4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Insurance Companies for High Risk Drivers in Georgia (2022)

For drivers that are high-risk in Georgia, it's important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate for drivers that are high-risk.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Georgia. The following are the best insurance rates from carriers that offer car insurance for high-risk drivers in Georgia.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| Travelers | $215 |

| Mile Auto | $226 |

| Amigo America | $227 |

| GAINSCO | $268 |

| Liberty Mutual | $283 |

| Direct Auto | $315 |

| SafeAuto | $339 |

| American Family Insurance | $348 |

| AssuranceAmerica | $354 |

| Midvale Home & Auto | $355 |

What Makes a Driver High-Risk in Georgia?

If you are someone who is more likely to file a claim with your insurance company than the average driver, you are considered high-risk by car insurance companies in Georgia.

What makes you more likely to file a claim? Drivers who take risks on the road, including those who speed, have DUIs, and ignore red lights, are all more likely to a) have accidents and b) file a claim because of their actions. Insurance for high-risk drivers can be harder to come by and costlier. By increasing the rates they charge high-risk motorists, insurance companies can be ready to pay for the claims they predict will come.

Georgia Car Insurance Rates for High-Risk Drivers

Insurify's comparison tool will help you make sure you're getting the best possible quote even after high risk driving violation. You can have peace of mind you're not paying any more than need to, and customers save $48 per month on average.

How Much Does High-Risk Driving Affect Car Insurance Rates in Georgia?

With a recent increase in highway fatalities, it's no wonder that auto insurers are so harsh on high-risk drivers in this state. Compared to other states, Georgia high-risk drivers experience a higher monthly increase in rates to the tune of hundreds of dollars.

While an at-fault accident in Pennsylvania raises average monthly rates by $26, rates in Georgia increase by $105. Speeding tickets and reckless driving are penalized similarly. Overall, high-risk drivers in Georgia can expect their rates to go up as much as 34 percent.

| Driving History | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| No Violation | $309 |

| Speeding Ticket | $387 |

| At-Fault Accident | $414 |

| Reckless Driving | $378 |

| Failure to Stop | $366 |

How Much Does a Speeding Ticket Impact Car Insurance Rates in Georgia?

Lift your feet off the accelerator a little bit if you want to experience cheaper car insurance rates in Georgia. Speeders see an average monthly rate increase of $78. Over the five years that your rates will be elevated, this adds up to $4,680 in added cost!

How Does an at-Fault Accident Impact Insurance Rates in Georgia?

When insurance companies find out about an at-fault accident, they raise rates by 34 percent. Monthly, this means that you'll have to find an extra $105 to cover your auto premium.

How Much Does Failure to Stop for a Red Light or Stop Sign Impact Car Insurance Rates in Georgia?

Running a red is going to cost you dearly in Georgia. While perfect drivers pay an average of $309 for insurance monthly, red-light-runners pay $57 more, at $366. Over five years, this high-risk mistake could cost you $3,420 in unnecessary insurance premiums.

Does Driving With a Suspended License Impact Car Insurance Rates in Georgia?

If you are someone who is more likely to file a claim with your insurance company than the average driver, you are considered high-risk by car insurance companies in Georgia.

What makes you more likely to file a claim? Drivers who take risks on the road, including those who speed, have DUIs, and ignore red lights, are all more likely to a) have accidents and b) file a claim because of their actions. Insurance for high-risk drivers can be harder to come by and costlier. By increasing the rates they charge high-risk motorists, insurance companies can be ready to pay for the claims they predict will come.

Tips for Researching High-Risk Georgia Car Insurance Rates

Insurance prices and policies can vary significantly between companies, and a large and growing state like Georgia draws a wide variety of choices when factoring high-risk driving insurance rates.

Insurify''s rate comparison tool will help you make sure you''re getting the best possible quote based on your needs and location. You can have peace of mind you''re not paying any more than you need to, and customers save $585 per year on average.

