4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Companies for SR-22 Insurance in Arkansas (2022)

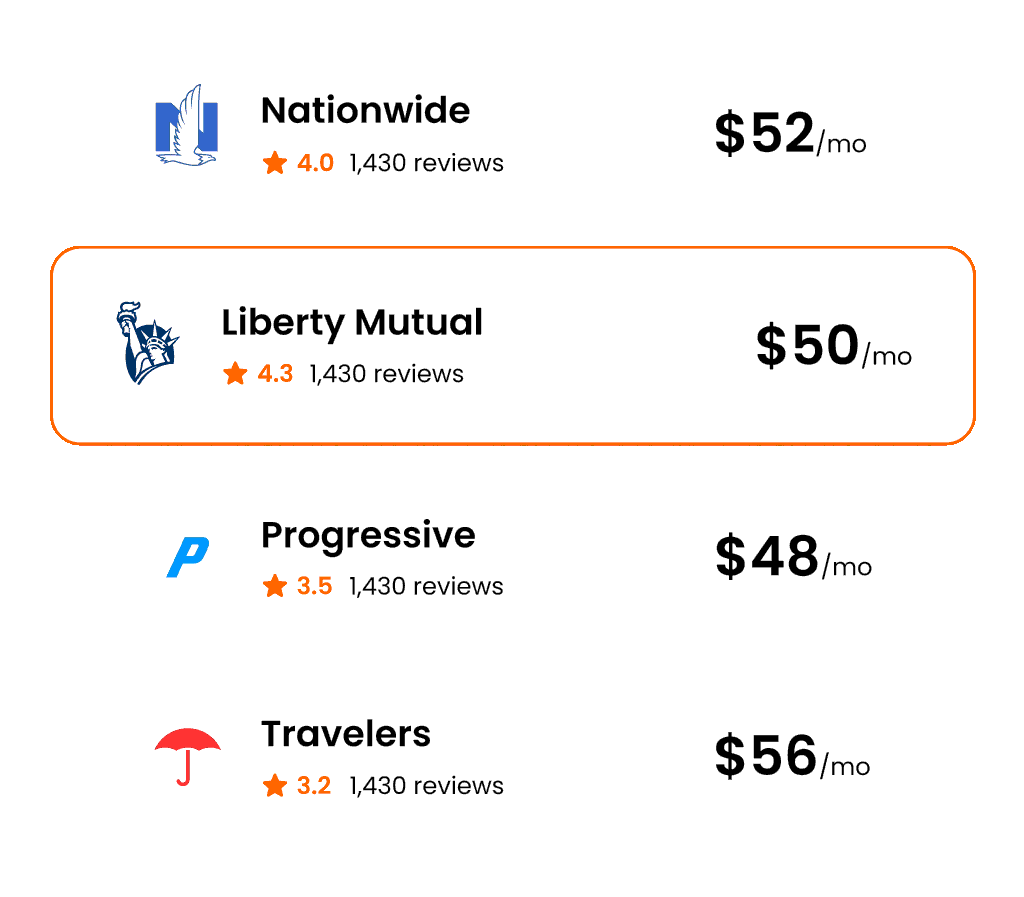

For drivers with SR-22 in Arkansas, it’s important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate after an SR-22.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Arkansas. The following are the best insurance rates from carriers that offer car insurance for drivers with an SR-22 in Arkansas.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| Dairyland | $189 |

| Direct Auto | $196 |

| Hallmark | $203 |

| Safeco | $218 |

| The General | $274 |

Table of contents

- How Much Does SR-22 Insurance Cost in Arkansas?

- What Is an SR-22, and Who Needs One in Arkansas?

- How Much Does Credit Score Affect SR-22 Insurance Costs in Arkansas?

- How to Find the Best SR-22 Insurance Rate in Arkansas

- Non-Owner SR-22 Insurance in Arkansas

- Alternatives to an SR-22 in Arkansas

- Frequently Asked Questions

- Compare Top Auto Insurance Companies

How Much Does SR-22 Insurance Cost in Arkansas?

