreign object extraction. It also covers chronic and congenital conditions that aren’t considered pre-existing conditions like diabetes, allergies, and brachycephalic airway syndrome. In case of emergencies, it will also cover expensive costs like surgery, medications, and end-of-life expenses.

The preventative care add-on helps cover routine expenses for your dog like routine exam fees, spaying and neutering, dental care, canine heartworm tests, and vaccines for diseases like canine rabies and canine bordetella.

Like any other pet insurance company, ASPCA won’t cover cosmetic procedures, breeding costs, or pre-existing conditions. However, it will reinstate coverage for any pre-existing condition, except for knee and ligament conditions, if the condition is considered cured. So if your pet doesn’t show symptoms for an illness or injury for 180 days, ASPCA will reinstate coverage for that illness or condition.

ASPCA offers its complete coverage policy for your favorite feline that covers accidents, illness, behavioral conditions, chronic conditions, and prescription drug coverage. It reimburses cat parents for a variety of non-routine costs from licensed veterinarians, specialists, and emergency clinics.

Depending on the purchased plan, pet owners can be reimbursed up to 90% for unexpected costs like foreign object removal or bone fractures. ASPCA will also cover common and not-so-common illnesses, from urinary tract infections to cancer treatments and polycystic kidney disease.

With the purchase of the preventative care add-on, ASPCA can help c over routine costs for your cat like spaying and neutering, routine exam fees, FELV screenings, and FELV and FVRCP vaccines.

While ASPCA pet insurance plans don’t cover pre-existing conditions, the company will reinstate coverage for any condition deemed fully cured, except for knee and ligament issues. The condition is considered cured if your pet doesn’t show any symptoms for the condition or require treatment for 180 consecutive days.

ASPCA pet insurance offers policies for horses in California, Colorado, Connecticut, Kentucky, Oklahoma, Texas, New York, New Jersey, Ohio, Pennsylvania, Virginia, and Wisconsin. Horses qualify for complete coverage and accident-only coverage, and both plans include coverage for colic conditions. Horse owners can also opt-in for the preventative care add-on.

Depending on the plan purchased, horse owners can receive up to 90 percent reimbursement for veterinary, specialist, and emergency clinic costs. These plans can cover unexpected veterinary costs like lacerations, hoof abscesses, injuries from trailer accidents, Cushing’s disease, cancer, and more. ASPCA’s colic coverage includes problems like impaction, displacement, spasmodic, and enteritis.

Adding preventative care to your policy can also help with covering veterinary fees like routine exam costs, vaccines, dental floatings, and more.

Equine insurance will not cover arthritis, navicular disease, joint injections, or pre-existing conditions. Pre-existing conditions coverage can be reinstated if your horse is asymptomatic and treatment-free for 180 consecutive days.

The ASPCA does not offer insurance for birds or exotic pets other than horses. According to its website, the ASPCA does not approve of exotic animals as domesticated pets. Currently, Nationwide is the only pet insurance company to offer pet insurance for exotic animals.

ASPCA insurance offers a lot of flexibility when it comes to building a policy. Pet owners get to customize how much they want to spend each month, what they want to be covered, their annual limits for reimbursement, and how much of their veterinary costs are covered per claim.

ASPCA’s complete coverage plan and accident-only plan offer annual deductibles of $100, $250, and $500 for cats, dogs, and horses. This means that your pet insurance policy will kick in once you’ve spent the chosen amount of money on something like exam fees, blood tests, or medications.

Since this is an annual deductible and not a deductible per claim, once you’ve paid the chosen amount, the policy should kick in for the rest of the year up until you reach your maximum annual benefit limit.

ASPCA insurance offers different reimbursement options for the amount of coverage per veterinary expense. Reimbursement works like co-pay. So if you pick a 90 percent reimbursement percentage, ASPCA covers 90 percent of the costs while you pay the remaining 10 percent.

Pet owners can choose between a 70 percent, 80 percent or 90 percent reimbursement option for their ASPCA policy, which will adjust the monthly cost. The higher the reimbursement percentage, the higher your monthly premium.

However, ASPCA’s reimbursements are based on the average cost of each procedure and treatment, not necessarily what your invoice cost. This means you might not get back the entirety of your expected reimbursement.

Your annual payout limit depends on the plan you pick and can range from $5,000 to an unlimited maximum amount for dogs and cats, and between $3,000 to $7,000 for horses. An annual limit is the maximum amount of money an insurance company will pay to cover your costs for the year. The higher the annual limit, the more you pay each month. Once you’ve paid your deductible for the year, the annual limit is how much money ASPCA is willing to put towards your remaining veterinary bills for the year.

