4.8out of 3,000+ reviews

Updated March 9, 2022

Cheapest Companies for SR-22 Insurance in Texas (2022)

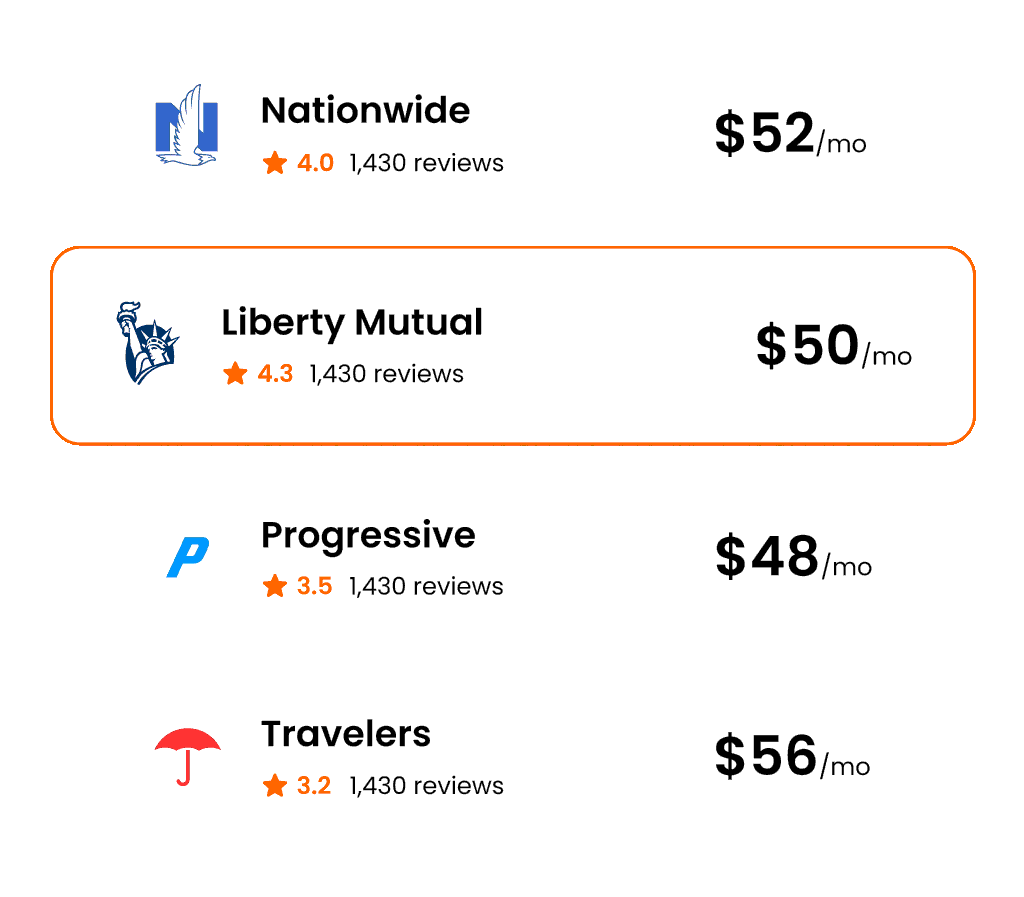

For drivers with SR-22 in Texas, it’s important that you evaluate all of your potential insurance options to ensure you are finding the best rate. Comparing the right insurance companies after this incident will allow you to get the best possible insurance rate after an SR-22.

To simplify comparing companies, Insurify has analyzed rates from top insurance providers in Texas. The following are the best insurance rates from carriers that offer car insurance for drivers with an SR-22 in Texas.

| Carrier | Avg. Monthly Cost The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. |

|---|---|

| AssuranceAmerica | $194 |

| Apparent Insurance | $196 |

| Direct Auto | $203 |

| Elephant | $203 |

| TSC | $213 |

| Dairyland | $216 |

| Travelers | $221 |

| Bristol West | $225 |

| Jupiter Auto | $232 |

| Texas Ranger | $232 |

Table of contents

- How Much Does SR-22 Insurance Cost in Texas?

- What Is an SR-22, and Who Needs One in Texas?

- How Much Does Credit Score Affect SR-22 Insurance Costs in Texas?

- How to Find the Best SR-22 Insurance Rate in Texas

- Non-Owner SR-22 Insurance in Texas

- Alternatives to an SR-22 in Texas

- Frequently Asked Questions

- Compare Top Auto Insurance Companies

How Much Does SR-22 Insurance Cost in Texas?

The filing fee for an SR-22 in most states averages $20. But the impact that needing an SR-22 can have on insurance is much more. If you have to file an SR-22 in Texas, you are most likely a high-risk driver. Those with no violations in the state pay an average of $251 in insurance premiums monthly, while high-risk drivers pay $31 more.

A 12 percent insurance rate hike can be costly, considering that you'll need to keep an SR-22 on file for two years in Texas. At $282 per month for insurance, needing to have an SR-22 costs motorists $6,768 over the 24 months required.