The average difference in monthly car insurance premiums between Arkansas drivers with no violation and those with SR-22 insurance is $20. The averages are $190 per month with no violation and $210 with an SR-22. That's not too shabby: that 11 percent difference is much higher in most states.

Insurify's comparison tool will help you make sure you're getting the best possible quote even after an SR-22. You can have peace of mind that you're reviewing all of your available insurance options and can confidently choose the one that is best for your situation.

What Is an SR-22, and Who Needs One in Arkansas?

DUIs, reckless driving, and getting in a crash without insurance are the types of offenses that will require you to obtain and carry an SR-22 certificate in Arkansas. If you receive notice from a court or the DMV that says you need one, you're not alone. Authorities require lots of drivers who they consider "reckless" to get an SR-22, which proves that you have adequate insurance.

When you buy SR-22 insurance, the carrier has to fill out the SR-22 form for you and submit it to the DMV. You may have heard that SR-22s are expensive. That's kind of true: You'll be charged a fee of $50 or less to file the form, which isn't bad, but since only serious violations will garner an SR-22 requirement, you'll likely pay higher premiums as well.

Compare Car Insurance Quotes Instantly

How Much Does Credit Score Affect SR-22 Insurance Costs in Arkansas?

It's true that having good credit means that insurance carriers tend to go a bit easier on you. So while it's true that nearly all drivers buying SR-22 insurance pay more for insurance than drivers without violations, if they have poor credit, not only are their rates generally higher in the first place, but they'll also have a heavier penalty for SR-22 insurance.

In Arkansas, drivers with SR-22s but great credit pay about $235 per month, $45 more than drivers with similar credit but no violations. If you have bad credit and an SR-22, you'll pay an average of $287 per month—$55 more than drivers with clean records but bad credit.

| Credit Tier | Avg. Monthly Rate - No Violation The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Avg. Monthly Rate - SR-22 The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Difference |

|---|---|---|---|

| Excellent | $190 | $235 | $45 |

| Good | $212 | $263 | $51 |

| Average | $214 | $265 | $51 |

| Poor | $231 | $287 | $55 |

How to Find the Best SR-22 Insurance Rate in Arkansas

Because SR-22s represent a change of paperwork and an important shift in your coverage, it's critical to reevaluate your insurance and make sure you're getting the best deal you can. Use Insurify to help you compare quotes across all the important companies in Arkansas—for free, and in just a few minutes—to be absolutely sure you're getting the best rate you can.

Non-Owner SR-22 Insurance in Arkansas

SR-22 forms are necessary for drivers that want to get their license reinstated. But what if you don't have a car? It's very possible that non-owner insurance could save you money. And you can still be insured and borrow cars on an infrequent basis from non-relatives who you don't live with. Ask the insurance company directly about this.

Alternatives to an SR-22 in Arkansas

Unfortunately, the only way to get your license reinstated if you are required to get an SR-22 certificate is to buy the insurance. There aren't other ways of covering yourself in Arkansas.

How Do I Get SR-22 Insurance in Arkansas

Make sure you get all the quotes you can from all the insurance carriers available; rates can vary, and some insurance companies won't offer SR-22 policies. Insurify can provide you a personalized slate of estimates from all the important carriers—for free—in just a few minutes.

Frequently Asked Questions

SR-22s are required for a duration of three to five years in Arkansas. If you lapse your coverage, the clock resets, so be careful about switching or canceling; make sure you're covered at all times with no gaps!

Moving out of state doesn't nullify your SR-22 requirement. In order to register a car or get a license in the next state you live in, you'll still have to maintain the Arkansas SR-22.

To reinstate your license, you have to buy some form of insurance that meets the minimum coverage and have an insurance company file an SR-22 form on your behalf. If you don't have a car, ask insurers about non-owner SR-22 insurance—it could help you save.

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.