ASPCA will reimburse each clai m after it receives a completed claim form and a copy of your veterinary invoice. These can be uploaded directly to its member center through its website or app, emailed to [email protected], faxed to 1-866-888-2495, or mailed to the following ASPCA address:

ASPCA Pet Health Insurance

1208 Massillon Rd. Suite G 200

Akron, Ohio 44306

According to its website, ASPCA usually processes claims within 30 days of receiving all of your information. This can be tracked in the member center portal.

ASPCA should reimburse you for covered expenses up to the annual maximum limit you chose when you signed up for your policy.

ASPCA implements a 14-day waiting period for all accidents and illnesses. If your pet were to fall ill or get injured before the end of this waiting period, any claim filed would not be covered by your ASPCA plan, and you would have to pocket those costs. It would also become a pre-existing condition, and you would not get coverage in the future for it.

To see how ASPCA’s quotes stacked up to those from its competitors, Insurify’s data team compared pet insurance quotes from Nationwide, Healthy Paws, and PetPlan.

Below are the pet insurance quotes for a two-year-old purebred golden retriever named Sally who lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| ASPCA | $54/mo |

| Nationwide | $54/mo |

| Healthy Paws | $66/mo |

| Petplan | $89/mo |

These are the pet insurance quotes for a one-year-old German shepherd named Jerry who also lives in San Jose, California:

| Company Name | Quotes |

|---|---|

| ASPCA | $49/mo |

| Nationwide | $63/mo |

| Healthy Paws | $63/mo |

| Petplan | $84/mo |

Finally, these are the quotes for a three-year-old labradoodle named Sandy in San Jose. Mixed breed dogs usually have lower insurance premiums since they aren’t as susceptible to genetic conditions:

| Company Name | Quotes |

|---|---|

| ASPCA | $43/mo |

| Nationwide | $38/mo |

| Healthy Paws | $53/mo |

| Petplan | $68/mo |

And for cats, these are the quotes for a three-year-old British shorthair named Simon, who lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| ASPCA | $30/mo |

| Nationwide | $15/mo |

| Healthy Paws | $16/mo |

| Petplan | $20/mo |

Remember, cat insurance premiums tend to be cheaper than dog insurance premiums.

And these are the quotes for a five-year-old mixed breed long-haired cat named Wesley, who also lives in Houston, Texas:

| Company Name | Quotes |

|---|---|

| ASPCA | $27/mo |

| Nationwide | $15/mo |

| Healthy Paws | $14/mo |

| Petplan | $23/mo |

If you want to find out how much it would cost to insure your pet, check out Insurify. Insurify allows you to compare pet insurance policies and prices all in one place, so you can buy the best policy for your best friend.

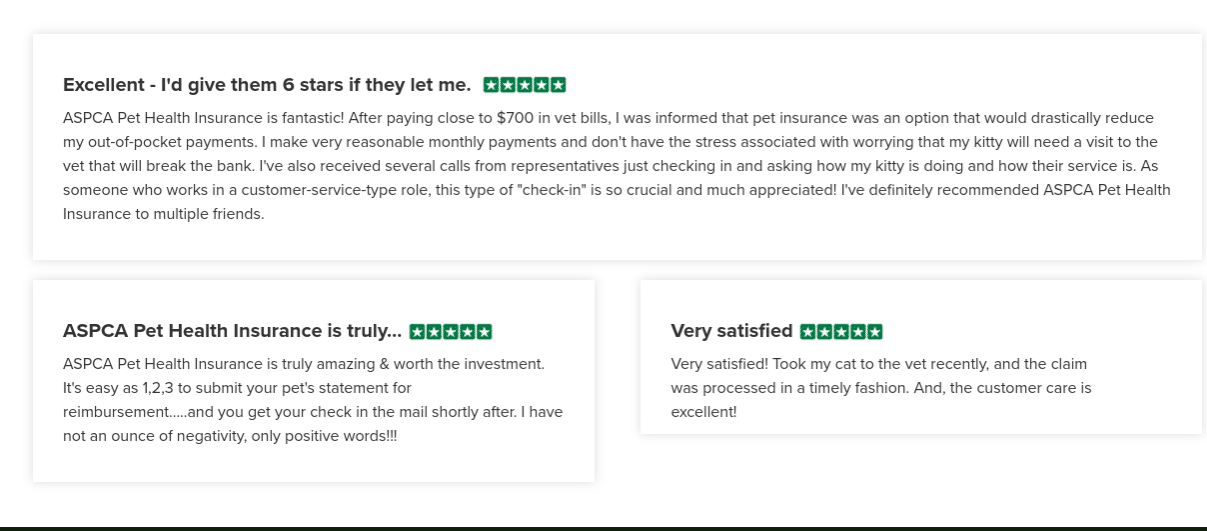

ASPCA has a page on its website dedicated to showcasing some reviews from Trustpilot. These reviews are mostly positive and mention how ASPCA’s insurance policy helps customers better afford healthcare for their pets.