Compare Car Insurance Quotes Instantly

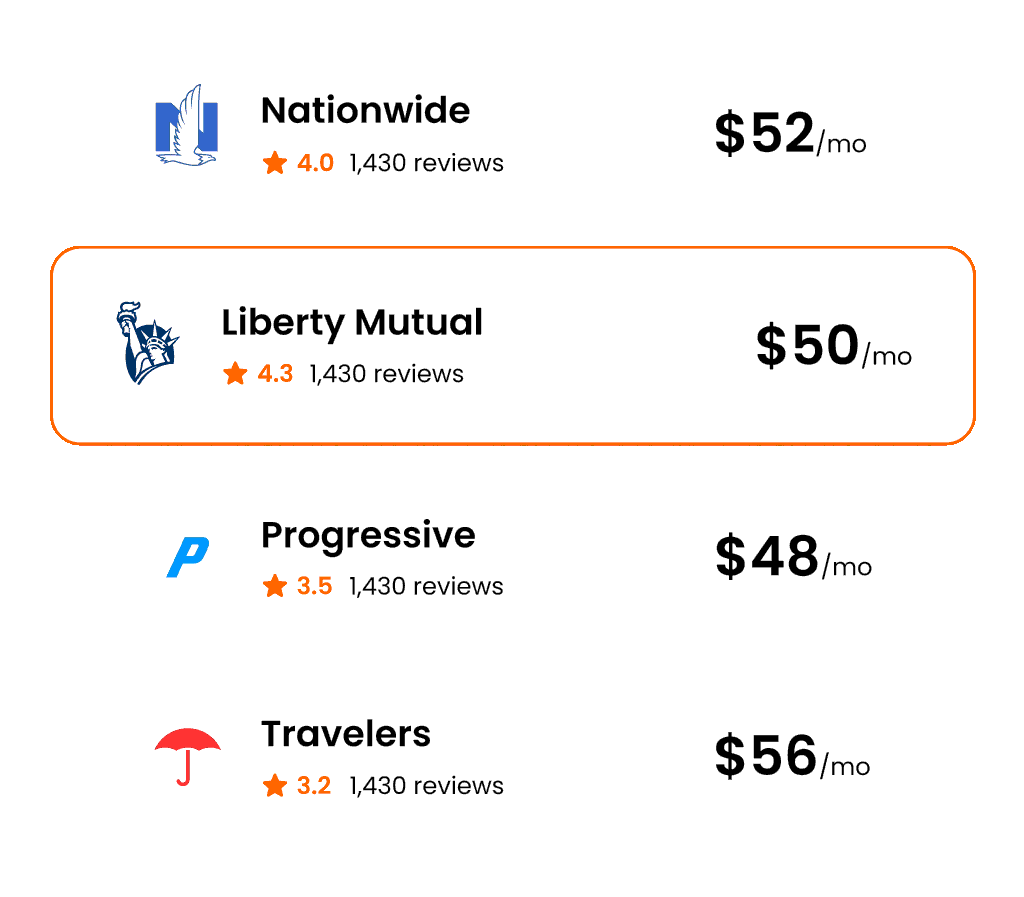

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

FAQs - Georgia Car Insurance

There are many different factors that go into the how expensive your car insurance is. That said, some of the reasons why you could be paying so much for your insurance include: living in a state with high minimum insurance requirements, being a young or new driver, committing past traffic offenses like at-fault accidents or DUIs, and having a low credit score.

Auto insurance costs will vary between locations and insurance carriers, depending on the county Georgia. Insurify analyzed the latest data for the five most populous cities in Georgia to find you the cheapest quotes in each of these metropolitan areas.

The way to find the carrier with the best auto insurance ratings in Georgia and save on your insurance premiums is to compare quotes from all companies in your area. Use a car insurance quotes comparison site like Insurify to compare up to 10+ real quotes for your specific driver profile and unlock savings and discounts. Rates can fluctuate greatly based on whether you're a safe driver or a high risk one, but you should never overpay. Insurify provides the cheapest car insurance quotes and companies in your area in just a few seconds.

During the past three years in the United States, national premium costs have risen an average of 4.5 percent annually. In states where quotes have risen, this figure has been 7.8 percent; and in those where rates have fallen, prices have decreased by approximately 6.0 percent. Individual rates by state will of course vary depending on the driver’s history and a multitude of factors.

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.