Everything You Should Know About Life Insurance

Updated April 16, 2021

Reading time: 7 minutes

Updated April 16, 2021

Reading time: 7 minutes

Buying a life insurance policy can seem like a daunting task, but taking the time to understand how life insurance works before making a decision will save you time, money, and stress in the long run.

Life insurance is a financial planning tool intended to protect your loved ones financially in case of your death, offering you peace of mind regardless of your current situation. That’s why it’s so important to pick the right policy with sufficient coverage.

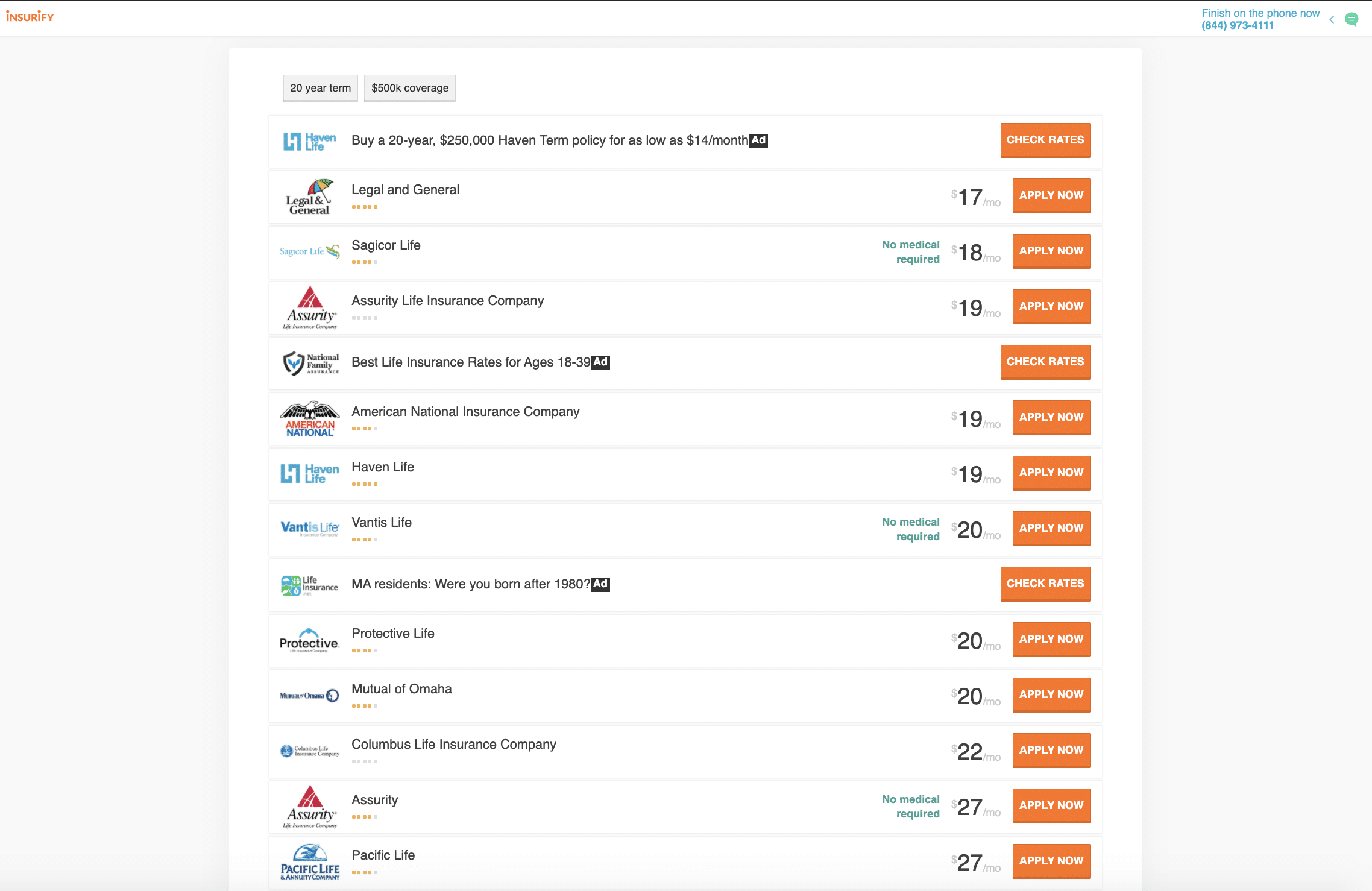

Whether you are thinking ahead and browsing policies for the future or are ready to buy now, Insurify’s free, user-friendly platform allows you to compare quotes from top life insurance coverage providers in just a few minutes.

A life insurance policy is a financial safety net that provides your beneficiaries with a predetermined sum of money if you die during the policy term.

When you buy your life insurance policy, you appoint beneficiaries and set a payout. Beneficiaries can be anyone—from family members, close friends, and business partners to institutions like schools and museums. The payout, also known as the death benefit, refers to the amount of money your beneficiaries will receive.

Life insurance covers most causes of death, like illnesses and accidents. However, in some cases, like suicide within the first two years of a policy, or application fraud, your insurance provider may decline to pay the death benefit.

Your policy’s death benefit is typically given as a tax-free lump sum with no strings attached. This way, your beneficiaries can use it for whatever they need, from funeral expenses to mortgage payments to college tuition costs.

The payout amount you choose for your death benefit depends on your current financial obligations and the standard of living you want to give your loved ones after you have passed. To calculate the coverage amount, you need to add up all of your current and shared debts as well as the amount of money you want your beneficiaries to have for future expenses.

For example, if you have children who want to go to college and you plan to pay tuition, you will want to make sure your death benefit is large enough to cover that cost in your absence. If it doesn’t, your children might have to take out loans or forgo higher education.

While there are a few different types of life insurance —such as variable, universal, and term—the main idea is pretty simple: as long as you pay your life insurance premiums, your insurer will pay out the life insurance benefits to your designated beneficiaries if you die within the policy period.