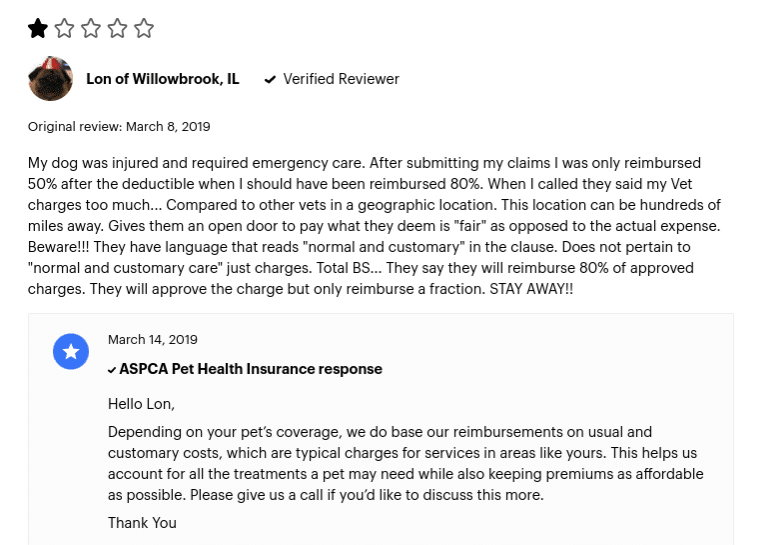

While ASPCA does include a handful of less-than-perfect reviews on its website, it still doesn’t post inherently negative reviews. Sites like ConsumerAffairs gives unhappy patrons a chance to air their grievances. However, ASPCA also holds a 4.75-star rating on ConsumerAffairs, which is higher than any other pet insurance company on the website. A representative for ASPCA has responded to many of the one-star reviews with the company’s helpline phone number.

One-star reviews typically complain about ASPCA’s reimbursement policy and the company’s explanation of what it will actually cover. While ASPCA’s website says it will cover your vet invoice, it will actually base your reimbursement amount on “usual and customary cost.” This means that if you initially signed up for a 90% reimbursement rate and your vet invoice for neutering was $400, but the average cost in your area is $100, ASPCA will only pay $90. Another issue that comes up is the pre-existing condition policy and ASPCA’s denial of claims.

| Customer Care | 1 (866) 204-6764 |

| Claims email | [email protected] |

| Member center portal | Portal login |

| Website | www.aspcapetinsurance.com |

ASPCA pet insurance policies are underwritten by the United States Fire Insurance Company, and produced by C&F Insurance Agency, Inc., a Crum & Forster company.

ASPCA's pet insurance rates depend heavily on your pet's breed, age, pre-existing conditions, and location. On average, ASPCA's insurance plans cost around $35 a month per pet. Again, these rates are heavily subject to the aforementioned factors, as well as the insurance plan you choose. In comparison to other pet insurance companies, ASPCA's prices tend to be neither more expensive nor cheaper than its competitors. Its prices are quite average. Still, you should compare pet insurance plans and prices before settling on one policy.

The ASPCA will give you a 10 percent discount for insuring multiple pets. You can also get 10 percent off at affiliate veterinary practices in participating states. These two discounts can be stacked together.

ASPCA seems to offer a good amount of coverage for pet owners and is able to keep its rates relatively low. It is one of the few pet insurance providers that offer equine coverage, and include options for routine care coverage. But some policyholders complain that the actual reimbursement amount and constant denial of claims don't feel worth the monthly cost. Whether ASPCA is a good choice for you comes down to what you can afford and what kind of coverage fits you and your pet best. That's why you should make sure you compare quotes before settling down on a single pet insurance policy.

Insurance Writer

Samantha Vargas is a freelance writer for Insurify. She has a background in comparative English literature and film and has produced a variety of journalistic content for the University at Buffalo's independent student newspaper, The Spectrum. She currently works in Buffalo, NY while finishing her master's degree. She spends her free time baking and working with animal welfare groups.

Learn More