Insurify's comparison tool will help you make sure you're getting the best possible quote even after an SR-22. You can have peace of mind that you're reviewing all of your available insurance options and can confidently choose the one that is best for your situation.

What Is an SR-22, and Who Needs One in Texas?

Most states have financial responsibility laws to ensure that people have enough money to cover other parties' expenses should they get into an accident. In general, having auto insurance satisfies these laws. States sometimes order high-risk drivers (those with DUIs, for example) to have their insurance company file an SR-22 along with their insurance as a way of guaranteeing that they indeed have the minimum liability coverage required by the state.

An SR-22 isn't insurance but is an endorsement filed by the insurance company—and tacked onto the insurance policy. It's an extra step, courtesy of the state, because the driver's behavior either wasn't financially responsible to begin with or could lead to a situation where having enough insurance is critical. Some insurance companies won't insure high-risk drivers and, therefore, won't issue an SR-22.

Compare Car Insurance Quotes Instantly

How Much Does Credit Score Affect SR-22 Insurance Costs in Texas?

Regardless of your credit score, car insurance premiums are higher in Texas if you have to file an SR-22. For example, drivers who have an excellent credit rating and carry an SR-22 pay $57 more monthly for insurance than those without this requirement. Those with poor credit scores pay the most, at $70 more than a similarly scoring driver's premium without an SR-22.

| Credit Tier | Avg. Monthly Rate - No Violation The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Avg. Monthly Rate - SR-22 The car insurance quotes, statistics, and data visualizations on this page are derived from Insurify’s proprietary database of over 4 million car insurance applications from ZIP codes across the United States. Insurify’s data science team performs a comprehensive analysis of the various factors car insurance providers take into account while setting rates to provide readers insight into how car insurance quotes are priced. | Difference |

|---|---|---|---|

| Excellent | $239 | $296 | $57 |

| Good | $266 | $330 | $64 |

| Average | $269 | $333 | $64 |

| Poor | $291 | $361 | $70 |

How to Find the Best SR-22 Insurance Rate in Texas

It isn't too hard to get an SR-22 in Texas. You'll want to first talk to your current insurance carrier and ask them if they will file one for you. If they refuse, or if your policy gets too expensive, you'll have to start shopping around for other insurance companies. Once your insurance company files the SR-22 with the state, they will provide you a copy, too. This copy must be kept with you and used as proof of insurance. Just having your insurance card on hand won't do.

Non-Owner SR-22 Insurance in Texas

Not everyone who has to secure an SR-22 owns a vehicle. That's ok. You can get non-owner insurance and add an SR-22 on top of that. A non-owner insurance policy follows you, not the vehicle. This means whatever car you're driving, you'll have liability coverage.

Alternatives to an SR-22 in Texas

If two or more insurance companies have turned you down for an SR-22, you can satisfy minimum coverage requirements through the Texas Automobile Insurance Plan Association (TAIPA). In addition to an SR-22, there are several other ways of proving financial responsibility in Texas. For example, you can set $55,000 in cash or a personal certificate of deposit CD aside with the state to secure a financial responsibility certification.

Another alternative form the state uses is the SR-22A. The liability requirements for the insurance attached to this form are similar to the requirements for an SR-22. However, because of the repeat nature of the violation, Texas requires the insurance policy to be paid up front.>/p>

How Do I Get SR-22 Insurance in Texas

If you don't mind the time and frustration, feel free to call insurance companies one by one and ask if they'll issue an SR-22. But if you want to take care of insurance matters the easy way, use Insurify to examine multiple qualifying carriers at once. Simply mark that you are looking for affordable SR-22 options, and Insurify will return a side-by-side list of carriers and pricing based on your insurance profile.

Frequently Asked Questions

According to Texas law, if the court orders you to have an SR-22, you'll need to keep it on file for two years from the date of judgment. Your insurance company will notify the state immediately if you cancel your policy, they terminate it, or you let it lapse. If any of this happens, the DMV will suspend your license immediately.

Moving out of state isn't a reason to let your SR-22 expire. Even if you travel to a state that doesn't require an SR-22, most states will expect that you complete the duration of the assigned period for your SR-22. How will they know you even need an SR-22? When you file for new tags and show insurance, your insurance past usually shows up in the DMV system.

Yes. Even if you don't own a car, you'll have to get an SR-22 in Texas if so ordered. Talk to your insurance agent about a Texas non-owner SR-22 insurance policy. This non-owner policy follows you, not the vehicle, if you decide to borrow someone's car to be on the road.

Compare Top Auto Insurance Companies

Use Insurify for all of your car insurance comparison needs! Compare and connect directly with the top insurance companies to find the best rates as well as the most personalized discounts and coverage options. Insurify’s network includes over 200 insurance companies throughout the U.S. who can work with you to get you the right auto insurance policy at the cheapest price. See All Auto Insurance Companies

Compare Car Insurance Quotes Instantly

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.