Typically, you can pay your premiums monthly, twice a year, or annually. Paying the premium is very important; if you stop paying, you could lose coverage and be forced to reapply. Not only does that leave you uninsured, but it also means you’ll have to pay higher premiums.

Depending on your needs, you can choose between five different types of life insurance. Some are more expensive and comprehensive, while others are cheaper and more bare-bones.

- Term Life Insurance

- These policies only last for a predetermined period ranging from two to 30 years. This type of policy is usually cheaper due to its set term length and simplicity.

Whole Life Insurance

- A whole life insurance policy lasts for the entirety of your life. This costs more because it accrues cash value over a period of time and is permanent.

Universal Life Insurance

- A universal life policy is also a permanent life insurance policy but tends to be cheaper, like a term life insurance policy. Most even come with a flexible premium option, which allows you to adjust your premium over the course of time, depending on your circumstances. This policy comes with an investment savings component.

Variable Life Insurance

- A variable life insurance policy is a permanent policy that provides separate accounts made up of instruments and investment funds. The cash value associated with this policy varies based on the performance of your investments (usually in mutual funds ). This type of policy is more expensive than others, but it does offer tax benefits, like the tax-deferred accumulation of earnings.

Variable Universal Life Insurance

A variable universal life insurance policy is another type of permanent policy that allows you to invest the cash component so you can produce greater returns during the life of the policy. This type of policy is generally more expensive but has a flexible premium option.

Keep in mind that you can change the type of policy if your life circumstances call for it. However, it’s best to keep the same policy as long as you can because getting a new one later in life is typically more expensive.

If you’re interested in learning more, be sure to read up on how term and whole life insurance can differ based on their varying features and requirements.

A life insurance rider offers you, the policyholder, additional benefits aside from those already provided to you as part of your policy. Typically, riders add coverage at an added cost. However, exclusionary riders restrict coverage for named conditions. These are less common but do exist.

Three common types of life insurance riders are:

- Guaranteed Insurability Rider

With this rider, you can buy additional insurance coverage without a medical exam during a stated period of the active policy. This is a good idea if you have had significant life changes, like getting married or having kids, or have seen a decline in health with age.

