4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Companies for SR-22 Insurance in Michigan (2022)

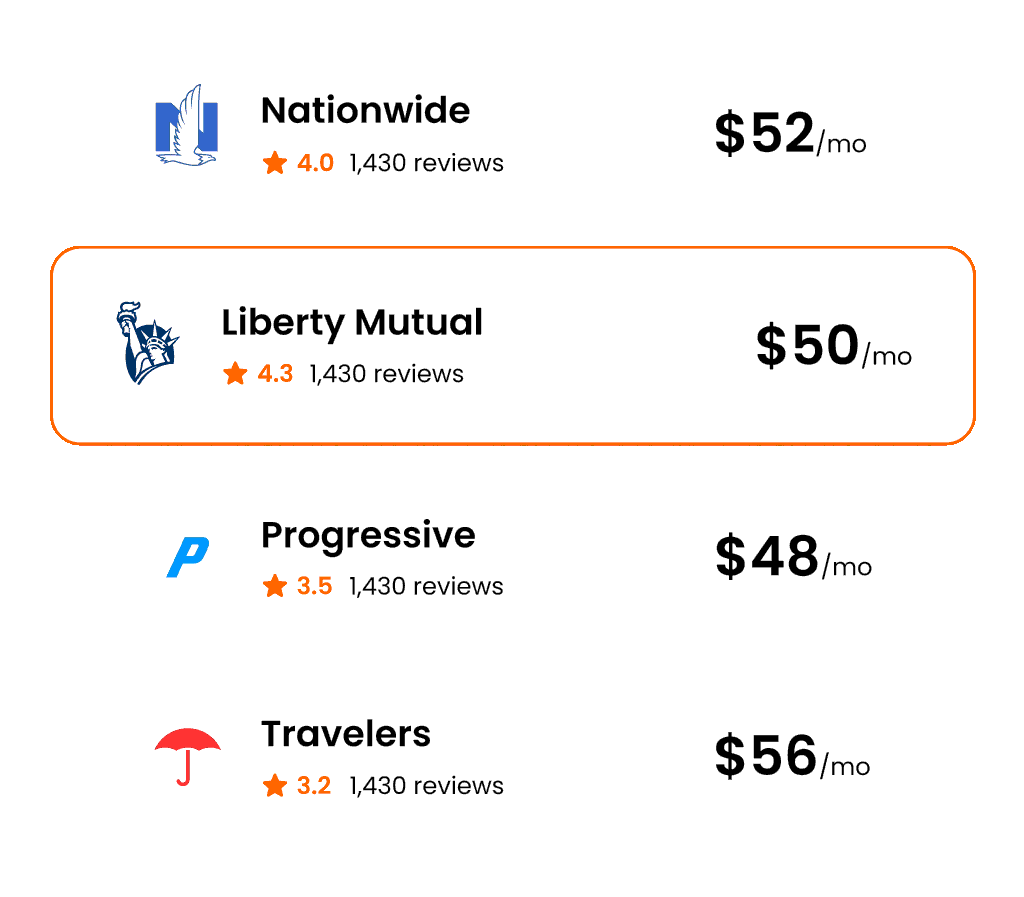

For drivers with SR-22 in Michigan, it’s important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate after an SR-22.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Michigan. The following are the best insurance rates from carriers that offer car insurance for drivers with an SR-22 in Michigan.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| RateForce, Arrowhead | $448 |

| Kemper | $465 |

Table of contents

- How Much Does SR-22 Insurance Cost in Michigan?

- What Is an SR-22, and Who Needs One in Michigan?

- How Much Does Credit Score Affect SR-22 Insurance Costs in Michigan?

- How to Find the Best SR-22 Insurance Rate in Michigan

- Non-Owner SR-22 Insurance in Michigan

- Alternatives to an SR-22 in Michigan

- Frequently Asked Questions

- Compare Top Auto Insurance Companies

How Much Does SR-22 Insurance Cost in Michigan?

Auto insurance coverage is already costly enough in Michigan, but having to obtain an SR-22 form can cause your rates to increase drastically. Typically, insurance providers will charge an average of 24 percent more for coverage in Michigan if a driver is required to maintain an SR-22. This increase can result in paying $113 more each month for auto insurance.

Insurify's comparison tool will help you make sure you're getting the best possible quote even after an SR-22. You can have peace of mind that you're reviewing all of your available insurance options and can confidently choose the one that is best for your situation.

What Is an SR-22, and Who Needs One in Michigan?

Having an SR-22 form isn't a requirement for every driver. In fact, only drivers who have major driving violations in Michigan, such as a DUI, repeat traffic offenses or causing an accident without insurance, typically need it. Many insurance companies will offer the SR-22 document to motorists, but it often results in a fee on your auto insurance policy.

In Michigan, the SR-22 form is generally used as a way to prove to the state that a driver is maintaining the minimum auto liability insurance requirements. Many states, including Michigan, require that drivers who need an SR-22 form keep it for a minimum of three years.

Compare Car Insurance Quotes Instantly

How Much Does Credit Score Affect SR-22 Insurance Costs in Michigan?

Your credit score can have a significant impact on the overall cost of an SR-22 in Michigan. Compared to drivers without an SR-22, those who fall into the excellent category experience a smaller increase than customers in the other three tiers. For instance, drivers who have an excellent credit rating only see an increase of $95, whereas drivers who have poor credit scores can pay as much as $116 more.

| Credit Tier | Avg. Monthly Rate - No Violation The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Avg. Monthly Rate - SR-22 The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Difference |

|---|---|---|---|

| Excellent | $397 | $492 | $95 |

| Good | $443 | $549 | $106 |

| Average | $446 | $553 | $107 |

| Poor | $483 | $599 | $116 |

How to Find the Best SR-22 Insurance Rate in Michigan

Finding an affordable SR-22 option in Michigan can be difficult, especially if you haven't been exposed to the process before. With Insurify, obtaining an SR-22 in Michigan is easy and simple. By answering a couple of questions, you will be given a list of affordable SR-22 quotes within minutes to review, all on one screen.

Non-Owner SR-22 Insurance in Michigan

Customers who need to obtain an SR-22 but don't currently have a vehicle will want to look for non-owner insurance. The non-owner policy provides coverage for drivers who don't own a car but are still required to show proof of insurance to the state. It is important to note that this option is sometimes not available if someone in your household owns a car.

Alternatives to an SR-22 in Michigan

While there aren't any direct alternatives to getting around paying for an SR-22 in Michigan, there are ways to lower the cost you pay. Most customers assume that there is a standard SR-22 rate that everyone pays, but that isn't the case. Often, shopping around can give you the best chance of paying a lower amount for an SR-22 form.

How Do I Get SR-22 Insurance in Michigan

Obtaining an SR-22 can be expensive, making it nearly impossible to maintain coverage if an unexpected expense comes up. Shopping around for rates is the best way to ensure you have an affordable rate that you can manage. With Insurify, you can quickly compare SR-22 insurance rates in Michigan and select the quote that makes sense for you.

Frequently Asked Questions

In Michigan, the time requirement for maintaining an SR-22 is a minimum of three years. During this time, drivers must also maintain a clean driving record and the minimum auto insurance coverage, otherwise the length of time will be extended.

In Michigan, if you move out of the state, you will be required to transfer your SR-22 to your new location. You won't have to start the time requirement over, but you will need to finish out any remaining time. Often, contacting your insurance provider is the best way to ensure your SR-22 has been moved to the new area.

If you don't have a car, you will need to obtain a non-owner SR-22 instead of a standard SR-22 form. The non-owner option will help provide proof of insurance if it is needed to reinstate your license with the state.

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.