Accelerated Death Benefit Rider

This rider allows you to use part of your death benefit to pay medical bills or improve your quality of life if you’re diagnosed with a terminal illness. However, the amount used will be subtracted from the death benefit your beneficiaries receive.

Long-Term Care Rider

This rider helps you take care of nursing home or at-home care costs by way of monthly payments. You can purchase long-term care insurance separately from your life insurance policy, but many insurance providers offer this type of rider.

The cost of life insurance varies widely from person to person. Usually, your life insurance premium is impacted by your age, health, benefit amount, policy type, and amount of coverage.

Generally, younger, healthier people pay significantly cheaper premium payments for their insurance products because they are considered less of a risk. Additionally, your death benefit is directly proportional to your premiums, so the higher your death benefit, the higher your premium. The best chance to lock in a good life insurance rate is by purchasing a life insurance policy when you are young.

As we mentioned before, the different types of life insurance also differ in affordability. Term life insurance is the most affordable because it only covers you for a set number of years (the policy “term”). Whole life insurance is more expensive than term insurance because it is a form of permanent life insurance. So, even though you pay premiums for your entire life with a whole life policy, it is more expensive due to its permanence and cash-value component.

Paying for life insurance can be a bit tricky. Most carriers accept electronic funds transfers and checks. Some accept credit cards or debit cards, but this is less common. High fees and state-specific regulations are common reasons providers don’t accept credit cards. If you know you would like to pay for life insurance via recurring online payments, be sure to have your bank account number and routing number ready when you apply.

Whichever policy you buy, though, make sure to look for discounts from your life insurance company. Companies won’t usually come right out and offer them to you, but if you do your research, you could end up saving a lot of money. You can get discounts for everything from being married or not smoking to owning a home or belonging to AARP.

One way to make sure you’re getting all the discounts you’re eligible for is by comparing life insurance quotes on Insurify.

To get a life insurance policy, you should follow these five basic steps:

1. Figure out how much life insurance you want. Think about why you’re getting a policy, what kind of policy best suits your needs, and what payout you want to set up for your beneficiaries. You may want to consult with your financial advisor.

Then, compare life insurance quotes on a quote comparison website like Insurify. Insurify makes it easy to get quotes from many providers at the same time, which simplifies the process and saves you time. This way, you can see how much your desired policy will cost at several different companies.

After you apply, representatives from the insurance providers may call you to discuss the information on your application.

Once that is complete, you can schedule your medical exam. This medical exam is a basic health checkup that allows the insurance provider to get current information on your health. The medical technician will verify any medical conditions you mentioned on your application and check for ones that weren’t mentioned. If you don’t need much coverage, are very healthy, or have a virtually clean medical history, you might be able to skip the medical exam. However, most types of life insurance policies require an exam; those that don’t are usually more expensive.

After all that, the insurer will use your information to calculate a premium. In general, the younger and healthier you are, the cheaper your premium will be.

If you are the beneficiary of someone with a life insurance policy, you may be wondering how to file a claim in the case of their passing. To begin the process, you will need three documents: the policyholder ’s death certificate or certified copies of it, the policy document, and the claim form.

The insurance company needs a copy of the death certificate to ensure that your claim for the death benefit is legitimate. The policy document has all the information about the life insurance policy, which tells you and the insurance company what you’re entitled to. The claim form is what you will fill out to request your benefits. Once the claim has been submitted, the settlement funds should be issued within a few weeks.

If you are just getting started exploring possible policies, Insurify ’s life insurance quotes comparison platform can help you get quotes from multiple providers and compare them all in one place.

Tanveen Vohra is an editorial manager at Insurify specializing in writing about property and casualty insurance. Through her work, Tanveen helps consumers better understand the components of their insurance policies so they can make smarter purchase decisions.

Tanveen's work has been cited by CNBC , Fox Business, Business Insider, Fortune, and Market Watch, among others.

Learn More